Pinterest reaches 600 million users while revenue climbs 17% in third quarter

Pinterest hits 600 million users in Q3 2025 with $1.049 billion revenue, up 17% year-over-year. International markets accelerate growth despite stock decline.

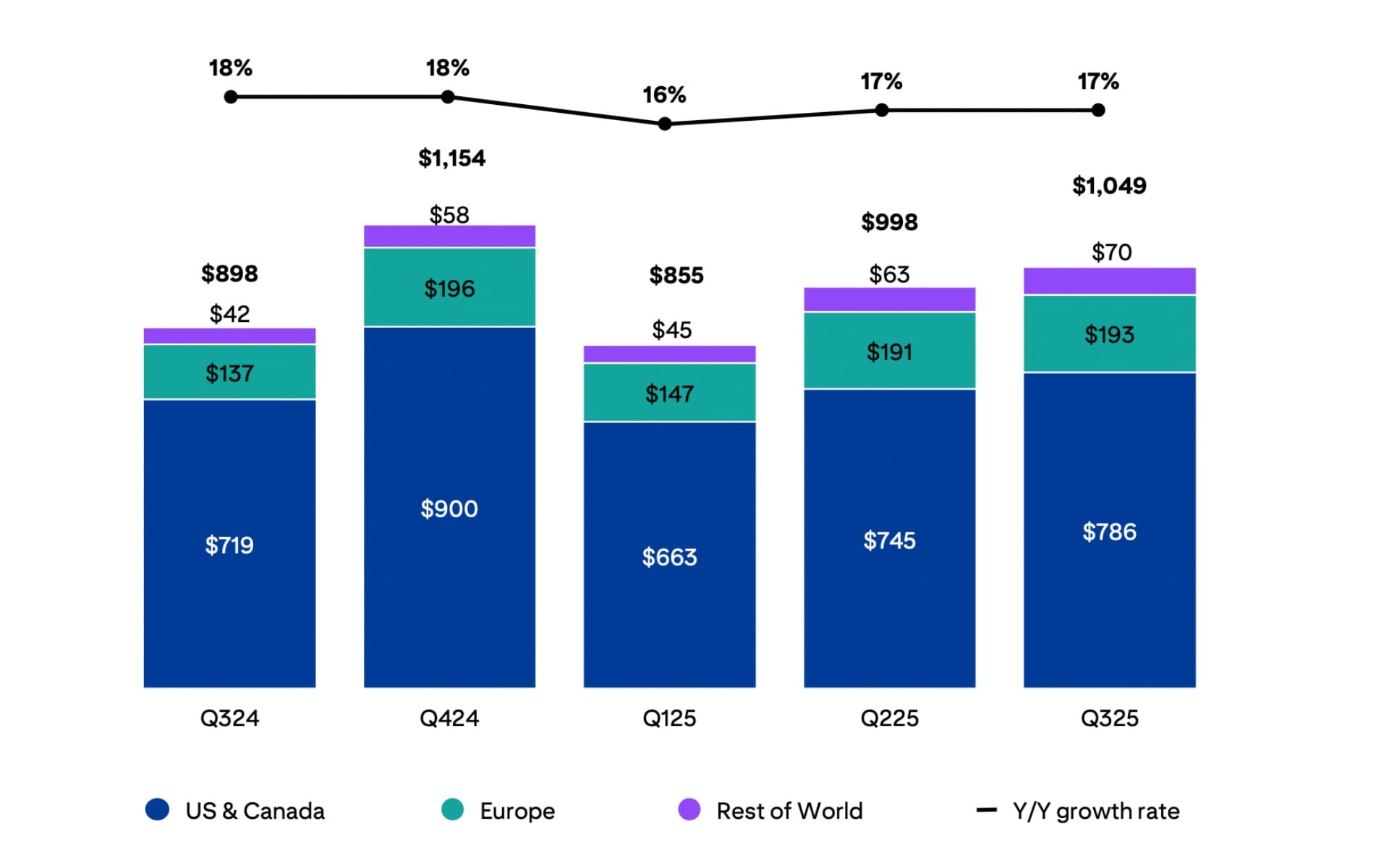

Pinterest achieved a ninth consecutive quarter of record user growth on November 4, 2025, reaching 600 million monthly active users as revenue expanded 17% year-over-year to $1.049 billion. The visual discovery platform demonstrated particular strength in international markets, where Europe revenue surged 41% and rest of world markets grew 66% compared to the same period in 2024.

The company's stock declined 19.72% over five days following the earnings announcement, according to market data. The financial results showed GAAP net income of $92 million and adjusted EBITDA of $306 million, representing a 29% margin. Net cash from operating activities reached $322 million with free cash flow of $318 million for the quarter ended September 30, 2025.

CEO Bill Ready emphasized the platform's transformation into an AI-powered shopping assistant serving 600 million consumers during the earnings call. "We've become a leader in visual search and have effectively turned our platform into an AI-powered shopping assistant," Ready stated in the press release. The company reported that global advertisers increasingly depend on Pinterest as a search platform to reach customers and drive sales.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

User growth remained consistent across all geographic regions tracked by the platform. The U.S. and Canada region recorded 103 million monthly active users, representing 4% year-over-year growth and marking the highest user level in that market over the past four and a half years. Europe reached 150 million monthly active users with 8% growth, while rest of world markets expanded to 347 million users with 16% growth.

Platform revenue growth demonstrated significant geographic variation reflecting different stages of market development. The U.S. and Canada generated $786 million in revenue with 9% growth compared to the prior year. Europe produced $193 million in revenue, growing 41% on a reported basis or 34% when adjusted for currency fluctuations. Rest of world markets contributed $70 million in revenue with 66% growth on a reported basis and 65% on a constant currency basis.

Global average revenue per user increased 5% to $1.78 during the quarter. The metric showed varied performance across regions, with U.S. and Canada ARPU growing 5% to $7.64, Europe ARPU expanding 31% to $1.31, and rest of world ARPU increasing 44% to $0.21. The company calculates ARPU by dividing total revenue in each geography by the average number of monthly active users in that region during the period.

Ad impressions grew 54% year-over-year while ad pricing declined 24% during the third quarter. CFO Julia Donnelly explained during the earnings call that the primary driver of strong impression growth and corresponding price decline stems from the growing mix shift toward ad impressions in previously unmonetized or undermonetized international markets, which carry lower ad pricing than more mature markets.

Shopping ads represented a substantial portion of international revenue growth, according to Ready's prepared remarks. The category accounted for 30% of international revenue in the third quarter, up from just 9% of international revenue during the company's investor day in September 2023. Shopping ad revenue in both Europe and rest of world regions grew over two times faster than overall revenue growth in their respective markets.

The platform recorded approximately 80 billion monthly queries during the quarter, split between related items, other forms of visual search, and traditional text-based searches. All individual query types grew year-over-year, with queries per user also increasing as the company deepened engagement. Related items and other forms of visual search represent the largest source of queries, with the latest visual search features showing the fastest growth at 44% year-over-year.

Pinterest introduced several new advertising products during the quarter targeting different stages of the shopping journey. Top of Search ads, currently in beta across all monetized markets, appear directly within the top ten search results and related pins. Internal testing demonstrated an average click-through rate 29% higher for Top of Search ads compared to standard campaigns, with a 32% higher likelihood of attracting new users who haven't previously engaged with a brand's ads.

The company launched local inventory advertising in September, enabling retailers to display real-time prices for in-stock items within a shopper's local store radius. This functionality integrates with retailer inventory management systems to provide accurate availability information. The platform also introduced Where to Buy Links, making standard ads instantly shoppable by surfacing multiple in-stock retailer options for a single product directly from an advertisement.

Pinterest Performance Plus campaigns, the company's AI-powered suite of automated advertising products, continued demonstrating strong adoption among mid-market and smaller advertisers. Retail advertisers spending on Performance Plus campaigns experienced, on average, a 24% higher conversion lift compared to those spending only on traditional campaigns. Among mid-market and smaller managed advertisers, Performance Plus campaign adopters exhibited, on average, a 12% higher monthly growth rate in spend on Pinterest post-adoption when compared to non-adopters.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

ROAS bidding, launched in the first quarter of 2025 as part of the Performance Plus suite, provides granular bidding functionality for advertisers optimizing for conversion value rather than just conversion volume. The feature proved particularly impactful for advertisers with large catalogs at varying price points. Globally, 22% of lower-funnel retail revenue flows through ROAS bidding after just two quarters of general availability. The number of unique shopping SKUs with a paid ad impression grew more than 100% year-over-year in the third quarter, with ROAS bidding adopters contributing the entirety of that growth.

Ready highlighted the platform's position as a destination for users rather than a referral-dependent service during the earnings call. Nearly 85% of users come directly to the mobile app, meaning the company does not rely on search engines or other third parties for traffic. Generation Z represents the largest and fastest-growing user cohort, comprising over 50% of the user base. This demographic represents influential tastemakers, content creators, and a lucrative audience for advertisers.

The company emphasized its AI capabilities throughout the earnings discussion, noting that 100% of reported users are logged in, providing valuable first-party intent signals. These signals power the recommendation engine and create improved user shopping experiences. Pinterest introduced multimodal search in May for women's fashion, allowing users to refine searches with both image and text inputs. A proprietary in-house multimodal model trained on Pinterest's data set proved 30% more effective at identifying and recommending relevant content from the corpus compared to leading off-the-shelf models.

The platform began beta testing Pinterest Assistant during the quarter, a new tool transforming text-based search into a voice-activated conversational assistant. Users can describe open-ended, complex questions like "What outfits might match this theme?" The AI technology surfaces real-time inspiration by running conversational descriptors through AI systems fine-tuned with first-party signals, then surfaces shoppable products from the catalog.

Pinterest announced plans to introduce Boards Made for You to U.S. and Canada users in the coming weeks. This feature brings timely curated collections of fresh and personalized content directly into the home feed, combining AI-driven recommendations with expert human curation. The goal focuses on driving more frequent visitation and curation while introducing relevant shopping recommendations. The company also launched the Holiday Edit for the fourth quarter, consisting of hundreds of new expert-curated gift guides spanning 17 categories including fashion, home, food, beauty, travel, parenting, and technology.

Operating expenses showed controlled growth as the company balanced investment with profitability targets. Non-GAAP cost of revenue reached $206 million, up 13% year-over-year and 5% versus the second quarter due to increased infrastructure spending related to user and engagement growth. Non-GAAP operating expenses totaled $543 million, up 15%, driven by investments in sales and marketing and research and development to support AI initiatives and sales force expansion.

The adjusted EBITDA margin expanded 170 basis points compared to the third quarter of 2024, demonstrating the company's ability to grow profitably. Over the trailing 12 months, more than 90% of adjusted EBITDA converted to free cash flow, highlighting the cash-generative nature of the business model. The company ended the quarter with $2.7 billion in cash, cash equivalents, and marketable securities.

Pinterest allocated $199 million toward share repurchases and $115 million toward net share settlement of equity awards during the third quarter as part of ongoing efforts to mitigate dilution from employee stock-based compensation. These actions brought fully diluted share count roughly flat year-over-year. The company's capital allocation framework maintains four pillars: investing in product and technology innovation, balance sheet optimization, preserving flexibility for opportunistic and disciplined mergers and acquisitions, and dilution management.

The company provided fourth-quarter 2025 revenue guidance of $1.313 billion to $1.338 million, representing 14% to 16% growth year-over-year. This guidance assumes approximately one percentage point of tailwind from foreign exchange impacts based on current spot rates. The company expects fourth-quarter 2025 adjusted EBITDA in the range of $533 million to $558 million. Pinterest anticipates non-GAAP cost of revenue to grow sequentially from the third quarter by high single digits percentage.

Donnelly noted during the earnings call that the company faced pockets of moderating ad spend in U.S. and Canada markets during the third quarter as larger U.S. retailers navigate tariff-related margin pressure in the current environment. Spend from Asia-based e-commerce players in the U.S. declined year-over-year again in the third quarter, though relative to the second quarter, the company observed a partial recovery. The fourth-quarter guidance range of 14% to 16% growth sits one point lower than the third-quarter guidance range as the company sees broader trends and market uncertainty continuing, with the addition of a new tariff in the fourth quarter impacting the home furnishings category.

Despite near-term headwinds in specific segments, the company expressed confidence in its mid-to-high-teens revenue growth targets over the medium and long term. Ready highlighted several momentum areas in the U.S. and Canada business that have continued over recent quarters, including emerging verticals like financial services, where Pinterest estimates less than half a point of market share in a nearly $40 billion U.S. digital advertising category that has been growing nicely for the company for some time.

The platform continues expanding programmatic access, with third-party demand complementing and rounding out the auction when gaps exist. Most efforts with respect to third-party demand have focused on bringing new sources of demand to the platform, as many of these programmatic budget pools are large and new to Pinterest. The company also began exploring very early testing of how valuable its audience could be beyond its own platform, given the strong commercial intent demonstrated by users.

The company's international expansion strategy employs region-specific go-to-market approaches. In Europe, Pinterest leads primarily with its first-party sales team to serve advertisers directly while strengthening relationships with agencies who manage and deploy much of the digital advertising spend in the region. The company also integrates with marketing technology partners who help advertisers manage creative and campaigns. In rest of world markets, Pinterest deployed a hybrid model blending direct sales force in select markets, reseller partners in over 40 countries, and incremental third-party ad demand.

Pinterest emphasized that advertisers have begun adopting AI-based optimization of events valued in their measurement sources of truth. While many advertisers adopted these solutions first with larger platforms, as typical of adoption cycles, Pinterest has been testing with some of its largest partners and seeing promising early results. The alignment of AI bidding with advertiser measurement sources of truth is market-expanding and tends to give more credit to events leading up to a conversion, such as view-through attribution, which should benefit full-funnel platforms.

Ready characterized the current period as a market-expanding moment where multiple players are growing simultaneously. Over the past couple of years, as AI chatbots like OpenAI's ChatGPT reached 800 million users, Pinterest still delivered nine consecutive quarters of record users while deepening engagement across desired metrics including search. The company believes it has carved out a unique space solving a different type of shopping journey focused on "I'll know it when I see it" discovery through a visual-first approach driven by human curation.

The platform operates in a competitive landscape where Instagram, TikTok, and traditional e-commerce sites all compete for visual discovery and shopping activities. Pinterest's differentiation lies in its explicit focus on planning and inspiration rather than social networking. The user base demonstrates high intent for planning purchases and projects, making the platform attractive for certain advertiser categories despite being smaller than competitors.

Infrastructure and platform represent strategic assets supporting the company's performance, reliability, and AI roadmap. While Amazon serves as a fantastic partner, the company constantly assesses the best infrastructure options moving forward, especially in an AI-driven world. Pinterest continues benchmarking across multiple providers on LLMs, chip providers, and hyperscalers. In early testing with fine-tuned open-source models, the company observed orders of magnitude reduction in cost with comparable performance versus leading off-the-shelf proprietary models.

The company's long-term adjusted EBITDA margin target remains 30% to 34% over a three-to-five-year time horizon, as stated during the 2023 investor day. In 2025, the company is approaching 30% for the full year, having made significant progress by growing the top line while investing thoughtfully, primarily in research and development and to a lesser extent in sales. Looking forward, the company continues to see many investment opportunities with high return on investment, particularly across AI powering user experiences including the new Pinterest Assistant.

Donnelly confirmed that cost of revenue, which consists mostly of infrastructure costs, will naturally rise due to ongoing user and engagement growth. The company has previewed for multiple quarters that it expects to see diminishing returns from infrastructure cost optimization work undertaken over the past two-plus years. Partially offsetting this natural upward pressure on cost of revenue is the company's ability to apply AI use cases directly in service to monetization, where it sees immediate revenue lift rather than rolling out new features and planning to monetize them years later.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- November 4, 2025: Pinterest announces Q3 2025 earnings with $1.049 billion revenue, 17% year-over-year growth, and 600 million monthly active users

- October 27, 2025: Pinterest introduces AI-powered board upgrades with personalized tabs, styling tools, and "Boards made for you" feature

- October 16, 2025: Pinterest launches user controls for generative AI content allowing feed customization across beauty, art, fashion and home decor

- October 1, 2025: Google Analytics adds Pinterest cost data import integration enabling automatic tracking of Pinterest advertising expenses and performance

- September 25, 2025: Pinterest unveils Top of Search ads achieving 29% higher CTR, plus local inventory advertising and Media Network Connect

- September 18, 2025: Instacart CFO Emily Reuter joins Pinterest board signaling strategic commerce focus

- August 20, 2025: Pinterest launches Thrift Shop feature responding to 550% increase in sustainable shopping searches among Gen Z

- August 7, 2025: Pinterest reports Q2 2025 results with $998 million revenue, 17% growth, and 578 million monthly active users

- July 8, 2025: Pinterest releases first Men's Trend Report revealing male users represent over one-third of global audience

- February 6, 2025: Pinterest hits first billion-dollar quarter with Q4 2024 revenue of $1.15 billion and 553 million monthly active users

- January 28, 2025: Pinterest expands programmatic access through Index Exchange and Criteo partnerships

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Pinterest Inc., the San Francisco-based visual discovery platform led by CEO Bill Ready and CFO Julia Donnelly, announced results affecting 600 million monthly active users and global advertisers across retail, CPG, telecom, and entertainment verticals.

What: Pinterest reported third quarter 2025 financial results showing $1.049 billion in revenue, representing 17% year-over-year growth, with 600 million monthly active users marking the ninth consecutive quarter of record user growth. The company achieved adjusted EBITDA of $306 million with a 29% margin and free cash flow of $318 million. New product launches included Top of Search ads, local inventory advertising, Pinterest Assistant, and Boards Made for You.

When: The earnings were announced on November 4, 2025, covering the quarter ended September 30, 2025. The stock declined 19.72% over the subsequent five days following the announcement.

Where: Growth occurred across all geographic regions, with particularly strong international performance. Europe revenue grew 41% to $193 million and rest of world revenue increased 66% to $70 million, while U.S. and Canada revenue rose 9% to $786 million. The platform serves users globally with 103 million monthly active users in U.S. and Canada, 150 million in Europe, and 347 million in rest of world markets.

Why: The results matter for the marketing community because Pinterest has successfully transformed from an inspiration platform into an AI-powered shopping assistant with proven performance advertising capabilities. The platform's 44% growth in visual search queries, 40% increase in outbound clicks to advertisers, and expansion into performance budgets demonstrate its growing importance as an advertising channel. International markets remain significantly undermonetized, with shopping ads growing from 9% of international revenue in September 2023 to 30% in the third quarter of 2025, creating substantial opportunities for advertisers to reach high-intent users in developing markets. The company's AI investments, including multimodal search capabilities 30% more effective than off-the-shelf models and automated Performance Plus campaigns driving 24% higher conversion lifts, position Pinterest as a differentiated visual search platform capturing commercial intent at earlier stages of the shopping journey than traditional text-based search or social media platforms.