The Trade Desk to partially sunset Kokai periodic table interface

The programmatic advertising platform will remove controversial visualization from key sections following months of user resistance and slower-than-expected adoption rates affecting company revenue performance.

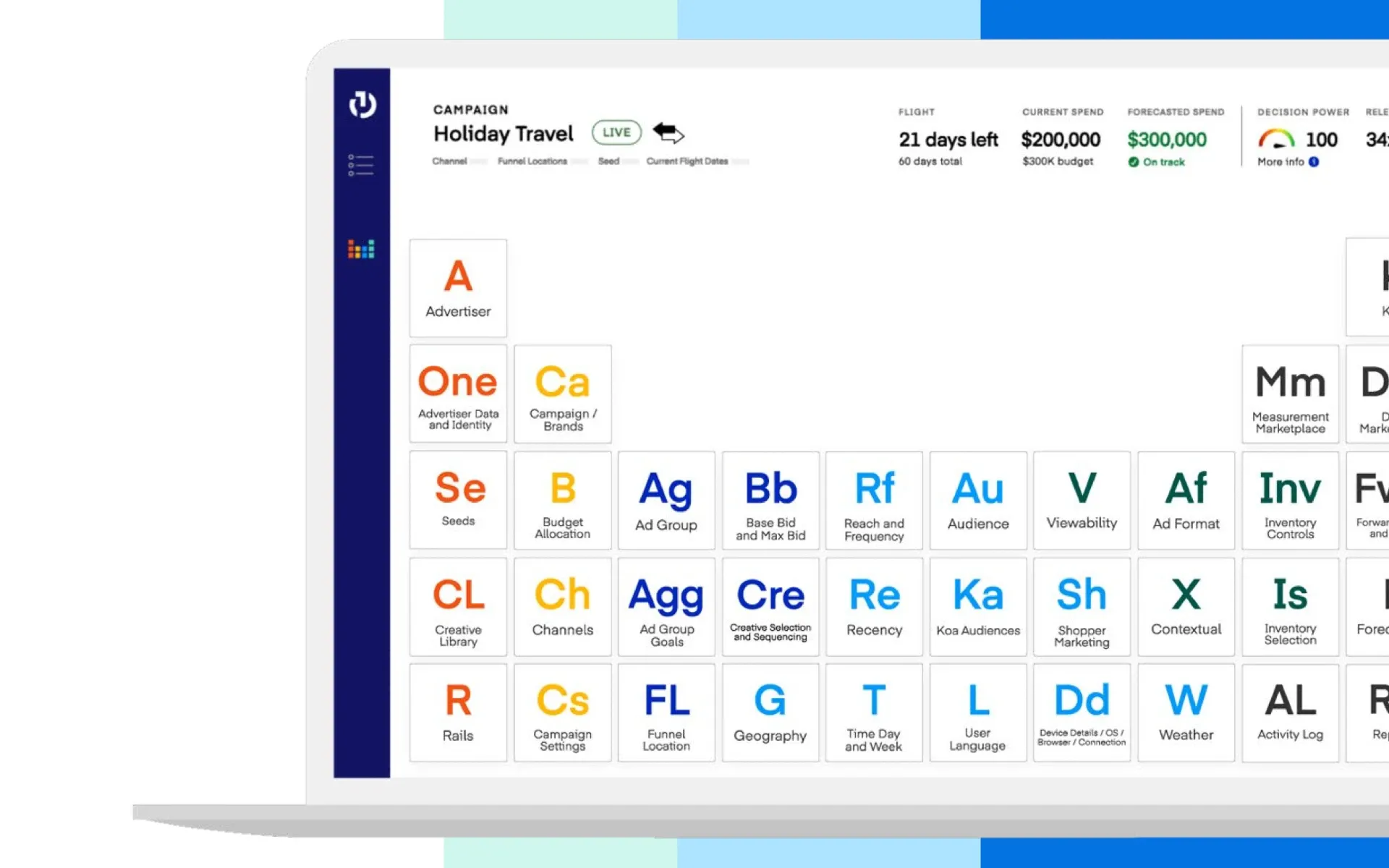

The Trade Desk will partially eliminate the periodic table interface from its Kokai programmatic buying platform as part of a comprehensive redesign scheduled for implementation. According to ADWEEK reporting on September 17, 2025, the color-coded visualization system that displays campaign information in blocks resembling the chemical periodic table will be removed from advertiser and campaign views while remaining available only at the ad group level.

"The Trade Desk is rolling out a redesign of Kokai, its programmatic buying platform, that will partially sunset one of its most recognizable—and debated—features: the periodic table," according to ADWEEK. The platform confirmed the changes will keep the visualization "only at the ad group level."

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

The periodic table feature has served as Kokai's signature interface element since the platform launched on June 6, 2023. The visualization aimed to provide traders with an alternative to traditional spreadsheet-style layouts found on competing demand-side platforms. According to ADWEEK, "Unlike the spreadsheet-like layouts of rival demand-side platforms, Kokai was designed to give traders a more visual way to configure and troubleshoot campaigns."

The redesign follows sustained criticism from programmatic advertising professionals who have expressed frustration with the interface since Kokai's introduction. According to sources familiar with the platform's development, the periodic table has contributed to slower-than-expected adoption rates that have affected The Trade Desk's revenue performance. ADWEEK reported that "the update follows months of grumbling from advertisers."

Technical specifications and implementation details

The periodic table interface organized campaign data into visual blocks that represented different campaign elements through color-coding and positioning. According to ADWEEK, "The table visualizes advertisers' campaigns in color-coded blocks like budget allocation or ad formats, and has been a signature of Kokai's interface since its launch in 2023."

Each block contained specific metrics such as budget allocation percentages, bid strategies, audience segments, and performance indicators. The system allowed users to manipulate campaign settings by interacting directly with the visual elements rather than navigating through traditional menu structures.

The visualization attempted to surface all campaign information and relevant data on the main view, enabling users to move through the media buying process without switching between multiple screens. Campaign optimization decisions could be made by analyzing the color patterns and block relationships within the table format.

Under the redesigned interface, the periodic table will continue operating at the ad group level, where more granular campaign management typically occurs. Advertiser and campaign-level views will transition to conventional interface designs that align more closely with industry-standard programmatic platforms.

Revenue impact and adoption challenges

According to The Trade Desk's financial disclosures and ADWEEK reporting, "Some of The Trade Desk's revenue miss is attributed to slower-than-expected adoption of Kokai." The periodic table interface has been identified as a contributing factor to user resistance during the platform transition process.

The company reported that over 70% of client spend now flows through Kokai as of the second quarter of 2025, representing significant progress from initial adoption rates. However, the migration timeline has extended beyond original projections, with complete client transition to Kokai expected by the end of 2025 rather than earlier target dates.

Industry professionals have documented specific concerns about the periodic table's functionality through programmatic marketing communities. According to feedback posted on social media platforms, media buyers have criticized the interface as "not intuitive" and described the menu system as "overloaded" compared to traditional campaign management tools.

Broader context within programmatic advertising

The periodic table redesign will occur during a period of significant technological transformation across the programmatic advertising sector. The Trade Desk has undergone its largest organizational restructuring in company history, implementing changes to client-facing teams and engineering operations while pursuing complete platform migration to Kokai.

The company will simultaneously introduce multiple platform enhancements including Deal Desk for managing advertising partnerships, expanded AI-powered creative marketplace integrations, and enhanced measurement capabilities through retail partnerships. These developments reflect broader industry trends toward artificial intelligence integration and supply chain transparency in programmatic advertising.

Competing platforms have leveraged The Trade Desk's transition challenges to attract clients through alternative pricing structures and interface designs. The extended Kokai adoption timeline has created opportunities for rival demand-side platforms to emphasize interface stability and user experience consistency in their competitive positioning.

Industry reaction and user feedback

The periodic table interface has generated polarized reactions within the programmatic advertising community since Kokai's launch. While The Trade Desk positioned the visualization as an innovative approach to campaign management, practical implementation has faced resistance from experienced traders accustomed to traditional interface designs.

According to industry analysis, some programmatic professionals have expressed concerns that the periodic table complicates routine campaign optimization tasks and increases the time required for standard troubleshooting procedures. The visual approach, while distinctive, has been criticized for requiring additional learning curves compared to spreadsheet-based interfaces that dominate the programmatic advertising sector.

Former Trade Desk executives have defended the platform's innovative approach despite user criticism, with departing Vice President of Product Bill Simmons noting in March 2025 that critics "only see the surface" and haven't experienced "the whole picture" of Kokai's capabilities.

Platform capabilities and artificial intelligence integration

Beyond the periodic table interface, Kokai will incorporate distributed artificial intelligence capabilities designed to enhance campaign optimization and decision-making processes. The platform processes over 13 million advertising impressions per second while applying predictive algorithms for bid optimization, audience targeting, and creative performance analysis.

The system will include three key measurement indices: the Retail Sales Index for measuring online and offline retail sales against advertising spend, the TV Quality Index for assessing viewer experiences across streaming platforms, and the Quality Reach Index for expanding customer base targeting. These tools operate independently of the periodic table interface and will remain unaffected by the redesign.

Kokai's Partner Portal will enable thousands of integration partners to connect directly with The Trade Desk through standardized adapters. The portal supports integrations for OpenPath, Unified ID 2.0, retail onboarding, measurement capabilities, third-party audience data, and contextual targeting solutions.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Connected television and streaming advertising focus

The redesign will coincide with The Trade Desk's continued emphasis on connected television advertising, which represents the company's largest and fastest-growing revenue segment. The platform reaches more than 90 million households and 120 million connected TV devices, positioning the company to capitalize on streaming platform adoption trends.

Connected television campaigns require sophisticated targeting and optimization capabilities that benefit from artificial intelligence integration rather than specific interface designs. The periodic table removal from campaign-level views may streamline connected TV campaign management by reducing visual complexity while maintaining underlying optimization functionality.

Recent partnerships with major streaming platforms including Disney, NBCU, Walmart, Roku, LG, and Netflix have expanded during 2025 as these services increasingly adopt programmatic advertising models. These relationships operate through Kokai's technical infrastructure regardless of interface design choices.

Financial performance and market positioning

The Trade Desk reported second quarter 2025 revenue of $694 million, representing 19% year-over-year growth despite platform transition challenges. The company maintained customer retention above 95% for the 11th consecutive year, indicating sustained client satisfaction despite interface-related concerns.

Operating expenses reached $448 million in the second quarter, up 23% year-over-year, primarily driven by platform investments and team expansion related to Kokai development and implementation. The company maintained $1.7 billion in cash, cash equivalents, and short-term investments while generating $117 million in free cash flow.

The company joined the S&P 500 index on July 18, 2025, validating its position within the programmatic advertising sector despite platform transition challenges. The stock inclusion occurred during the period of Kokai adoption difficulties, suggesting investor confidence in the company's long-term technological strategy.

Competitive landscape implications

The periodic table redesign will reflect broader competitive pressures within the programmatic advertising sector, where user experience and platform adoption rates directly impact market share and revenue growth. Major technology companies including Google, Amazon, and Meta continue expanding their advertising technology offerings, creating pressure for independent platforms to maintain user satisfaction and operational efficiency.

The Trade Desk's independent platform positioning distinguishes it from competitors that operate within larger technology ecosystems. However, this independence will require sustained user adoption and satisfaction to maintain competitive advantages against integrated advertising solutions offered by major technology companies.

Recent industry developments have included regulatory scrutiny of major advertising platforms, creating opportunities for independent providers like The Trade Desk to emphasize transparency and objectivity in their market positioning. The periodic table removal may support these positioning efforts by addressing user experience concerns that could affect platform competitiveness.

Implementation timeline and future developments

The periodic table redesign represents part of The Trade Desk's broader platform optimization strategy as the company pursues complete Kokai adoption by the end of 2025. Additional interface modifications and feature enhancements are expected throughout the remainder of the year as user feedback influences platform development priorities.

The company will continue investing in artificial intelligence capabilities and partner integrations that operate independently of specific interface designs. These technological investments aim to maintain The Trade Desk's competitive position regardless of visual interface choices or user experience modifications.

Future platform developments will likely emphasize functionality and performance optimization rather than distinctive visual elements, reflecting lessons learned from the periodic table implementation and user adoption challenges experienced throughout 2024 and 2025.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- June 6, 2023: The Trade Desk launches Kokai platform with periodic table interface and distributed AI capabilities

- December 2024: Company implements largest organizational restructuring in history while pursuing Kokai migration

- March 14, 2025: VP of Product Bill Simmons announces departure while defending Kokai against industry criticism

- April 28, 2025: Bunny Studio integration announced for audio ad creation within Kokai platform

- June 9, 2025: Deal Desk feature launches as new pillar of Kokai platform

- June 17, 2025: Rembrand partnership expands AI creative marketplace within Kokai

- July 18, 2025: The Trade Desk joins S&P 500 following strong programmatic growth

- August 7, 2025: Company reports Q2 revenue of $694 million with 19% year-over-year growth

- August 13, 2025: Users report forced Kokai adoption for new campaign creation amid platform resistance

- September 17, 2025: ADWEEK reports The Trade Desk will announce periodic table interface redesign, removing feature from advertiser and campaign views

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: The Trade Desk, a Ventura, California-based programmatic advertising platform, will implement interface changes affecting traders, media buyers, and advertisers using the Kokai platform globally.

What: The company will partially eliminate the periodic table visualization from Kokai's interface, removing the color-coded campaign management blocks from advertiser and campaign views while maintaining the feature only at the ad group level.

When: ADWEEK reported the announcement on September 17, 2025, following months of user resistance and slower-than-expected adoption rates since Kokai's launch on June 6, 2023.

Where: The changes will affect The Trade Desk's global Kokai platform used by programmatic advertising professionals worldwide, with the periodic table interface being removed from specific platform sections.

Why: The redesign will address sustained user criticism and adoption challenges that have contributed to revenue performance issues, with ADWEEK noting that "some of The Trade Desk's revenue miss is attributed to slower-than-expected adoption of Kokai."