Meta reports 26% revenue growth amid infrastructure spending surge

Meta's third quarter advertising revenue reached $50.1 billion, though net income plummeted 83% due to a one-time tax charge related to new federal legislation.

Meta Platforms reported total revenue of $51.24 billion for the third quarter ended September 30, 2025, representing growth of 26% compared to the same period last year. The company disclosed these results on October 29, 2025, during its quarterly earnings announcement from Menlo Park, California.

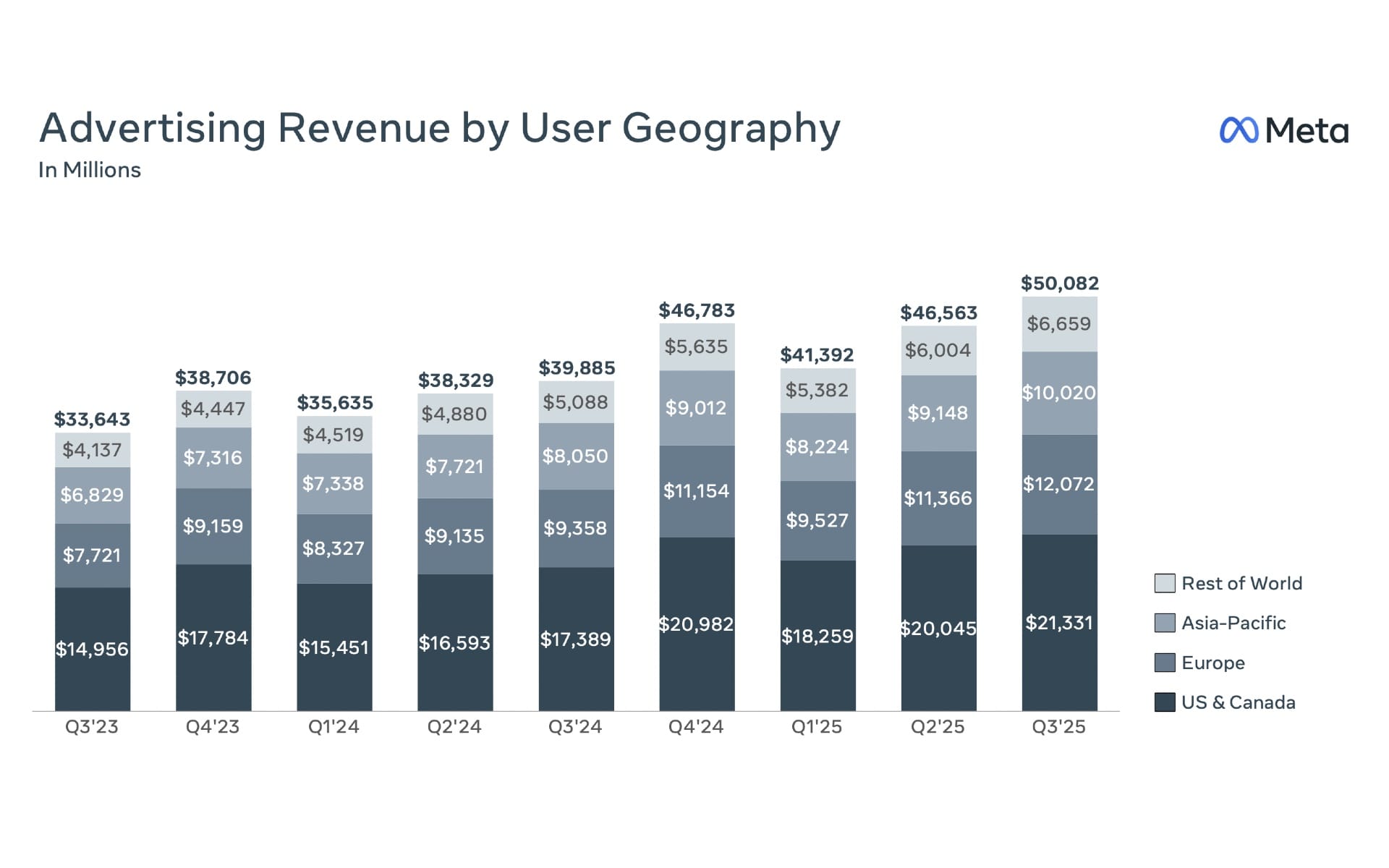

The social media giant's advertising business delivered $50.08 billion in the quarter, up 26% year-over-year. Ad impressions increased 14% while the average price per ad rose 10%. Family of Apps other revenue, primarily from WhatsApp paid messaging and Meta Verified subscriptions, totaled $690 million, up 59% from the previous year.

Reality Labs revenue reached $470 million, marking a 74% increase driven by retail partners stocking Quest headsets ahead of the holiday season and strong sales of Ray-Ban Meta AI glasses.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Tax legislation creates accounting impact

Meta recorded a one-time, non-cash income tax charge of $15.93 billion in the third quarter related to the One Big Beautiful Bill Act. The implementation led to recognition of a valuation allowance against U.S. federal deferred tax assets, reflecting the impact of the U.S. Corporate Alternative Minimum Tax.

The tax provision resulted in an 87% effective tax rate for the quarter. Excluding this charge, the effective tax rate would have been 14%, net income would have reached $18.64 billion instead of the reported $2.71 billion, and diluted earnings per share would have been $7.25 rather than $1.05.

"We expect a significant reduction in our U.S. federal cash tax payments for the remainder of 2025 and future years due to the implementation of the One Big Beautiful Bill Act," the company stated in its earnings release.

Total costs and expenses increased 32% year-over-year to $30.71 billion. Operating income was $20.54 billion, representing a 40% operating margin.

Artificial intelligence investments accelerate

CEO Mark Zuckerberg announced the company is "aggressively front-loading" infrastructure capacity to prepare for multiple scenarios around when superintelligence might arrive. "Some people think that we'll get there in a few years, others think it'll be 5, 7 years, or longer," Zuckerberg said during the earnings call. "I think it's the right strategy to aggressively front-load building capacity so that way we're prepared for the most optimistic cases."

The company's newly formed Meta Superintelligence Labs has begun developing next-generation AI models. "I think that we have already built the lab with the highest talent density in the industry," Zuckerberg told analysts.

Capital expenditures, including principal payments on finance leases, reached $19.37 billion in the quarter. Meta raised its full-year 2025 capital expenditure guidance to a range of $70-72 billion, up from the prior outlook of $66-72 billion.

CFO Susan Li indicated infrastructure needs continue expanding beyond previous expectations. "As we have begun to plan for next year, it has become clear that our compute needs have continued to expand meaningfully, including versus our expectations last quarter," Li explained in prepared remarks.

The company expects capital expenditure dollar growth will be "notably larger" in 2026 than 2025. Total expenses are anticipated to grow at a "significantly faster percentage rate" in 2026, driven primarily by infrastructure costs including cloud expenses and depreciation, followed by employee compensation.

Advertising systems demonstrate continued improvement

Meta achieved meaningful advances in its AI ranking systems during the quarter by unifying different models into simpler, more general architectures. The annual run-rate going through completely end-to-end AI-powered ad tools surpassed $60 billion.

Third-quarter ad impressions growth varied by geography. Worldwide ad impressions increased 14%, with the strongest growth in Asia-Pacific at 23%, followed by Rest of World at 9%, Europe at 6%, and U.S. & Canada at 8%.

Average price per ad showed 10% worldwide growth. U.S. & Canada led with 13% growth, followed by Europe at 19%, Rest of World at 20%, and Asia-Pacific at 1%.

"We continue to refine ad supply across each of our major surfaces within Facebook and Instagram to better deliver ads at the time and place they are most relevant to people," Li stated during the call.

Meta has systematically expanded its automated advertising capabilities throughout 2025, consolidating campaign structures and defaulting to AI-powered optimization. The company completed rollout of streamlined campaign creation flows for Advantage+ lead campaigns in the third quarter, enabling end-to-end automation from the beginning for sales, app, and lead campaigns.

Lattice, Meta's unified model architecture, expanded to app ads during the quarter, driving nearly a 3% gain in conversions for that objective. Since introducing Lattice in 2023, the company has reduced the number of ads ranking and recommendation models by approximately 100 through consolidation into larger models that generalize learnings across surfaces and objectives.

The company piloted a new run-time ads ranking model in the third quarter that leverages more compute and data than prior models. Testing showed the new model drove more than a 2% lift in conversions on Instagram.

Andromeda, Meta's ads system combining retrieval and early-stage ranking, delivered a 14% increase in ads quality on Facebook surfaces during the quarter. Meta completed improvements to GEM's model architecture that doubled the performance benefit from adding a given amount of data and compute, making GEM four times more efficient at driving ad performance gains compared to original recommendation ranking models.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Engagement metrics show healthy growth

Family daily active people reached 3.54 billion in September 2025, an increase of 8% year-over-year. Time spent on Facebook increased 5% while Threads saw 10% growth in time spent, driven by AI recommendation system improvements.

Instagram reached 3 billion monthly active users during the quarter. Video continues demonstrating strength, with video time spent on Instagram up more than 30% since last year. Reels now represents an annual run rate exceeding $50 billion.

Threads surpassed 150 million daily active users and "remains on track to become the leader in its category," according to Zuckerberg. The platform launched direct messaging in the third quarter, expanded advertising formats to include carousel ads and Advantage+ catalog ads, and continues scaling its monetization efforts.

"On Facebook, our systems are now surfacing twice as many Reels published that day than at the start of the year," Li noted, highlighting improvements in content freshness.

The company reported more than 1 billion monthly active users for Meta AI. "We see usage increase as we improve our underlying models," Zuckerberg said. "I'm very excited to get a frontier model into Meta AI and I think that the opportunity there is very large."

Business AI continues gaining traction. People have more than 1 billion active threads with business accounts across Meta's messaging platforms daily. Millions of conversations between people and Business AIs have occurred since the company began expanding access in Mexico and the Philippines during the third quarter.

Meta launched Vibes in the quarter, representing the next generation of AI creation tools and content experiences. Media generation in the app increased more than tenfold following the September launch. "People have created over 20 billion images using our products," Li disclosed during the earnings call.

Fourth quarter outlook and long-term planning

Meta expects fourth quarter 2025 total revenue in the range of $56-59 billion, assuming foreign currency provides approximately a 1% tailwind to year-over-year growth based on current exchange rates. The outlook reflects expectations for continued strong ad revenue growth, partially offset by lower year-over-year Reality Labs revenue.

The anticipated Reality Labs revenue reduction stems from lapping the Quest 3S introduction in the fourth quarter of 2024 and retail partners procuring Quest headsets during the third quarter of 2025 to prepare for the holiday season.

The company updated its full-year 2025 total expense outlook to $116-118 billion, from the prior range of $114-118 billion, reflecting a growth rate of 22-24% year-over-year. Absent changes to the tax landscape, Meta expects its fourth quarter 2025 tax rate to be 12-15%.

For 2026, the company anticipates investments in ads and organic engagement initiatives will enable continued strong revenue growth while progress on AI models and products positions Meta to capitalize on new revenue opportunities in subsequent years.

"A central requirement to realizing these opportunities is infrastructure capacity," Li explained. "As we have begun to plan for next year, it has become clear that our compute needs have continued to expand meaningfully."

Headcount reached 78,450 as of September 30, 2025, up 8% year-over-year, driven by hiring in monetization, infrastructure, Reality Labs, Meta Superintelligence Labs, and regulation and compliance areas. Employee compensation costs will be the second largest contributor to 2026 expense growth as the company recognizes a full year of compensation for employees hired throughout 2025, particularly AI talent, and adds technical talent in priority areas.

Hardware products gain momentum

Meta announced its 2025 line of AI glasses at the Connect conference. The new Ray-Ban Meta glasses and Oakley Meta Vanguards feature improved battery life, camera resolution, and new AI capabilities. Meta Ray-Ban Display glasses, the company's first glasses with a high-resolution display and the Meta Neural Band for interaction, sold out in almost every store within 48 hours.

"Demo slots are fully booked through the end of next month," Zuckerberg reported. "So we're going to have to invest in increasing manufacturing and selling more of those. This is an area where we're clearly leading and have a huge opportunity ahead."

Reality Labs operating loss totaled $4.43 billion in the third quarter, relatively flat compared to $4.43 billion in the same period last year. For the first nine months of 2025, Reality Labs accumulated operating losses of $13.17 billion.

Regulatory and legal considerations

Meta continues monitoring active legal and regulatory matters that could significantly impact business and financial results. In the European Union, the company continues engaging with the European Commission on its Less Personalized Ads offering.

"However, we cannot rule out the Commission imposing further changes to that offering that could have a significant negative impact on our European revenue, as early as this quarter," Li cautioned during prepared remarks.

In the United States, several youth-related trials are scheduled for 2026 that may ultimately result in material losses, according to the company's outlook commentary.

Meta announced plans in October to use AI chat data for ad targeting beginning December 16, 2025. Conversations and interactions with Meta AI will become another data source for personalizing content recommendations and advertisements across Facebook, Instagram, and other platforms.

Financial position and capital allocation

Cash, cash equivalents, and marketable securities totaled $44.45 billion as of September 30, 2025. The company generated $30.0 billion in cash flow from operating activities and $10.62 billion in free cash flow during the quarter.

Meta repurchased $3.16 billion of Class A common stock and paid $1.33 billion in dividends and dividend equivalent payments during the third quarter. The company ended the quarter with $28.83 billion in long-term debt.

"Our primary focus is deploying capital to support the company's highest order priorities, including developing leading AI products, models, and business solutions," Li explained. "As we make significant investments in infrastructure to support this work, we are focused on preserving maximum long-term flexibility to ensure we can meet our future capacity needs."

The company is establishing strategic partnerships that provide option value for future compute needs. In October, Meta announced a joint venture with Blue Owl for data center development in Louisiana, representing one approach to accessing additional pools of cost-efficient capital while maintaining flexibility.

Why this matters for marketers

Meta's third quarter results demonstrate the platform's continued ability to grow advertising revenue through AI-powered optimization despite increased competition and regulatory scrutiny. The 26% year-over-year revenue growth occurred alongside substantial improvements in ad performance metrics, validating the company's strategy of consolidating specialized models into larger, more capable systems.

For advertisers, the expansion of Advantage+ automation to additional objectives and the maturation of tools like Lattice and GEM mean campaigns increasingly benefit from sophisticated machine learning without requiring manual optimization. The $60 billion annual run-rate through end-to-end automated solutions indicates widespread adoption among advertisers seeking performance improvements.

Throughout 2025, Meta has systematically reduced advertiser controls while expanding automation defaults, including eliminating detailed targeting exclusions, enabling Dynamic Media by default for catalog ads, and introducing placement spending on excluded placements. These changes reflect the platform's confidence that algorithmic optimization delivers superior results compared to manual campaign management.

The infrastructure investment surge signals Meta's commitment to maintaining technological leadership in AI-powered advertising. Capital expenditures approaching $72 billion in 2025, with even larger growth expected in 2026, position the company to continue advancing its recommendation and ranking systems. These systems directly influence both organic engagement and advertising effectiveness across the platform's 3.54 billion daily active people.

The expansion of AI capabilities into new product areas, including Business AI for customer conversations and Meta AI for consumer interactions, creates additional touchpoints for advertising integration. With more than 1 billion monthly Meta AI users and millions of Business AI conversations occurring since launch, these products represent potential new advertising surfaces and data sources for targeting improvements.

Meta's advertising platform evolution throughout 2025 has emphasized transparency alongside automation, introducing Creative breakdowns for Flexible formats and AI-generated images, expanded brand customization tools, and performance analytics enhancements. These capabilities allow advertisers to understand how AI-driven optimizations impact results while maintaining brand safety standards.

The company's focus on video content, with Reels reaching a $50 billion annual run rate and video time on Instagram up more than 30% year-over-year, indicates where advertising inventory growth will concentrate. Advertisers optimizing for video placements align with user behavior shifts and platform prioritization.

Looking toward 2026, Meta expects continued strong revenue growth driven by ranking innovations including foundational ranking models, increased data and compute in training, and deeper integration of large language models for content understanding. These technical advances will enable more precise matching between user interests and both organic content and advertisements.

The regulatory environment remains uncertain, particularly regarding European revenue impacts from potential Commission actions on personalized advertising. Advertisers with significant European exposure should monitor developments closely and prepare for possible platform changes affecting targeting capabilities or ad delivery.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- October 29, 2025: Meta reports Q3 2025 results showing $51.24 billion total revenue, 26% growth year-over-year

- October 28, 2025: Meta expands Threads advertising with Advantage+ catalog ads and carousel formats

- October 23, 2025: LiveRamp enables retail media networks to measure Meta campaign performance through Clean Room platform

- October 7, 2025: Meta begins notifying users about AI chat data usage for ad targeting starting December 16

- September 1, 2025: Meta enables Dynamic Media by default for Advantage+ Catalog ads

- August 2025: Meta expands advertising features with targeted offers, universal value rules, and restricted words

- July 12, 2025: Meta unveils Creative breakdown for Flexible formats and AI-generated image ads

- June 17, 2025: Meta announces generative AI advances for advertisers at Cannes Lions

- May 29, 2025: Meta launches unified API structure for Advantage+ campaigns

- April 23, 2025: Meta expands Threads ads globally with default placement activation

- January 21, 2025: Meta removes detailed targeting exclusions for ad accounts

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Meta Platforms, Inc., led by CEO Mark Zuckerberg and CFO Susan Li, announced quarterly financial results affecting 3.54 billion daily active people across Facebook, Instagram, WhatsApp, and Messenger, along with advertisers using the company's advertising platform.

What: Meta reported third quarter 2025 total revenue of $51.24 billion, representing 26% year-over-year growth, with advertising revenue reaching $50.08 billion. The company recorded a one-time, non-cash income tax charge of $15.93 billion related to the One Big Beautiful Bill Act, resulting in net income of $2.71 billion (or $18.64 billion excluding the tax charge). Capital expenditures reached $19.37 billion in the quarter, with full-year 2025 guidance raised to $70-72 billion.

When: The results cover the quarter ended September 30, 2025, announced on October 29, 2025. The company provided fourth quarter 2025 revenue guidance of $56-59 billion and indicated capital expenditure dollar growth will be "notably larger" in 2026 than 2025.

Where: Meta's global advertising business showed year-over-year ad impression growth across all regions: Asia-Pacific (23%), Rest of World (9%), U.S. & Canada (8%), and Europe (6%). Average price per ad increased in all regions: Europe (19%), Rest of World (20%), U.S. & Canada (13%), and Asia-Pacific (1%).

Why: The results matter because they demonstrate Meta's ability to sustain strong advertising revenue growth through AI-powered optimization while making unprecedented infrastructure investments to maintain technological leadership. The company's strategy of aggressively front-loading compute capacity aims to position Meta for a potential paradigm shift when superintelligence arrives, with implications for both existing products serving 3.54 billion daily users and new AI-powered experiences. For the marketing community, the $60 billion annual run-rate through end-to-end automated advertising tools validates the effectiveness of Meta's algorithmic optimization approach, while planned ranking innovations including foundational models and deeper LLM integration signal continued performance improvements ahead.