Google Finance expands AI capabilities with Deep Search and prediction markets

Google Finance adds Deep Search, prediction markets from Kalshi and Polymarket, live earnings tracking, and launches in India with English and Hindi support.

Google Finance expands AI capabilities with Deep Search and prediction markets

Description: Google Finance adds Deep Search, prediction markets from Kalshi and Polymarket, live earnings tracking, and launches in India with English and Hindi support.

Google announced significant expansions to its AI-powered Finance platform on November 6, 2025, introducing Deep Search capabilities, prediction markets data integration, and enhanced earnings tracking features. The announcement marks three months after the company began testing the redesigned Finance experience in August 2025.

The new capabilities center on three primary additions to the existing platform. Deep Search employs advanced Gemini models to conduct hundreds of simultaneous searches, reasoning across disparate information sources to produce comprehensive, fully cited responses within minutes. Prediction markets data from Kalshi and Polymarket enables users to query future market events directly from the search interface. A live earnings experience provides real-time audio streams with instant transcripts during corporate earnings calls, supplemented by AI-powered insights that update before, during, and after presentations.

According to Robert Dunnett, Director of Product Management for Search at Google, the enhanced platform aims to help users "make sense of the financial world" through AI-powered research, technical analysis tools, and real-time market monitoring. The company positions these additions as addressing complex financial research needs beyond traditional search functionality.

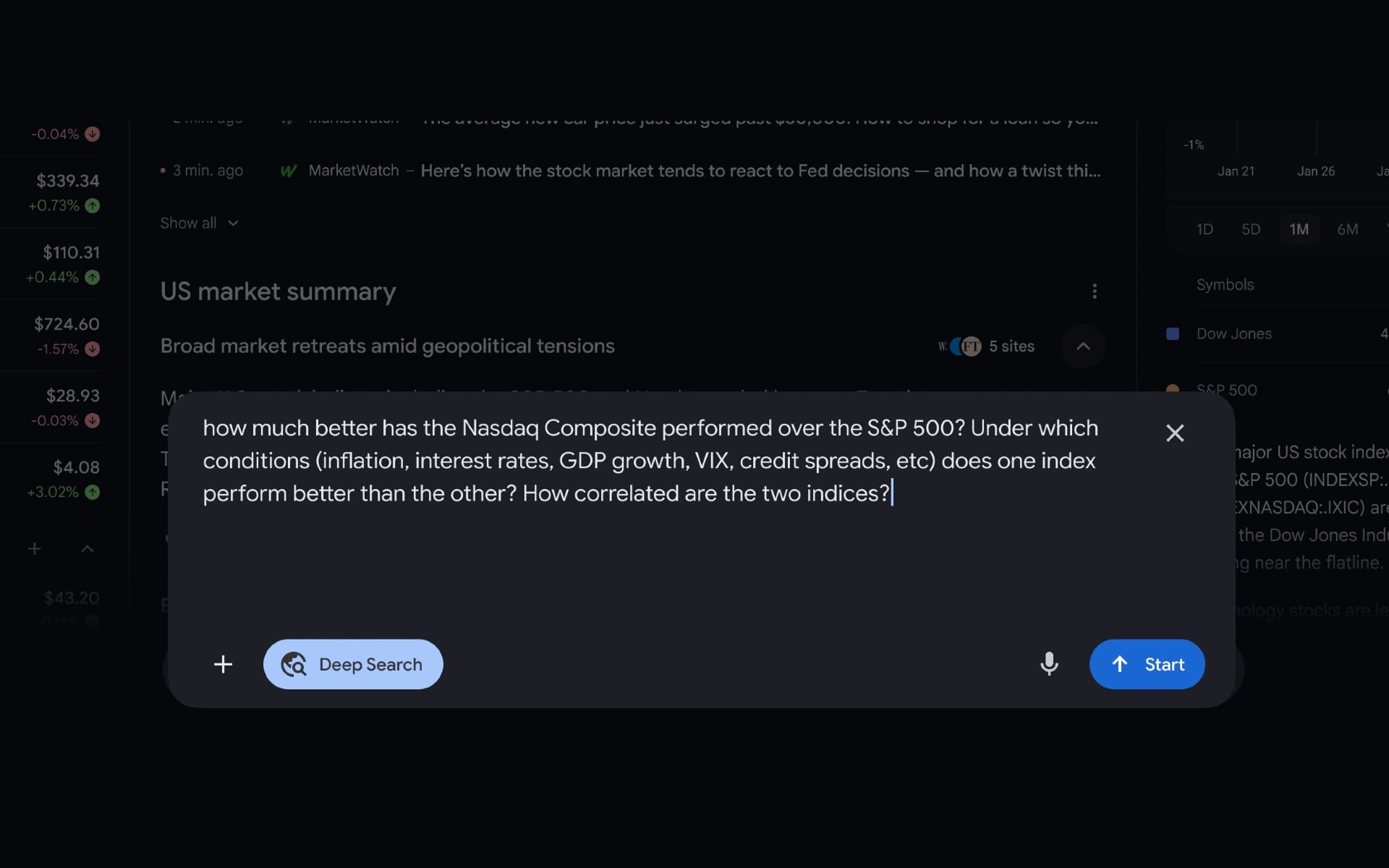

Deep Search targets complex financial analysis

Deep Search represents Google's most sophisticated research capability within the Finance platform. The system processes complex queries by issuing up to hundreds of simultaneous searches and reasoning across disparate pieces of information. Users receive fully cited, comprehensive responses that typically generate within several minutes.

The feature displays a research plan while generating responses, providing transparency into how the system constructs its analysis. Users can ask follow-up questions to expand on initial findings or explore linked websites for additional detail. The functionality targets users requiring thorough analysis for professional work, academic studies, or major financial decisions.

Access to Deep Search operates through a tiered system. Google previously deployed Deep Search capabilities in its broader search platform on July 16, 2025, limiting access to Google AI Pro and AI Ultra subscribers. The Finance implementation follows this subscription model, with higher limits for paid subscribers. Early access requires opting into the Google Finance experiment through Labs, Google's testing framework for experimental features.

The rollout schedule extends over several weeks following the November 6 announcement. Google indicated that availability depends on subscription status and geographic location, with initial deployment targeting United States markets before potential international expansion.

Prediction markets integration introduces crowd wisdom

Google Finance now incorporates prediction markets data from Kalshi and Polymarket, enabling users to query future market events through natural language inputs. Queries like "What will GDP growth be for 2025?" return current probabilities and historical probability changes displayed directly within the interface.

Prediction markets aggregate forecasts from participants who stake money on specific outcomes, creating probability distributions that theoretically reflect collective intelligence about future events. The integration provides Financial professionals with an additional data source for gauging market sentiment around economic indicators, policy decisions, and corporate outcomes.

The prediction markets feature follows the same rollout pattern as Deep Search, beginning with Labs users over the coming weeks. Google has not disclosed specific launch dates for broader availability or international markets. The company's documentation indicates that prediction markets data will appear alongside traditional financial metrics within the existing Finance interface.

The timing coincides with increased mainstream attention to prediction markets during the 2024 election cycle, when platforms including Polymarket and Kalshi gained prominence for displaying election outcome probabilities. Political betting markets drew scrutiny from regulators and academics debating whether such platforms provide accurate forecasting or enable market manipulation.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Earnings tracking delivers real-time corporate information

Google introduced a comprehensive earnings experience on October 30, 2025, one week before the broader Finance announcement. The system provides users with upcoming earnings calendars, live audio streams during calls, real-time transcripts, and AI-powered insights that update throughout each reporting cycle.

Users access earnings information through an "Upcoming earnings" calendar in the center panel or by selecting a ticker from their watchlist. A dedicated Earnings tab displays scheduling information for upcoming calls. During live presentations, users can tune into audio streams with real-time transcripts that remain accessible after calls conclude.

The "At a glance" section delivers AI-powered insights that update at three stages: before the call begins, during the live presentation, and after management concludes remarks. These insights synthesize information from news reports, analyst reactions, and market data to provide snapshots of key developments. Additional features include financial comparisons against historical data, performance evaluations against expectations, related earnings reports, and access to regulatory documents and forms.

The earnings infrastructure builds on Google's broader AI search developments. The company has systematically expanded multimodal AI capabilities across its search products throughout 2025, introducing features that process text, images, video, and audio inputs through unified interfaces.

India launch expands international availability

Google Finance's international expansion begins in India, marking the first deployment outside United States markets. The India launch includes language support for both English and Hindi, addressing the country's multilingual user base. Rollout commenced during the week of November 6, with gradual deployment expected over subsequent days.

The latest capabilities—Deep Search, prediction markets, and earnings tracking—remain limited to United States users during initial deployment. Google indicated intentions to expand these features to additional markets over time without specifying concrete timelines or target countries.

Access requirements remain consistent across markets. Users must visit google.com/finance/beta on mobile or desktop while signed into their Google accounts. The beta designation indicates continued testing status for the redesigned platform, which initially launched for testing on August 8, 2025, before expanding access through Search Labs opt-in on August 27, 2025.

Competitive positioning against established platforms

The enhanced Finance platform positions Google against established financial data providers including Bloomberg Terminal, Reuters Eikon, and FactSet. These professional platforms maintain advantages in specialized datasets, institutional features, and trading integrations that serve institutional investors and financial professionals. Google's strategy emphasizes consumer accessibility and AI integration as alternative value propositions for retail investors and semi-professional users.

The company's AI search infrastructure supports these capabilities through substantial computational investments. Alphabet's Q3 2025 earnings call revealed capital expenditure of $24 billion focused on technical infrastructure, with 60% allocated to servers and 40% to data center and networking equipment. The company processes over 1.3 quadrillion monthly tokens across all surfaces, representing more than 20 times growth year-over-year.

Financial services represent a strategic growth area where technology companies leverage AI capabilities, regulatory compliance expertise, and consumer trust. Anthropic launched Claude for Financial Services on July 15, 2025, targeting banks, insurance companies, asset managers, and fintech organizations with comprehensive data integrations and enterprise security features.

Implications for financial information distribution

The Finance enhancements arrive amid broader questions about how AI systems transform information discovery and attribution. Publisher concerns about traffic declines have intensified as AI Overviews and similar features provide direct answers within search interfaces, potentially reducing clicks to external websites. EU antitrust complaints filed by publishers allege significant traffic declines exceeding 34% when AI Overviews appear in results.

Google's approach to financial information synthesis raises questions about how the company will handle attribution, compensation, and content licensing as AI systems increasingly aggregate information from multiple sources into unified displays. The Deep Search feature promises fully cited responses, suggesting the system will maintain links to source materials. However, the extent to which users click through to original sources remains unclear.

Financial professionals require current, accurate information for investment decisions, regulatory compliance, and risk management. The stakes differ from general search queries where approximate answers may suffice. Research tracking user behavior found that financial and health-related searches demonstrate higher scroll depth and click-through rates compared to entertainment queries, indicating that users validate information more thoroughly for consequential decisions.

Educational implications include potential changes in financial literacy development as AI systems provide instant explanations for complex investment concepts. Traditional learning approaches may shift toward conversational education where users explore topics through questions rather than structured coursework. This accessibility could accelerate financial education adoption among broader populations while raising questions about information quality and potential oversimplification of nuanced concepts.

The Finance platform's technical infrastructure relies on Gemini models that Google has deployed across its product portfolio. The company revealed in July 2025 technical podcasts that Gemini's multimodal capabilities enable applications spanning visual analysis, document processing, and complex reasoning tasks. First-party models now process seven billion tokens per minute through direct API usage by Google's customers.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- August 8, 2025: Google begins testing AI-powered Finance platform with AI research capabilities, advanced charting, and real-time market data

- August 27, 2025: Google Finance expands AI testing access through Search Labs opt-in mechanism for controlled feature distribution

- July 16, 2025: Google introduces Deep Search in AI Mode for Google AI Pro and AI Ultra subscribers

- July 24, 2025: Google Search experts reassure SEO community that traditional methods remain effective as AI tools share similar mechanisms

- July 30, 2025: Google expands AI search with canvas and video features including enhanced research capabilities

- October 29, 2025: Alphabet Q3 earnings reveal AI Mode has 75 million daily active users and drives incremental query growth

- October 30, 2025: Google launches earnings tracking experience in Finance (one week before broader announcement)

- November 6, 2025: Google announces Deep Search, prediction markets, and India expansion for Finance platform

Summary

Who: Google, through its Search product management team led by Director Robert Dunnett, announced enhancements to Google Finance affecting retail investors, financial professionals, and market researchers. Initial deployment targets United States users with paid Google AI subscriptions, while India receives the base Finance platform with language support for English and Hindi speakers.

What: Google Finance received three major capability additions. Deep Search employs advanced Gemini models to conduct hundreds of simultaneous searches for complex financial queries, producing comprehensive cited responses. Prediction markets integration from Kalshi and Polymarket enables users to query future event probabilities. Live earnings tracking provides real-time audio streams, transcripts, and AI-powered insights before, during, and after corporate earnings calls.

When: The announcement occurred on November 6, 2025, at 9:00 AM Pacific Time (12:00 PM Eastern Time). Deep Search and prediction markets will roll out over coming weeks beginning with Labs users. The earnings experience launched on October 30, 2025, one week before the broader announcement. India expansion began during the week of November 6, 2025.

Where: Features deploy initially in United States markets through google.com/finance/beta on mobile and desktop platforms. India represents the first international expansion, with English and Hindi language support. Deep Search, prediction markets, and earnings features remain United States-exclusive during initial rollout, with international expansion planned for future phases.

Why: The enhancements address growing demand for AI-powered financial research tools that synthesize information from multiple sources. Google competes against established financial data providers while leveraging its AI infrastructure investments and search technology capabilities. The company aims to make financial information more accessible to retail investors while monetizing advanced features through subscription tiers. The timing coincides with broader AI search expansion across Google's product portfolio, with AI Mode reaching 75 million daily active users and driving incremental query growth according to Q3 2025 earnings disclosures.