PubMatic and Magnite battle for ad tech dominance

Financial reports reveal strengths and challenges for leading supply-side platforms.

The supply-side platform (SSP) market continues to evolve with PubMatic and Magnite releasing their Q1 2025 financial results this month. Both companies face distinct challenges while positioning themselves in the competitive digital advertising ecosystem. The financial data provides insights into their performance and strategic directions as they navigate changes in the ad tech landscape.

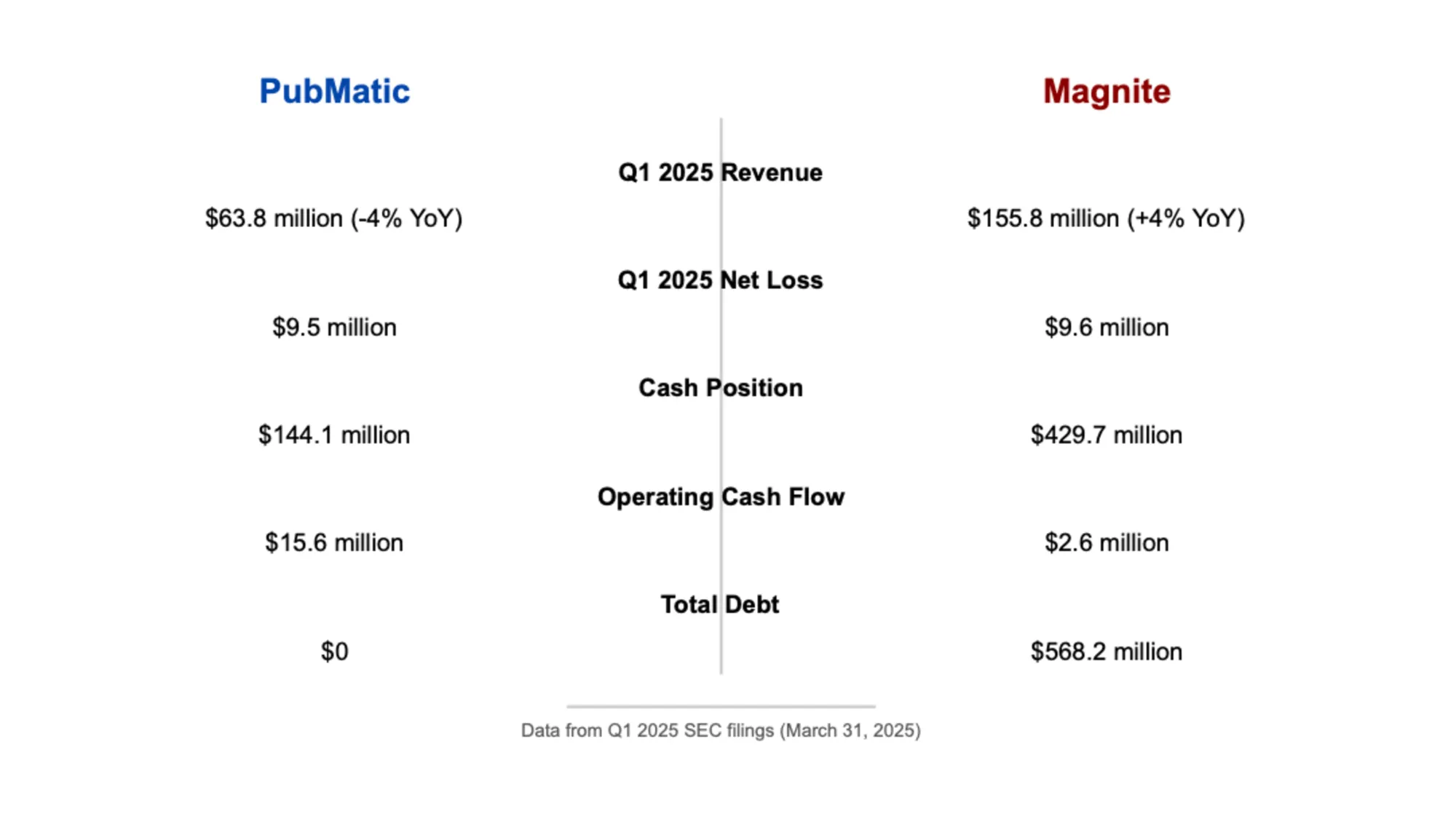

PubMatic reported $63.8 million in revenue for Q1 2025, a 4% decrease compared to the $66.7 million in the same period last year, according to the company's recent SEC filing. Despite this revenue decline, the company demonstrated financial discipline, reporting a net loss of $9.5 million, compared to a loss of $2.5 million in Q1 2024.

"We continue to focus on the strengths that we believe provide us with long-term competitive advantages," PubMatic stated in their Q1 2025 report. "These strengths include our global, omnichannel reach which targets a diverse set of publishers touching many ad formats and digital device types, including mobile app, mobile web, desktop, display, video, over-the-top video/connected TV ("OTT/CTV"), and rich media."

The company's platform processed approximately 842 billion ad impressions daily during March 2025, highlighting its significant scale in the industry. PubMatic now serves approximately 1,950 publishers and app developers worldwide, an increase from approximately 1,800 in the same period last year.

Despite revenue challenges, PubMatic maintained strong gross margins of 60%, slightly lower than the 62% reported in Q1 2024. The company ended the quarter with a strong cash position of $144.1 million in cash, cash equivalents, and marketable securities.

In contrast to PubMatic, Magnite reported revenue growth for Q1 2025. The company generated $155.8 million in revenue, a 4% increase from $149.3 million in Q1 2024. Magnite also significantly reduced its net loss to $9.6 million, a 46% improvement compared to a loss of $17.8 million in the same period last year.

Magnite's Contribution ex-TAC (a non-GAAP metric similar to gross profit plus cost of revenue excluding traffic acquisition costs) grew 12% year-over-year to $145.8 million, with CTV Contribution ex-TAC increasing by 15%.

"Our revenue growth was driven by growth in mobile and desktop revenue, which increased by $4.5 million, or 8%, and $2.0 million, or 9%, respectively," Magnite stated in their filing. "Revenue from CTV for the three months ended March 31, 2025 was relatively flat year-over-year."

Magnite ended the quarter with $429.7 million in cash and cash equivalents, positioning it well for future investments and operations.

Profitability challenges persist

Both PubMatic and Magnite continue to face profitability challenges despite their revenue performance. Neither company achieved profitability in Q1 2025, though their financial trajectories differ significantly.

PubMatic reported a net loss of $9.5 million for Q1 2025, a deeper loss compared to $2.5 million in Q1 2024. This represents a concerning trend despite the company's strong gross margin of 60%. However, PubMatic did generate positive cash flow from operations, with $15.6 million in cash from operating activities during the quarter, indicating underlying financial strength despite the accounting loss.

Magnite showed more promising progress toward profitability, reducing its net loss to $9.6 million, a 46% improvement compared to the $17.8 million loss in Q1 2024. The company also reported positive cash flow from operations of $2.6 million, though significantly less than PubMatic's operational cash generation.

Both companies continue to invest heavily in growth initiatives, including technology development and sales and marketing, which impacts their near-term profitability. PubMatic spent $8.8 million on technology and development in Q1, while Magnite invested $22.3 million in this area, demonstrating their commitment to innovation despite profitability challenges.

The path to consistent profitability for both companies likely depends on scaling revenue faster than operating expenses, particularly as they navigate industry changes related to identity solutions and potential market restructuring following the Google antitrust ruling.

Both companies share similarities as leading independent supply-side platforms but have distinct strategic approaches and market positions.

PubMatic emphasizes its infrastructure-driven approach, stating that it "allows for the efficient processing and utilization of data in real time." The company owns and operates its software and hardware infrastructure globally, which it claims "saves significant infrastructure expenditures as compared to public cloud alternatives."

Meanwhile, Magnite positions itself as "the world's largest independent omni-channel sell-side advertising platform ("SSP"), offering a single partner for transacting globally across all channels, formats and auction types, and the largest independent programmatic CTV marketplace."

Magnite's strategic focus on CTV is evident in their recent announcement. In April 2025, Magnite introduced "next generation SpringServe CTV platform, which is currently in beta testing. The new SpringServe platform combines the features and functionalities of our streaming SSP and ad server to provide a more efficient connection for buyers to premium CTV supply."

Recent industry developments are likely to affect both companies' future performance. On April 17, 2025, the United States District Court for the Eastern District of Virginia ruled that Google had violated federal antitrust laws by maintaining monopoly power in the display publisher ad server market and display ad exchange market.

According to Magnite, "While the specific timing and nature of the remedy remains uncertain, and Google has indicated its intent to appeal the decision, we expect this ruling to have a significant positive impact on our industry and business prospects."

In April 2025, Google also announced changes to its approach to third-party cookies. Magnite noted that "Google announced that they would be maintaining their existing settings and would not introduce new features related to third-party cookies." This represents a shift from Google's previous plan to fully deprecate third-party cookies.

PubMatic similarly referenced this development, stating, "In April 2025, Google confirmed that it was abandoning its effort to deprecate the use of third-party cookies in Chrome and instead ask users to opt-in or opt-out of cookies in Chrome, which may impact the industry's anticipated shift to alternative identity solutions."

Financial health

The financial health of both companies shows some notable differences. PubMatic operates with no active debt, maintaining a strong cash position. The company has a revolving credit facility with a total availability of $110 million, but has not drawn on this facility as of March 31, 2025.

In contrast, Magnite carries a significant debt load. As of March 31, 2025, Magnite had an aggregate gross principal amount of $568.2 million in debt, consisting of a 2024 Term Loan B Facility and Convertible Senior Notes. The company recently completed Amendment No. 2 to its 2024 Credit Agreement on March 18, 2025, which reduced the interest rate on its Term Loan B Facility by 75 basis points.

Magnite's Convertible Senior Notes, with a balance of $205.1 million, will mature on March 15, 2026, adding a near-term obligation for the company to address.

Both companies are pursuing growth initiatives to strengthen their positions in the market. PubMatic focuses on its net dollar-based retention rate, which was 102% for the trailing twelve months ended March 31, 2025, down from 106% for the same period ended March 31, 2024. This metric indicates the company's ability to retain and grow revenue from existing customers.

Magnite places significant emphasis on Supply Path Optimization (SPO), which refers to efforts by buyers to consolidate vendors to find efficient paths to procure media. The company believes it is "well positioned to benefit from SPO in the long run" due to its transparency, inventory supply, and brand safety measures.

Both companies are also investing in identity solutions as the industry shifts away from third-party cookies. Magnite launched "Magnite Curator Marketplace" in 2024, a self-service platform allowing buyers to create custom marketplaces with inventory enriched with first-party or third-party data.

Looking ahead, both companies provided general guidance about their future performance. PubMatic expects "the cost of revenue to be higher in 2025 compared to 2024 in absolute dollars" as it expands capacity to process impressions.

Magnite was more optimistic, stating, "For 2025, we believe our revenue will increase compared to the prior year period and we expect CTV will be our biggest growth driver." The company also expects "Contribution ex-TAC will increase compared to the prior year period" for the remainder of 2025.

The financial results and strategic positioning of both companies highlight the evolving nature of the supply-side platform market. As regulatory changes, especially regarding Google's market position, potentially reshape the industry landscape, PubMatic and Magnite are positioning themselves to capitalize on new opportunities while addressing existing challenges.

Timeline

- March 15, 2025: Magnite implemented Amendment No. 2 to its 2024 Credit Agreement, reducing interest rates on its Term Loan B Facility

- March 31, 2025: PubMatic ended Q1 with $144.1 million in cash and equivalents; Magnite ended with $429.7 million

- April 17, 2025: U.S. District Court ruled Google violated antitrust laws in the display ad market

- April 2025: Google announced it would maintain existing settings for third-party cookies in Chrome

- April 2025: Magnite announced its next generation SpringServe CTV platform (in beta)

- May 2025: Both companies released their Q1 2025 financial results