New planning playbook reveals potential of integrated TV advertising in India

Strategic framework shows how brands can optimize reach and costs by combining traditional TV with Connected TV advertising.

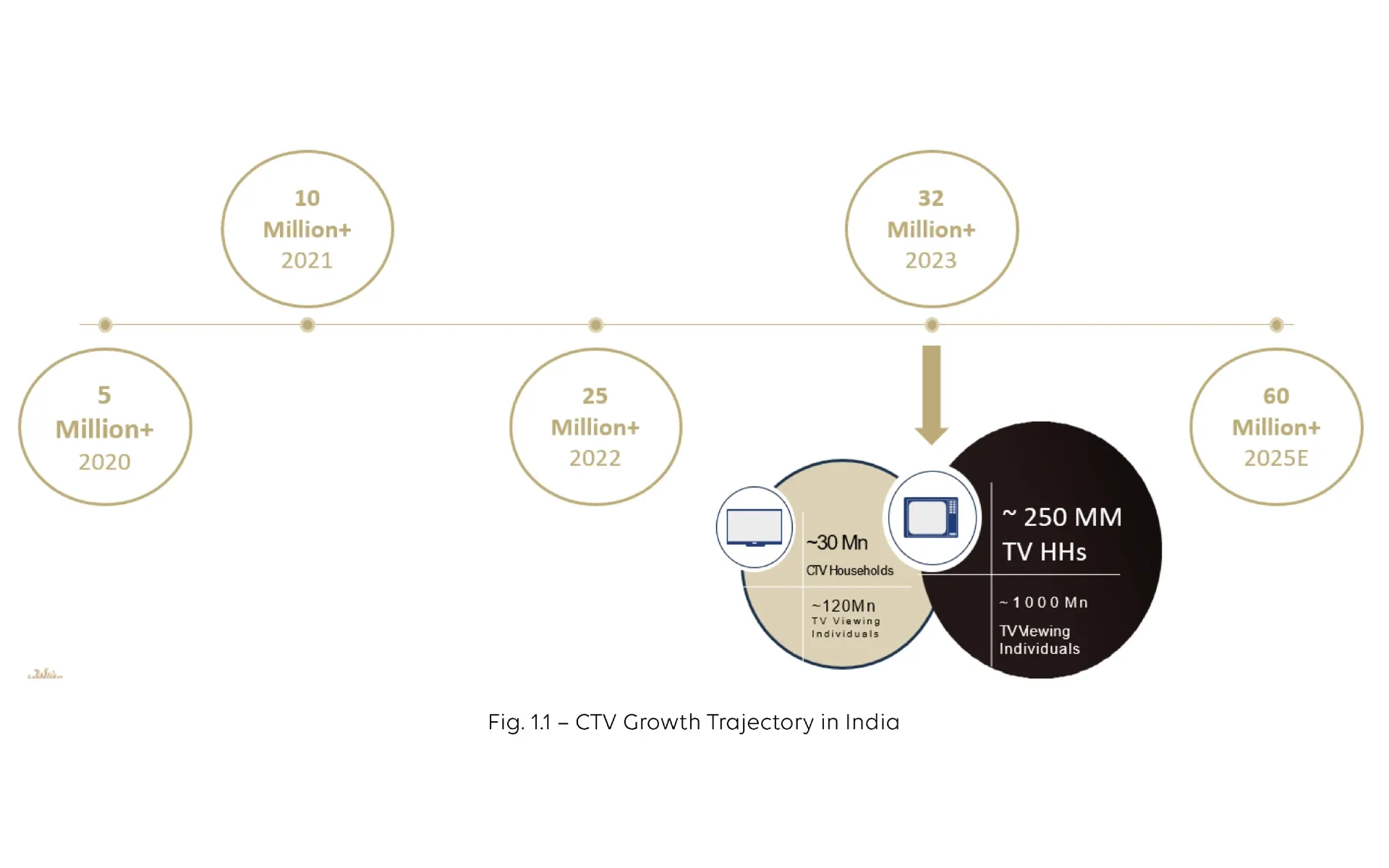

A comprehensive planning playbook released by Publicis Media outlines a strategic framework for integrating traditional TV and Connected TV (CTV) advertising in India. According to the document authored by Rajiv Gopinath, Rahul Beer, Rudra Sen, and Parisha Tyagi, the framework addresses the rapid transformation of India's media landscape, where CTV has grown 600 times since 2020.

The playbook presents detailed analysis showing how CTV has reached 32 million households in 2023 and is projected to expand to 60 million households by 2025. This growth trajectory creates both opportunities and challenges for advertisers seeking to optimize their media investments.

Central to the framework is the concept of data-driven allocation across platforms. The research demonstrates that non-integrated planning can result in up to 25% of advertising budgets being wasted through duplication and low-frequency exposure. This inefficiency becomes particularly significant as India's digital advertising market approaches its projected value of ₹62,045 crore by 2025.

The framework introduces a scientific approach to budget optimization, particularly relevant for reaching affluent NCCS AB households, where CTV comprises 55% of viewership. This demographic insight forms the foundation for sophisticated targeting strategies that combine traditional TV's broad reach with CTV's precision.

In metropolitan markets, the playbook reveals compelling efficiency gains. Analysis of India's top six metros shows that integrated planning can deliver 17% cost savings at 50% reach goals, with savings remaining stable at 18-19% for higher reach targets. These findings demonstrate the framework's potential for significant cost optimization while maintaining effective audience coverage.

The strategic approach varies by region, with distinct patterns emerging across different markets. In the Hindi-speaking market (HSM), integration of TV with CTV platforms such as Hotstar, Jio, and YouTube enhances reach across various objectives. The data shows CTV's incremental reach contribution growing from 12.7% to 17.8% as reach goals increase from 50% to 70%.

Southern states present different optimization opportunities. The framework details how Tamil Nadu achieves consistent 8% savings at higher reach goals, while Kerala shows emerging potential with 5% savings at 70% reach targets. Karnataka demonstrates clear efficiency gains at higher reach goals, with 7-8% cost reductions at 65-70% reach objectives.

The playbook emphasizes geographic targeting as a crucial component of the framework. In India's top six metro areas, where CTV adoption is particularly significant, incorporating CTV into media plans can lead to cost savings of up to 18.9% compared to traditional TV-only campaigns. For southern states, the framework shows how CTV becomes more efficient at higher reach goals, particularly for 3+ frequency objectives.

A key innovation in the framework is its approach to frequency management across platforms. The playbook details how integrated planning prevents over-exposure to advertisements, which can lead to viewer fatigue and diminishing returns on investment. This sophisticated frequency capping strategy ensures optimal exposure levels while maintaining campaign effectiveness.

The framework also addresses resource allocation challenges through a data-driven methodology. By leveraging first-party data from TV manufacturers and Automatic Content Recognition (ACR) technology, the approach enables precise audience targeting and optimization of advertising investments across different platforms and geographies.

This strategic framework represents a significant advancement in media planning methodology, offering advertisers a structured approach to navigate India's evolving media landscape. The playbook's emphasis on data-driven decision-making and market-specific optimization strategies provides a blueprint for maximizing advertising effectiveness in an increasingly complex media environment.