Magnite hits growth targets as CTV thrives

First quarter 2025 financial results show 15% growth in CTV, as company capitalizes on streaming boom and awaits benefits from Google antitrust remedy.

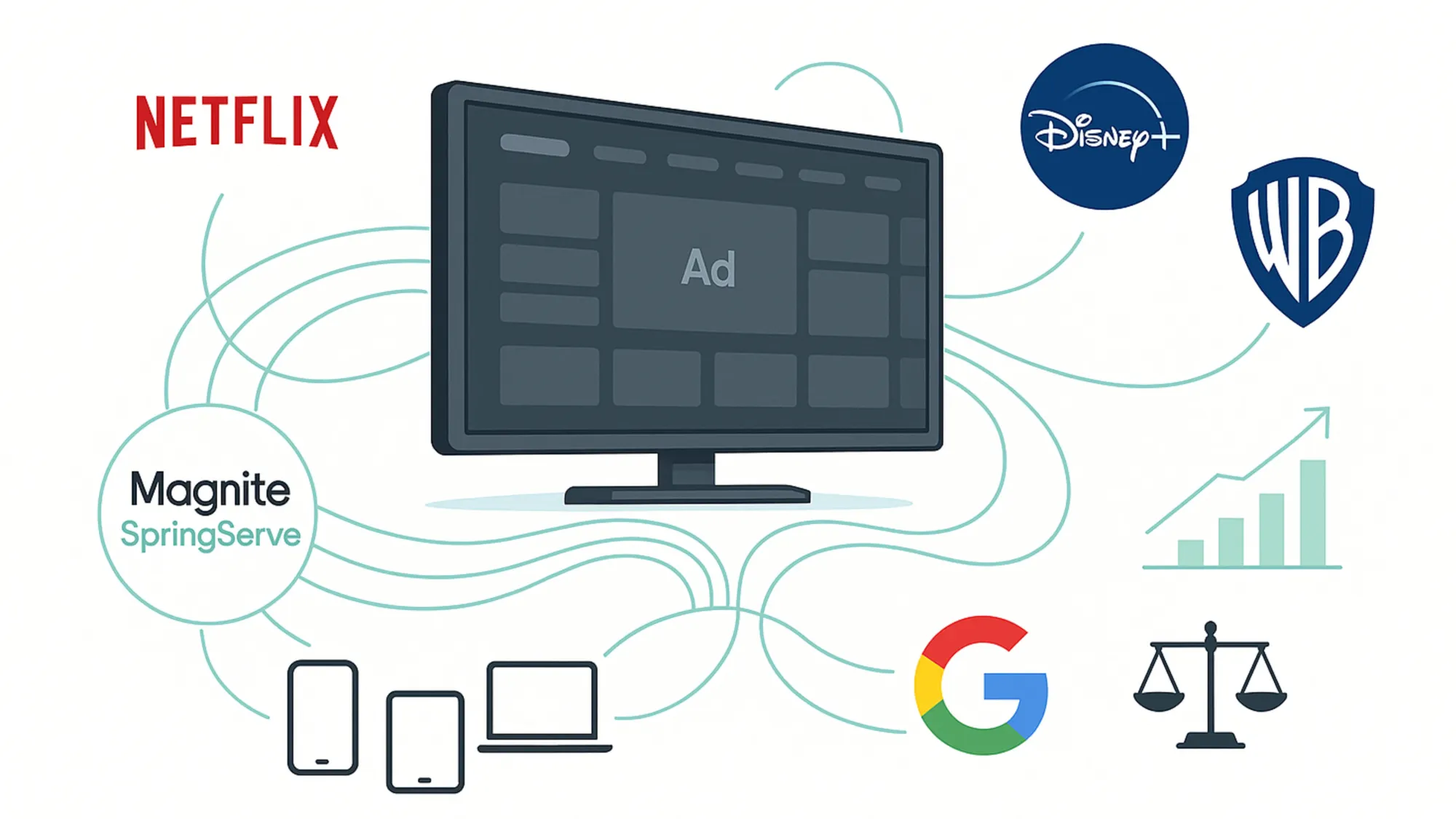

Magnite announced strong Q1 2025 financial results on May 7, with Connected TV (CTV) revenue growing 15% year-over-year and overall contribution ex-TAC increasing 12% to $145.8 million. The largest independent sell-side advertising platform delivered significant growth despite economic uncertainty, outperforming expectations while positioning itself to benefit from landmark antitrust developments against Google.

The company reported CTV growth of 15% for Q1 2025, modestly beating targets and ahead of the company's 13% target, while showing some moderation from the 23% growth seen in Q4. CTV revenue reached $63.2 million, slightly ahead of the targeted $61-63 million range.

Display and video revenue grew 9% versus 1% in Q4, exceeding the 6% target with improvement noted across 10 of the top 11 verticals, including food and beverage, retail, and financial services. Display trends in April and early May appear to be pacing slightly slower, up about 5%.

The company completed a second successful term loan repricing during the first quarter, reducing its interest rate by an additional 75 basis points to Term SOFR plus 3.00%, resulting in annual interest savings of approximately $2.7 million. In total, Magnite has been able to lower its original term loan rate by 200 basis points.

For the second quarter of 2025, Magnite expects contribution ex-TAC to be between $154 million and $160 million, with CTV contribution ex-TAC between $70 million and $72 million, and DV+ (Display and Video) contribution between $84 million and $88 million.

CTV Growth Drivers

The company's most significant growth came from major streaming platforms including Roku, LG, Warner Bros. Discovery, Fox, Vizio, Walmart, and Netflix. Netflix continues to roll out its programmatic business globally, most recently in EMEA, with further expansion expected throughout the rest of the year. Magnite remains a critical part of Netflix's programmatic ad stack.

On April 23, Magnite unveiled the next generation of SpringServe, a unified solution that combines their ad server with advanced Magnite Streaming SSP capabilities. Set for general availability in July, this platform creates a more efficient path to premium streaming inventory for buyers while offering publishers streamlined workflows and smarter yield optimization.

Agency marketplaces powered by Magnite's ClearLine product have been a strong focal point for agencies, with GroupM, Horizon, and Dentsu aggressively working on differentiated marketplaces with Magnite's help.

Live sports continues to be an important growth driver, with nearly 20 partners using Magnite's live stream acceleration technology. NCAA basketball contributed significantly to Q1 growth. Looking ahead, the company is excited about major upcoming events across MLB, NBA, WNBA, NHL playoffs, and college sports. Magnite has also expanded its international sports portfolio to include opportunities with FIFA Plus, Champions League, and Liga MX.

These factors in CTV have led to further stabilization of Magnite's business mix and corresponding take rate, making CTV less sensitive to macro volatility for several reasons. Programmatic CTV offers TV advertising that is more targetable and measurable, providing better accountability that advertisers seek during economically uncertain times. Additionally, programmatic TV doesn't require upfront guarantees, giving marketers the flexibility to adjust spending quarter by quarter rather than committing beyond the current period as required with linear TV.

Google Antitrust Case: Potential Game Changer

On April 17, 2025, the United States District Court for the Eastern District of Virginia ruled that Google had engaged in illegal monopolistic practices with respect to its ad server and ad exchange (SSP). The court found that for years Google has been engaging in illegal practices that resulted in an unfair auction within its ad server, which disproportionately drove volume through its SSP at the expense of rival SSPs like Magnite.

The court has scheduled the remedy phase for September 22, 2025, and has indicated that there will be attention to both behavioral and structural remedies. Although the specific timing and nature of remedies are still being debated, Magnite is highly encouraged by the Court's initial ruling on liability.

Magnite executives believe the ruling could potentially change the entire landscape of the open internet and drive significant upside for the company's DV+ business. A more level playing field could result in a more fair and transparent process and drive greater returns for publishers and advertisers.

Magnite estimates that Google's exchange currently controls greater than 60% share in the DV+ market, while Magnite is the second largest player with market share only in the mid-single-digits. Given Magnite's leading technology and deep publisher relationships, the company believes it is exceptionally well-positioned to capture market share that may shift as a result of Google ceasing its illegal practices.

Audio Expansion and AI Integration

In early April, Spotify announced its new Spotify Ad Exchange (SAX) and named Magnite a global partner for its programmatic offering. Magnite's SpringServe will be integrated into SAX to power omnichannel advertising across audio, video, and native display for Spotify subscribers worldwide.

On the efficiency front, Magnite's neural net and machine learning systems play a key role in cost-effectively scaling infrastructure across both data centers and the cloud. These capabilities have contributed to reductions in EBITDA operating expenses, helping buyers achieve better outcomes on the platform.

On the product side, Magnite is building generative AI into its portfolio. Its AI-powered audience discovery feature in the curator product is now live and gaining traction. The company is also investing in using Large Language Models (LLMs) to make its supply under management more addressable, particularly in CTV, with enhancements expected to roll out over coming quarters.

Economic Outlook

While Q1 came in very strong with both CTV and DV+ exceeding expectations, Magnite's outlook notes some risks despite stable performance in April. The company has widened typical guidance ranges for Q2 due to tariff-driven economic uncertainty. Although not currently seeing lower than expected ad spend, Magnite has assumed some softening in the back half of Q2 related to higher risk verticals such as auto, retail, and travel.

Given this uncertainty, Magnite is not reaffirming its previously shared full-year 2025 expectations. However, the company noted that if current trends were to continue, they would not change their Q2 forecast and full-year 2025 views shared in late February.

Timeline

- April 17, 2025: US District Court rules Google engaged in illegal monopolistic practices in ad tech

- Early April 2025: Spotify announces SAX with Magnite as global partner

- April 23, 2025: Magnite unveils next generation SpringServe platform

- May 7, 2025: Magnite announces Q1 2025 financial results

- July 2025: New SpringServe platform general availability expected

- September 22, 2025: Google antitrust remedy phase scheduled