Google faces first private collateral estoppel motion after monopoly ruling

Advertisers file motion demanding Google be prevented from relitigating monopoly findings after Virginia court established liability for anticompetitive conduct.

The first private plaintiff lawsuit seeking collateral estoppel against Google based on the Eastern District of Virginia antitrust decision emerged on June 20, 2025, according to a filing in the Southern District of New York. Advertisers in the multidistrict litigation filed a memorandum demanding Google be barred from relitigating findings already established in the government's successful monopolization case.

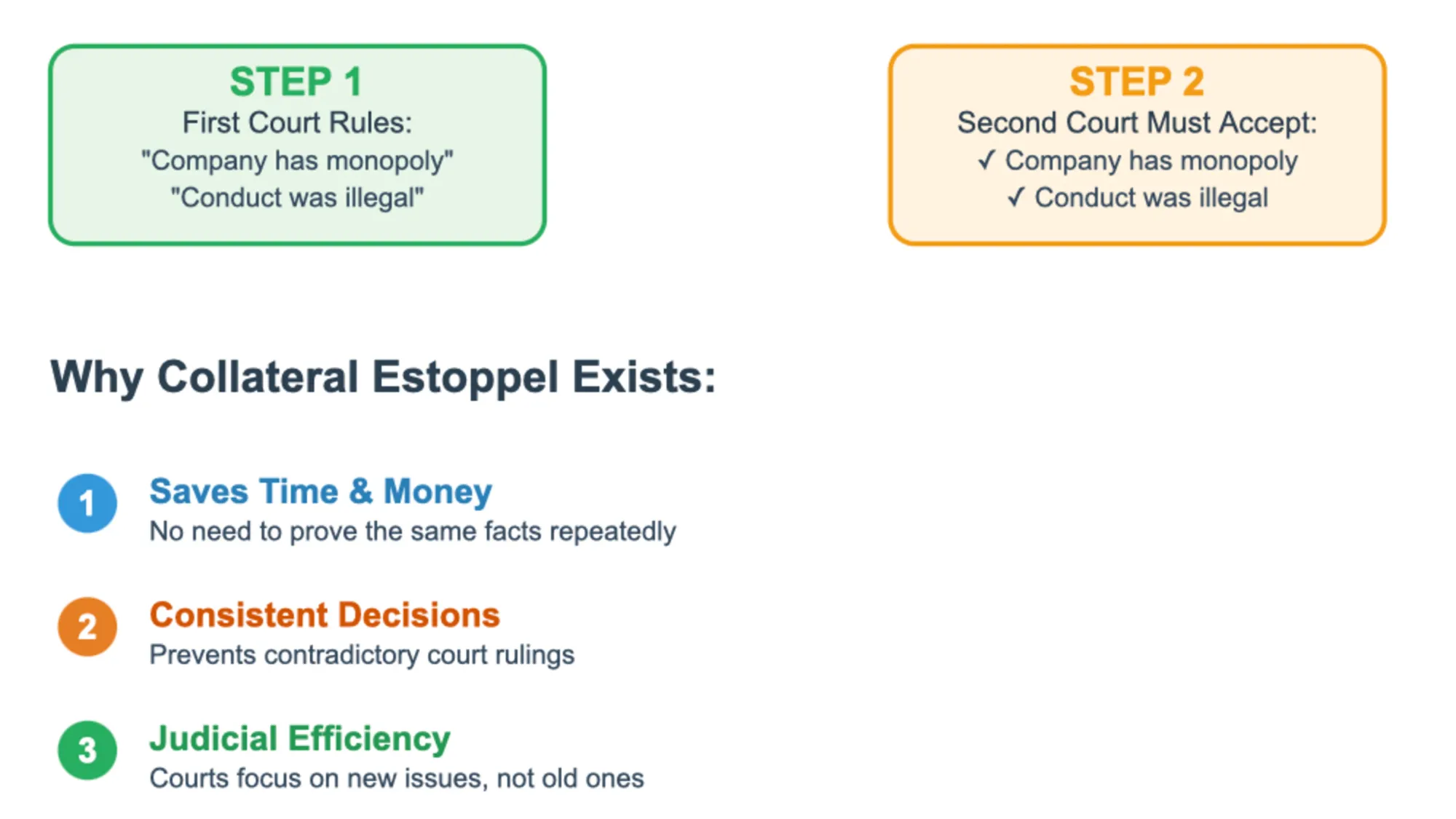

Collateral estoppel is a legal doctrine that prevents parties from relitigating issues already decided in court. Once a court makes a final ruling on a specific factual or legal issue, that same issue cannot be brought up again in future lawsuits involving the same parties. The doctrine promotes judicial efficiency by avoiding repetitive trials, ensures consistent court decisions by preventing contradictory rulings, and protects parties from repeatedly defending the same points in multiple cases. For collateral estoppel to apply, the issue must be identical in both cases, actually litigated and decided previously, with parties having full opportunity to present arguments, and the previous decision must have been necessary for the court's final judgment.

According to Jason Kint, CEO of Digital Content Next, who shared the development on June 21, 2025, "We now have what I believe is first private plaintiff lawsuit v Google making a motion for collateral estoppel based on the strong findings of fact and antitrust decision in EDVA." The 24-page filing represents a significant legal strategy that could accelerate private litigation by eliminating the need to re-establish basic facts about Google's monopolistic conduct.

Summary

Who: Advertiser plaintiffs in the multidistrict litigation In re Google Digital Advertising Antitrust Litigation filed the motion for collateral estoppel against Google. Jason Kint, CEO of Digital Content Next, shared the development.

What: A 24-page memorandum seeking collateral estoppel and partial summary judgment based on Judge Leonie Brinkema's April 17, 2025 findings that Google monopolized digital advertising markets and engaged in anticompetitive conduct through Unified Pricing Rules.

When: The motion was filed on June 20, 2025, in the Southern District of New York, approximately two months after the Eastern District of Virginia ruled against Google in the government's antitrust case.

Where: The filing occurred in the U.S. District Court for the Southern District of New York as part of the multidistrict litigation consolidating private antitrust claims against Google's advertising practices.

Why: Advertiser plaintiffs seek to prevent Google from relitigating identical issues already decided against the company, potentially accelerating private litigation by eliminating the need to re-establish basic facts about Google's monopolistic conduct and anticompetitive behavior.

Get the PPC Land newsletter ✉️ for more like this

The motion filed in the multidistrict litigation case In re Google Digital Advertising Antitrust Litigation seeks to prevent Google from challenging five core findings from Judge Leonie Brinkema's April 17, 2025 ruling. These findings include Google's monopoly power in ad exchanges for open-web display advertising, the relevant antitrust product market definition, and determinations that Unified Pricing Rules constituted anticompetitive conduct under Section 2 of the Sherman Act.

According to the filing, "there can be no serious question that the elements of collateral estoppel are met." The document argues that Judge Brinkema's thorough 115-page opinion after a three-week trial provides sufficient basis for preventing Google from relitigating identical issues in private lawsuits. The court found Google liable for monopolization in the ad tech stack through extensive briefing and presentations from both sides.

Yield: How Google Bought, Built, and Bullied Its Way to Advertising Dominance

A deeply researched insider’s account of Google’s epic two-decade campaign to dominate online advertising by any means necessary.

Specific monopoly findings targeted for estoppel

The advertiser plaintiffs seek collateral estoppel on Google's monopoly power in ad exchanges for open-web display advertising markets. According to the EDVA Opinion cited in the filing, Judge Brinkema found that "Google possesses monopoly power in the ad exchanges for open-web display advertising market." The court detailed how Google charged durable supracompetitive prices for AdX, maintained high market share with AdX having roughly nine times greater share than its next-largest competitor, and remained unwilling to lower AdX's take rate even as competitors reduced prices.

The filing seeks preclusion on multiple subsidiary factual findings supporting the monopoly determination. These include findings that high barriers to entry exist in the ad exchange market, that Google used its market power in supply-side and demand-side platforms to make switching to rival exchanges more difficult, and that Google artificially handicapped its buyside to boost AdX's attractiveness despite knowing advertiser customers would benefit from bidding on non-Google exchanges.

According to the motion, these monopoly power findings are threshold requirements for Section 2 Sherman Act liability. The document states that "the existence of monopoly power is a threshold requirement to a finding of liability under Section 2 of the Sherman Act," making these determinations essential to any private antitrust claims against Google.

Product market definition already established

The advertisers also seek estoppel on the relevant product market definition, arguing that Judge Brinkema conclusively determined that "ad exchanges for open-web display advertising constitute a distinct relevant product market." The Virginia court conducted extensive analysis rejecting Google's arguments that all ad tech tools belong in a single market or that the display ad tech ecosystem constitutes a single, two-sided market.

According to the filing, the EDVA Opinion found that "advertiser buying tools, ad exchanges, and publisher ad servers each serve distinct functions, are priced differently, and cannot be substituted for each other." The court also determined that the relevant product market does not include products facilitating instream video, mobile app, or social media advertising, and that display advertising on closed networks differs from open-web display advertising.

The motion emphasizes that these market definition findings were extensively litigated by the Department of Justice and Google, with both sides presenting detailed evidence and arguments. According to the document, "the identification of a relevant product market is a necessary prerequisite to a finding of monopoly power (and thus Section 2 liability)," making the EDVA Opinion's market definition conclusions necessary to Google's liability determination.

Unified Pricing Rules deemed anticompetitive

Central to the collateral estoppel motion are findings about Google's Unified Pricing Rules (UPR), which the Virginia court determined constituted anticompetitive conduct under Section 2. According to the filing, Judge Brinkema held that UPR was "an exclusionary and anticompetitive act to maintain Google's monopoly power in violation of Section 2 of the Sherman Act."

The EDVA Opinion found that UPR limited Google's rivals' ability to compete in the ad exchange market and harmed competition by depriving publishers of choices they had previously exercised to promote competition. According to the court's findings cited in the motion, UPR "increased the number of impressions AdX won and the revenue it received, while decreasing impressions won and revenue received by third-party exchanges."

The filing details how UPR restricted Google's customers' ability to deal with rivals, thereby reducing rivals' scale and limiting their competitive ability. According to the motion, "the overall result of Unified Pricing Rules was that Google's ad tech products continued to gain scale in the display advertising space while rival ad tech products lost scale."

Google's defenses already rejected

The advertiser plaintiffs seek estoppel on Google's failed procompetitive justifications for UPR, which Judge Brinkema rejected after considering extensive record evidence. According to the filing, Google offered justifications including that UPR established a level playing field for advertisers, simplified the bidding process for publishers, improved matches, and increased publisher revenue.

The EDVA Opinion found that "Google implemented Unified Pricing Rules to enhance the AdX-DFP tie, and not for its proffered justifications of helping its publisher customers simplify their decision-making, receive better matches, and increase revenue." The court also rejected Google's argument that product design choices shield conduct from antitrust liability, finding that Google's actions constituted anticompetitive conduct rather than legitimate product improvements.

According to the motion, the Virginia court determined that the refusal to deal doctrine does not apply to UPR, rejecting another primary defense Google raised. The filing states that Judge Brinkema found "the refusal to deal doctrine articulated in Trinko does not protect Google from antitrust liability in this civil action."

Legal precedent supports collateral estoppel application

The filing cites multiple cases where courts granted collateral estoppel based on prior antitrust findings, including Discover Financial Services v. Visa USA Inc., where a court applied estoppel to findings that defendants had market power and engaged in unlawful restraints of trade. According to the document, courts have consistently applied estoppel to monopoly power determinations, relevant market definitions, and findings of anticompetitive conduct.

The motion emphasizes that all elements for non-mutual offensive collateral estoppel are satisfied: identical issues in both proceedings, actual litigation and decision in the prior proceeding, full and fair opportunity for litigation, and necessity to support valid final judgment on the merits. According to the filing, "Google vigorously contested each issue on which Advertisers seek collateral estoppel" in the EDVA Action.

The document argues that applying collateral estoppel would not be unfair to Google, noting that the company took "full advantage of every opportunity to litigate these issues" and had "every incentive to do so." The motion states that Google repeatedly acknowledged similarities between the EDVA action and claims in the multidistrict litigation.

Implications for digital advertising industry

This development represents a critical juncture for Google's defense strategy across multiple antitrust challenges. The company faces the prospect of being unable to challenge core liability findings in numerous private lawsuits, potentially accelerating damages phases and settlement discussions across pending litigation.

For the digital advertising industry, successful collateral estoppel could establish binding precedent about market structure and competitive dynamics. Publishers, advertisers, and ad tech companies would operate under legally established findings about Google's monopoly power and anticompetitive conduct, potentially influencing business relationships and market strategies.

The motion comes as Google faces remedial proceedings in the original Virginia case, where the Department of Justice seeks structural remedies including divestiture of key ad tech properties. Private remedies in this litigation could include monetary damages and injunctive relief addressing Google's monopolistic practices.

According to industry observers, the timing of this motion reflects strategic coordination among private plaintiffs to maximize leverage from the government's successful prosecution. The collateral estoppel approach could eliminate years of duplicative litigation while preserving resources for damages determinations and remedy implementation.

Response considerations and next steps

Google's response to the collateral estoppel motion will likely focus on distinguishing the private claims from government allegations and arguing that different legal standards apply to private litigation. The company may also challenge whether specific findings were necessary to the EDVA Opinion's ultimate conclusions or whether procedural differences justify relitigating issues.

The Southern District of New York court must determine whether to grant partial summary judgment based on the Virginia findings. This decision could set precedent for similar motions across other pending Google antitrust litigation, including cases involving search, app store practices, and other advertising technologies.

Industry experts suggest that successful collateral estoppel applications could encourage more private antitrust litigation against dominant technology platforms. The strategy demonstrates how government enforcement actions can provide foundations for private remedies, potentially increasing the total legal consequences for anticompetitive conduct.

Timeline

- 2008: Google acquires DoubleClick for $3.1 billion, obtaining dominant publisher ad server and nascent ad exchange

- 2011: Google acquires Admeld, yield management tool helping publishers decide which ad networks to use

- 2014-2015: Header bidding emerges as publishers seek to mitigate Google's advantages in ad tech stack

- 2019: Google implements Unified Pricing Rules, restricting publishers' ability to set higher price floors for AdX

- January 2023: Federal government and eight states file antitrust lawsuit against Google

- April 17, 2025: Eastern District of Virginia rules Google illegally monopolized digital advertising markets

- April 21, 2025: Industry analysis examines potential remedies following monopoly ruling

- May 11, 2025: Remedies phase begins with government seeking breakup of Google's ad tech business

- June 20, 2025: First private plaintiff motion for collateral estoppel filed in Southern District of New York