Study reveals optimal CTV and linear TV investment balance for 2025

New research analyzes 224.2 billion TV ad impressions to determine the ideal mix of CTV and linear TV spending for maximum ROI.

A comprehensive study analyzing 224.2 billion TV advertising impressions from 87 brands across 12 industries has revealed significant insights into the optimal balance between Connected TV (CTV) and linear TV investments. According to data released in Q3 2024, even minor reallocations of advertising spend can drive measurable performance improvements.

The research, conducted by iSpot using its Unified Measurement dataset, demonstrates that top-performing brands allocate 23.7% of their impressions to CTV, compared to an average of 17.4% for other advertisers. This 6.3 percentage point difference in allocation strategy has resulted in substantial performance gains.

The travel industry leads CTV adoption with a 33.3% share of impressions, followed by home and real estate at 26.1%, and pharmaceutical and medical at 24.1%. In contrast, entertainment brands show the lowest CTV adoption at 7.6%, according to the study findings.

Campaign size significantly influences optimal CTV allocation. Small campaigns, defined as those with fewer than 300 million impressions, see the strongest performance when allocating 53.1% of impressions to CTV. Medium-sized campaigns, ranging from 300 million to 2.9 billion impressions, perform best with 26.5% CTV allocation. Large campaigns exceeding 3 billion impressions show optimal results with 12.8% CTV share.

Linear TV continues to dominate current advertising spend, capturing 67.5% of total TV ad spending compared to 32.5% for CTV. This imbalance has led to significant oversaturation in linear TV, with an average frequency of 26.5 exposures compared to 7.3 for CTV.

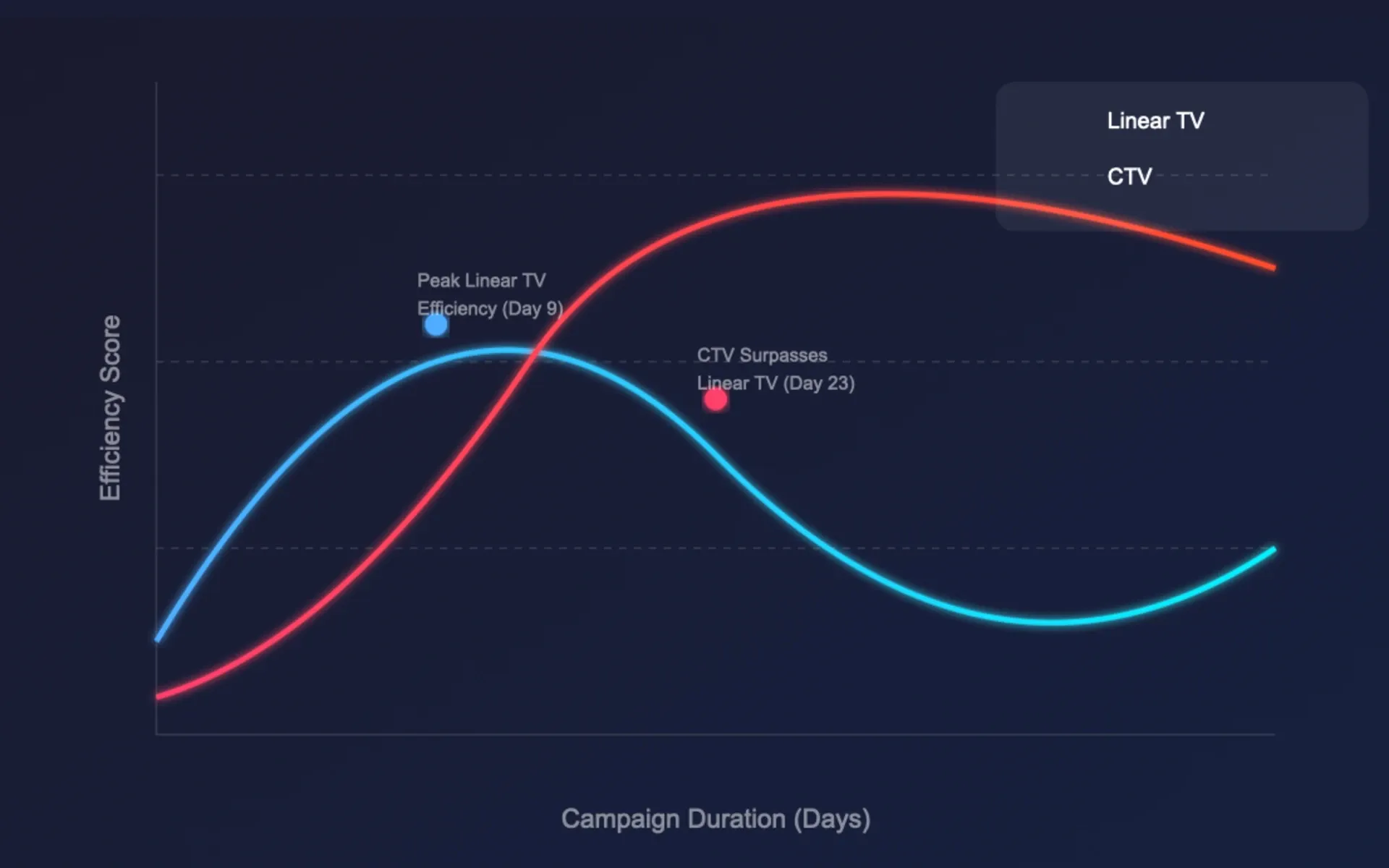

The efficiency analysis reveals that linear TV reaches peak effectiveness within 10 days of campaign launch, after which increased frequency yields diminishing returns. In contrast, CTV maintains steady efficiency growth throughout the campaign duration, surpassing linear TV's efficiency after 23 days.

According to the data from EMARKETER, linear TV generates 86.9% of total TV ad impressions despite accounting for only 54.2% of TV time spent. This disparity highlights the current inefficiencies in traditional TV advertising approaches.

The study emphasizes four critical key performance indicators: CTV total reach percentage, CTV exclusive reach percentage, CTV frequency, and CTV conversion rate. These metrics formed the basis for ranking brand performance and determining optimal allocation strategies.

The research methodology included strict sample criteria, analyzing only brands advertising on both CTV and linear TV platforms while tracking web conversions directly attributable to their advertising efforts. This approach ensured comprehensive cross-platform performance assessment.

For 2025, the findings suggest that advertisers should implement a CTV-first strategy while using linear TV for incremental reach. This approach enables brands to tap into exclusive CTV households while maintaining optimal ad exposure levels and driving measurable business outcomes.

The study recommends three strategic actions for 2025: reallocating budgets based on campaign size, leveraging first-party TV OEM data for refined targeting, and incorporating real-time analytics for continuous optimization against the efficiency curve.

These findings represent a significant shift in TV advertising dynamics, providing concrete data to guide investment decisions in an increasingly fragmented media landscape. The research underscores the importance of strategic allocation between platforms to maximize advertising effectiveness and reach.