Google AI Overviews reduce organic CTR 61%, paid traffic 68%

Organic click-through rates for informational queries featuring Google AI Overviews dropped 61% since mid-2024, according to new research from Seer Interactive.

Organic click-through rates for informational queries featuring Google AI Overviews fell 61% since mid-2024, while paid CTRs on those same queries plunged 68%, according to research published November 4, 2025, by marketing agency Seer Interactive. The study analyzed 3,119 informational queries across 42 organizations, spanning 25.1 million organic impressions and 1.1 million paid impressions from June 2024 to September 2025.

According to the research, organic CTRs for AI Overviews queries dropped from 1.76% to 0.61%. Paid CTRs fell from 19.7% to 6.34%. Even queries without AI Overviews experienced significant declines, with organic CTRs falling 41% year-over-year to 1.62%.

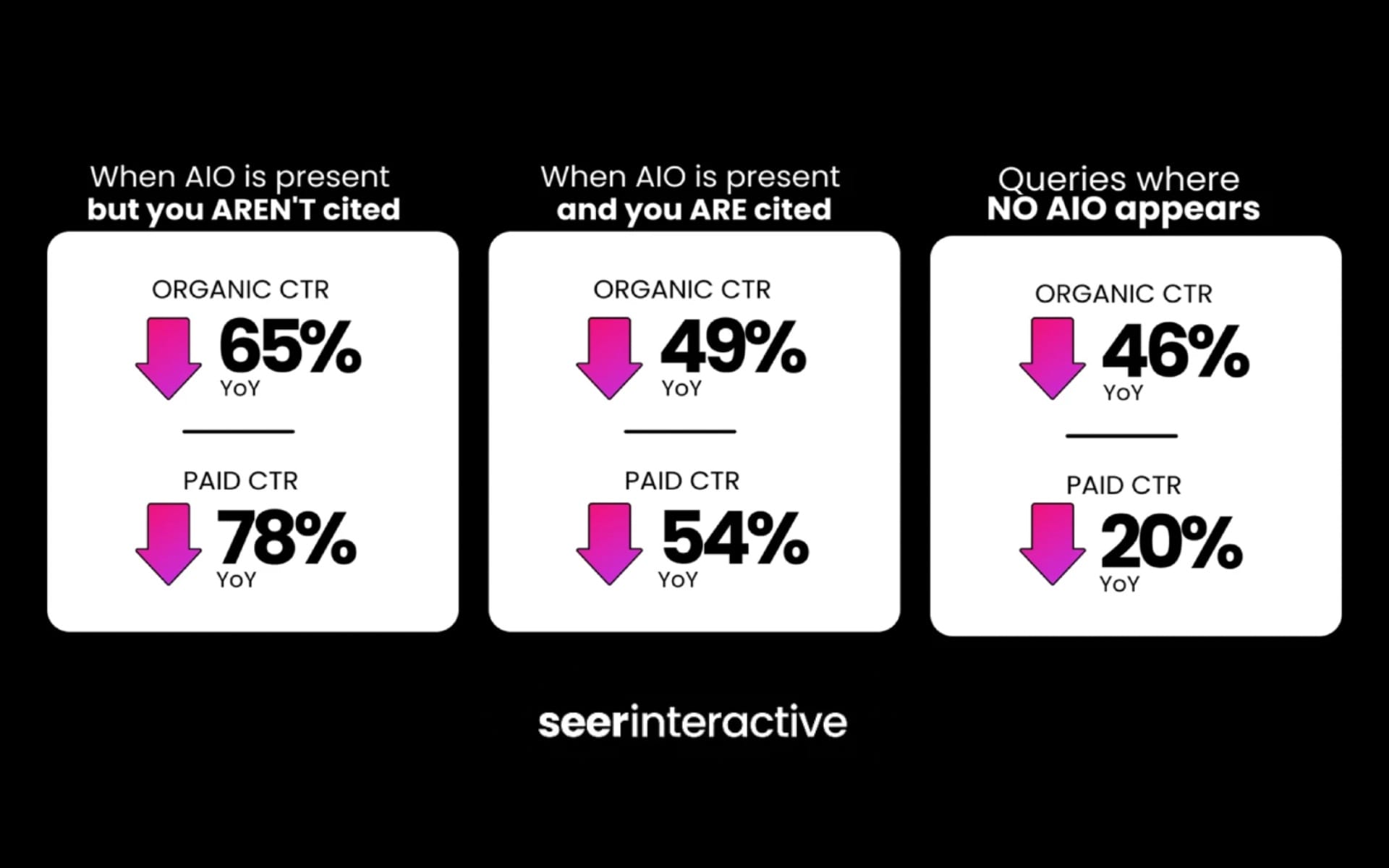

The findings confirm the hypothesis that AI Overviews significantly affect click-through rates for both organic and paid search, with impact varying based on query type and whether brands receive AI citation. Brands cited in AI Overviews earned 35% more organic clicks and 91% more paid clicks compared to those not cited, though researchers acknowledged they cannot definitively prove citation causes higher CTRs.

Paid search sees catastrophic July decline

The paid CTR trajectory revealed a particularly alarming pattern for advertisers running campaigns on informational keywords where AI Overviews appear. According to the study, paid CTR experienced dramatic month-over-month decreases, with rates plunging from approximately 11% to 3% in a single month during July 2025. While there has been slight recovery to 6.34% by September, paid CTR remains down 68% from the June 2024 baseline.

This July drop raises questions about potential SERP layout changes that may have pushed advertisements further down on queries dominated by AI Overviews. The pattern suggests users have learned that advertisements on informational queries rarely provide the educational content they seek.

Tracy McDonald, who authored the Seer Interactive study, observed that the paid impression sample of 1.1 million is significantly smaller than the organic sample of 25.1 million. This reflects the reality that informational queries have lower commercial intent, and some clients do not run paid campaigns on these query types, representing a limitation for the paid analysis.

Non-AIO queries declining faster than expected

The research challenged earlier assumptions about queries without AI Overviews serving as safe harbors for traffic. According to McDonald's January 2025 analysis, organic CTR for non-AIO queries appeared to be increasing, suggesting "untapped opportunities" for marketers. The extended data reveals a different pattern.

The full trajectory for non-AIO queries shows June 2024 CTR at 2.72%, a peak in February 2025 at 3.14%, and a September 2025 decline to 1.62%, representing an overall 41% decrease. While these queries briefly showed growth through early 2025, they have since declined dramatically. They still outperform AIO queries by 166%, but the trend suggests broader forces affecting search behavior beyond just AI Overviews.

McDonald noted this indicates users are likely seeking answers in other platforms before turning to Google, including ChatGPT, Perplexity, social platforms, or going directly to trusted brands. Even when AI Overviews do not dominate search results, traditional organic results struggle to maintain historical click-through rates for informational queries.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Historical CTR patterns reveal pre-existing gaps

The research revealed that queries currently triggering AI Overviews in September 2025 have consistently shown lower CTRs than non-AIO queries throughout the entire 15-month tracking period. According to the data, the June 2024 baseline showed queries without AI Overviews at 2.74% organic CTR, while queries with AI Overviews started at 1.76%, a gap of 1.18 percentage points.

By September 2025, queries without AI Overviews declined to 1.62% while those with AI Overviews fell to 0.61%, maintaining a gap of 1.01 percentage points. This pattern suggests AI Overviews are not randomly appearing on high-performing queries and subsequently destroying their CTR. Instead, they consistently surface on query types that were already generating fewer clicks, most likely informational searches where users historically found answers without clicking.

The pattern resembles what the industry observed years ago with featured snippets, where certain query types naturally generated lower click volumes regardless of SERP features. McDonald's methodology categorized queries based on September 2025 AIO presence, comparing the 15-month CTR trajectory of queries that eventually showed AI Overviews versus those that did not. This represents a retrospective cohort analysis rather than a month-by-month correlation study.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Citation advantage becomes more pronounced

When brands are cited in AI Overviews, organic CTR reaches 0.70% compared to 0.52% for non-cited queries in Q3 2025, representing a 35% advantage. The paid CTR gap is even more substantial, with cited brands achieving 7.89% compared to 4.14% for non-cited brands, a 91% increase.

According to the study, year-over-year organic CTR declined 49.4% for cited queries compared to 65.2% for non-cited queries. Paid CTR year-over-year declines were more uniform, with both cited and non-cited queries dropping approximately 33.3%. The citation advantage persists even as overall CTR expectations deteriorate across the board.

McDonald emphasized an important caveat about causation. "We cannot definitively prove that citation causes higher CTRs," the study noted. "It's equally possible that brands with stronger authority and higher baseline CTRs are simply more likely to be cited by Google's AI." The consistent outperformance of cited queries could reflect underlying brand authority and EEAT signals rather than having direct causal relationships.

One possible explanation suggests that AIO presence, paid CTR, and organic CTR may all reflect underlying brand authority and EEAT signals rather than having direct causal relationships. Brands that rank well, get cited in AI Overviews, and earn high CTRs may share common characteristics that Google's algorithms recognize.

Implications for marketing strategy

The research indicates that traditional KPIs focused on clicks and traffic require fundamental reassessment. Success metrics are shifting from clicks and traffic to visibility and share of voice, a transition that multiple industry analysts have advocated throughout 2025. Earlier research in January 2025 documented similar patterns, showing organic click-through rates for queries featuring AI Overviews dropped from 1.41% to 0.64% year-over-year.

McDonald recommended that VP and CMO-level marketing leaders treat AIO citations as a competitive moat, noting that the CTR boost and authority signals of AIO citation represent one of the few remaining ways to maintain competitive separation in search. The study questioned whether paying for informational queries still provides value at 6.34% CTR for AIO queries in September 2025, down from 19.70% in June 2024.

For search consultants and content marketers, the data shows no signs of CTR recovery, with both AIO and non-AIO queries in sustained decline. The study recommended building 2026 strategy around the assumption that CTRs for high-funnel queries will be 20-30% lower than current levels, assuming the 6-month decline rate continues through 2026 with 30% deceleration as floor effects emerge.

The research suggested using budget from AIO-laden queries to test other advertising platforms and focusing on lower-funnel searches on Google. While organic CTR for non-AIO queries has declined 41% year-over-year, they still outperform AIO queries by 166%, making them a relative safe haven for maintaining share of voice rather than pursuing growth.

Industry context and publisher concerns

The decline in click-through rates occurs amid broader tensions between Google's artificial intelligence ambitions and the economic foundation of web publishing. Publishers have reported significant drops in organic traffic since AI Overviews launched, with some educational sites experiencing decreases of 40% or more.

Google maintains that AI features help users discover more web content and that clicks from summaries demonstrate higher quality, with greater time spent on destination sites. According to Google statements from July 2025 earnings calls, AI Overview reaches 1.5 billion monthly users, with 10% increases in searches in markets like the United States and India.

However, research from Ahrefs published in April 2025 found that when AI Overviews appear in search results, the first organic link loses an average of 34.5% of clicks. Pew Research Center data from July 2025 documented that users clicked on traditional search results 47% less frequently when AI summaries appear.

Google Discover has overtaken traditional search as the dominant traffic source for news and media websites, accounting for two-thirds of Google referrals according to August 2025 research. Traditional Google Search traffic dropped from approximately 16% to 10% of total referrals during the period when AI Overviews rolled out to more than 100 countries.

Data methodology and limitations

Seer Interactive analyzed 3,119 search terms across 42 client organizations from June 2024 through September 2025. Keywords from the original January 2025 analysis were excluded if they dropped out of top 20 rankings, lacked organic or paid data for every month in the period, or were no longer clients. Data sources included Google Search Console for organic performance, Google Ads for paid performance, SeerSignals for September 2025 AIO presence, and ZipTie for historical AIO presence.

Queries were categorized based on September 2025 AIO presence, meaning the analysis compared the 15-month CTR trajectory of queries that eventually showed AI Overviews versus those that did not. The study did not claim AI Overviews were present for all 15 months. According to the methodology, all CTR percentages represent monthly averages across the query set, with individual query CTRs varying significantly. Standard deviations ranged from 0.8-1.2 percentage points for organic and 3-5 percentage points for paid, meaning results for specific queries or industries may differ from aggregate findings.

The paid impression sample of 1.1 million is significantly smaller than organic impressions of 25.1 million because informational queries have lower commercial intent and some clients do not run paid campaigns on these query types. This represents a limitation for the paid analysis, with findings directionally consistent but having wider confidence intervals than organic results.

What Seer is watching for 2026

McDonald outlined several predictions for tracking through early 2026. The study anticipates paid CTRs on information queries will not improve, questioning whether the paid CTR drop represents a permanent structural change in SERP layouts or a temporary anomaly that will course-correct. The research projects CTRs will continue to decline as much as 0.5% by January 2026, watching whether 0.6% represents a floor for organic CTR on AIO queries or whether declines continue.

The study expects AI Overviews will spread to commercial and transactional queries, raising questions about how CTR performance differs for other search intents. The dataset focused on informational queries, but as AI Overviews spread to commercial and transactional searches, similar CTR impacts may emerge. McDonald predicted AIO presence for informational queries will increase, with searches that did not show an AI Overview in January or September 2025 displaying them by January 2026.

The research anticipates non-AIO query CTRs will continue to decline due to fundamental shifts in user behavior that extend beyond just AI Overviews. The 41% decline suggests broader forces at work as users change how and where they ask questions, both within Google and across language models. McDonald stated the team will check back on this data in Q1 2026 to see whether any of these trends persist.

According to the conclusion, based on 15 months of consistent decline across nearly every metric, the outlook for rebound appears pessimistic. The search landscape has fundamentally changed from 18 months ago, with no indication that waiting for stabilization represents a viable strategy for marketing professionals.

Timeline

- June 2024: Baseline data shows organic CTR at 1.76% for AIO queries and 2.72% for non-AIO queries

- July 2024: Google announces AI Overviews reaching 1.5 billion monthly users with 10% query growth

- October 2024: Traditional Google Search traffic begins sharp decline from 16% to 10% of total referrals

- January 2025: Seer Interactive publishes initial CTR analysis showing 54.6% organic decline for AIO queries

- February 2025: Non-AIO queries peak at 3.14% CTR before subsequent decline

- March 2025: Google expands AI Overviews and introduces experimental AI Mode

- April 2025: Ahrefs research documents 34.5% reduction in clicks when AI Overviews appear

- May 2025: Research shows users only read top third of AI Overviews with 30% median scroll depth

- June 2025: Google acknowledges "great decoupling" of impressions from clicks at Warsaw conference

- July 2025: Paid CTR for AIO queries crashes to 3.26% before slight recovery; Pew Research documents 47% reduction in clicks

- August 2025: Google Discover overtakes traditional search, accounting for 66% of news referrals

- September 2025: CTRs stabilize at historic lows with organic at 0.61% for AIO queries and 1.62% for non-AIO queries

- October 2025: Google expands AI Mode to over 40 countries and territories

- November 4, 2025: Seer Interactive releases updated study documenting 61% organic CTR decline for AIO queries

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Seer Interactive, a marketing agency, analyzed search performance across 42 client organizations. Tracy McDonald authored the research examining how Google AI Overviews affect brands, publishers, and advertisers dependent on search traffic.

What: Organic click-through rates for informational queries featuring Google AI Overviews fell 61% from 1.76% to 0.61% between June 2024 and September 2025. Paid CTRs plunged 68% from 19.7% to 6.34% during the same period. Even queries without AI Overviews experienced 41% organic CTR declines. Brands cited in AI Overviews earned 35% more organic clicks and 91% more paid clicks compared to non-cited brands.

When: The study tracked performance from June 2024 through September 2025, with results published November 4, 2025. The analysis revealed a particularly dramatic paid CTR collapse in July 2025, when rates plummeted from 11% to 3% before partially recovering to 6.34% by September.

Where: The research analyzed 3,119 informational queries generating 25.1 million organic impressions and 1.1 million paid impressions across Google search results. The findings apply to markets where Google has deployed AI Overviews, which now reach 1.5 billion monthly users globally.

Why: The findings matter for marketing professionals because they document fundamental shifts in search behavior that render traditional traffic-focused KPIs increasingly ineffective. Success metrics are evolving from clicks and traffic toward visibility and share of voice. Advertisers running campaigns on informational keywords where AI Overviews appear now capture a fraction of the clicks they received 15 months ago, requiring fundamental reassessment of paid search strategy and budget allocation. The research suggests users are changing how and where they ask questions, with implications extending beyond Google to include ChatGPT, Perplexity, social platforms, and direct brand engagement.