Marketers struggle to adapt social creative for connected TV campaigns

New survey finds 72% reuse existing assets while only 25% develop tailored content for cross-platform video advertising.

The disconnect between video advertising strategy and creative execution has reached a critical point. Smartly and EMARKETER published research on July 9, 2025, revealing that 72% of marketers reuse or slightly modify assets across platforms, while just 25% tailor creative for both social and connected TV (CTV) campaigns.

The findings highlight significant challenges in cross-channel storytelling as video consumption patterns reshape the advertising landscape. With 78% of U.S. adults expected to use multiple screens simultaneously by the end of 2025, brands face mounting pressure to develop cohesive strategies that span social media and television screens.

The research examined responses from 220 marketers surveyed between March and April 2025, assessing their approaches to digital video advertising across social and CTV channels. Nearly 70% of participants plan to increase CTV investment this year, reflecting growing recognition of the medium's potential. However, creative strategies have not evolved at the same pace as media allocation.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Smartly, an AI-powered advertising technology platform, partnered with EMARKETER to conduct research involving 220 marketers from brands, agencies, and publishers.

What: A comprehensive study revealing that 72% of marketers reuse or slightly modify creative assets across social media and connected TV platforms, while only 25% develop tailored creative for both channels. The research examined cross-channel video advertising strategies and execution challenges.

When: The survey was conducted between March and April 2025, with findings published on July 9, 2025.

Where: The research focused on digital video advertising strategies across social media platforms and connected TV channels, examining global marketing practices with particular emphasis on U.S. market trends.

Why: The study addresses the growing disconnect between media strategy evolution and creative execution as 78% of U.S. adults are expected to use multiple screens simultaneously by the end of 2025, creating pressure for more sophisticated cross-platform advertising approaches while revealing significant inefficiencies in current creative development processes.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

According to the study, 44.5% of marketers dedicate at least 30% of their digital advertising budgets to video ads. This substantial investment underscores video's importance in marketing strategies, yet the execution reveals significant inefficiencies in creative development processes.

"The lines between social media and CTV are blurring, with more people watching social videos and creator content on TV sets," said EMARKETER vice president and principal analyst Jasmine Enberg. "Marketers must break down the silos between media and creative and think more holistically about their video strategies."

The data shows that 55.2% of marketers make slight modifications to their creative, such as length and format changes, while keeping the core creative unchanged when adapting content from social to CTV. Meanwhile, only 24.1% develop completely different creative for social and CTV platforms. An additional 16.7% use identical creative across both channels.

CTV viewing time is projected to grow 7.7% in 2025, reaching 2 hours and 35 minutes daily. Social media usage remains strong at 1 hour and 31 minutes per day. This dual consumption creates opportunities for marketers to reach audiences across multiple touchpoints, but requires sophisticated coordination between creative teams and media planners.

"Social assets are often built to be nimble, short, engaging, and tested through real-time feedback," said Oli Marlow-Thomas, chief innovation officer at Smartly. "When repurposed thoughtfully for CTV, that agility meets the power of a more immersive format."

The research reveals distinct effectiveness ratings for different video formats. Short-form social video leads in impact, with over 80% of marketers ranking it as "effective" or "very effective." CTV follows closely at 72% effectiveness ratings. Some 34% of marketers rate CTV ads as "very positive," compared to 29.1% for short-form social video.

Budget allocation patterns demonstrate the growing importance of both channels. Nearly 7 in 10 marketers (68.6%) expect their CTV budget to increase in the next 12 months, compared with 57.7% for social video. Despite CTV's rapid growth, only 8.7% plan to decrease their social budget, indicating that marketers view these channels as complementary rather than competitive.

The targeting capabilities of both platforms contribute to their appeal. CTV offers household-level precision while social media provides individual-level engagement. Both channels deliver rich audience segmentation based on interests, demographics, and viewing behavior. Some 67.7% of marketers have moved linear TV budget to CTV due to "better audience targeting and personalization."

Production challenges present the most significant barriers to cross-platform creative strategies. The cost of producing multiple creative variations ranks as the top challenge, cited by 47.3% of marketers. Budget constraints for high-quality CTV creative follow at 41.4%. These financial pressures force marketers to compromise between creative quality and platform optimization.

Interactive elements represent an emerging opportunity in CTV advertising. Some 42.1% of marketers who use CTV cite the "ability to leverage interactive, digital creative elements" as a reason for choosing CTV over linear television. More than one-third of marketers plan to increase their focus on shoppable ads in 2025, reflecting consumer demand for actionable advertising experiences.

Brand lift through awareness and recall remains the primary objective for video advertising, with 47.3% of marketers producing content primarily for awareness purposes. However, 45% consider brand lift among the most important indicators of video ad success, followed by view-through completion rates at 29.6% and engagement metrics at 29.1%.

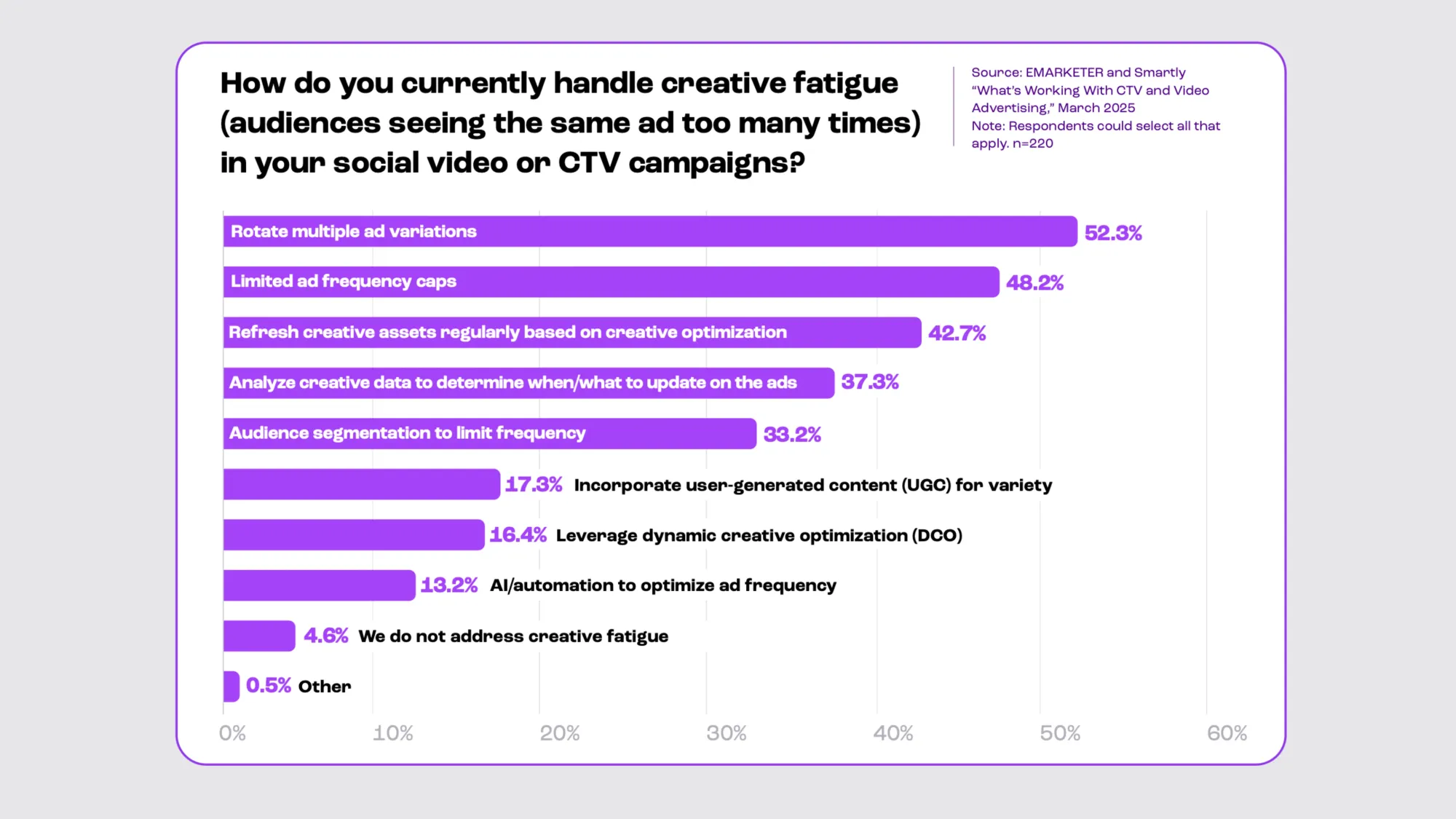

Creative fatigue management has become a critical concern as marketers expand across platforms. Rotating multiple ad variations is the most common approach, used by 52.3% of marketers. Some 42.7% refresh creative assets regularly based on optimization data. Limited ad frequency caps are employed by 48.2% of marketers to prevent audience oversaturation.

The research indicates that audience feedback from social campaigns can inform CTV strategies. "Social provides rapid feedback and testing environments, helping marketers understand what messages resonate," said Marlow-Thomas. "That insight can then inform which creative assets get elevated to CTV, reducing guesswork and maximizing ROI."

Technical infrastructure improvements continue to address advertiser needs. Server-side solutions and measurement enhancements reduce ad errors while optimizing revenue streams. The programmatic ecosystem has expanded significantly, with approximately 86% of CTV inventory purchased through automated channels.

The findings suggest that successful multichannel video strategies require three key elements: consideration of channel nuances, internal collaboration between creative and performance teams, and planning for creative fatigue from the outset. While 87% of marketers have creative teams involved in production, only 13% involve them in creative optimization, indicating missed opportunities for performance improvement.

"High quality doesn't necessarily mean highly produced," said Enberg. "The definition of premium content is shifting from traditional studio production value toward content that is relatable, relevant, and features a strong narrative or storytelling."

The study reveals that 57.7% of marketers focus on storytelling and narrative-driven ads for both social and CTV platforms, making these channels complementary in terms of content approach and success measurement. Nearly all brands (94%) now use influencer content outside of the influencer's own social channels.

As the digital video landscape continues expanding, marketers show no signs of reducing investments. However, the research indicates that breaking down silos between social video and CTV becomes essential for optimizing spend and delivering cohesive brand narratives. Developing adaptable rather than bespoke creative for each channel offers the added benefit of reducing production costs without compromising creative quality or brand voice.

This development matters significantly for the marketing community because it highlights the gap between media strategy evolution and creative execution capabilities. Previous PPC Land coverage has shown that programmatic advertising growth reached 72% in 2025, with CTV's share of media budgets projected to double from 14% in 2023 to 28% in 2025. The Smartly and EMARKETER findings reveal that creative strategies have not kept pace with this rapid budget reallocation.

The implications extend beyond budget efficiency to audience experience and brand consistency. As consumers increasingly engage with brands across multiple screens simultaneously, misaligned creative strategies risk diluting brand messages and wasting advertising investment. The research provides a roadmap for marketers to address these challenges through improved collaboration, strategic planning, and technology adoption.

Timeline

- March-April 2025: Smartly and EMARKETER conduct survey of 220 marketers on cross-channel video advertising approaches

- July 9, 2025: Smartly and EMARKETER release research findings showing 72% of marketers reuse creative assets across platforms

- February 9, 2025: Industry data shows 72% of marketers increasing programmatic spending, with CTV budget share projected to double

- June 16, 2025: Amazon Ads and Roku announce largest authenticated CTV partnership providing access to 80M U.S. households

- July 1, 2025: MNTN and ZoomInfo partner for B2B Connected TV advertising as 98% of LinkedIn users watch CTV content weekly

- June 23, 2025: Nielsen launches CTV tracking within Ad Intel platform starting in Germany

- December 22, 2024: New planning playbook reveals integrated TV advertising potential in India

- January 8, 2025: Smart TV ads show 73% growth in helping holiday shoppers make purchasing decisions