Google retains search dominance despite AI advances, Australian regulator finds

ACCC report shows Google's 94% market share persists as generative AI integration brings uncertain impacts on search quality.

The Australian Competition and Consumer Commission (ACCC) released its latest interim report on digital platforms this September, revealing that Google has maintained its dominant position in general search services despite recent technological advancements in artificial intelligence.

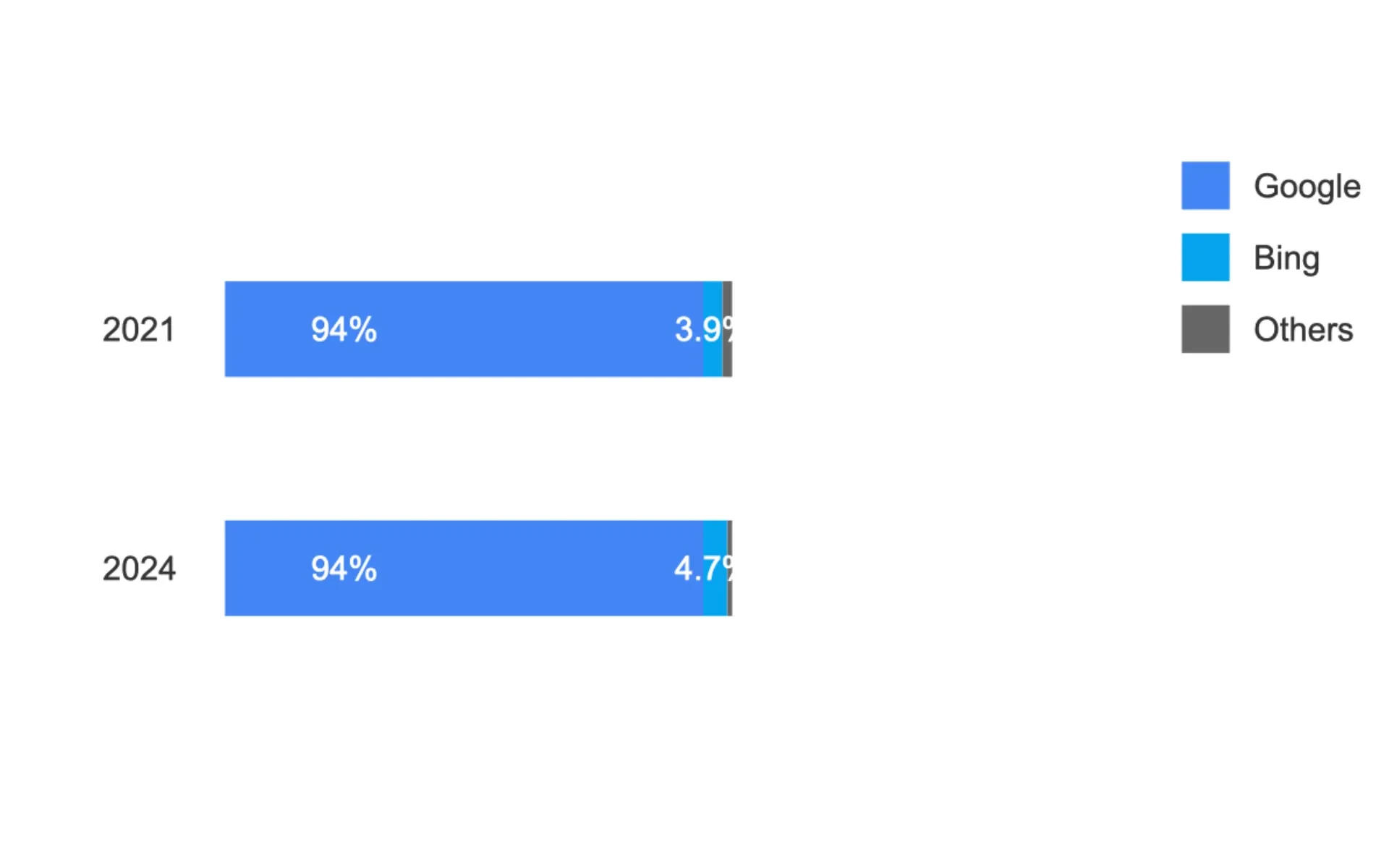

According to the report, Google Search continues to hold a 94% market share in Australia as of August 2024, unchanged from September 2021. Microsoft's Bing follows with a modest increase from 3.9% to 4.7% during the same period, while smaller search engines like DuckDuckGo and Ecosia have seen their already minimal market shares decline.

The ACCC's investigation highlights how Google's position is reinforced through pre-installation and default arrangements. Through vertical integration with its Chrome browser and commercial agreements with Apple's Safari browser, Google Search serves as the default search engine for more than 91% of mobile browsers and 77% of desktop browsers in Australia.

The integration of generative AI into search services emerges as a significant development in the field. However, the ACCC finds that despite speculation about its disruptive potential, generative AI has had limited impact on market structure. Both Google and Microsoft maintain advantageous positions in the AI supply chain through partnerships and investments.

The report details how Google's parent company Alphabet spent approximately USD 12 billion on AI infrastructure in the first quarter of 2024 alone, with similar investment levels expected throughout the year. Microsoft made comparable investments of USD 14 billion in capital expenditures during the same period.

The quality of search results remains a central focus of the investigation. The ACCC identified several factors affecting search quality, including the increasing prominence of advertisements. The report notes that search engines dependent on advertising revenue have modified their interfaces over time to make ads more prominent and less distinguishable from non-sponsored content.

Search engine optimization (SEO) practices also influence result quality. The report finds that at least 80% of websites engage in some form of optimization, which can either enhance or diminish the search experience for users. While optimization may increase the visibility of high-quality websites, it can also enable lower-quality sites to achieve higher rankings.

Regarding personalization, the ACCC's analysis suggests its impact remains limited. While search engines collect user data for various purposes, personalization primarily occurs based on location information, with other forms of customization playing a minimal role in search results.

The integration of generative AI into search services presents new challenges for result quality. The report highlights concerns about the accuracy and reliability of AI-generated content, noting that even advanced AI models exhibit some level of hallucination. According to research cited in the report, no large language models surveyed had a hallucination rate below 1%.

The ACCC emphasizes the uncertain implications of these developments for consumers. While AI-powered search features may offer more efficient ways to find information, they could also affect how users engage with search results and the types of information available to them.

Despite these technological changes, the ACCC concludes that Google's market dominance persists. The commission considers that recommendations made in its previous reports remain relevant for addressing competition and consumer issues in digital platform markets. These include implementing service-specific codes for designated digital platforms and measures to prevent anti-competitive practices.

The report forms part of the ACCC's Digital Platform Services Inquiry, which is scheduled to conclude in March 2025. This latest interim report builds on previous investigations and suggests that recent technological developments have not fundamentally altered the competitive dynamics in the general search market.

The findings align with broader international regulatory developments, including the European Union's Digital Markets Act and ongoing investigations by competition authorities worldwide into the market power of major digital platforms. The ACCC's analysis contributes to the growing body of evidence informing regulatory approaches to digital platform services.