Magnite reports strong Q3 2025 results with CTV growth

Magnite exceeded expectations with 18% CTV growth in Q3 2025, reaching $75.8 million. Netflix partnership expansion and agency marketplace momentum drove performance.

Magnite announced its third quarter 2025 financial results on November 5, 2025, exceeding expectations across key metrics as Connected TV advertising continued to drive growth for the independent sell-side advertising platform. The company reported contribution ex-TAC of $166.8 million, representing 12% year-over-year growth.

"Q3 came in strong, and we once again exceeded total top line expectations with CTV contribution ex-TAC growing 18% and 25%, excluding political," stated Michael Barrett, CEO of Magnite, during the earnings call. "DV+ continued to perform well, growing in line with expectations. Adjusted EBITDA was also strong at $57 million, beating expectations, resulting in a margin of 34%."

The results demonstrated particular strength in Connected TV, where contribution ex-TAC reached $75.8 million, marking 18% year-over-year growth or 25% when excluding political advertising. This performance exceeded the company's guidance range of $71 million to $73 million. Revenue for the quarter totaled $179.5 million, an 11% increase compared to the same period in 2024.

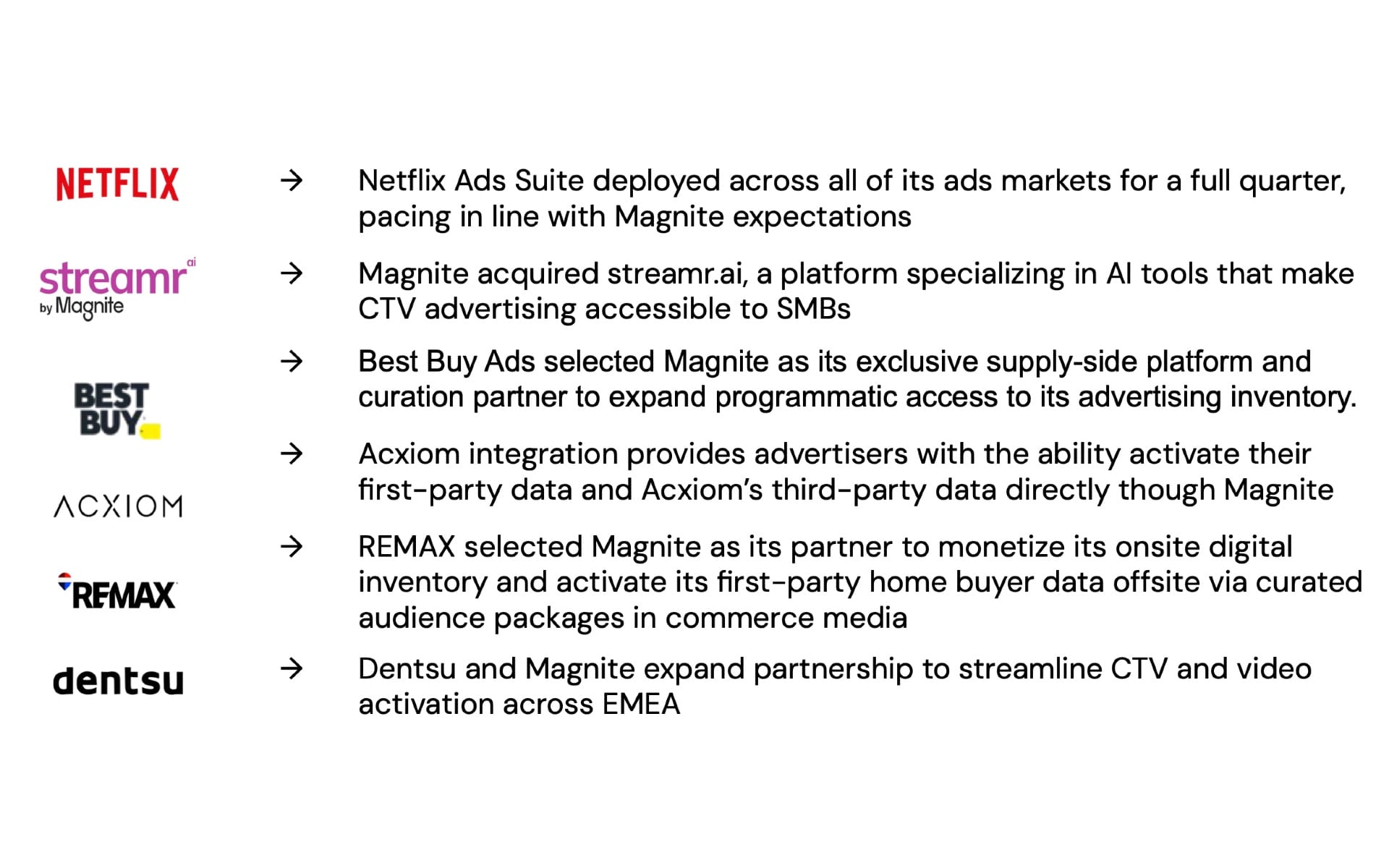

Barrett attributed the strong performance to multiple growth drivers. "Our performance in CTV was driven by growth of our largest publisher partners, significant traction with agency marketplaces, ClearLine adoption, positive SMB trends and programmatic expansion in live sports," he explained. "Our most significant growth came from the industry's largest players, including LG, NBCU, Netflix, Roku, Vizio, Walmart and Warner Bros. Discovery."

The Netflix partnership demonstrated continued momentum. "Regarding Netflix, we've supported the expansion of their ads business to all ad-supported markets," Barrett stated. "The pacing of the Netflix ramp has gone very well, and we remain excited about our continued growth opportunity with them in 2026."

Roku maintained its position as a fast-growing publisher partner. "Roku also continues to be a very fast-growing publisher with the Roku Exchange, where Magnite is the preferred programmatic partner," Barrett noted. "This quarter, in particular, demonstrated especially great momentum where our partnership saw meaningful traction in sports and in attracting SMBs to their platform. We continue to explore areas for further expansion of our relationship to drive more revenue for them."

Warner Bros. Discovery launched its NEO platform in September. "Warner Bros. Discovery has also made great progress with its NEO platform launching in September," Barrett said. "NEO, a new ad platform, will provide buyers direct access to Warner Bros. entire premium video inventory through one simplified and intuitive user interface where Magnite is helping to power transactions."

ClearLine, Magnite's unified supply platform, expanded to over 30 clients during the quarter. Barrett highlighted recent enhancements: "ClearLine continues to gain momentum with over 30 clients, and we recently rolled out a number of key enhancements to the product. Earlier this year, we announced that native home screen units are available through ClearLine."

The company announced plans to integrate AI capabilities into ClearLine. "We also announced plans to integrate AI assistance and Agentic workflows into ClearLine, which will be powered in part by technology from our acquisition of streamer.ai, which we announced in September," Barrett explained.

The streamer.ai acquisition addresses a persistent challenge in Connected TV advertising. "As I've mentioned before, the CTV advertising opportunity for small and medium-sized businesses is enormous, but it's historically been bottlenecked by complexity and high cost," Barrett stated. "To address this, streamer.ai gives small businesses the tools to create production quality CTV commercials in minutes and in an extremely cost-efficient manner."

Magnite announced two client wins following the September acquisition of streamer.ai: ITV, the UK's largest commercial broadcaster, and Wolt, part of DoorDash. "We're licensing Streamer to large media owners, commerce players, agencies, DSPs and other media buyers so they can help their SMB clients easily break into CTV advertising, and the response has been very positive," Barrett said.

Agency spending demonstrated significant growth during the quarter. "We are seeing agencies becoming more active in their programmatic SPO efforts, and it's driving spend now," Barrett noted. "We have long supported agencies and have dedicated teams in place to support their growth efforts in this area. As evidence of this acceleration, ad spend from top holds grew nearly 20% in Q3 year-over-year."

Barrett explained the mechanics of agency marketplace growth: "A significant driver of our growth with agencies is from Magnite's powered buyer marketplaces. These private label marketplaces allow agencies to connect directly with publishers to develop curated pools of inventory that are enriched by proprietary data are DSP agnostic and maximize working media spend."

SpringServe, Magnite's combined CTV ad serving and supply-side platform, continued to differentiate the company's offering. "Our combined CTV ad serving and SSP platform, SpringServe, continues to be a significant differentiator for us with publishers," Barrett stated. "As well as offering a leading ad server in CTV, SpringServe plays a crucial role as the mediation layer for publishers."

The platform recently added Viant's Direct Access product. "We just added Viant's Direct Access product to our list of direct integrations that include Amazon APS, Yahoo's Backstage and Trade Desk's OpenPath," Barrett said. "SpringServe also allows publishers to maximize their yield by unifying demand from these direct ad server integrations directly amongst buyers that connect to our SSP."

Live sports maintained its position as a growth driver. "Live sports continues to drive growth in our business, and we see tremendous potential in the future as programmatic adoption continues to escalate," Barrett explained. "We have seen new contributions notably from Disney of NFL and college football as well as Major League Baseball in the WNBA."

Subscribe PPC Land newsletter ✉️ for similar stories like this one

The Digital Video Plus (DV+) segment achieved contribution ex-TAC of $90.9 million, representing 7% year-over-year growth or 10% excluding political advertising. "On the DV+ side of the business, Q3 contribution ex-TAC was up 7% or 10% excluding the impact of political last year," Barrett stated. "Our DV+ business continues to benefit from ramping partners as well as new client wins. A notable update is that our partnership with Pinterest began to ramp in Q3."

Magnite's commerce media offering showed continued expansion. "We've been really pleased with the progress of our Commerce Media offering as our roster of partners continues to grow," Barrett said. "We've announced partnerships with Best Buy, RE/MAX, Western Union, PayPal and Connective Media by United Airlines. Commerce entities are attracted to the unique technology Magnite provides."

Audio emerged as the fastest-growing format within the DV+ segment. "Our fastest-growing format in TV+ in the third quarter was audio," Barrett noted. "We are gaining traction in this area and see it as a significant opportunity in the future. Earlier this year, Spotify announced its new Spotify Ad Exchange or SAX, and selected Magnite as its global programmatic partner."

Barrett provided insights on how agentic AI technologies will impact the advertising ecosystem. "Turning to AI. We delivered another quarter of progress and have an increasingly clear view of how Agentic technologies will show up across the industry and in our products," he stated. "In October, an industry association comprised of some of the industry's best regarded executives introduced the Ad context protocol or AdCP, a proposed standard for how buy and sell-side agents will transact."

He explained Magnite's positioning for this technological shift: "When you look into the structure, you see that the agents are designed to operate on top of the transactional infrastructure that exists today, much of which we've built. As always, these transactions must be vetted, negotiated, processed and cleared in a privacy-compliant manner, jobs we excel at. We envision the new world as one where sell-side assets, in particular, are going to be even more valuable and especially Magnite with our strong publisher relationships, SPO partnerships and leading technology."

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

David Day, Magnite's Chief Financial Officer, provided detailed financial performance metrics. "As Michael mentioned, we had a very strong Q3 with standout performance in CTV, achieving 18% contribution ex-TAC growth or 25%, excluding political, exceeding our expectations," Day stated. "DV+ performed well and was in line with our guide. Adjusted EBITDA was solid as well, growing 13% to $57 million and beating expectations, resulting in a 34% margin. We're pleased with these results, particularly the acceleration in CTV growth, which was significantly above market growth."

Adjusted EBITDA reached $57.2 million, up 13% year-over-year, representing a margin of 34%. Net income totaled $20.1 million, or $0.13 per diluted share, compared to net income of $5.2 million in the year-ago period. Non-GAAP earnings per share reached $0.20, compared to $0.17 for the third quarter of 2024.

Day discussed the company's infrastructure investments: "As we've discussed, our technology team has made significant progress improving operational efficiency and reducing per unit cloud costs, which is allowing us to manage significant increases in ad request volumes with modest total cost increases."

He announced increased capital expenditures. "As a result, we decided to increase our CapEx investment by $20 million this quarter, specifically investing in two new data center build-outs in Ashburn, Virginia and Santa Clara, California to secure future data capacity needs," Day explained. "We now expect CapEx for Q4 and the full year to be approximately $23 million and $80 million, respectively. For 2026 and beyond, we believe this increased investment will lead to additional efficiencies and plan to reinvest some of the savings in critical growth areas. We expect CapEx to be in the $60 million range in 2026."

The company's balance sheet remained strong. "Our cash balance at the end of Q3 was $482 million, an increase from $426 million at the end of the second quarter," Day reported. "Operating cash flow, which we define as adjusted EBITDA less CapEx, was $39 million."

Day noted the company's leverage position: "Net leverage for the quarter was well below our goal of less than 1 times and came in at 0.3 times at the end of Q3, down from 0.6 times at the end of the second quarter."

Barrett provided updates on the Google ad tech antitrust trial. "As you likely know, Judge Brinkema concluded a two-week trial on the remedies phase of the DOJ's case in early October," he stated. "The post-trial briefing has recently been filed and closing arguments are scheduled for November 17."

He explained the potential remedies under consideration: "At this stage, having found that Google had illegally engaged in a series of anticompetitive acts to establish monopolies in the ad exchange and ad server market, both structural and behavioral remedies remain on the table, structural referring to the forced divestiture of parts of their ad tech business and behavioral being a set of rules and practices designed to rectify and prohibit Google's illegal anticompetitive conduct."

Barrett expressed confidence in the outcome. "We think there are merits to both types of remedies and have confidence that the court will reach the right outcome. The remedy hearings in September did not change our positive outlook about remedies. Ultimately, our point of view is that any decision that helps restore competition and eliminates Google self-preferencing behavior will be a big win for the open Internet as well as Magnite specifically."

He quantified the potential impact: "To that point, as we've said previously, every 1% of market share that shifts to Magnite as a result of these remedies could mean $50 million of additional contribution ex-TAC on an annualized basis and at a very high 90% plus flow-through margins. Needless to say, we're watching developments in this case very closely."

Barrett also announced Magnite's own legal action. "On a related note, we recently announced that we had filed our own lawsuit against Google relating to its anticompetitive conduct," he stated. "The suit, which seeks financial damages as well as other remedies, is a follow-on action to the DOJ litigation and builds on the allegations proved in that case."

For the fourth quarter of 2025, Day provided guidance: "For the fourth quarter, we expect contribution ex-TAC to be in the range of $191 million to $196 million, which represents growth of 6% to 9% or 13% to 16%, excluding political. Contribution ex-TAC attributable to CTV to be in the range of $87 million to $89 million, which represents growth of 12% to 14% or 23% to 25% when excluding political."

He explained factors affecting the DV+ outlook: "In DV+, our guide reflects slightly lower growth versus the year-to-date performance due to a couple of factors. First, in October, we've seen some additional drop in vertical spend in automotive and some additional weakness in technology and in Home and Garden, indicating a slightly softening macro environment. We're also seeing some spend movement from online video to CTV, which makes a ton of sense given more competitive CTV CPMs and expanded SMB access to CTV inventory."

Day also noted external factors: "Lastly, we've seen some near-term pressure from a recent feature change by a top DSP partner affecting all SSPs."

Looking ahead to 2026, Day provided preliminary guidance. "Now turning to 2026. I want to point out that our estimates do not include any potential market share gains as a result of remedies from the Google Ad tech trial," he stated. "We currently expect contribution ex-TAC growth for 2026 to be at least 11%. We also expect to get back into our target margin range, which is 35% at the low end, inclusive of a sizable investment in people we are making to support our growth initiatives and CapEx to be approximately $60 million."

During the Q&A session, Barrett addressed questions about Trade Desk's recent software changes. "Yes, so in late Q3, Trade Desk made a software change to their operating system that prioritized OpenPath as a default path for supply," he explained. "And since that occurred, we've worked with all of our major buyers, which include agency holding companies to reconnect Magnite as a preferred supply path."

He elaborated on Magnite's value proposition: "As we noted in the script, Magnite powers many of the Holdco buyer marketplaces, so connection to Magnite is essential for their business. So there was impact. We project impact for Q4 and that kind of softer DV+ guide that we put forth. But we do feel as though the bulk of the impact has already occurred that it's been limited to DV+."

Barrett expressed support for ecosystem improvements while highlighting Magnite's importance: "I will say we definitely support Trade Desk's goal of cleaning up the ecosystem and cutting out supply players that provide very little value. And I assure you this move will do that. But I also think this shows Magnite's importance to the buying community, the profile of the media that we supply, the services that we provide building their businesses, by our marketplaces on our rails and obviously, the importance that we bring to the supply side."

Regarding demand-side platform partnerships, Barrett noted: "Yes, listen, our spend from the leading DSPs remain very strong. We are closing that gap that we had highlighted multiple quarters ago, where the total ad spend was outpacing the contribution ex-TAC growth. And that's narrowed, but we still have a very healthy spend pattern. And with all DSPs, and Amazon, in particular, is having a banner year, and we really enjoy that partnership both with Amazon as a buyer of inventory and Amazon as a publisher where we can help them monetize the inventory there."

On the SMB opportunity, Barrett explained the strategic approach: "The idea of Streamer is to help folks like that, not just Mountain, but other DSPs that may not have the tools to attract SMB dollars or merchants or agencies. And so the idea is that we offer the streamer product to those folks that have direct relationships with SMBs. The idea isn't for us to be chasing SMBs ourselves, but to make sure that, that spend winds up on our platform. And that's why we're super excited about the Streamer acquisition because it accomplishes that."

Day concluded with optimism about the company's trajectory: "The third quarter was really positive for Magnite as we continue to see significant traction from our partners and from our strategic initiatives. I'm excited about the progress in our business and look forward to continued momentum into 2026."

The earnings report underscores Magnite's position as the largest independent sell-side advertising company, with particular strength in Connected TV advertising. The company's 99% coverage of the CTV supply market, as revealed in the March Jounce Supply Benchmarking Report, positions it to capitalize on continued growth in streaming advertising.

Timeline

- September 2025 – Warner Bros. Discovery launches NEO platform with Magnite powering transactions

- September 2025 – Magnite acquires streamer.ai for AI-powered CTV creative production

- Early October 2025 – Judge Brinkema concludes remedies phase hearings in Google ad tech trial

- November 5, 2025 – Magnite reports Q3 2025 results with $166.8 million contribution ex-TAC

- November 17, 2025 – Closing arguments scheduled in Google ad tech remedies phase

- March 2025 – Jounce report reveals Magnite's 99% CTV market coverage

- April 17, 2025 – Federal court rules Google illegally monopolized ad server and exchange markets

- May 2025 – Magnite reports Q1 2025 with 15% CTV growth

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Magnite, the largest independent sell-side advertising company, reported third quarter 2025 financial results with CEO Michael Barrett and CFO David Day presenting the performance.

What: The company exceeded expectations with contribution ex-TAC of $166.8 million (12% year-over-year growth) and particularly strong Connected TV performance at $75.8 million (18% growth, or 25% excluding political advertising). Major partnerships with Netflix, Roku, and Warner Bros. Discovery drove results, alongside growth in agency marketplaces and the acquisition of streamer.ai for small business CTV advertising access.

When: Results were announced on November 5, 2025, covering the quarter ended September 30, 2025. The company provided guidance for Q4 2025 and full-year 2026 expectations.

Where: Magnite operates globally as an omni-channel sell-side platform, with U.S. revenue representing 75% of total revenue ($134.7 million) and international revenue contributing 25% ($44.8 million) in the third quarter.

Why: The results matter for the marketing community because they demonstrate continued growth in programmatic Connected TV advertising, with implications for how advertisers access streaming inventory. The pending Google antitrust remedies could significantly reshape the digital advertising landscape, potentially shifting market share to independent platforms like Magnite. The company's expansion of tools for small business CTV access and agency marketplace momentum indicates evolving pathways for advertisers to reach streaming audiences.