UK cryptocurrency exchanges gain advertising clearance under new Google policy

New Google policy allows UK cryptocurrency exchanges to advertise starting January 2025, with FCA registration requirement.

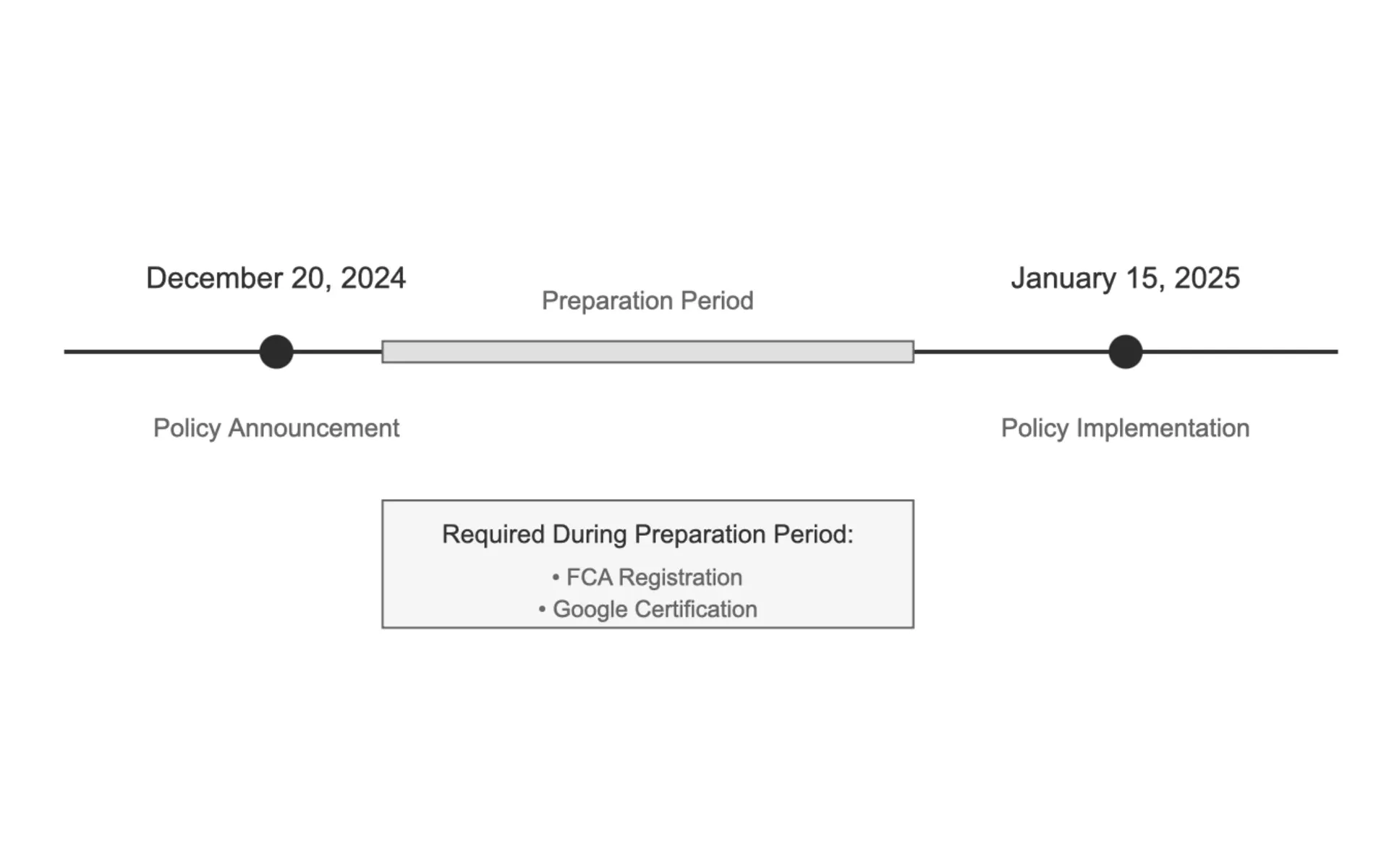

In a policy update announced on December 20, 2024, Google will permit cryptocurrency exchanges targeting the United Kingdom to advertise on its platform starting January 15, 2025. According to the official policy document, this change marks a significant shift in Google's approach to cryptocurrency-related advertising in the UK market.

The updated policy establishes specific requirements for cryptocurrency businesses seeking to advertise in the United Kingdom. According to the policy documentation, cryptocurrency exchanges must obtain registration from the Financial Conduct Authority (FCA) before gaining advertising privileges on Google's platform. This regulatory prerequisite aims to maintain oversight of cryptocurrency advertising activities.

The scope of the policy encompasses both software and hardware cryptocurrency wallets. For software wallet providers, the policy mandates FCA registration similar to cryptocurrency exchanges. Hardware wallet manufacturers face different criteria - they may advertise products specifically designed for storing private keys of cryptocurrencies, non-fungible tokens (NFTs), and other crypto-based assets. However, these devices must not offer additional services such as purchasing, selling, exchanging, or trading functionalities.

The policy implementation includes a certification process through Google's verification system. Prior to running advertisements, cryptocurrency businesses must complete Google's certification requirements in addition to meeting regulatory standards. This dual-verification approach creates multiple checkpoints for advertisers entering the cryptocurrency advertising space.

Google's policy documentation explicitly states that advertisers must comply with all local legal requirements beyond the specified FCA registration. This provision suggests that cryptocurrency businesses may need to navigate additional regulatory frameworks depending on their specific services and target markets within the UK.

The timing of this policy change arrives as regulatory bodies worldwide continue developing frameworks for cryptocurrency oversight. The January 2025 implementation date provides cryptocurrency businesses approximately one month from the announcement to prepare necessary documentation and certification materials.

To maintain policy compliance, Google has established a warning system for violations. According to the policy document, accounts violating these guidelines will receive a minimum seven-day warning before any suspension actions. This grace period allows advertisers to address compliance issues and maintain their advertising capabilities.

The policy update reflects broader changes in the cryptocurrency advertising landscape. Hardware wallet manufacturers gain specific provisions previously unavailable, while exchanges and software wallet providers must meet stringent regulatory requirements through FCA registration.

This policy modification follows multiple updates to Google's financial services advertising requirements throughout 2024. The cryptocurrency-specific changes represent part of an ongoing refinement of digital asset advertising guidelines within Google's broader advertising framework.

The implementation timeline spans from the December 20, 2024 announcement to the January 15, 2025 effective date. During this period, cryptocurrency businesses must secure both FCA registration and Google certification to maintain uninterrupted advertising capabilities once the policy takes effect.

Cryptocurrency exchanges and wallet providers operating in the UK market face a defined regulatory and certification process through this policy update. The requirements establish clear parameters for cryptocurrency advertising while maintaining regulatory oversight through established financial authorities.

The policy's structural framework creates distinct categories for different cryptocurrency services, with specific requirements for exchanges, software wallets, and hardware wallets. This categorization provides targeted guidelines based on service type rather than applying blanket requirements across the cryptocurrency sector.