Semrush triples AI visibility in one month with systematic optimization

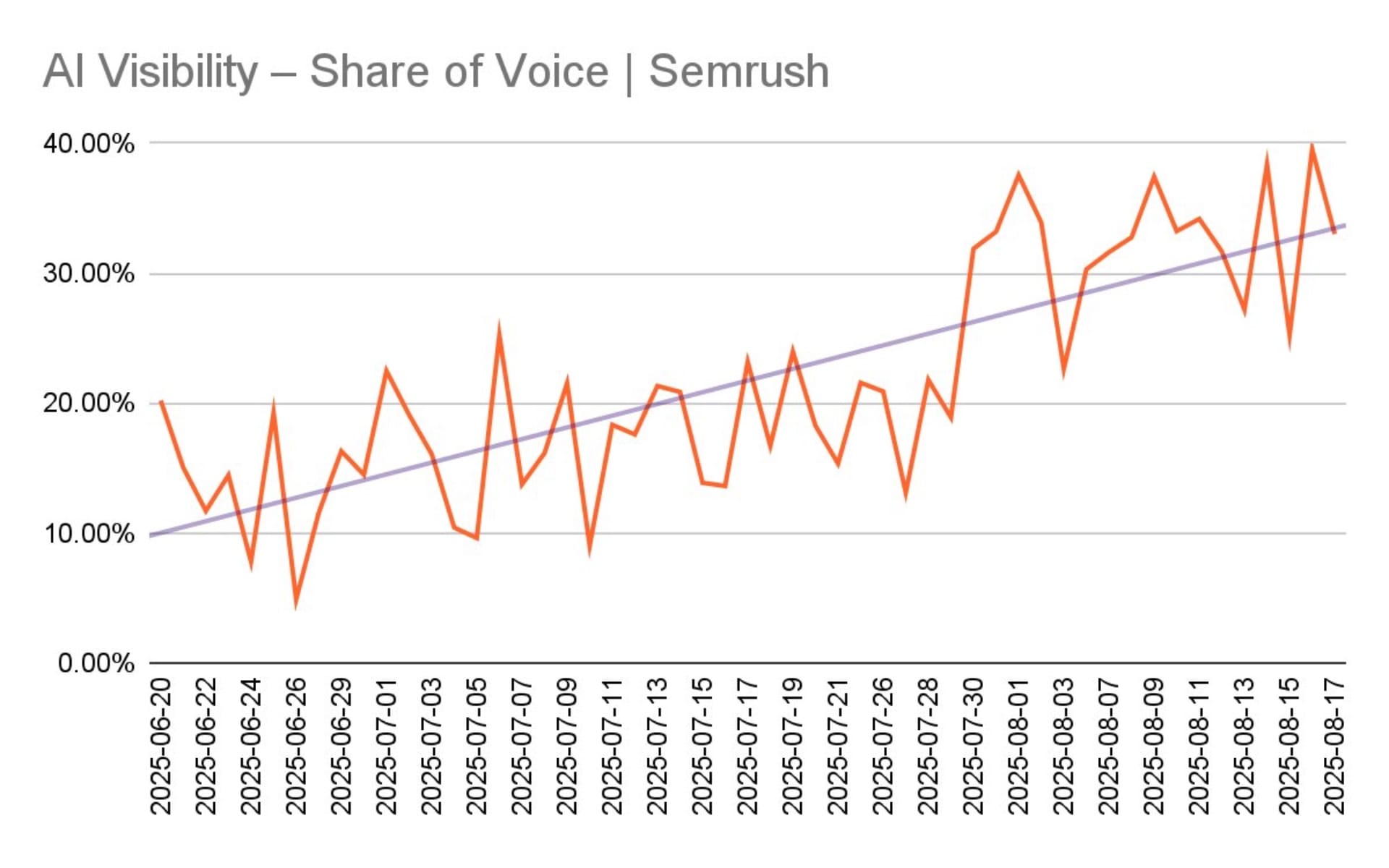

Semrush nearly tripled its share of voice for AI visibility topics from 13% to 32% in one month after large language models failed to mention the company despite its Enterprise AIO launch.

Semrush revealed on October 17, 2025, that the company nearly tripled its AI share of voice from 13% to 32% in one month after discovering that ChatGPT and other large language models failed to mention the company when users queried about AI monitoring tools. The disclosure from Sergei Rogulin, Semrush's Head of Organic & AI Visibility, documented a systematic five-step optimization process that addressed a fundamental disconnect between content citations and competitive positioning across artificial intelligence platforms.

The Boston-based online visibility management platform tested ChatGPT shortly after launching Enterprise AIO and AI Visibility Toolkit in June 2025. According to the company, "ChatGPT mentioned every competitor—but not us." LLMs cited Semrush blog content hundreds of times while simultaneously recommending competitors, creating what the company characterized as a measurement problem distinct from traditional search engine optimization challenges.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Citations failed to indicate competitive position

Traditional attribution systems measure clicks and conversions, but AI influence operates differently. LLMs cite content without generating website visits, according to Semrush's analysis. The company's blog traffic declined even as LLM citations increased, demonstrating that content references alone don't translate to brand recommendations or competitive visibility.

Studies referenced by Semrush indicate that 40% to 60% of sources cited by LLMs change monthly. This citation volatility stems from non-deterministic AI platforms that generate different responses for identical prompts throughout the day. The variability creates operational challenges distinct from traditional SEO, where rankings remain relatively stable and teams can check performance weekly.

Two metrics replaced traditional traffic analysis

Semrush identified visibility and share of voice as core metrics after testing multiple measurement approaches. Visibility measures whether a brand receives any mention for target prompts—the specific queries prospects type into ChatGPT. Share of voice measures competitive positioning when mentions occur. If ChatGPT lists five solutions and mentions a brand third, that brand's share of voice ranks lower than the first-mentioned solution.

The company tracks these metrics across ChatGPT, Perplexity, Google, and other AI platforms using Enterprise AIO. Semrush focused on bottom-funnel prompts rather than generic queries. The team selected 39 prompts including "best enterprise AI visibility platform" because they represent actual buying decisions. When users ask ChatGPT specific product recommendation questions and see particular solutions, those brands enter consideration sets without requiring paid advertising.

Five-step process addressed multiple platforms

Semrush's optimization framework began with identifying 20 to 50 bottom-funnel queries that stakeholders would prioritize. The second step established baseline measurement through tracking campaigns. Semrush measured a starting position of 13% share of voice for AI visibility topics, confirming that LLMs lacked awareness of the company's AI monitoring capabilities.

The third step audited existing content for what Semrush termed "injection opportunities"—locations where product mentions could integrate naturally without disrupting content flow. The company updated an existing blog post about getting LLM brand mentions to include how Enterprise AIO's Source Impact Analysis reveals which sources LLMs actually cite. This created what Semrush described as authentic tie-ins rather than forced product placements.

Step four represented the company's biggest strategic shift. Semrush expanded optimization beyond its own domain to anywhere LLMs might discover information. The team worked simultaneously on Reddit, Quora, acquired domains including Backlinko, and social media networks. According to Semrush, many LLMs now crawl social platforms and community discussions for real-time information and user sentiment.

The fifth step created fresh, citable content targeting specific prompts. Semrush focused on listicles, which frequently appear in LLM citations, and developed authoritative, data-driven content answering questions in target prompts directly.

Semrush posted 20% revenue growth in Q2 2025, with AI Optimization launching as an Enterprise Solution generating nearly $1 million in annual recurring revenue within several weeks. The company's AI Toolkit became the fastest-growing product in company history, expanding from zero to $3 million in ARR within months of its late Q1 2025 launch.

Content optimization tactics emphasized clarity

Semrush's content team developed specific LLM optimization tactics. Writers mirror heading syntax in the first sentence of each section. If a heading asks "What Is AI Visibility?" the opening sentence begins "AI visibility is…" rather than contextual preambles. Answers appear clearly and completely in first sentences rather than buried multiple paragraphs down.

The team uses specific, verifiable claims with dates. Content states "share of voice increased from 10% to 20% in August 2025" rather than vague phrases about significant improvement. Writers avoid analogies, idioms, metaphors, and similes. Content states "AI visibility is crucial for discovery" rather than metaphorical language about guiding ships through fog.

Unclear antecedents disappear from optimized content. Writers specify "Enterprise AIO tracks mentions across platforms. The tool updates daily" instead of using ambiguous pronouns. Semrush's approach prioritizes clarity over creativity, reasoning that LLMs need to understand and extract information quickly.

Speed of results exceeded traditional SEO timelines

Semrush observed results within days, sometimes hours. This timeline contrasted dramatically with typical SEO where ranking improvements require weeks or longer. The company's non-brand visibility—how often Semrush appears for general industry queries that don't mention the company name—improved from 40% to 50%, demonstrating the approach worked beyond AI-specific topics.

The company reported three discoveries that changed its thinking about AI optimization entirely. The speed shocked the team. With AI platforms, visibility changes manifested almost immediately rather than following the gradual progression typical of search engine rankings.

Content maintenance became urgent. Since up to 60% of LLM citations change monthly, declining content requires immediate attention. Semrush characterized this as a fundamental shift from traditional SEO timelines where teams could defer updates. When visibility drops in AI platforms, the company determined that responses need to happen almost immediately.

Revenue attribution remains challenging. Semrush acknowledged difficulty tying visibility improvements directly to revenue. The number of variables makes distinguishing AI visibility impact from paid search, email campaigns, and other initiatives extremely complicated, according to the company's assessment.

Multi-platform strategy amplified results

Semrush cannot isolate specific actions because the team executed multiple tactics simultaneously. Whether content injection, new content creation, or the multi-platform strategy drove success remains unclear. The company stated it needs longer timeframes to understand individual impact.

The biggest strategic breakthrough involved expanding beyond Semrush's main domain. LLMs cite diverse sources across the web including Reddit, Quora, and acquired asset domains. Working across all these platforms simultaneously appeared to amplify mentions beyond expectations, according to Semrush's analysis.

The operational reality became clear: with citations changing constantly and fresh content winning immediately, traditional SEO workflows don't function effectively for AI optimization. Semrush characterized this as everyone figuring out the landscape together, though some lessons emerged clearly.

Industry context shows competitive landscape

Adobe launched its LLM Optimizer on October 14, providing businesses tools to monitor, measure, and enhance discoverability in generative AI interfaces. Adobe released data showing a 1,100% year-over-year increase in AI traffic to U.S. retail sites, with visitors from generative AI sources demonstrating 12% higher engagement through longer visits and more page views.

Amplitude introduced AI Visibility on October 30, enabling marketers to monitor brand presence across ChatGPT, Claude, and Google AI Overview with conversion tracking. The San Francisco-based digital analytics company integrated the tool directly into its core platform, connecting AI search presence to traffic and conversion data without requiring separate applications.

Zeta Global unveiled its Generative Engine Optimization solution on September 17, positioning the tool as a response to fundamental shifts in consumer search behavior. According to Gartner data referenced in the announcement, query volume on traditional search engines will fall by 25% next year as users increasingly rely on AI systems for synthesized answers.

However, Lorelight founder Benjamin Houy shut down his AI visibility tracking platform on October 31, after concluding that tracking brand mentions in AI search engines addresses a problem that does not require a separate solution. Churn rates revealed customers explored data but generated zero behavioral changes, according to Houy's explanation.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Marketing implications extend beyond clicks

Semrush expects top-funnel content to lose traffic as ChatGPT answers questions directly. The company stated that teams should stop fighting this reality and start measuring visibility instead of clicks. Domain optimization alone proves insufficient anymore. Organizations need to optimize for mentions on Reddit, Quora, Medium, LinkedIn, and industry forums—anywhere LLMs might discover expertise.

Stakeholders require preparation for new metrics before budget approval situations arise. CEOs still expect traffic growth, but significant wins might remain invisible in Google Analytics. Semrush recommended educating leadership about visibility and share of voice immediately rather than scrambling to justify results later.

Content teams need new processes. When visibility drops, fixes become urgent. Content workflows need to support immediate responses to AI platform changes rather than deferring updates to backlogs. Semrush advised choosing automation battles wisely. While custom workflows can enhance content creation, building proprietary LLM visibility tracking rarely justifies the investment. API costs, maintenance burden, and data reliability issues make purpose-built tools better investments for measurement, according to the company's assessment.

Similarweb launched its GenAI Intelligence Toolkit on July 28, combining visibility tracking across AI chatbots with traffic measurement capabilities. The platform addressed growing marketer demands for comprehensive performance data as AI platforms generated 1.1 billion referral visits in June 2025, representing a 357% year-over-year increase according to Similarweb estimates.

Research indicates that 68% of marketers currently focus on ChatGPT for tracking AI search presence, substantially exceeding attention on other platforms. This concentration reflects practical considerations including transparent referral traffic attribution and strategic positioning for potential future growth as industry analysis suggests ChatGPT could potentially overtake Google search traffic by 2030.

Semrush acknowledged the industry continues learning. Teams that start experimenting now gain advantages when others scramble to catch up later. The company characterized the shift as happening whether marketing teams feel ready or not, recommending that organizations begin measuring and optimizing rather than waiting for perfect clarity.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- June 2025 – Semrush launches Enterprise AIO as Enterprise Solution with $1M ARR in first weeks

- July 2025 – Semrush measures 13% share of voice for AI visibility topics, confirming LLMs lack awareness of company's AI monitoring capabilities

- July 28, 2025 – Similarweb unveils GenAI Intelligence Toolkit combining visibility tracking with traffic measurement

- August 2025 – Semrush share of voice reaches 32% after implementing five-step optimization framework

- September 14, 2025 – Google eliminates n=100 SERP parameter, forcing Semrush and other platforms to execute 10x more requests

- September 17, 2025 – Zeta Global announces Generative Engine Optimization solution as traditional search volume declines

- October 14, 2025 – Adobe launches LLM Optimizer showing 1,100% year-over-year increase in AI traffic to retail sites

- October 17, 2025 – Semrush publishes detailed case study revealing nearly tripled AI share of voice in one month

- October 30, 2025 – Amplitude introduces AI Visibility tool with competitive tracking across ChatGPT, Claude, and Google AI Overview

- October 31, 2025 – Lorelight founder shuts down AI visibility tracking platform citing zero behavioral changes from customers

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Semrush, the Boston-based online visibility management platform with $108.9 million Q2 2025 revenue, led optimization efforts through Sergei Rogulin, Head of Organic & AI Visibility, along with contributors Alex Lindley and Carlos Silva.

What: Semrush nearly tripled its AI share of voice from 13% to 32% in one month using a systematic five-step optimization process after discovering ChatGPT and other LLMs mentioned competitors but not Semrush despite the company's Enterprise AIO and AI Visibility Toolkit launch. The process included identifying target prompts, establishing baseline measurement, auditing existing content for injection opportunities, expanding optimization beyond Semrush's domain to platforms including Reddit and Quora, and creating fresh citable content.

When: Semrush launched Enterprise AIO in June 2025, measured 13% share of voice in July 2025, implemented its optimization framework throughout July and August 2025, achieved 32% share of voice by August 2025, and published the detailed case study on October 17, 2025.

Where: Optimization efforts spanned multiple platforms including Semrush's main domain, acquired asset domains like Backlinko, social media networks, Reddit, Quora, and other locations where LLMs gather information. Visibility tracking covered ChatGPT, Perplexity, Google AI platforms, and other artificial intelligence systems.

Why: Large language models cited Semrush blog content hundreds of times while recommending competitors, creating a disconnect between content usage and competitive positioning. Traditional traffic metrics proved insufficient as LLM citations increased while blog traffic declined. The company needed metrics measuring competitive positioning rather than just content usage, prompting development of visibility and share of voice measurements that correlate with AI influence rather than clicks. The approach matters for marketers as up to 60% of LLM citations change monthly, requiring immediate content maintenance rather than traditional SEO timelines where teams could defer updates.