Media fragmentation demands new budget allocation strategies

AudienceProject analysis reveals younger audiences abandon traditional channels for gaming and streaming platforms.

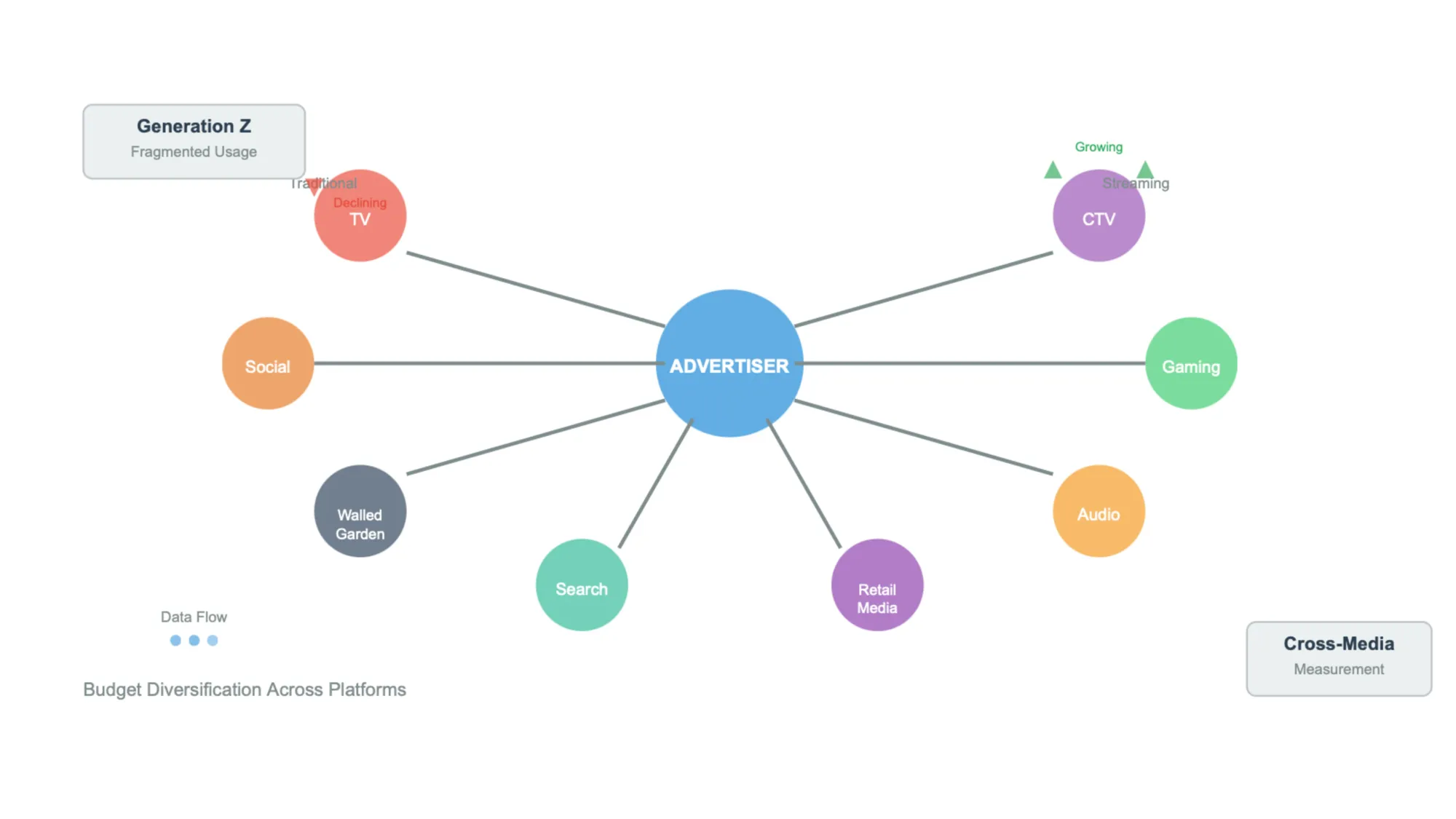

Media consumption fragmentation has reached unprecedented levels, forcing advertisers to restructure their budget allocation strategies across multiple platforms. According to industry analysis published on July 17, 2025, traditional channel loyalty has diminished significantly as content-driven consumption patterns emerge.

Younger demographics, particularly Generation Z, demonstrate highly fragmented media consumption behaviors that challenge established advertising approaches. "Media usage is more fragmented than ever before. Usage is less loyal to fixed channels and is more strongly oriented towards content and interests," according to Michaela Schmitz, Managing Director of AudienceProject DACH, in an analysis published July 17, 2025.

Traditional linear television has lost relevance among younger audiences unless specific formats become available through streaming platforms. Gaming platforms like PlayStation and Twitch represent emerging channels where younger target groups can be reached effectively. This shift requires advertisers to identify new incremental reach opportunities beyond conventional media channels.

The data reveals that streaming services, walled garden platforms, and gaming environments have become primary consumption venues for Generation Z audiences. Connected television usage continues expanding while traditional broadcast viewership declines among younger demographics.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: AudienceProject DACH Managing Director Michaela Schmitz and the digital advertising industry addressing media consumption fragmentation challenges.

What: Analysis reveals media consumption has become more fragmented than ever, requiring advertisers to restructure budget allocation strategies across multiple platforms rather than traditional channel-focused approaches.

When: Published July 17, 2025, reflecting current trends in media consumption behavior and advertising strategy adaptation.

Where: The analysis addresses global media consumption patterns with particular focus on younger demographics' platform usage across streaming services, gaming platforms, and walled garden environments.

Why: Traditional channel loyalty has diminished as content-driven consumption patterns emerge, forcing advertisers to develop diversified budget strategies, improved measurement capabilities, and cross-platform reach optimization to effectively engage fragmented audiences.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Budget diversification becomes essential strategy

The fragmentation phenomenon necessitates broad budget distribution across multiple channels rather than concentration in top-performing platforms. "The fragmentation of media consumption makes a broad budget allocation essential," Schmitz stated. Advertisers must first verify their brand presence within specific channels and identify which age groups and target audiences utilize those platforms.

Diversification enables more efficient reach building, particularly when platforms serve different target audiences. Campaign net reach analysis, focusing on incremental reach and audience overlaps, allows advertisers to develop strategies for increasing incremental reach effectiveness.

Organizations that continuously analyze reach trends, costs, and target group coverage can adjust budgets flexibly within ongoing campaigns. Large advertisers increasingly conduct detailed channel analysis and make targeted investments based on performance data.

Cross-platform measurement challenges persist

Measuring campaign effectiveness across fragmented media environments requires comprehensive data collection and validation systems. PPC Land has documented measurement standardization efforts addressing similar challenges in digital audio advertising, where consumer attention significantly exceeds advertiser investment.

AudienceProject's cross-media measurement platform collects campaign data and uses panels for validation and deduplication. Direct integrations with walled gardens including Google, Amazon, and Meta enable reliable campaign reach verification through hashed email address comparison methods.

Clean-room technologies facilitate data matching with platform providers such as Netflix, Amazon, Meta, and Disney+ while considering platform-specific configurations. These technical integrations validate campaign reach across diverse media environments.

Data-driven allocation requires daily insights

Effective media budget diversification depends on daily data covering reach across channels, CPM developments, target audience distribution, and cost trends. These metrics enable advertisers to recognize optimal timing for shifting budgets between channels when comparable target groups can be reached more cost-effectively elsewhere.

The analysis identifies three core principles for optimal budget utilization: minimizing dependencies on individual platforms through multi-channel presence, diversifying budgets across those channels due to consumption fragmentation, and implementing systematic measurement protocols.

"Many companies still advertise blindly or only look at their channels in isolation. Budget allocations are then often gut decisions instead of being data-driven," Schmitz observed. Daily insights generation identifies optimization potential that enables recognition of effective reach-building channels and worthwhile investment opportunities.

Return to fundamental advertising metrics

Digital advertising has matured beyond initial focus on clicks and impressions toward net reach and advertising impact measurements. The emphasis now centers on determining how many people were reached, frequency of exposure, and target group accuracy.

Brand association building and subsequent purchase decisions represent the classical media dialogue gaining renewed importance. This shift reflects digital advertising's established position within media mix strategies rather than experimental channel status.

Strategic implications for marketing community

The documented media consumption changes require marketing organizations to develop new competencies in experimental design and statistical interpretation. Enhanced measurement capabilities drive more efficient advertising markets, as demonstrated by recent improvements in incrementality testing accessibility.

Platform integration expansion continues across the advertising technology ecosystem. AudienceProject has created integrations with Netflix, Disney+, Amazon, YouTube, Meta, and numerous connected television providers. Pixel measurements enable mapping of advertising inventories from additional channels including Samsung and LG devices.

Marketing mix expansion reflects digital advertising normalization within overall media strategies. Industry standardization efforts address fragmentation challenges across multiple advertising categories, establishing frameworks for consistent measurement and optimization.

The transition toward sophisticated targeting and measurement capabilities requires corresponding skill development within marketing teams. Organizations must build capabilities in hypothesis formation, experimental planning, and results analysis to leverage advanced measurement tools effectively.

Key Terms Explained

Incremental Reach: This metric measures the additional unique audience members reached when adding new media channels or platforms to existing campaigns. Unlike total reach, incremental reach specifically identifies audiences that would not have been exposed to advertising through current channels. Advertisers use this measurement to justify budget expansion across multiple platforms rather than increasing spend within single channels. For fragmented media environments, incremental reach analysis prevents audience overlap waste while maximizing campaign exposure across diverse consumption patterns.

Walled Garden Platforms: These are closed advertising ecosystems where platform owners control both the advertising inventory and audience data, limiting external access to user information. Major examples include Google, Meta, Amazon, and Apple, which operate their own advertising platforms with proprietary targeting and measurement systems. Advertisers cannot export detailed audience data from these platforms, making cross-platform measurement challenging. The term "walled garden" reflects the enclosed nature of these environments, where data sharing occurs only under strict platform-controlled conditions.

Cross-Media Measurement: This methodology tracks advertising campaign performance across multiple media channels and platforms using unified measurement frameworks. Unlike single-channel analytics, cross-media measurement requires data integration from television, digital, radio, print, and out-of-home advertising sources. Advanced systems use identity resolution techniques, including hashed email matching and device fingerprinting, to connect user interactions across different touchpoints. This comprehensive approach enables advertisers to understand true campaign reach and frequency while identifying the most effective channel combinations.

Clean Room Technology: These secure data collaboration environments allow multiple parties to analyze combined datasets without exposing underlying user information to each other. Clean rooms use privacy-preserving techniques like differential privacy and cryptographic protocols to enable insights generation while maintaining data separation. Advertisers can match their customer data with publisher or platform data to measure campaign effectiveness without sharing personally identifiable information. This technology has become essential for measurement in privacy-focused advertising environments where traditional tracking methods face restrictions.

Net Reach: This fundamental measurement represents the total number of unique individuals exposed to advertising campaigns across all channels, with duplicate exposures removed. Net reach differs from gross reach, which counts the same person multiple times if reached through different platforms. Calculating net reach requires sophisticated deduplication techniques to identify when the same individual encounters advertising across multiple touchpoints. This metric provides the foundation for understanding true campaign scale and enables accurate frequency capping and budget optimization decisions.

Programmatic Advertising: This automated system for buying and selling digital advertising inventory uses real-time bidding algorithms and data-driven targeting to place ads. Programmatic platforms analyze user behavior, context, and campaign objectives to determine optimal ad placement and bidding strategies within milliseconds. The technology encompasses demand-side platforms, supply-side platforms, and ad exchanges that facilitate automated transactions. Programmatic advertising enables precise audience targeting and dynamic campaign optimization while reducing manual media buying inefficiencies.

Attribution Modeling: These analytical frameworks assign conversion credit to different marketing touchpoints along the customer journey, determining which channels and interactions contribute to desired outcomes. Attribution models range from simple last-click attribution to complex algorithmic approaches that consider timing, channel influence, and customer behavior patterns. Advanced attribution uses machine learning to analyze cross-device interactions and offline conversions. Proper attribution modeling enables advertisers to understand true channel effectiveness and optimize budget allocation based on actual contribution to business results.

Connected Television (CTV): This category encompasses television content delivered through internet-connected devices rather than traditional broadcast or cable systems. CTV includes smart TVs, streaming devices, gaming consoles, and mobile devices used for video consumption. Unlike linear television, CTV offers advanced targeting capabilities, real-time optimization, and detailed measurement similar to digital advertising. The CTV ecosystem includes both ad-supported and subscription streaming services, with programmatic buying capabilities that enable precise audience targeting and campaign measurement.

Frequency Capping: This campaign management technique limits the number of times individual users see specific advertisements within defined time periods. Frequency capping prevents ad fatigue and wasted impressions while optimizing campaign reach and user experience. Implementation requires audience identification across devices and platforms, often using cookies, device IDs, or logged-in user data. Effective frequency capping balances message reinforcement with audience saturation, typically involving complex algorithms that consider campaign objectives, audience size, and creative performance.

Media Mix Modeling (MMM): This statistical analysis technique quantifies the impact of different marketing channels on business outcomes using historical performance data. MMM uses econometric modeling to isolate the contribution of each media channel while accounting for external factors like seasonality, economic conditions, and competitive activity. The methodology enables marketers to understand diminishing returns within channels and optimize budget allocation across the media mix. Modern MMM incorporates real-time data feeds and machine learning algorithms to provide more granular insights and faster optimization recommendations.

Timeline

- July 17, 2025: AudienceProject publishes analysis on efficient budget allocation strategies in fragmented media landscape

- July 15, 2025: IAB Europe releases second annual retail media report documenting partnership diversification trends

- June 24, 2025: IAB releases comprehensive guide addressing chronic underinvestment in digital audio advertising

- May 22, 2025: Google announces enhanced incrementality testing with reduced $5,000 minimum budget requirements

- March 26, 2025: IAB Europe publishes updated retail media definitions for European markets