Google reveals internal plans for AdX shutdown during federal antitrust trial

Google executive testifies about Project Monday plans to shut down AdX entirely, contradicting earlier testimony that divestiture was impossible in ongoing Virginia antitrust remedies trial.

The U.S. Department of Justice's antitrust remedies trial against Google took a dramatic turn on September 25, 2025, when internal company documents revealed that Google had previously evaluated shutting down its entire AdX advertising exchange. According to courtroom testimony from Tim Craycroft, Google's VP in charge of display products, the company conducted multiple feasibility studies for the exact remedies now being demanded by federal prosecutors.

The revelation directly contradicted testimony from software expert Professor John Weissman, who spent six hours explaining why proposed DOJ remedies would be technically impossible to implement. Craycroft's testimony demonstrated that Google has been evaluating divestiture options since 2020, including complete AdX shutdown and transformation of DoubleClick for Publishers (DFP) into a standalone Google Cloud product.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Project Monday contemplated complete AdX elimination

Craycroft testified that Google's 2021 internal analysis, codenamed Project Monday, examined "fully shuttering AdX" and converting DFP into a licensable Google Cloud service. This evaluation followed an earlier 2020 study called Project Sunday that found AdX and DFP spin-outs were feasible. The testimony revealed Google's strategic thinking about voluntarily implementing changes similar to those now mandated by federal courts.

"In this scenario, no source code would be sold, but 'reference code' and technical assistance would be given to a buyer to reproduce AdX on their own infra," according to courtroom reports from The Monopoly Report. The internal analysis estimated a maximum of two years to initiate the business transfer process and up to two years for complete customer migration.

Google's 2024 analysis examined three specific remedies nearly identical to current DOJ proposals: AdX business transfer to another company, open sourcing DFP auction logic, and enabling DFP to bid into Prebid. These internal studies directly addressed technical implementation questions that dominated early trial testimony.

Judge suggests AdX shutdown as elegant solution

U.S. District Judge Leonie Brinkema surprised courtroom observers on September 25 by proposing complete AdX elimination as a potential remedy. "If the decision was to shut down AdX wouldn't publishers get the same demand from AdWords through Prebid instead? Wouldn't that be an elegant solution?" Brinkema asked during Craycroft's testimony.

The judge's suggestion aligns with economic analysis showing that approximately 60% of AdX revenue represents Google Ads demand, with another significant portion coming from DV360. Technical experts testified that creating Prebid adapters for these products could potentially reduce revenue impact to "no more than a couple hundred million."

Expert testimony from Professor Robin Lee revealed that 89% of AdWords display spending flows through AdX, while 63% of DV360's display budget uses Google's exchange. These percentages exclude YouTube spending, which represents three to four times the display advertising volume according to recently disclosed internal data.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Timeline estimates emerge for technical implementation

Software expert Goranka Bjedov, who previously managed complex migrations at Google and Facebook, provided specific timeline estimates for proposed remedies. Her testimony indicated API development for data migration would require 18 months, while open sourcing DFP auction logic would take 24 months. Both AdX and DFP migrations were estimated at 18 and 24 months respectively.

Bjedov's credentials include directing the Instagram migration to Facebook's cloud infrastructure, lending credibility to her technical assessments. Her timeline estimates contrasted sharply with earlier testimony suggesting implementation would be prohibitively complex or impossible.

Michael Racic, President of Prebid.org, testified about his organization's capability to host open-sourced DFP auction logic. The Prebid testimony addressed governance concerns about transferring Google's proprietary advertising technology to industry oversight.

Financial stakes revealed through internal data

Newly released financial data shows Google's advertising technology represents substantial revenue streams vulnerable to divestiture. According to expert analysis, AdX generates approximately $7 billion annually from AdWords alone, based on monthly indirect open web display spending of $600-700 million. DV360's total spending across all inventory types approaches $20 billion annually, with YouTube representing the largest component at over $10 billion.

These figures exclude additional revenue from publisher fees, data licensing, and integrated service offerings. Industry analysis suggests that Google's ad exchange and publisher ad server generated 12% of Alphabet's total revenue in 2024, representing approximately $42 billion in annual business.

The financial impact of forced divestiture extends beyond direct advertising technology revenue. Google's integrated business model leverages advertising data across search, YouTube, and cloud services. Separation of these systems could affect cross-platform optimization capabilities that drive premium pricing.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Negotiation atmosphere emerges despite legal adversity

Craycroft's testimony revealed potential compromise positions on contested remedies. When questioned about specific DOJ proposals, the Google executive indicated flexibility on several technical requirements. He expressed openness to restricting AdWords from bidding directly into DFP and allowing private marketplace deals to bid into Prebid systems.

The Google executive also demonstrated willingness to extend monitoring periods beyond the company's proposed three-year timeframe. "Three years for monitoring conduct was not a magic number for us," Craycroft testified, suggesting negotiating room on compliance oversight duration.

These concessions occurred despite Google's formal opposition to DOJ remedies. The testimony indicated that "we're very open to implementing clarified versions" of behavioral remedies that received criticism in Google's written response.

Technical complexity challenges legal framework

The trial highlighted fundamental differences between legal and engineering approaches to antitrust remedies. Legal experts focused on market structure and competitive harm, while technical witnesses emphasized implementation risks and system dependencies. This disconnect became apparent during cross-examination of Professor Weissman, where attorneys spent hours challenging specific technical assumptions.

Google's legal team successfully demonstrated uncertainty in Professor Weissman's opinions about code dependencies and cloud migration challenges. The aggressive cross-examination showed how technical complexity can be weaponized in legal proceedings, even when broader feasibility remains undisputed.

The contrast between legal and technical perspectives prompted courtroom observers to note that "lawyers are from Mars, engineers are from Venus." This philosophical divide complicates judicial decision-making about remedies requiring both legal authority and technical implementation.

Industry precedent and competitive implications

The Virginia trial occurs as Google faces multiple concurrent antitrust cases targeting different aspects of its integrated business model. A separate Washington D.C. case addresses search monopolization, while European regulators pursue Digital Markets Act enforcement. The convergence of these proceedings creates unprecedented pressure for structural changes.

Digital advertising industry observers anticipate that remedies could fundamentally reshape competitive dynamics. Publishers who have complained about dependence on Google's tools may gain access to alternative technology platforms. Advertisers could benefit from increased transparency in auction processes and reduced take rates across the ecosystem.

The potential emergence of independent AdX and DFP operators could create new competitive dynamics. However, technical experts warned about the substantial operational requirements for running large-scale advertising technology platforms. Questions remain about which companies possess sufficient resources and expertise to acquire divested Google assets.

Monitoring and compliance framework considerations

The trial revealed complex challenges in monitoring compliance with potential behavioral remedies. Technical witnesses discussed the difficulty of auditing algorithmic decision-making in real-time advertising auctions. Proposed solutions include third-party oversight and mandatory API access for competitors and regulators.

Google's integration of advertising technology with broader cloud infrastructure complicates monitoring efforts. Separating AdX operations from Google Cloud Platform, Search, and YouTube could require extensive technical coordination and oversight. The company's global scale adds jurisdictional complexity to any compliance framework.

Expert testimony suggested that structural remedies might be easier to monitor than behavioral restrictions. Complete divestiture eliminates the need for ongoing oversight of business practices, while behavioral remedies require continuous monitoring and enforcement.

Small publishers face uncertain future without Google integration

The proposed remedies raise significant concerns for smaller publishers who lack the technical resources to implement alternative advertising solutions. While much of the trial testimony focused on Prebid integration and header bidding technologies, many small and mid-sized publishers operate without these advanced monetization tools, relying entirely on Google's streamlined ad serving infrastructure.

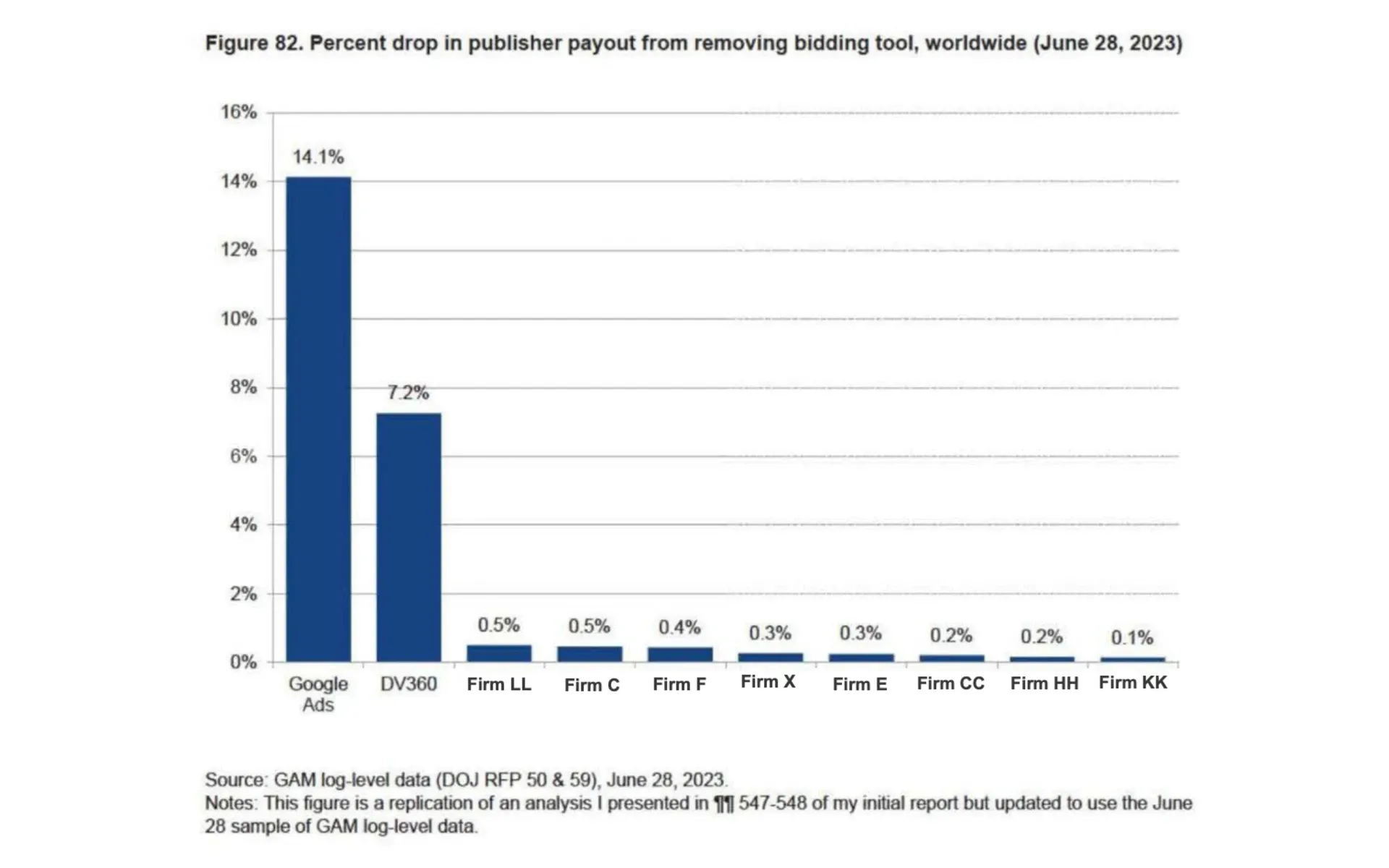

Data presented during the trial revealed that removing Google's bidding tools would cause a 14.1% drop in publisher payouts for Google Ads and a 7.2% decline for DV360 demand. For smaller publishers without sophisticated yield management systems, these revenue impacts could prove devastating to their business models.

The technical complexity of implementing alternative solutions poses particular challenges for publishers with limited engineering resources. Unlike major publishing companies that maintain dedicated ad operations teams, smaller publishers typically depend on Google's automated optimization and simplified integration processes. Forced divestiture could eliminate access to these user-friendly tools without providing comparable alternatives.

Smaller publishers face a "digital divide" in advertising technology adoption. While large publishers have successfully implemented header bidding and diversified their demand sources, smaller sites often lack the traffic volume and technical expertise required for complex programmatic setups. The trial proceedings largely overlooked these implementation barriers for resource-constrained publishers.

The potential elimination of Google's integrated advertising ecosystem could force smaller publishers to choose between investing heavily in technical infrastructure or accepting reduced monetization efficiency. This scenario could accelerate industry consolidation, as smaller independent publishers might become economically unviable without access to Google's simplified advertising tools.

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- 2008: Google acquires DoubleClick for $3.1 billion, establishing advertising technology foundation

- 2020: Project Sunday evaluates AdX and DFP spin-out feasibility

- 2021: Project Monday contemplates AdX shutdown and DFP transformation to Google Cloud product

- January 24, 2023: DOJ files antitrust lawsuit against Google targeting advertising technology practices

- April 17, 2025: Federal court rules Google monopolized digital advertising markets

- May 11, 2025: Remedies phase begins with competing proposals filed

- August 15, 2025: Court documents reveal extensive witness lists and technical exhibits

- September 22, 2025: Remedies trial begins in Virginia federal court

- September 25, 2025: Tim Craycroft testifies about internal Google feasibility studies

- September 26, 2025: Expert witnesses provide implementation timeline estimates

Subscribe PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: U.S. District Judge Leonie Brinkema presides over the remedies trial, with DOJ prosecutors seeking structural changes to Google's advertising technology business. Key witnesses include Google VP Tim Craycroft, software expert Goranka Bjedov, and Prebid.org President Michael Racic.

What: The trial determines appropriate remedies for Google's illegal monopolization of publisher ad server and ad exchange markets. Proposed solutions range from complete AdX divestiture to behavioral restrictions on business practices.

When: The remedies phase began September 22, 2025, following Judge Brinkema's April 17, 2025 liability ruling. Key testimony occurred September 25-26, 2025, revealing internal Google studies dating to 2020-2021.

Where: The U.S. District Court for the Eastern District of Virginia handles the remedies proceedings, while related cases proceed in Washington D.C. and European jurisdictions.

Why: The trial addresses Google's anticompetitive conduct that harmed publishers, advertisers, and consumers through illegal tying arrangements and monopolistic pricing. Remedies aim to restore competitive conditions in digital advertising markets that fund much online content.