Poland television viewing rises while streaming declines in September

Polish television audiences spent more time with traditional broadcasting and less with streaming services during September 2025, according to Nielsen's latest report.

Nielsen, the global audience measurement company, released data on October 20, 2025, showing that streaming viewership declined by 2.20% in September compared to August, while traditional television consumption increased by 4.23%. The findings reveal shifting viewing patterns as Polish audiences returned to more established television formats during the first month of autumn.

According to Nielsen's All Screens Video Landscape report for September, daily streaming viewership dropped to 55 minutes and 39 seconds, while time spent watching cable, satellite, and terrestrial television rose to 3 hours and 19 minutes. The data comes from Nielsen's single-source telemetry panel of 3,500 households and nearly 9,700 panelists across Poland.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

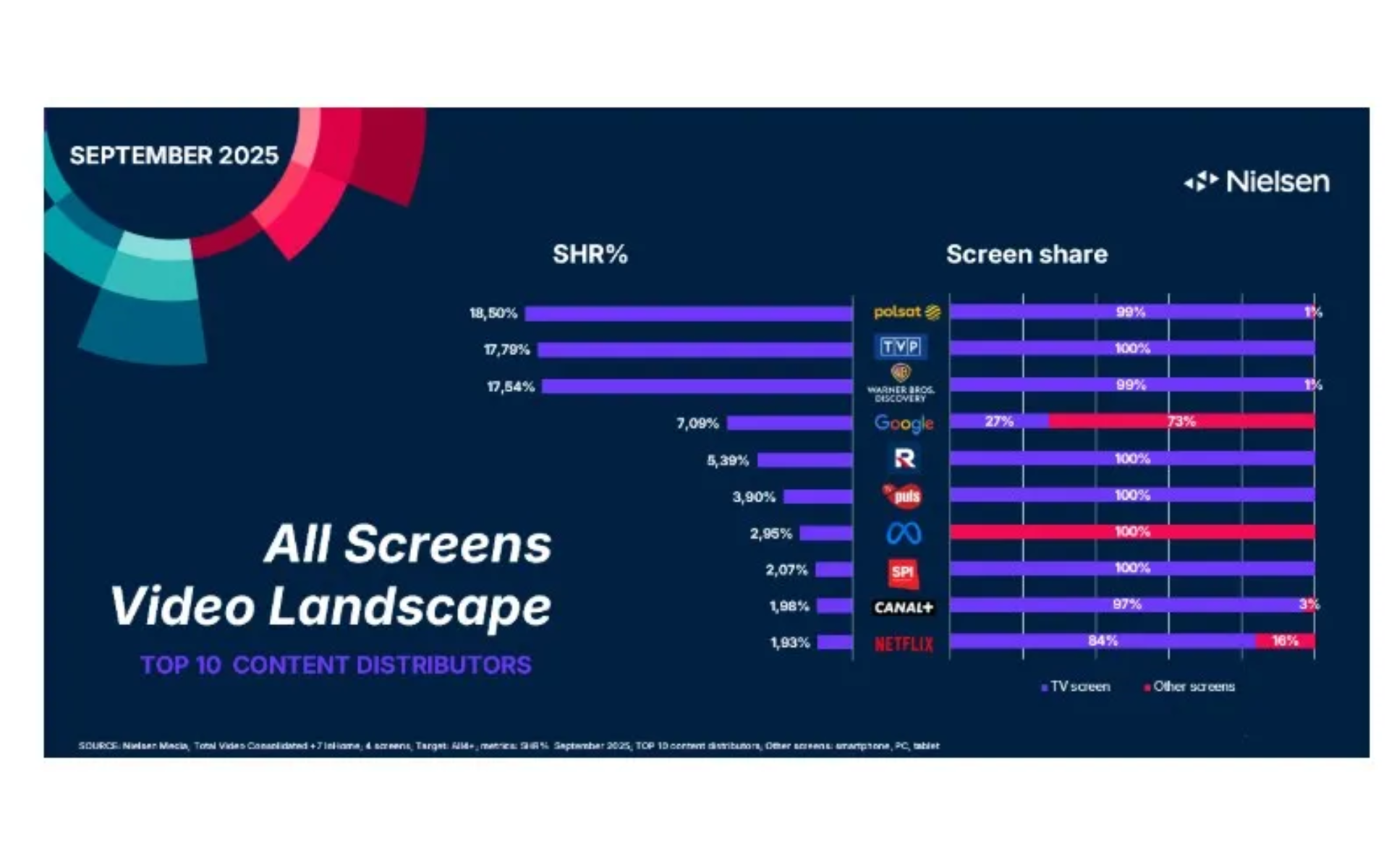

The Polsat Group maintained its position as Poland's leading television distributor with 18.50% viewership share in September. Telewizja Polska secured second place at 17.79%, followed by Warner Bros. Discovery at 17.54%. These three distributors commanded more than half of all Polish television viewership during the month.

The September data marks a reversal from the streaming growth patterns observed earlier in 2025. Polish streaming viewership climbed through the summer months, with services capturing 9.7% of total viewing time in June and reaching a historic 10.1% share in July. The September decline represents the first significant reversal in streaming's upward trajectory throughout 2025.

Television screens remained the dominant platform for video content consumption across all major distributors in September. Warner Bros. Discovery recorded 99% of its viewership on television screens, matching Canal+ Group's 97% television screen share. Netflix showed 84% of its consumption on television screens, while Google's YouTube demonstrated the most diverse viewing patterns with only 27% of viewership occurring on televisions.

The distribution patterns reflect Poland's television infrastructure, where traditional delivery methods continue serving the majority of households. Canal+ Group retained ninth place in Nielsen's rankings, while Netflix maintained its position at the bottom of the top ten distributors despite its relatively high television screen concentration.

Nielsen's methodology captures viewership as a combination of total reach and time spent across four screens: televisions, personal computers and laptops, smartphones, and tablets. The measurement framework provides the media industry with monthly analysis of video content distributors across all monitored platforms.

The data presentation focuses on the 4+ age group and includes the ten distributor groups with the highest total viewership for each month. Individual distributor groups encompass all television stations and online platforms or players owned by the distributor and included in Nielsen's monitoring systems.

For September 2025, Warner Bros. Discovery's portfolio included 30 television channels and three streaming platforms: Max, Player, and TVN24.pl. The distributor's offerings ranged from entertainment channels like TVN and TLC to specialized networks covering sports, lifestyle, and news programming.

Polsat Group's September portfolio comprised 34 television channels and three digital properties: Polsat Box Go, Polsat Go, and its news websites Polsatnews.pl and Interia.pl. The group's channels covered sports through its Eleven Sports and Polsat Sport networks, entertainment via multiple Polsat-branded channels, and news through Polsat News and Wydarzenia 24.

Telewizja Polska operated 16 channels in September, including its flagship TVP1 and TVP2 networks alongside specialized channels for history, culture, sports, and documentary programming. The public broadcaster's 4K channel TVP4K represented its technical advancement in broadcast quality.

Google's presence in Nielsen's measurement came entirely through YouTube, while Telewizja Republika operated a single channel under its TV Republika brand. TV Puls maintained two channels, Puls and Puls2, in the measurement framework.

Netflix appeared in the rankings as a standalone streaming platform without traditional television channels. Meta's inclusion covered viewership across Facebook and Instagram video content on television screens.

SPI International's portfolio included eight specialty channels focused on film and gaming content, featuring brands like Stopklatka, Kino Polska, and FILMBOX Premium. Canal+ Group operated the most extensive channel lineup with 18 television networks and its Canal+ streaming platform.

The September viewing patterns align with seasonal trends in Polish television consumption. Previous Nielsen reports showed August 2025 maintained steady viewing habits with 9.7% streaming share, suggesting September's decline represented a meaningful shift rather than statistical variation.

The measurement company's All Screens Video Landscape reports provide monthly viewership analysis based on Average Minute Rating (AMR) audience share data. The compilation methodology ensures consistent month-to-month comparisons while accounting for platform additions or changes in distributor portfolios.

Nielsen's panel-based approach represents households and panelists across Poland's demographic spectrum. The single-source methodology enables the company to track viewing behavior consistently across multiple platforms and delivery systems simultaneously.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Traditional television's September growth occurred across all three major distribution methods. Cable television, which typically commands the largest share of Polish viewing time, increased alongside satellite and terrestrial broadcasting. The combined growth across these platforms more than offset streaming's decline.

The data reflects broader tensions in Poland's television market, where traditional infrastructure maintains dominance despite gradual streaming expansion. Cable and satellite services together captured over 60% of viewing time in previous Nielsen reports, demonstrating the persistent strength of established distribution networks.

The September increase in traditional television viewing may reflect autumn programming changes as broadcasters launched new content schedules following the summer season. Television networks typically introduce fresh programming in September to coincide with audiences returning from vacation and students resuming school schedules.

For the marketing community, Poland's September data presents a contrast to global trends where streaming platforms have gained consistent market share throughout 2024 and 2025. The reversal in Poland suggests that streaming growth is not linear and may face seasonal fluctuations or market-specific factors that differ from patterns in more mature streaming markets.

The concentration of viewership on television screens across most distributors reinforces television's role as the primary video consumption device in Polish households. Even Netflix, a service designed for multi-device viewing, derives the vast majority of its Polish consumption from television screens rather than mobile devices or computers.

Nielsen's measurement infrastructure tracks both live viewing and time-shifted consumption up to seven days after original broadcast. The methodology includes live streaming of traditional television stations through over-the-top platforms in its streaming category, capturing the full spectrum of how audiences access video content.

The company's global presence positions it to provide comparative insights across international markets. Nielsen operates measurement systems in multiple countries, enabling media industry stakeholders to benchmark performance and understand how local market dynamics compare to global patterns.

Nielsen's All Screens Video Landscape reports serve media buyers, content creators, and distributors in making programming and investment decisions. The monthly cadence provides timely information about viewing pattern changes, enabling rapid strategic adjustments in a dynamic media environment.

The September data arrives as the television industry continues adapting to changing consumption patterns. Industry forecasts project streaming television advertising to grow 19.3% globally in 2025, while linear television faces a 3.4% decline, creating pressure on traditional broadcasters to defend their market positions.

Poland's market presents unique characteristics that may influence viewing patterns differently than other European markets. The country's television landscape includes strong public broadcasting through Telewizja Polska, commercial networks like Polsat and TVN, and specialty networks serving specific content niches.

The September report covers the complete month from September 1 through September 30, 2025. Nielsen releases these reports monthly to provide consistent tracking of television market dynamics across all measured platforms and distributors.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- February 2024: Streaming viewership in Poland jumped 8% in January 2024, with Netflix reaching 2.1% share

- July 2024: Cable and satellite dominated Polish TV with 62.2% combined share while streaming reached 8.6%

- September 2024: Polish TV viewership rose 3.2% as summer ended, with streaming capturing 8.8% of viewing time

- October 2024: Polish TV viewing increased 6 minutes daily amid autumn programming changes

- June 2025: Streaming services captured 9.7% of Polish TV viewing time during summer vacation period

- July 2025: Streaming hit historic 10.1% share in Poland with YouTube at 2.4% and Netflix at 1.8%

- August 2025: Polish viewers maintained steady habits with 9.7% streaming share as political and sports programming drew traditional TV audiences

- September 2, 2025: Nielsen launched Big Data + Panel measurement for 2025 TV season, combining panel data with device information from 45 million households

- October 20, 2025: Nielsen released September 2025 data showing streaming decline and traditional TV growth in Poland

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Nielsen, the global audience measurement company, analyzed viewing patterns across Poland's television market using data from 3,500 households and 9,700 panelists. The Polsat Group, Telewizja Polska, and Warner Bros. Discovery led viewership rankings.

What: Streaming viewership declined 2.20% to 55 minutes and 39 seconds per day in September 2025, while traditional television viewing (cable, satellite, and terrestrial) increased 4.23% to 3 hours and 19 minutes. Television screens remained the dominant viewing platform across all major distributors.

When: The data covers September 2025, with Nielsen releasing the All Screens Video Landscape report on October 20, 2025. The measurements represent a reversal of streaming growth trends observed throughout the earlier months of 2025.

Where: The measurements cover Poland's television market across all major distribution platforms including cable, satellite, terrestrial broadcasting, and streaming services. Nielsen tracked viewership across four screen types: televisions, computers, smartphones, and tablets.

Why: The September decline in streaming and growth in traditional television viewing likely reflects seasonal patterns as audiences returned to regular schedules after summer vacation, combined with autumn programming launches by major broadcasters. The data matters for the marketing community because it demonstrates that streaming growth is not linear and faces market-specific fluctuations, particularly in markets where traditional television infrastructure remains strong. This contrasts with patterns in more mature streaming markets where streaming continues gaining consistent share.