Yelp reports Q3 2025 revenue of $376 million amid economic headwinds

Yelp's third quarter 2025 revenue reached a record $376 million, up 4% year-over-year, as services categories drove growth despite macroeconomic challenges affecting restaurants.

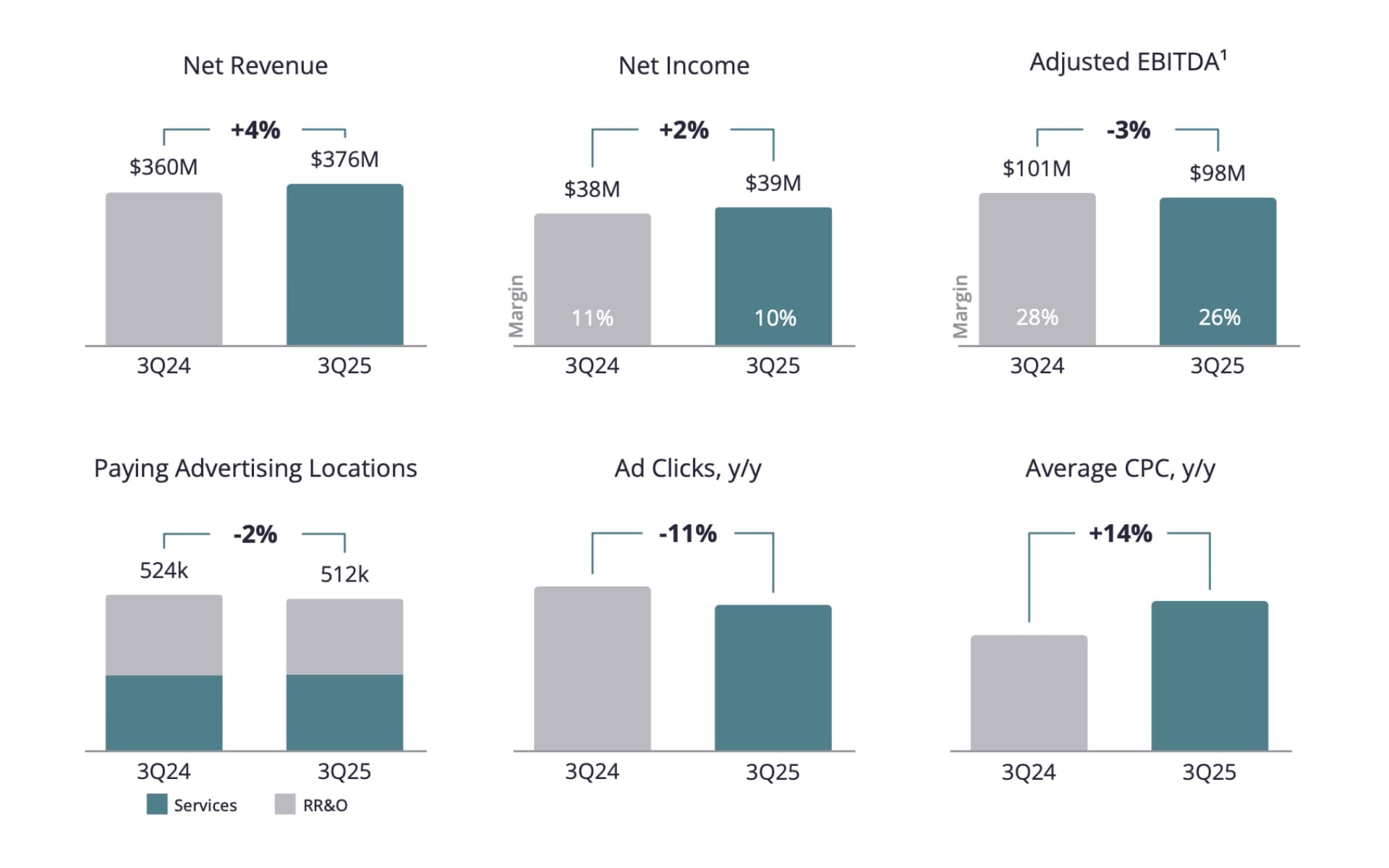

Yelp Inc. reported record net revenue of $376 million for the third quarter ended September 30, 2025, representing a 4% increase from the same period in 2024, according to financial results the company released on November 6, 2025. The San Francisco-based local business platform exceeded its third quarter revenue guidance by $6 million while navigating persistent macroeconomic uncertainties that continued to pressure restaurant and retail advertisers.

Services advertising revenue increased 7% year-over-year to $244 million during the quarter, marking a record performance for the category. This growth was driven primarily by increased advertiser demand from home and auto services businesses, with the RepairPal acquisition contributing approximately two percentage points to overall advertising revenue growth. Average revenue per Services location reached record levels during the quarter.

The company's restaurant, retail and other categories experienced a 2% year-over-year decline to $114 million. This decrease reflected ongoing challenges in the operating environment for these businesses and competitive pressures from food ordering and delivery platforms. Despite the revenue decline, the impact was partially mitigated because the locations that reduced spending were generally lower-spend advertisers.

Total paying advertising locations decreased 2% year-over-year to 512,000 as of September 30, 2025, as declines in restaurant and retail categories offset gains in services. Ad clicks fell 11% year-over-year, primarily due to macroeconomic pressures and reduced spending on paid project acquisition. However, average cost-per-click increased 14% year-over-year, reflecting stronger demand from services advertisers and fewer overall clicks.

Net income for the third quarter reached $39 million, or $0.61 per diluted share, compared to $38 million, or $0.56 per diluted share, in the third quarter of 2024. The company achieved a net income margin of 10%, down slightly from 11% in the prior year period. Adjusted EBITDA decreased 3% year-over-year to $98 million, representing a 26% margin and exceeding the high end of the company's guidance range by $13 million.

The company's artificial intelligence initiatives continued to gain traction during the quarter. Yelp expanded its AI-powered features with the rollout of more than 35 new updates in October 2025, including the expansion of Yelp Assistant to business pages across restaurant, retail and other categories. The chatbot, which initially launched for services categories, now provides instant answers to consumer questions about specific businesses by leveraging Yelp's trusted content and information from business websites.

Request-a-Quote projects increased approximately 5% year-over-year overall. Excluding projects acquired through paid search initiatives, project submissions grew approximately 10% year-over-year, driven by improvements to the request flow and Yelp Assistant. Project submissions through Yelp Assistant specifically increased nearly 400% year-over-year during the third quarter.

Yelp recently launched two AI-powered call answering services: Yelp Host for restaurants and Yelp Receptionist for services businesses. These subscription products combine large language models with Yelp's business data to provide automated answering services tailored to individual businesses. Yelp Host, priced at $149 per month ($99 for Yelp Guest Manager customers), handled thousands of calls and booked hundreds of reservations during its initial month of availability. Yelp Receptionist launched in October at $99 per month for select services categories.

The company also introduced Menu Vision, an augmented reality feature that allows diners to point their phone cameras at menus to view photos and reviews of individual dishes. Yelp partnered with DoorDash as its preferred food ordering and delivery provider, expanding the food ordering network by approximately 200,000 restaurants to more than 500,000 total. The company expects this partnership to generate incremental revenue recorded as other revenue.

Data licensing revenue continued to show momentum during the quarter. Other revenue, which includes data licensing products, API access, and Yelp Guest Manager, increased 17% year-over-year to $19 million. The company reported strong demand for its data licensing products, particularly related to AI search platforms seeking access to Yelp's trusted local business content.

Operating expenses demonstrated disciplined cost management. Cost of revenue increased 12% to $36 million, primarily due to revenue share payments from the RepairPal acquisition and higher advertising fulfillment costs. Sales and marketing expenses rose 4% to $151 million, driven by increased employee-related costs from higher average headcount. Product development expenses remained relatively flat at $78 million. General and administrative expenses decreased 8% to $45 million, as the prior year period included impairment charges related to office space.

Stock-based compensation expense declined to 9% of revenue in the third quarter, down from 11% in the prior year period. The company maintains targets to reduce stock-based compensation to below 8% of revenue by the end of 2025 and below 6% by the end of 2027. Management expects these reductions will improve the quality of adjusted EBITDA and benefit GAAP profitability in future years, particularly earnings per share.

Yelp repurchased approximately 2.3 million shares during the third quarter at an aggregate cost of $75 million, with an average purchase price of $32.59 per share. As of September 30, 2025, the company had $127 million remaining under its share repurchase authorization. Cash, cash equivalents and marketable securities totaled $334 million at quarter end, with no debt outstanding.

The company lowered its full-year 2025 revenue outlook due to persistent macroeconomic uncertainties. Yelp now expects net revenue in the range of $1.460 billion to $1.465 billion, reflecting a decrease of $8 million at the midpoint from previous guidance. Management anticipates that heightened macroeconomic uncertainties will persist in the fourth quarter, combined with typical seasonal declines in services categories, resulting in net revenue decreasing sequentially from the third quarter.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Despite the revenue outlook adjustment, Yelp raised its adjusted EBITDA guidance. The company now expects full-year adjusted EBITDA in the range of $360 million to $365 million, reflecting an increase of $8 million at the midpoint. For the fourth quarter, Yelp projects net revenue between $355 million and $360 million, with adjusted EBITDA between $77 million and $82 million.

Management maintained its commitment to approximately flat headcount year-over-year for 2025, excluding the RepairPal team acquired in November 2024. The company continues to leverage AI to deliver operational efficiencies as part of its product-led strategy. Stock-based compensation is expected to remain around 8% of net revenue in the fourth quarter and approximately 9% for the full year.

The company's transformation through artificial intelligence represents a strategic shift in how consumers interact with local business information on the platform. Management expects Yelp Assistant to become the primary method for users to discover and connect with local businesses in the future. The recent expansion to restaurant and retail business pages marks progress toward a comprehensive cross-category assistant planned for testing before year-end.

Restaurant industry challenges continued to weigh on results. Management noted that restaurants have faced significant inflation in ingredient and labor costs, making it difficult to pass those costs to consumers in the current environment. As these inflationary pressures moderate and wrap year-over-year comparisons, restaurants may be better positioned to generate margin and increase advertising investment.

The services categories demonstrated resilience despite broader economic uncertainty. Home services and auto services, including revenue from RepairPal's integrated booking system, drove services growth. The company recently integrated RepairPal's booking system into Yelp to simplify appointment scheduling with auto repair shops following successful testing.

Yelp's data licensing business represents an emerging opportunity as AI search platforms seek access to high-quality local business information. The company reported strong demand for its Yelp Places API (formerly Yelp Fusion), Yelp Insights API, and data licensing products during the quarter. Management emphasized that Yelp's trusted content about small and medium-sized businesses serves as a critical resource for large language model-based search experiences.

Profitability metrics reflected disciplined expense management amid revenue pressures. The company achieved a 10% net income margin and 26% adjusted EBITDA margin in the third quarter. Management expects fourth quarter expenses to remain relatively consistent with third quarter levels while continuing efforts to reduce stock-based compensation as a percentage of revenue.

The advertising auction system continued to optimize budget deployment for advertisers. With fewer clicks available due to macroeconomic pressures, the auction mechanism increased cost-per-click while maintaining advertiser focus on cost per lead rather than cost per click. Management indicated that advertisers recognize the value of leads in an environment with reduced consumer demand and remain willing to pay for quality traffic.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- August 7, 2025: Yelp reported Q2 2025 results with $370 million revenue, marking 4% growth and demonstrating early AI initiative momentum

- August 6, 2025: Yelp launched Local Co-branded Showcase Ads, enabling national brands to feature local business partners in search results

- October 21, 2025: Yelp announced Fall Product Release with over 35 AI-powered features including expanded Yelp Assistant, Menu Vision, and call answering services

- November 6, 2025: Yelp reported Q3 2025 results with $376 million revenue, net income of $39 million, and adjusted EBITDA of $98 million

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Yelp Inc., the San Francisco-based local business platform connecting consumers with service providers, restaurants, and retailers

What: Reported third quarter 2025 financial results with record revenue of $376 million (up 4% year-over-year), net income of $39 million, and adjusted EBITDA of $98 million (down 3% year-over-year), while expanding AI-powered features and lowering full-year revenue guidance

When: Results released November 6, 2025, covering the quarter ended September 30, 2025

Where: Performance driven primarily by services categories including home and auto services, with geographic operations concentrated in United States markets

Why: Services advertising revenue growth of 7% offset a 2% decline in restaurant, retail and other categories as macroeconomic pressures, inflation concerns, and competitive dynamics from food delivery platforms weighed on advertiser spending, prompting the company to accelerate AI integration while maintaining disciplined cost management