Temu's abrupt withdrawal from U.S. Google Shopping

Chinese e-commerce giant's sudden advertising pullback coincides with heightened tariffs and app ranking collapse.

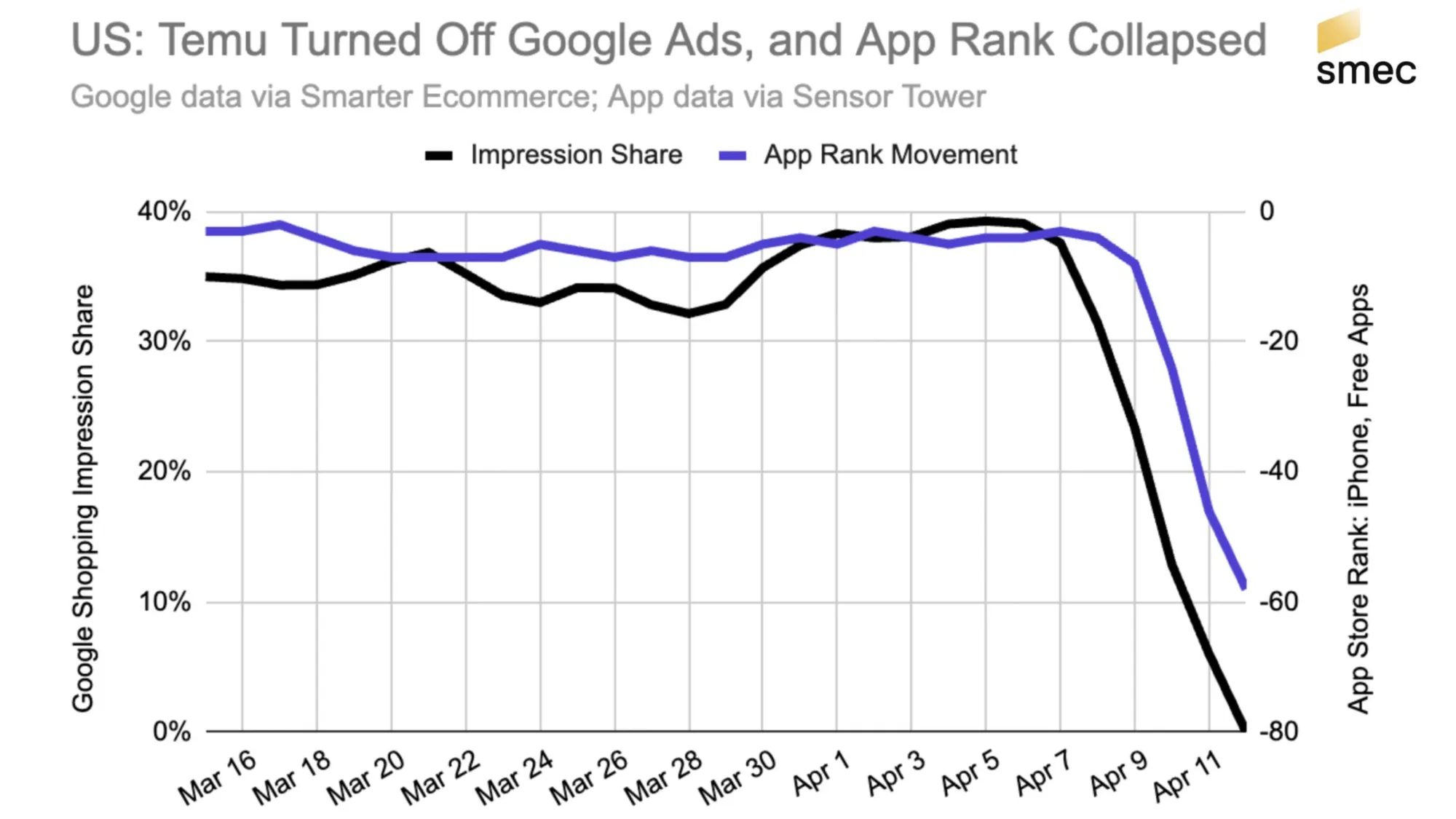

Temu completely ceased all Google Shopping advertising campaigns in the United States on April 9, according to data analysis shared by ecommerce experts. This pullback, occurring just one week ago, has triggered a dramatic decline in the retailer's mobile application performance, with its App Store ranking plummeting from a consistent top 5 position to 58th place in merely three days.

The timing of this significant advertising withdrawal coincides precisely with the Trump administration's intensified position on Chinese imports, which has raised tariffs to 125% while maintaining more moderate approaches toward other trading partners. This policy shift appears to have directly impacted Temu's aggressive U.S. market strategy.

Mike Ryan, Head of Ecommerce Insights at Smarter Ecommerce, first documented this development, providing detailed impression share data that demonstrates the complete disappearance of Temu's advertising presence from auction visibility metrics by April 12.

"Temu completely shut off Google Shopping ads in the U.S. on April 9, with its App Store ranking subsequently plummeting from a typical third or fourth position to 58th in just three days," Ryan noted in his analysis shared on professional networks.

Business model vulnerabilities exposed

Temu's rapid rise in the U.S. market has been fueled by an extraordinarily aggressive advertising strategy. According to multiple reports, the company has been among the top spenders on digital advertising platforms. A March 2024 report from The Wall Street Journal indicated that Temu's parent company, PDD Holdings, spent approximately $2 billion on Facebook and Instagram advertisements alone in 2023, making it Meta's largest advertising client.

The company simultaneously maintained position as one of Google's top five advertising spenders, according to industry analysts. This massive ad expenditure supported a business model predicated on heavily subsidized orders from parent company PDD Holdings, designed to drive market share growth despite operating at losses on individual sales.

"Temu's business model relied on heavily subsidized orders from parent company PDD to drive market share growth, despite operating at a loss on individual sales," according to analysis in Search Engine Land's reporting on the sudden ad pullback.

The abrupt cessation of this aggressive advertising strategy has revealed the fragility of Temu's market position. The company's immediate app performance decline demonstrates a critical dependence on continuous paid acquisition channels rather than organic customer interest or retention.

"The company's inability to maintain app performance without advertising for even a single day demonstrates the fragility of its market position," noted analysts reviewing the impact of this strategic shift.

Tariff impacts and regulatory challenges

Temu's advertising withdrawal directly follows significant changes in U.S. trade policy affecting Chinese imports. Beyond increased tariff rates, recent regulatory scrutiny has focused on closing the "de minimis" import loophole that allowed shipments valued under $800 to enter the United States without paying duties.

This regulatory framework provided a competitive advantage for companies like Temu and Shein, which typically ship individual small-value packages directly to consumers. The crackdown on this practice, combined with elevated tariff rates specifically targeting Chinese imports, appears to have severely undermined Temu's direct-from-manufacturer approach.

According to data from the U.S. Congress, Temu and its competitor Shein collectively ship approximately 600,000 packages to the United States daily, highlighting the scale of their operations that may be affected by these policy changes.

U.S. lawmakers have specifically targeted these companies in recent months, with some calling for outright bans on imports of goods sold through Temu, citing concerns about forced labor and other trade practice issues.

Want to reach marketing professionals and decision-makers? Showcase your brand, tools, or services with our sponsored content opportunities.

Market implications for advertisers

The sudden withdrawal of such a dominant advertising spender creates significant ripple effects across digital marketing ecosystems. Previous instances of major advertisers rapidly exiting auction platforms have resulted in measurable decreases in cost metrics for remaining participants.

"Ecommerce advertisers may experience temporary relief in digital advertising costs as Temu's aggressive spending vanishes from auction platforms," notes Anu Adegbola, Paid Media Editor at Search Engine Land. "Similar rapid market exits (e.g., Amazon during early pandemic lockdowns) led to drops in cost-per-click metrics."

Market analysts anticipate potential reductions in CPM (cost per thousand impressions) rates, which could subsequently lower both CPC (cost per click) and cost-per-conversion metrics for advertisers competing in similar spaces.

However, the underlying causes of Temu's strategic retreat – specifically the tariffs and import restrictions – may ultimately prove more damaging to the broader ecommerce landscape, particularly for small and medium-sized businesses reliant on similar cross-border supply chains.

Future outlook remains uncertain

Despite this significant setback, analysts note important distinctions between Temu and previous failed ecommerce ventures such as Wish.com. Critically, Temu's parent company, PDD Holdings, remains fundamentally sound from a financial perspective, with robust performance in its primary Asian markets.

With U.S. trade policy subject to potential changes and facing internal opposition even within the current administration, experts suggest Temu's retreat may not necessarily be permanent. The company's strategic withdrawal appears specifically targeted to the U.S. market rather than reflecting global operational challenges.

"Unlike failed competitor Wish.com, Temu's parent company remains fundamentally sound. With U.S. trade policy still in flux and facing internal opposition even within the administration, Temu's retreat may not be permanent," notes Search Engine Land in its assessment of the situation.

This development highlights the increasingly complex interplay between international trade policies, digital advertising strategies, and ecommerce market dynamics in an environment where cross-border commerce faces growing regulatory scrutiny.

Why this matters for marketers

This abrupt change in Temu's advertising strategy holds significant implications for digital marketers across multiple channels. First, it demonstrates the vulnerability of business models overly dependent on continuous paid acquisition versus sustainable organic growth and customer retention. Temu's immediate performance collapse after halting advertising reveals the absence of sufficient brand loyalty or organic demand to sustain its market position.

Second, the situation highlights how rapidly changing trade policies can dramatically impact digital marketing ecosystems. Companies heavily reliant on cross-border supply chains or specific trade advantages may need to reassess their long-term marketing strategies in light of potential regulatory shifts.

Finally, this case provides a real-time example of how the withdrawal of a major advertising spender can recalibrate auction dynamics across platforms. Marketers should monitor potential opportunities for improved efficiency in affected channels while remaining alert to the possibility that Temu might eventually return with modified strategies adapted to the new regulatory landscape.

Timeline

- March 7, 2024: Wall Street Journal reports Temu's parent company spent approximately $2 billion on Meta advertising in 2023, making it the platform's largest ad client.

- April 9, 2025: Temu completely shuts off all Google Shopping advertising campaigns in the United States.

- April 12, 2025: Temu's impression share data shows complete disappearance from advertiser auction visibility metrics.

- April 12-14, 2025: Temu's App Store ranking plummets from consistent top 3-4 position to 58th place.

- April 14, 2025: Mike Ryan shares comprehensive data analysis confirming Temu's advertising pullback and resulting app performance collapse.