WhatsApp introduces ads using Instagram and Facebook data

Status screen advertisements debut with cross-platform targeting as privacy advocates warn of enforcement challenges.

WhatsApp will introduce advertisements to its Status screen using personal data from Instagram and Facebook, according to Meta's announcement on June 16, 2025. The messaging platform, used by 1.5 billion people daily in the Updates tab, will display ads after users scroll through Status updates, utilizing signals from connected Meta accounts.

The advertising mechanism employs country or city location data, language preferences, followed channels, and ad interaction history to deliver targeted content. According to Meta's official statement, "Your personal messages, calls and statuses remain end-to-end encrypted, meaning no one can see or hear them. That includes Meta." Phone numbers will never be sold or shared with advertisers, while personal messages, calls, and groups remain excluded from advertising algorithms.

Get the PPC Land newsletter ✉️ for more like this

Summary

Who: Meta announced through Head of Instagram Adam Mosseri and WhatsApp VP Alice Newton Rex that the messaging platform will introduce advertising capabilities.

What: WhatsApp will display advertisements on the Status screen using personal data from connected Instagram and Facebook accounts, while excluding private messages, calls, and contact information from targeting algorithms.

When: The announcement occurred on June 16, 2025, with global rollout planned across coming months throughout 2025.

Where: The advertising implementation will launch globally across all WhatsApp markets, building upon existing business messaging revenue in regions like Brazil and expanding to the 100 million monthly active users in the United States.

Why: Meta positioned the change as natural business evolution to help brands discover new audiences within WhatsApp, supporting over 1.5 billion daily Status and Channels users while generating additional revenue beyond existing click-to-WhatsApp ads and business messaging services.

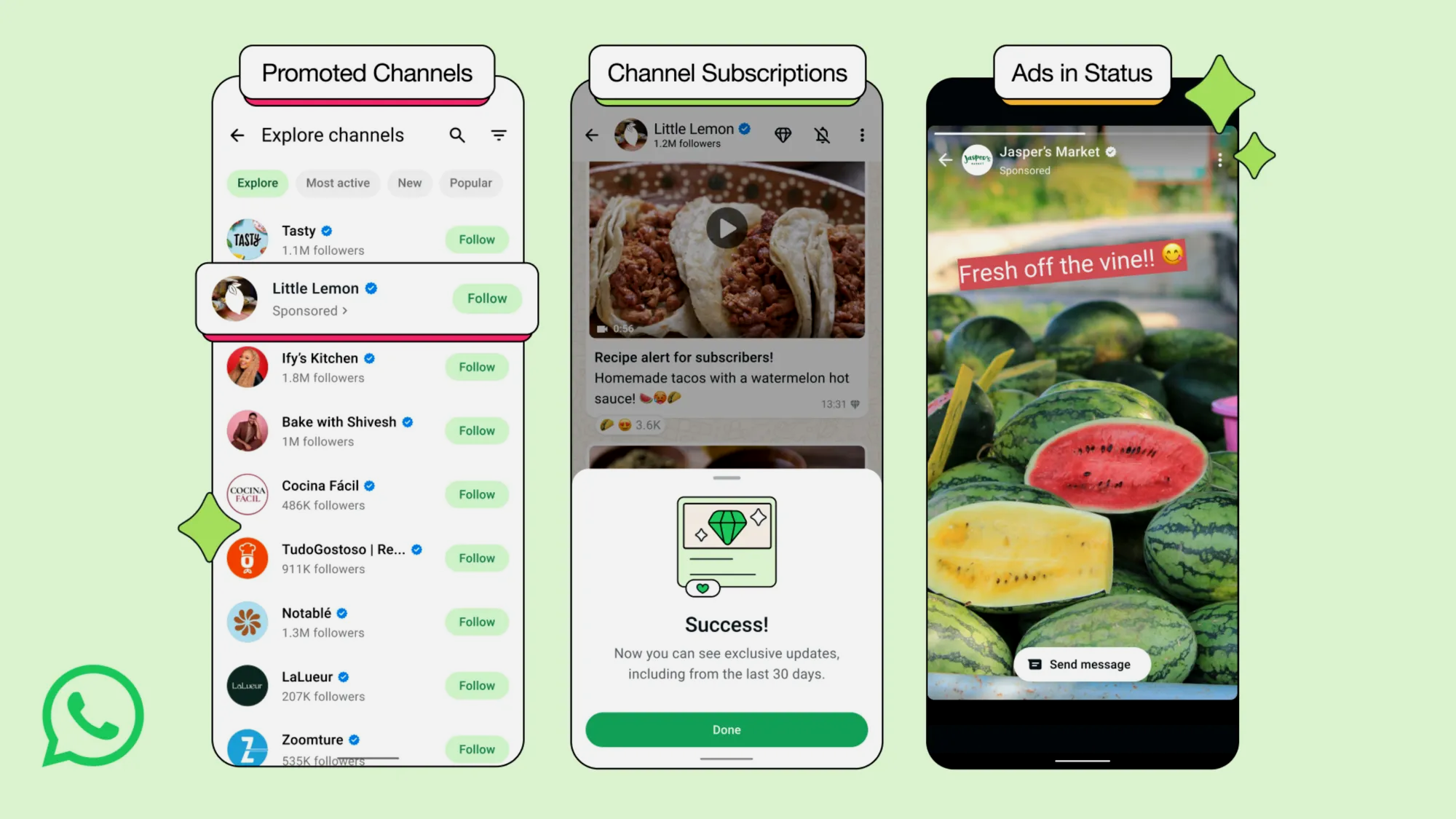

Three-pronged monetization strategy launches

Meta outlined three specific features launching within the Updates tab, which houses both Channels and Status content. Channel subscriptions will enable users to pay monthly fees for exclusive updates from preferred content creators like news networks. According to the announcement, "You'll be able to support your favorite channel, such as your favorite news network, by subscribing to receive exclusive updates for a monthly fee."

Promoted Channels will appear in the directory to help users discover new content, marking "the first time channel admins have a way to increase their channels' visibility." The feature targets content discovery within WhatsApp's expanding creator ecosystem.

Status advertisements represent the most significant change, allowing businesses to promote products and services directly within user feeds. Meta stated that users will "be able to find a new business and easily start a conversation with them about a product or service they're promoting in Status."

According to Meta's third quarter 2024 earnings, WhatsApp Business Platform drove significant growth in Family of Apps other revenue, which increased 48% to $434 million. Click-to-WhatsApp ads experienced particularly strong expansion in markets like Brazil, while paid messaging volumes grew through increased business adoption and conversational activity per client.

Yield: How Google Bought, Built, and Bullied Its Way to Advertising Dominance

A deeply researched insider’s account of Google’s epic two-decade campaign to dominate online advertising by any means necessary.

European regulators challenge implementation

The European Centre for Digital Rights (noyb) released a statement on June 16 questioning the legality of WhatsApp's advertising plans under current Digital Markets Act (DMA) and General Data Protection Regulation (GDPR) frameworks. Max Schrems, chairman of noyb, argued that linking data across Meta platforms without freely given consent violates EU requirements.

The organization highlighted concerns about Meta's Pay or Okay model, where users face fees of €9.99 monthly for Instagram or Facebook without ads. This represents approximately 120 times WhatsApp's original $1 annual cost. According to noyb, while only 3-10% of users prefer personalized advertising, Pay or Okay achieves consent rates exceeding 99% through "excessive fees."

Article 5(2) of the DMA mandates freely given user consent for cross-service data linking. The GDPR contains similar requirements for personalized advertising consent. However, Meta currently prevents users from declining data sharing on Instagram and Facebook without payment, a practice noyb describes as circumventing legal protections.

The advocacy group noted that Meta's approach demonstrates "exactly the opposite of what EU law requires." Despite enforcement mechanisms, the company continues operations with minimal regulatory consequences. EU Commission classification of Meta's Pay or Okay system as illegal has not resulted in substantial operational changes.

Technical implementation and advertising features

WhatsApp's advertising system introduces several promotional capabilities for businesses and content creators. Companies can promote their Channels within the discovery section, while select creators and businesses may charge subscription fees for exclusive Channel updates through app store payment systems.

Meta justified the Updates tab location by emphasizing user discovery patterns. "The Updates tab is where you discover something new on WhatsApp – whether that's a friend's status from their wedding day or a creator's entertaining channel," the company explained. The placement strategy aims to avoid interrupting personal conversations, with Meta stating: "This means if you only use WhatsApp to chat with friends and loved ones, there will be no change to your experience at all."

Meta reported that 1.5 billion users engage with the Updates tab daily globally. The advertising rollout will occur gradually, with the company stating it will be "rolling this out slowly over the next several months." Revenue expectations remain modest for 2025 compared to established Facebook and Instagram advertising platforms.

Business messaging revenue growth continues through the WhatsApp Business Platform, which enables companies to send paid messages and manage customer communications. The platform supports Click-to-WhatsApp advertisements that direct users from Facebook and Instagram feeds to messaging conversations.

TechCrunch confirmed that advertisements will integrate with Status screen navigation, appearing between user-generated content updates. The implementation mirrors Instagram Stories advertising, where commercial content displays after several organic posts.

Platform integration accelerates data consolidation

WhatsApp's advertising announcement follows Meta's January 21, 2025 launch of Account Center integration options. Users can now connect WhatsApp to centralized account management systems, enabling cross-posting between WhatsApp Status, Facebook Stories, and Instagram Stories.

The Account Center integration remains optional and disabled by default, though it facilitates single sign-on capabilities across Meta platforms. Additional planned features include centralized avatar management, Meta AI stickers, and "Imagine Me" creations for connected accounts.

Meta's strategy reflects broader consolidation efforts across its application ecosystem. The company previously separated WhatsApp from Facebook and Instagram data practices following its 2014 acquisition, maintaining distinct privacy policies and operational structures.

Cross-platform advertising integration represents a significant shift toward unified data usage across Meta's portfolio. The marketing community recognizes this development as potentially expanding targeting capabilities while raising compliance complexity.

Marketing implications and advertiser response

Advertising professionals anticipate expanded reach opportunities through WhatsApp's 100 million monthly active users in the United States. The platform's global dominance outside the US provides access to markets where WhatsApp serves as the primary messaging application.

Meta's advertising technology improvements include the introduction of Andromeda, a machine learning system developed with Nvidia that increased ads retrieval model complexity by 10,000 times. The system enhances personalization capabilities for determining relevant advertisements across all Meta platforms.

Advantage+ shopping campaigns generated over $20 billion annual revenue with 70% year-over-year growth in the fourth quarter of 2024. Over 4 million advertisers now utilize generative AI creative tools, representing a four-fold increase within six months.

The company plans to integrate WhatsApp advertising with existing Meta advertising infrastructure, allowing marketers to manage campaigns across Facebook, Instagram, and WhatsApp through unified interfaces. Default placement settings will include Threads feeds alongside traditional Meta advertising surfaces.

Recent developments in Meta's advertising capabilities include enhanced video generation tools and image animation features. The company expanded creative assistance options while implementing inventory filter controls for brand safety management across all platforms.

Historical context

WhatsApp's transition to advertising marks a departure from its original subscription model, which charged $1 annually without advertisements or data collection. Meta acquired WhatsApp for $19 billion in 2014, promising to maintain the service's privacy-focused approach and minimal commercial interference.

The messaging application competed primarily on privacy and simplicity compared to alternatives like Telegram, Signal, and traditional SMS systems. WhatsApp's end-to-end encryption and minimal data collection attracted users seeking secure communication options.

Meta's advertising expansion occurs amid increasing regulatory scrutiny in European markets and evolving privacy expectations globally. The company faces ongoing investigations under the Digital Markets Act while defending its data practices against consumer advocacy organizations.

Signal, a non-profit messaging alternative, operates on a $50 million annual budget without advertising or data monetization. The organization positions itself as a privacy-focused alternative to commercial messaging platforms, potentially benefiting from user migration following WhatsApp's advertising introduction.

Industry impact and competitive response

The advertising debut represents WhatsApp's evolution toward comprehensive revenue generation across Meta's platform portfolio. Analysts expect the change to influence competitive messaging applications to explore similar monetization strategies or emphasize privacy differentiation.

Marketing technology providers anticipate integration opportunities with WhatsApp's advertising systems. Third-party platforms may develop specialized tools for managing cross-platform campaigns that include WhatsApp Status advertisements alongside traditional social media placements.

Brand safety technology companies have begun developing solutions for WhatsApp advertising environments. Scope3 announced partnership with Meta to provide AI-powered content filtering across Facebook and Instagram, with potential extension to WhatsApp advertising contexts.

WhatsApp's advertising launch coincides with broader changes in digital marketing attribution and privacy compliance. Apple's App Tracking Transparency and Google's Privacy Sandbox initiatives continue reshaping how advertisers collect and utilize user data.

The messaging advertising market expansion may accelerate adoption of conversational commerce and customer service automation. Businesses increasingly leverage messaging platforms for sales interactions, customer support, and relationship management beyond traditional advertising placements.

Timeline

- June 16, 2025: Meta announces WhatsApp Status ads using Instagram and Facebook data

- June 16, 2025: European Centre for Digital Rights questions legality under EU law

- January 21, 2025: Meta launches WhatsApp Account Center integration options

- April 23, 2025: Meta expands Threads advertising globally after testing period

- March 2024: WhatsApp begins third-party messaging interoperability in Europe

- 2014: Meta acquires WhatsApp for $19 billion with privacy commitments