Magnite introduces machine learning-powered ad podding for streaming platforms

Magnite announced advanced ad podding technology on October 24, 2025, applying machine learning to optimize commercial breaks as CTV spending reaches $46.9 billion.

Magnite announced on October 24, 2025, the deployment of machine learning capabilities within its SpringServe ad server to optimize ad pod construction for connected television publishers. The technology addresses persistent inefficiencies in programmatic CTV advertising by reducing redundant bid requests while maintaining yield and competitive separation between brands.

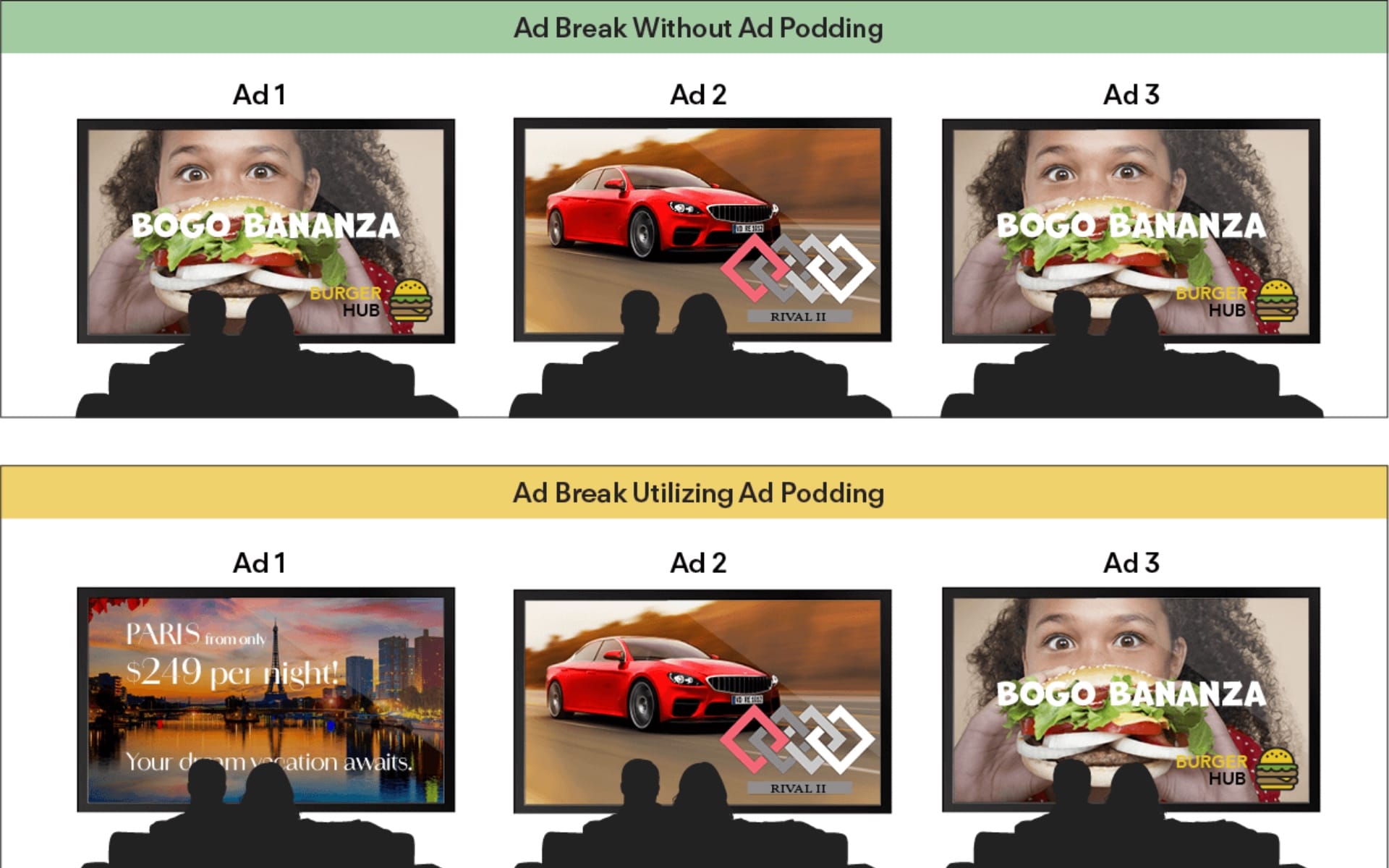

Ad podding groups multiple advertisements within a single commercial break, mirroring traditional linear television practices. However, programmatic execution introduces complexity that machine learning aims to resolve. SpringServe's system analyzes performance data to determine when fewer bid requests can achieve sufficient fill rates, reducing infrastructure costs for publishers and demand-side platforms.

"Publishers need tools that protect yield without losing audiences, and advertisers need efficient, brand-safe delivery," the company stated in its announcement.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Programmatic transactions account for three-fourths of all CTV advertising activity, according to Magnite's analysis. The streaming advertising ecosystem has experienced rapid transformation, with programmatic capabilities expanding across major platforms throughout 2025. Publishers increasingly seek yield optimization tools as CTV budget allocation doubles from 14% in 2023 to 28% in 2025.

Traditional programmatic pod construction has operated as what Magnite describes as a "spray and pray" approach. Publishers issue multiple bid requests per commercial break to ensure inventory fills completely. This volume-driven method inflates costs across the advertising ecosystem while creating forecasting difficulties for buyers.

SpringServe's machine learning predicts optimal bid request volumes for each ad break. The system reduces overhead while maximizing diversity and yield, according to the announcement. Publishers achieve fuller commercial breaks without overwhelming demand-side platforms with unnecessary auction opportunities.

Industry adoption of the OpenRTB 2.6 specification will formalize efficiency improvements across programmatic CTV transactions. ORTB 2.6 introduces native support for multi-ad podding and enhanced communication of pod structure between buyers and sellers. The specification reduces redundant bid requests while enabling more transparent transactions.

Magnite's early support for the standard positions publishers and advertisers to benefit as capabilities scale across the programmatic ecosystem. Technical standardization has emerged as a priority as streaming platforms address operational challenges in advertising infrastructure.

The technology applies both publisher and buyer rules to pod construction. Commercial breaks maintain competitive separation between rival brands, manage frequency capping, and create organized viewing experiences rather than randomized ad sequences. Linear television advertisers have long dictated placement within commercial breaks and ensured separation from competitors—expectations now extending into CTV environments.

Two-thirds of Americans (66%) prefer ad-supported streaming over ad-free alternatives, according to data cited in Magnite's announcement. Repetition remains the primary cause of subscriber frustration and churn, particularly among viewers who binge-watch content and encounter identical advertisements across multiple breaks.

SpringServe's Creative Review tool monitors advertisement quality by analyzing audio, metadata, and pacing. The system reduces filler screens and duplicate advertisements, replacing them with experiences that maintain narrative flow within programming.

"In order for a disruptive technology to become a dominant one, it eventually needs to deliver a superior experience," Magnite stated in the announcement. User experience has become a differentiator in the crowded U.S. streaming market.

Linear television advertisers access detailed pod reports showing which brands appeared before and after their advertisements. This visibility level is beginning to emerge in CTV, where measurement capabilities remain underdeveloped. Nearly half of U.S. marketers struggle with transparency and accountability in streaming campaigns, according to Magnite's analysis.

U.S. CTV advertising spending is projected to reach $46.9 billion by 2028, surpassing traditional television advertising at $45.1 billion for the first time. Advertisers demand proof of performance and clearer return on investment as more dollars shift toward streaming platforms.

Pod-level reporting and placement options will become standard capabilities, providing buyers better negotiation leverage and holding platforms more accountable for delivery. Measurement capabilities have expanded across major platformsthroughout 2025, reflecting advertiser requirements for transparency.

The technology safeguards publisher yield while benefiting buyers through cleaner supply paths with reduced waste and stronger competitive separation. For advertisers, this translates into more predictable performance, greater transparency, and placements that reinforce brand value.

Performance marketing has expanded into television environments as measurement capabilities improve. Publishers on programmatic platforms experience revenue uplift from diverse advertiser demand, while buyers access premium inventory through streamlined supply paths.

The announcement occurs as publishers balance monetization requirements with viewer experience demands. Streaming platforms implement various advertising innovations, from pause advertisements to contextual targeting solutions, addressing fragmentation challenges across the CTV landscape.

Attention-based measurement has gained prominence as advertisers seek deeper engagement insights beyond impression delivery. Smart ad podding technology applies these principles to commercial break construction, optimizing both yield and viewer satisfaction.

The machine learning system enables publishers to reduce waste while preparing for a future of transparent, negotiable streaming ad breaks. Publishers who balance monetization with viewer experience will capture sustainable value as spending continues shifting toward streaming platforms.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- October 24, 2025 – Magnite announces machine learning-powered ad podding within SpringServe ad server

- July 16, 2025 – Wunderkind launches programmatic CTV pause advertising with QR code integration

- August 11, 2025 – PubMatic reports CTV revenue growth exceeding 50% year-over-year

- August 20, 2025 – Kargo CTV campaigns achieve 78% higher attention than industry standards

- September 25, 2025 – Teads CTV HomeScreen ads achieve 48% attention rate

- October 1, 2025 – Gracenote highlights contextual targeting gap in CTV advertising

- October 13, 2025 – PubMatic and MNTN partnership delivers 10% publisher revenue lift

- October 23, 2025 – Teads launches deterministic CTV measurement for streaming campaigns

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Magnite announced advanced ad podding technology through its SpringServe ad server platform, targeting CTV publishers and programmatic advertisers.

What: Machine learning-powered ad pod construction optimizes commercial breaks by reducing redundant bid requests, maintaining competitive separation, and improving viewer experience. The technology supports OpenRTB 2.6 specification and includes Creative Review capabilities for quality monitoring.

When: The announcement occurred on October 24, 2025, as U.S. CTV advertising spending approaches $46.9 billion projected for 2028.

Where: The technology operates within SpringServe's ad server platform, serving publishers and advertisers across the programmatic CTV ecosystem where three-fourths of all connected television transactions occur.

Why: Publishers require tools that protect yield without degrading viewer experience, while advertisers demand efficient delivery, competitive separation, and transparency. Traditional "spray and pray" approaches inflate infrastructure costs and frustrate buyers, creating inefficiencies that machine learning addresses. The technology matters for the marketing community as CTV budget allocation doubles and measurement capabilities become critical competitive differentiators in streaming advertising.