Google Ads metrics show rising costs across industries in 2024

New data reveals significant cost increases in Google Ads, with 86% of industries seeing higher click costs in 2024 compared to 2023.

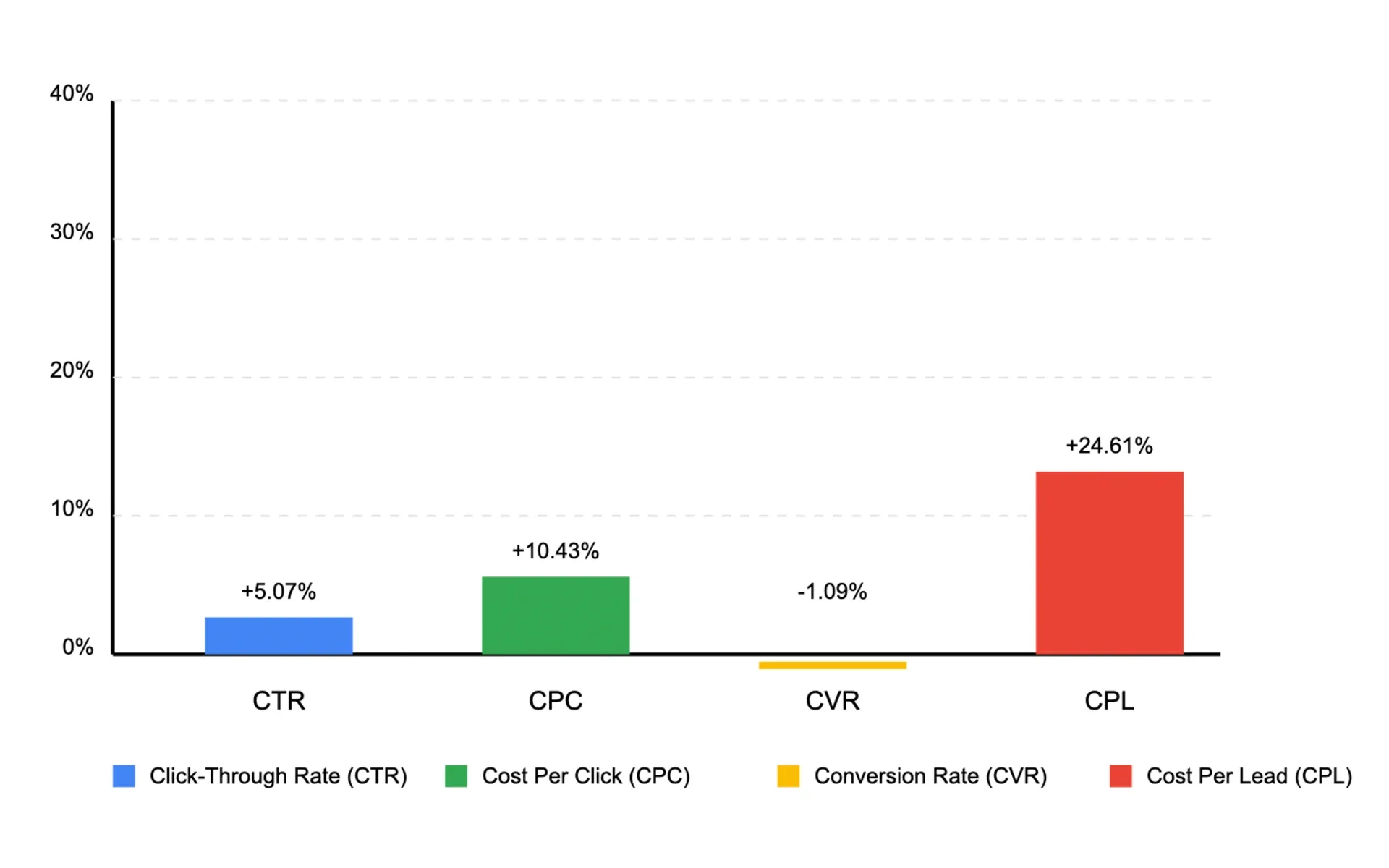

A comprehensive analysis of over 17,000 advertising campaigns reveals significant increases in Google Ads costs across most industries in 2024, with cost per click rising by an average of 10% compared to 2023. According to data from LocaliQ, released on June 10, 2024, 86% of industries experienced cost increases, with some sectors seeing rises of over 25%.

The analysis, examining campaigns run between April 2023 and March 2024, shows the average cost per click reaching $4.66, up from $4.22 in the previous year. Legal services maintain the highest costs at $8.94 per click, followed by home improvement at $6.96 and dental services at $6.82.

The data emerges seven months after evidence presented in the U.S. Department of Justice antitrust trial against Google indicated the company's ability to influence advertising costs. According to trial documents, Google demonstrated consistent increases in advertising costs over recent years.

According to Alessandro Colarossi, Partner Data Transformation Lead at Google, "The rise in CPC across most industries aligns with the ongoing economic challenges like inflation." The most significant cost increases affected real estate (35.48%), sports and recreation (32.20%), and personal services (26.92%).

Beyond cost increases, the analysis revealed varied performance across key metrics. The average click-through rate improved to 6.42% in 2024, up from 6.11% in 2023, with 70% of industries showing increases. Arts and entertainment leads with a 13.04% click-through rate, followed by travel at 10.16%.

Mark Irvine, Vice President of Search at SearchLab, noted structural changes in ad presentation: "Since the advent of Responsive Search Ads, Google has shifted away from ads reading as a fixed three-headline format to something more flexible and agile for different screens."

Conversion rates showed a slight decline, with the average dropping to 6.96% from 7.04% in the previous year. Twelve out of 23 industries experienced decreases, with finance and insurance seeing the largest decline at 32.40%. However, some sectors showed significant improvements, with apparel and fashion recording a 112.01% increase in conversion rates.

Cost per lead, a critical metric for advertisers, increased for 19 out of 23 industries. The average rose to $66.69, marking a $13.17 increase from the previous year's $53.52. Legal services recorded the highest cost per lead at $144.03, while automotive repair services showed the lowest at $27.94.

The implementation of Google's Search Generative Experience (SGE) and Gemini has influenced advertising performance. According to industry experts, these changes affect how ads appear and perform in search results.

Goran Mirkovic, CMO at Freemius, attributes the cost increases to multiple factors: "The noticeable jump in CPC prices could be due to the lingering effects of inflation. Like almost everything else, advertising costs have gone up for businesses."

The impending deprecation of third-party cookies has elevated the importance of first-party data collection and organization. Katia Hausman, Vice President of Ad Products at LocaliQ, emphasized the need for comprehensive tracking: "These benchmarks emphasize the necessity for a data-driven approach to target the appropriate audience and optimize campaigns for conversions across all touchpoints."

Economic conditions have particularly affected certain sectors. Real estate and financial services showed distinct patterns in response to high interest rates. While financial advertisers experienced reduced competitiveness in their offers, real estate maintained stronger click-through rates despite market challenges.

The analysis revealed that arts and entertainment achieved the lowest cost per click at $1.72, while attorneys and legal services recorded the highest at $8.94. Industries with the highest conversion rates included automotive repair services at 12.96% and animal-related businesses at 12.03%.

Looking ahead, experts suggest that advertisers focus on comprehensive conversion tracking and leverage durable tactics to future-proof their advertising approach. The data indicates that while some metrics may show improvement, others could continue to fluctuate as search engines evolve their platforms and economic conditions influence market dynamics.

The research methodology encompassed analysis of U.S.-based search advertising campaigns, with 80-85% of spend allocated to Google Ads and 15-20% to Microsoft Ads. Each industry subcategory included a minimum of 70 unique active campaigns, with median figures used to account for outliers.