Polish streaming viewership climbs as summer viewing habits evolve

Nielsen data shows YouTube and Netflix gains amid traditional TV decline during June vacation period.

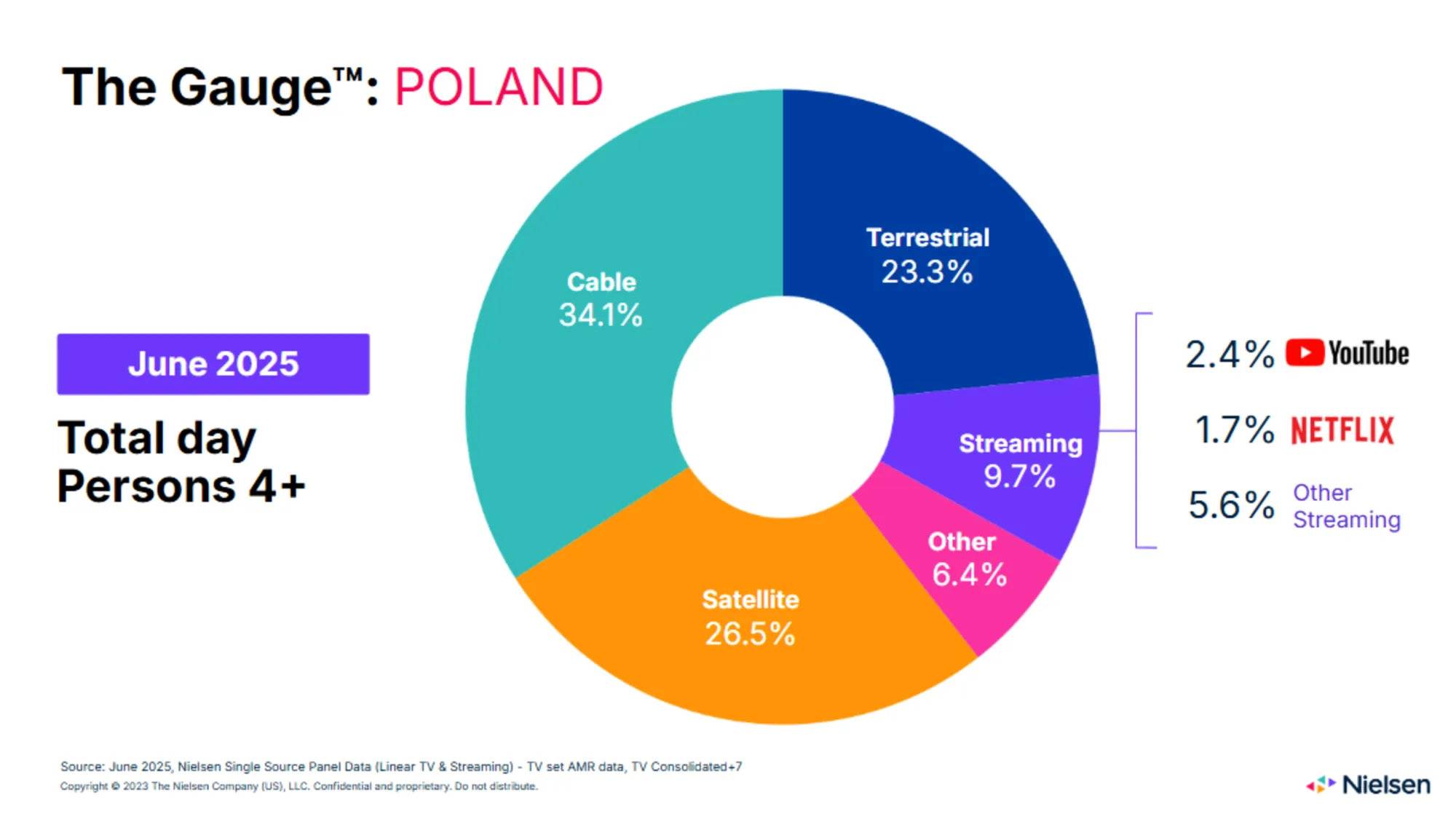

Polish television audiences spent an average of 3 hours and 37 minutes daily watching screens during June 2025, marking a seasonal 6% decline from May while streaming services captured an expanded 9.7% share of total viewership, according to Nielsen's latest Gauge report released in July 2025.

The data, compiled from Nielsen's panel of 3,500 households encompassing nearly 9,700 Polish viewers, revealed streaming's 0.3 percentage point increase from May 2025 despite the overall reduction in viewing time characteristic of summer vacation periods. This growth occurred as traditional television platforms experienced their typical seasonal downturn during the first full month of summer break.

YouTube emerged as the standout performer among streaming platforms, expanding its share to 2.4% of total television viewing time, representing a 0.2 percentage point gain from May. The platform's growth trajectory reflects broader European trends where streaming platforms have captured increasing market share across multiple markets throughout 2024 and 2025.

Netflix maintained its established position at 1.7% of total viewership, holding steady from the previous month. The streaming giant's stable performance comes during a period when Netflix has expanded its programmatic advertising capabilities and achieved significant growth in other European markets.

Additional streaming services including CDA.pl, Player, and SkyShowtime contributed to the overall expansion of streaming's market share. These platforms' collective growth indicates a diversifying Polish streaming landscape that mirrors developments across broader European markets where viewing concentration patterns have emerged as critical factors for advertising strategies.

The 217-minute average daily viewing time represented a decrease from May's 230 minutes, aligning with historical patterns where Polish audiences reduce television consumption during summer months. However, the 4-minute increase compared to June 2024's 213 minutes suggests underlying growth in screen engagement despite seasonal variations.

Traditional television distribution maintained its dominant position despite streaming gains. Cable television networks continued leading viewership patterns, followed by satellite and terrestrial broadcasting services. The distribution reflects Poland's established infrastructure preferences that have remained consistent across multiple measurement periods.

Nielsen's methodology encompasses data collection from Polish households representing diverse demographic segments across the country. The measurement framework includes both linear television viewing and time-shifted consumption up to seven days after original broadcast, providing comprehensive coverage of contemporary viewing behaviors.

The streaming category definition includes live streaming viewership of television stations through over-the-top platforms, capturing the full spectrum of digital television consumption. This approach enables Nielsen to track viewing habits that span traditional broadcast delivery and internet-based distribution methods.

Sports content emerged as a significant factor in June viewing patterns, with major international competitions drawing substantial audiences to both traditional and streaming platforms. The programming landscape during June featured diverse content that appealed to audiences across multiple demographic segments.

The measurement period's data collection follows Nielsen's established protocols for tracking television consumption across Poland's media landscape. The company's single-source panel methodology enables consistent month-to-month comparisons while accounting for seasonal fluctuations in viewing behavior.

YouTube's growth to 2.4% share positions the platform as Poland's leading streaming service by television viewing time. This achievement reflects the platform's diverse content ecosystem and its ability to attract viewers across age demographics during traditional vacation periods when audience availability patterns shift significantly.

The "Other" category in Nielsen's measurement framework accounts for viewing of unrecognized content, representing audience engagement with emerging platforms and content sources that fall outside traditional classification systems. This segment provides insight into evolving consumption patterns as new services enter the Polish market.

Streaming services' 9.7% collective share demonstrates their growing integration into Polish television consumption habits. The expansion occurs as global streaming trends show record-breaking performances in major markets worldwide, suggesting Poland's trajectory aligns with international patterns.

The June 2025 data represents the latest snapshot of Poland's evolving television landscape, where traditional broadcasting maintains majority market share while digital platforms expand their reach among increasingly connected audiences. Nielsen's measurement framework captures these transitions through comprehensive tracking of viewing across all major distribution platforms.

The competitive dynamics between streaming platforms and traditional television services continue shaping content acquisition strategies and advertising approaches across the Polish media market. June's data provides industry stakeholders with essential insights for understanding audience preferences during peak vacation periods.

Seasonal viewing variations consistently impact Polish television consumption patterns, with summer months typically showing reduced overall engagement as audiences spend increased time away from home. The 6% June decline from May reflects these established patterns while highlighting streaming's ability to maintain growth despite broader market contraction.

The data collection methodology ensures accurate representation of Polish viewing habits through Nielsen's established panel infrastructure. This approach enables consistent measurement across multiple platforms while adapting to evolving distribution technologies and consumption methods.

Netflix's stable 1.7% share occurs as the platform has expanded its measurement partnerships with Nielsen across multiple markets including Poland, providing enhanced audience insights for both companies' strategic planning.

The streaming segment's growth trajectory indicates continued expansion potential as Polish broadband infrastructure supports increasing demand for high-quality video content delivery. This foundation enables platforms to compete effectively for audience attention across diverse content categories.

Traditional television's continued dominance reflects established viewing habits and infrastructure investments that have characterized Poland's media landscape for decades. The gradual shift toward streaming services occurs within this context of sustained traditional media consumption.

Timeline

- June 2023: Streaming accounted for 6.4% of TV usage in Poland, with YouTube at 1.8% and Netflix at 1.5%

- June 2024: Streaming reached 8.3% share with YouTube at 2.1% and Netflix at 1.7%, boosted by Euro 2024 football coverage

- July 2024: Polish streaming surged further amid continued sports programming

- September 2024: Polish TV viewership increased 3.2% as summer ended, with streaming reaching 8.8%

- October 2024: Daily viewing time rose 6 minutes during autumn programming shifts

- January 2025: Nielsen ended legacy panel-only ratings globally, transitioning to Big Data + Panel system

- June 2025: Polish streaming climbed to 9.7% share with YouTube reaching 2.4% and Netflix maintaining 1.7%

- July 2025: Nielsen released June 2025 Poland data showing continued streaming growth

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Terminology guide

Streaming platforms: Digital video services that deliver content over internet connections to connected devices including smart TVs, computers, and mobile devices. These platforms have fundamentally transformed the television advertising landscape by offering targeted advertising capabilities, detailed viewer analytics, and flexible ad formats. Unlike traditional television, streaming platforms can provide advertisers with granular demographic data, viewing completion rates, and cross-device attribution, making them increasingly attractive for marketing campaigns seeking measurable results and precise audience targeting.

Market share: The percentage of total television viewing time captured by specific platforms or content categories within a defined market. This metric serves as the primary currency for media buying decisions, as advertisers allocate budgets based on platforms' ability to reach target audiences. Market share data influences advertising rates, content acquisition strategies, and platform investment priorities. For marketers, understanding market share trends helps identify emerging opportunities and optimize media mix strategies across traditional and digital television channels.

Average Minute Rating: A standardized television measurement methodology that calculates the average percentage of the target audience watching a program during each minute of broadcast. This metric provides the foundation for television advertising transactions, enabling marketers to compare audience delivery across different programs and time periods. AMR data helps advertisers understand viewer engagement patterns, optimize commercial placement timing, and negotiate advertising rates based on guaranteed audience delivery levels.

Programmatic advertising: Automated advertising technology that enables real-time bidding and placement of advertisements across digital platforms including streaming services. This approach allows marketers to target specific audience segments based on demographic, behavioral, and contextual data while optimizing campaign performance through machine learning algorithms. Programmatic advertising has revolutionized television advertising by enabling precise targeting, dynamic creative optimization, and transparent performance measurement across connected TV and streaming platforms.

Connected TV: Television sets or streaming devices connected to the internet that enable access to streaming content and interactive advertising experiences. CTV represents the convergence of traditional television viewing with digital advertising capabilities, allowing marketers to combine television's large-screen impact with digital's targeting precision. This platform enables advertisers to reach cord-cutting audiences, implement dynamic ad insertion, and measure campaign effectiveness through detailed analytics unavailable in traditional television advertising.

Over-the-top platforms: Content delivery services that bypass traditional television distribution networks by streaming directly to consumers via internet connections. OTT platforms have created new advertising opportunities by offering ad-supported tiers, interactive commercial formats, and first-party audience data. For marketers, OTT platforms provide access to engaged audiences who have actively chosen specific content, enabling more relevant advertising experiences and improved campaign performance measurement.

Audience measurement: The systematic collection and analysis of television viewing data to understand consumer behavior across platforms and content types. Modern audience measurement encompasses traditional television, streaming services, and digital video consumption, providing marketers with comprehensive insights into media consumption patterns. This data enables advertisers to optimize media planning, validate campaign reach, and understand cross-platform audience overlap for more effective targeting strategies.

Cross-platform viewing: Consumer behavior involving television content consumption across multiple devices and platforms during single viewing sessions or extended periods. This trend requires marketers to develop integrated campaigns that maintain consistent messaging while adapting creative formats for different screens and viewing contexts. Understanding cross-platform viewing patterns helps advertisers avoid audience duplication, optimize frequency management, and create seamless brand experiences across television and digital touchpoints.

Time-shifted viewing: Television consumption that occurs after the original broadcast time through digital video recorders, on-demand services, or streaming platforms. This viewing behavior has significant implications for advertising effectiveness, as traditional commercial avoidance increases while streaming platforms offer new advertising insertion opportunities. Marketers must consider time-shifted viewing patterns when planning campaigns, as they affect reach calculations, frequency delivery, and optimal advertising placement strategies.

Linear television: Traditional broadcast and cable television programming delivered according to fixed schedules, representing the foundation of television advertising for decades. While linear television maintains significant reach advantages, particularly for live events and news programming, its audience composition is shifting toward older demographics as younger viewers migrate to streaming platforms. Marketers continue leveraging linear television for broad reach campaigns while integrating streaming strategies to capture audience segments not accessible through traditional channels.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Polish television audiences, Nielsen measurement company, streaming platforms YouTube and Netflix, traditional television broadcasters

What: Streaming services captured 9.7% of Polish TV viewing time in June 2025, with YouTube growing to 2.4% share and Netflix holding 1.7%, while total daily viewing averaged 3 hours 37 minutes

When: June 2025 measurement period, with data released by Nielsen in July 2025

Where: Poland, measured across 3,500 households and 9,700 panelists representing the national television market

Why: Summer vacation patterns reduced overall viewing by 6% from May, but streaming platforms continued expanding market share through diverse content offerings and improved accessibility across Polish broadband infrastructure