Meta unveils Q5 marketing strategy for mobile game developers

Meta announces Q5 marketing opportunities for mobile game developers with lower CPMs and CPAs during late December to mid-January advertising period.

Mobile game developers have a new window of opportunity for cost-effective advertising following the traditional holiday season. Meta published guidance on October 13, 2025, outlining strategies for the "fifth quarter" or Q5 period, spanning late December through mid-January.

The timing matters because competition typically decreases after major shopping events conclude. Larger brands exit the auction as shipping deadlines pass, creating favorable conditions for gaming businesses not constrained by physical product delivery timelines.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Meta's internal data shows cost per acquisition (CPA) levels dropped below pre-Cyber 5 benchmarks during the Q5 window. Cyber 5 refers to the five-day period from Thanksgiving through Cyber Monday, encompassing Black Friday. Cost per thousand impressions (CPM) fell to their lowest seasonal levels, enabling performance-focused campaigns when competition subsides.

The announcement builds on broader holiday advertising trends where 90% of holiday conversions occur outside the traditional Cyber 5 period. Microsoft's research earlier found that the average holiday shopper takes 47 days to complete their purchase journey, indicating extended engagement windows beyond peak promotional periods.

Market dynamics create advertising efficiency

Four factors converge to establish Q5 as a strategic window. First, reduced auction competition emerges as physical retailers complete their holiday inventory cycles. Second, purchase intent remains elevated among consumers with gift cards and holiday cash. Third, time spent across Meta's platforms increases during this period. Mobile usage peaks as people spend more time at home.

Gaming businesses operate without the shipping restrictions that limit other retailers. When CPMs stabilize after the holiday rush, opportunities emerge for end-of-year campaigns. The platform dynamics shift favorably for digital products and services.

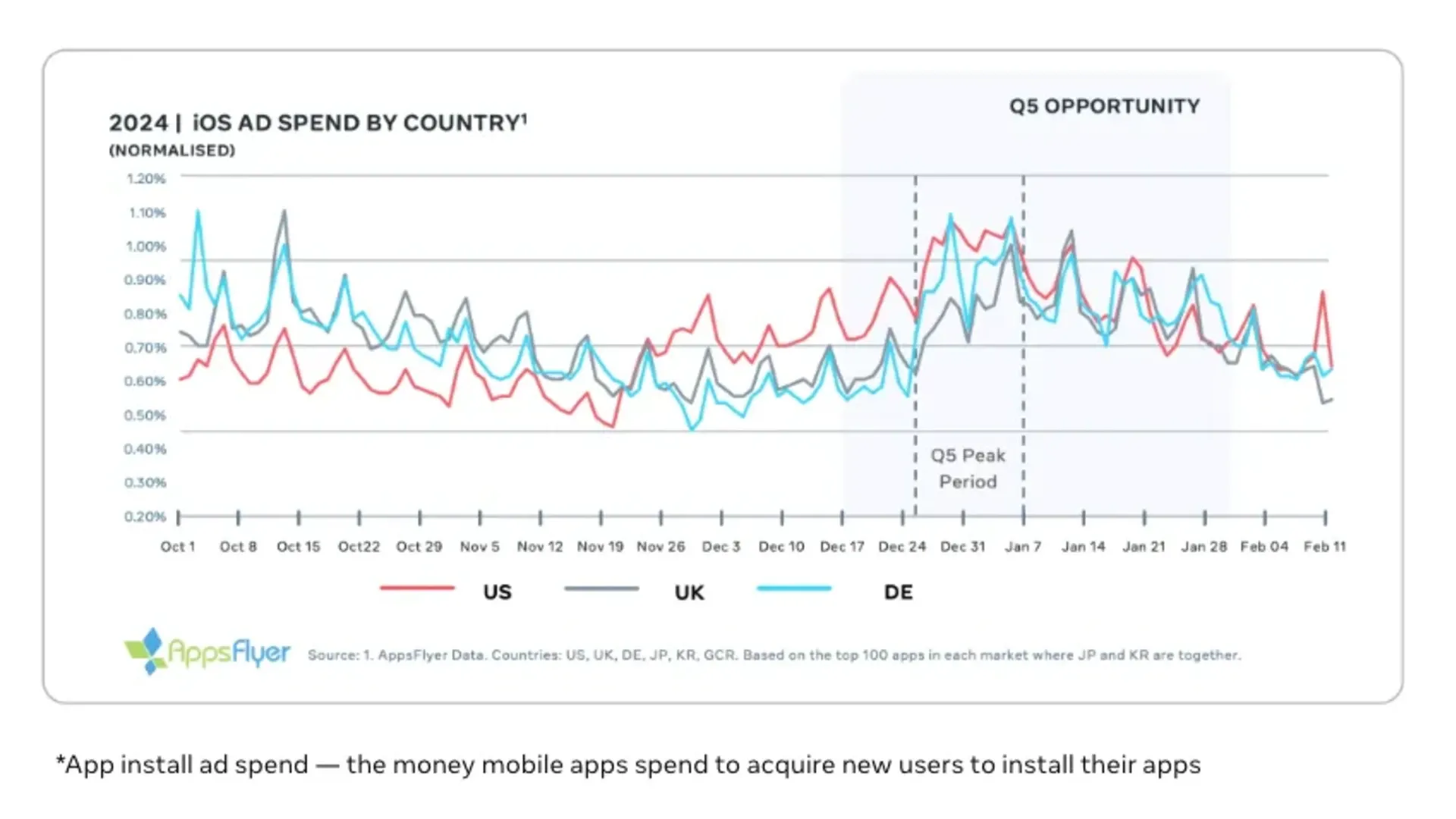

Meta partnered with AppsFlyer, described as the global leader in marketing measurement and attribution, to analyze Q5 potential for gaming advertisers. The collaboration produced four key findings about seasonal performance patterns.

Regional spending patterns diverge

Western markets show significant investment increases during Q5 as clients capitalize on market dynamics and expanding player bases. The United States, United Kingdom, and Germany demonstrated this pattern, with advertisers ramping up spending to capture seasonal momentum.

Asia-Pacific markets follow different seasonal rhythms driven by cultural celebrations. Developers should align campaigns with local holidays including Shōgatsu (New Year) in Japan and Lunar New Year in Greater China. Paid installs during Q5 remain strong in APAC, though peak periods differ from Western markets.

The geographic variations require localized campaign planning. What works in the US market may not translate directly to Japan or China, where cultural events drive distinct user behavior patterns.

Revenue models show distinct timing

Analysis of the top 100 games from the previous year revealed different patterns for in-app advertising (IAA) versus in-app purchase (IAP) revenue. IAA revenue begins increasing in early November, peaks around Black Friday, then experiences another opportunity during Q5 from December 25 through January 1.

IAP revenue follows expected Q5 dynamics, picking up closer to mid-December. The timing differences create strategic opportunities for mobile game developers to optimize resource allocation and campaign planning based on monetization models.

Understanding these patterns enables more effective budget distribution. Games relying primarily on advertising revenue should maintain campaigns through the full Q5 window, while those dependent on in-app purchases can concentrate efforts around the mid-December to early January period.

Retargeting gains momentum

Retargeting conversion analysis showed upward trends starting in early October across both iOS and Android platforms. Casual and Casino games on iOS demonstrated this pattern, while Casual and Midcore genres showed similar trends on Android.

The data suggests including retargeting as part of Q5 business activities. For advertisers new to retargeting, the period offers an opportunity to experiment and gather insights for future campaigns. Established retargeting programs can expand during the window when user engagement increases.

Meta's unified campaign structure now simplifies retargeting implementation. The platform eliminated the choice between manual and Advantage+ campaigns in May 2025, maintaining automation benefits within a unified system.

Automation features drive optimization

Meta recommends activating Advantage+ features to apply advanced AI optimizations. Advantage+ app campaigns offer machine learning algorithms that optimize targeting and bidding in real time. The system identifies audiences and delivers ads at optimal moments without manual intervention.

Automation features include budget scheduling and ad scheduling capabilities. These tools streamline campaign management, ensuring ad delivery at effective times. Automating these tasks frees time for other campaign aspects.

The guidance suggests including 50 differentiated creative ads per campaign. Having diverse creative assets helps reach different audience segments and drives better results. Testing multiple approaches identifies which variations perform best, ultimately improving return on ad spend (ROAS).

Recent platform data shows Meta's AI-powered recommendation systems increased ad conversions by approximately 5% on Instagram and 3% on Facebook Feed and Reels during the second quarter of 2025. The company's advertising revenue reached $46.6 billion in that period, representing 22% year-over-year growth.

Creative strategy emphasizes seasonal relevance

Campaigns should utilize diverse concepts and formats appealing to different audience segments. Using varied messaging and creative formats speaking to the season and diverse player motivations creates more engaging campaigns.

Generative AI can create multiple creative asset variations at scale. By generating multiple holiday creative versions, developers can test different approaches and identify top performers. The technology enables rapid iteration without proportional resource increases.

Partnership ads ensure creator collaborations comply with platform policies. Incorporating native gaming sounds into Reels videos creates immersive experiences for viewers, driving better results. The audio elements enhance engagement beyond standard video content.

Meta's restricted words feature, introduced in August 2025, allows advertisers to exclude specific terms from AI-generated text. This provides brand safety controls while maintaining automated creative generation efficiency.

Value optimization targets high-return users

New value tools help guide AI toward identifying what matters most for each business. Value Rules enable assigning different values to specific audiences, focusing budgets on actions driving greatest impact. Value Optimization allows choosing whether to optimize for in-app purchase value or in-app ad impression value.

Custom Product Pages (CPPs) and Custom Store Listings deliver personalized experiences by aligning top seasonal creatives with relevant audiences. Creating seasonally tailored store pages for best-performing creatives builds more engaging campaigns speaking to the holiday season.

Testing web-to-app strategies for app campaigns uses interactive landing pages to increase conversion rates. The approach supports enhanced measurement and reporting beyond standard app install campaigns.

The technical implementation requires coordination between creative assets and audience targeting. Developers must align store page experiences with ad creative to maintain consistency through the user journey.

Campaign planning requires early action

Planning campaigns well in advance provides time to develop strategy, create content, and configure campaigns effectively. Budget flexibility remains important as the season progresses, enabling adjustments based on performance and changing market conditions.

Letting auction trends guide planning takes advantage of Q5's lower media costs and continued demand. The period enables closing the current year strong while starting the new year with momentum.

Mobile gaming advertising faces broader challenges as 88% of the $45 billion consumer mobile app advertising market concentrates on major platforms. Research released in August 2025 showed marketers who diversify beyond these platforms achieve ROAS improvements up to 214%, suggesting opportunities exist beyond traditional channels.

The Q5 strategy fits within this larger context of strategic budget allocation. While Meta's platforms offer efficiency during this specific period, comprehensive annual strategies benefit from channel diversification across the full calendar year.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Technical requirements and next steps

Advertisers should verify their Advantage+ settings are enabled before the Q5 window opens. The automation features require proper configuration to deliver optimal results during the compressed timeframe.

Campaign creative assets need production lead time. Preparing 50 differentiated ads requires planning, particularly for teams without existing creative libraries. Starting creative development in early December allows for testing before the critical late December period.

Value Rules configuration requires defining which audiences and actions warrant increased or decreased bidding. This strategic work cannot happen during the campaign itself, making advance preparation essential.

Meta announced a webinar session providing additional insights on capitalizing on the Q5 opportunity. The session offers deeper technical guidance for implementation beyond the published documentation.

The Q5 period represents a tactical opportunity within annual marketing calendars. Mobile game developers can take advantage of favorable market conditions created by seasonal shopping patterns, but success requires advance planning and proper technical configuration to execute when the window opens.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- October 13, 2025: Meta publishes Q5 marketing guidance for mobile game developers

- September 2025: Microsoft releases 2024 Holiday Marketing Playbook showing 90% of holiday conversions occur outside Cyber 5 period

- August 2025: Meta expands value rules and targeting features across all ad accounts and campaign objectives

- July 2025: Meta reports Q2 2025 advertising revenue of $46.6 billion, up 22% year-over-year with AI-powered improvements

- May 2025: Meta launches unified API structure eliminating choice between manual and Advantage+ campaigns

- December 25, 2024 - January 1, 2025: Previous Q5 period showed CPMs at lowest seasonal levels with CPAs below pre-Cyber 5 benchmarks

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Meta published guidance for mobile game developers and advertisers, partnering with AppsFlyer for market analysis of gaming advertising patterns.

What: Comprehensive Q5 marketing strategy outlining opportunities during late December to mid-January when advertising costs decrease due to reduced competition, while purchase intent and platform engagement remain high.

When: Announced October 13, 2025, covering the Q5 period from December 25, 2025, through mid-January 2026, with recommendations for early campaign planning.

Where: Guidance applies to Meta's advertising platforms including Facebook, Instagram, and Meta Audience Network, with specific regional considerations for Western markets and Asia-Pacific.

Why: The period offers cost-effective marketing opportunities as larger brands exit the auction after shipping deadlines pass, CPMs fall to seasonal lows, and mobile usage peaks while gaming businesses face no physical delivery constraints.