Travel industry calls for stricter Google DMA enforcement

European travel tech organization urges Commission action on Google's self-preferencing violations.

The European travel technology sector has intensified pressure on regulators to enforce stricter compliance with the Digital Markets Act following Google's continued dominance in travel search markets. According to a July 7, 2025 opinion piece by eu travel tech, the organization representing European online travel industry interests, Google's non-compliance with DMA self-preferencing rules benefits only one player while harming businesses and consumers across the continent.

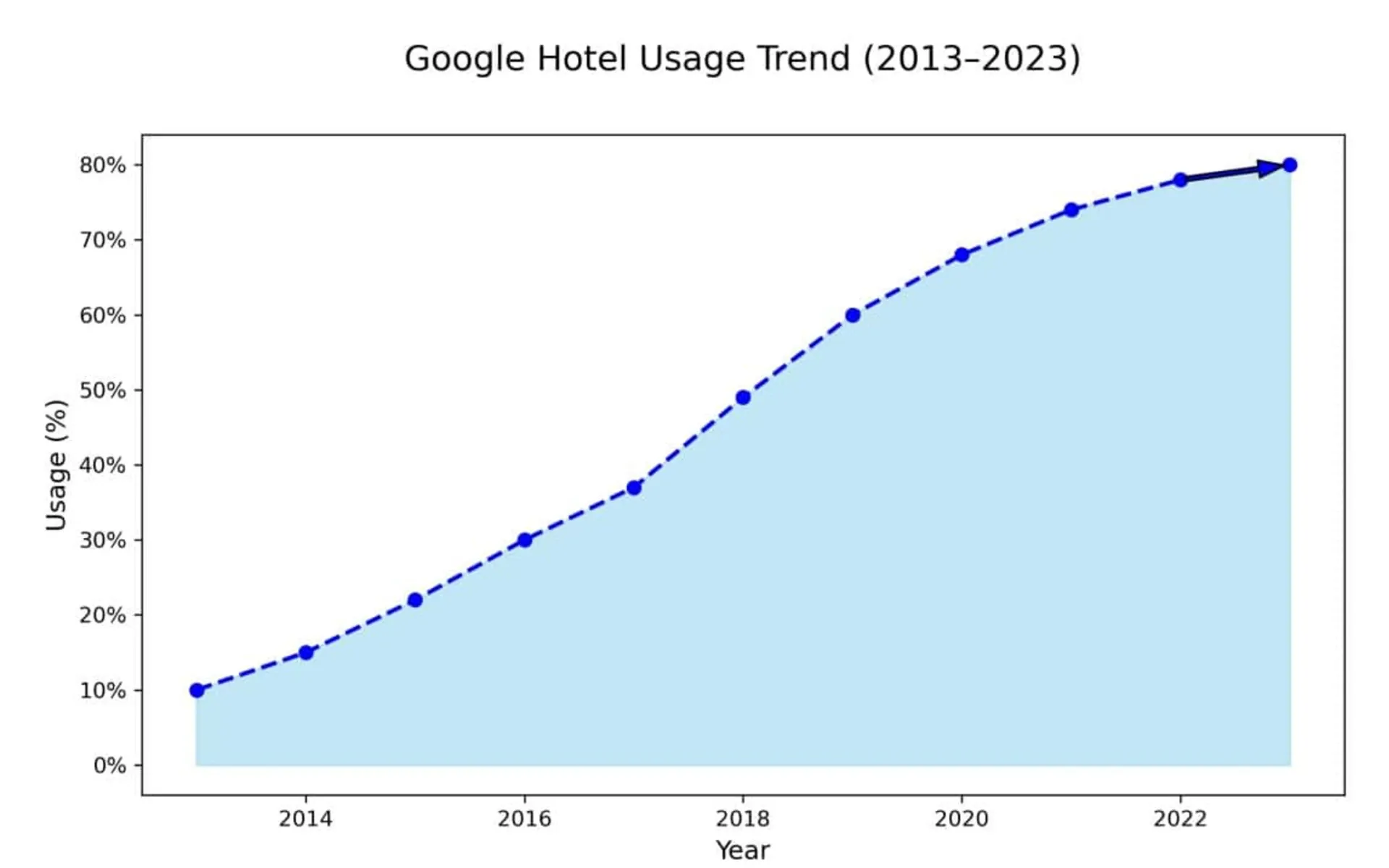

The statement from Emmanuel Mounier, Secretary General of eu travel tech, comes amid mounting evidence that Google has systematically expanded its travel market share through preferential treatment of its own services. Data presented in the organization's analysis reveals a dramatic increase in Google's hotel usage from 37% in 2013 to 80% in 2023, based on a recent HOTREC distribution study. This growth trajectory represents a near-complete capture of the hotel metasearch market within a decade.

According to the travel tech organization, Google's dominance extends beyond hotels into flight search markets. Between 2020 and 2023, Google Flights expanded its market share from 11.8% to 22.2% in Germany, from 19% to 33.6% in the Netherlands, and from 14.4% to 23.4% in Spain. These figures, sourced from similarweb data, demonstrate consistent growth patterns across major European markets.

The criticism follows Google's announcement of search modifications on November 26, 2024, which introduced over 20 changes to European search functionality. However, comparison sites have challenged these modifications as insufficient, arguing they fail to address fundamental DMA violations.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: eu travel tech, the organization representing European online travel industry interests, led by Secretary General Emmanuel Mounier

What: Published an opinion piece calling for stricter European Commission enforcement of Digital Markets Act self-preferencing rules against Google's travel search dominance

When: July 7, 2025, amid ongoing European Commission proceedings against Google for potential DMA non-compliance

Where: European Union markets where Google has achieved dominant positions in hotel metasearch (80% usage by 2023) and flight search (expanding market share across Germany, Netherlands, and Spain)

Why: To pressure regulators to prevent Google's continued market capture through self-preferencing practices that the organization argues benefit only Google while harming businesses, consumers, and competition across European travel markets

Systematic market capture strategy

The travel industry critique outlines what it describes as Google's four-step market capture strategy. First, Google provides prime visibility to new services through prominent placement in search results. The company then offers free advertising to retailers while competitors must pay for visibility. Third, Google eliminates competing services through this preferential treatment. Finally, the company begins charging once competition has been substantially reduced.

This pattern, according to eu travel tech, represents "obviously an anticompetitive practice" as previously established by European Commission findings and confirmed by the European Court of Justice in the landmark Google Shopping case. The organization argues that DMA's self-preferencing ban aims to prevent repetition of this pattern across vertical markets including hotels, flights, restaurants, jobs, maps, and news.

The travel organization's analysis specifically targets Google's hotel metasearch operations. According to their data, Google initially entered shopping comparison services in 2002 under the name "Froogle." The company then systematically expanded into travel markets using the same competitive approach that attracted regulatory scrutiny in shopping comparison.

Financial impact on travel sector

The financial implications for European travel businesses appear substantial. According to data cited by eu travel tech, Google's dominance in travel search affects not only large intermediaries but also small independent hotels that depend on visibility through multiple intermediaries for online discovery.

The organization argues that Google's current approach creates a zero-sum game where the company consistently selects itself as the winner. "There will not be winners and losers as claimed by Google. But only one winner: Google," according to their July 7 statement.

Recent regulatory enforcement demonstrates the European Commission's commitment to DMA implementation. On April 23, 2025, the Commission imposed €500 million in fines on Apple and €200 million on Meta for DMA violations, marking the first major enforcement actions under the new regulatory framework.

Ongoing compliance disputes

Google's compliance efforts have generated controversy among stakeholders. The company conducted over 100 consultation events seeking industry input on DMA compliance measures. However, comparison sites argue that Google "has simply, repeatedly, ignored this feedback, and instead continued to iterate on the same non-compliant solution for months."

The European Commission has initiated proceedings against Google for potential DMA non-compliance. Competition lawyer Thomas Höppner, representing various industry interests, highlighted the travel sector's concerns in LinkedIn posts discussing the Commission's workshop on Google's compliance with Article 6(5) DMA in product search.

According to Höppner's analysis, Google attempts to create false divisions between merchants and comparison shopping services by suggesting that increased competition would reduce visibility and increase costs for merchants. The travel industry organization's statement aims to counter this narrative ahead of European Commission workshops on travel sector self-preferencing.

The travel organization's position aligns with broader competition concerns about Google's search dominance. Competition lawyers have proposed structural remedies including graduated access to Google's search infrastructure to enable meaningful competition.

Technical implementation challenges

Google's DMA compliance modifications have created operational challenges across European markets. The company removed interactive flight information displays, certain map functionality, direct booking interfaces, and integrated comparison tools. These changes affect how travel businesses connect with customers through search results.

Current testing in Germany, Belgium, and Estonia includes reverting to simplified "ten blue links" format for hotel searches. This temporary modification removes the interactive map displaying hotel locations and contextual features beyond basic website links.

The implementation has resulted in up to 30% reduction in direct booking clicks for some businesses, according to Google's data. These metrics highlight the practical impact of regulatory compliance on travel industry operations.

Market structure implications

The travel organization's analysis suggests that Google's self-preferencing practices extend beyond immediate competitive concerns to fundamental market structure issues. According to their assessment, Google originally operated as a general search engine designed to direct users to external websites quickly.

The company's strategic shift toward keeping users within its ecosystem longer represents a fundamental change in its value proposition. This approach maximizes advertising exposure and related revenue by expanding into vertical markets including travel booking and comparison services.

For travel marketers, these developments create uncertainty about long-term platform strategies. Current DMA enforcement demonstrates that regulatory requirements continue evolving as authorities assess compliance efforts.

The travel sector's organized response through eu travel tech represents coordinated industry pressure for regulatory action. Similar coordination among comparison sites suggests growing industry consensus about Google's market practices.

Regulatory expectations

The European Commission faces pressure to demonstrate DMA effectiveness through enforcement actions. According to eu travel tech, allowing non-compliance to continue "will come at the expense of everyone" while benefiting only Google's market position.

The organization specifically calls for the Commission to "continue on the path forged by the Preliminary Findings of non-compliance to ensure the DMA delivers the level playing field between Google and its business users as it has promised."

Recent enforcement patterns suggest the Commission will likely escalate compliance requirements for major platforms. The timing of preliminary findings against Google coincides with broader regulatory actions across the technology sector.

Travel industry stakeholders expect concrete regulatory responses rather than continued consultation processes. The sector's coordinated messaging through trade organizations represents escalating pressure for decisive Commission action on Google's travel search practices.

For marketing professionals working in travel advertising, these regulatory developments signal potential structural changes in how Google operates travel search functionality. The outcome of current DMA enforcement proceedings could reshape competitive dynamics across European travel marketing channels.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- 2002: Google launches shopping comparison services under "Froogle" name

- 2013: Google hotel metasearch usage reaches 37% of hotels according to HOTREC study

- 2020: Google Flights holds 11.8% market share in Germany travel search

- 2023: Google hotel usage expands to 80% of European hotels; Google Flights reaches 22.2% German market share

- May 2, 2023: Digital Markets Act becomes applicable with Google designated as gatekeeper

- March 2024: DMA obligations become legally binding for designated gatekeepers

- April 23, 2025: European Commission issues first DMA fines totaling €700 million against Apple and Meta

- November 26, 2024: Google announces major search modificationsfor European DMA compliance

- December 11, 2024: Coalition of comparison sites criticizes Google changes as insufficient

- March 6, 2025: Meta submits second annual DMA compliance report challenging Commission interpretation

- July 2, 2025: Meta formally appeals Commission DMA decision on advertising requirements

- July 7, 2025: eu travel tech publishes opinion piece calling for stricter Google DMA enforcement