Gannett reports third quarter results, announces Microsoft AI licensing deal

Gannett posts $560.8 million Q3 revenue, reveals Microsoft AI content marketplace partnership, and achieves debt milestone below $1 billion.

Gannett Co., Inc. reported total revenues of $560.8 million for the third quarter ended September 30, 2025, representing an 8.4% year-over-year decrease, while simultaneously announcing a new artificial intelligence licensing agreement with Microsoft and achieving a significant debt reduction milestone.

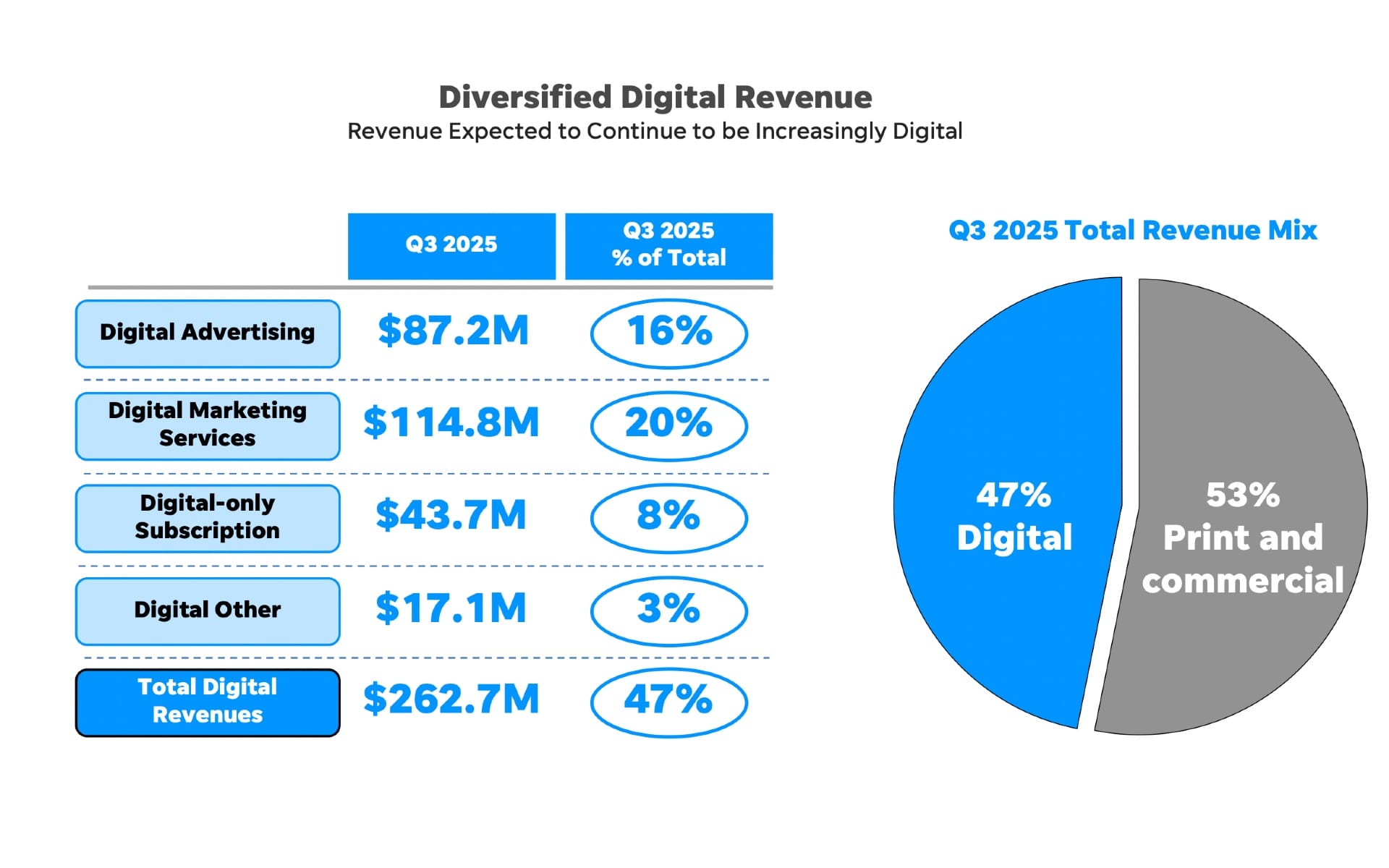

The media company disclosed on October 30, 2025, that total digital revenues reached $262.7 million, accounting for 46.9% of total revenues. This marks an increase from 45.4% in the second quarter, with the company expecting to approach 50% digital revenue composition by year-end. "With some digital revenue shifted from the third quarter to the fourth quarter, new AI licensing launching in the quarter, and our $100 million cost program in place, we expect strong digital revenue growth in the fourth quarter, accompanied by significant Adjusted EBITDA and free cash flow growth," stated Michael Reed, Gannett Chairman and CEO.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Microsoft publisher content marketplace partnership

The company announced its participation in Microsoft's upcoming Publisher Content Marketplace launch. "We are also very excited to announce this morning our newest AI licensing agreement, partnering with Microsoft on their upcoming launch of its Publisher Content Marketplace," Reed said in the earnings announcement.

During the earnings call, Kristin Roberts, President of Gannett Media, explained the significance of the partnership. "Microsoft is focused on building a scalable and equitable solution, one that is going to ensure that publishers are fairly compensated for the value that they're delivering through their content offerings, their premium content offerings," Roberts stated. She noted that Microsoft is piloting this marketplace with a select group of U.S. publishing partners "to learn and to shape the tools and the policies and the pricing models really that are going to define this era."

The licensing deal structure varies across partners. "Some of them include direct licensing fees, others include revenues sharing components," Roberts explained. The marketplace aims to establish fair compensation mechanisms as AI-driven search increasingly affects traditional publisher traffic patterns. Industry analysis indicates AI-driven search summaries reduce publisher traffic by 20-60% on average, creating pressure for alternative monetization approaches.

Financial performance and operational adjustments

The third quarter produced Total Adjusted EBITDA of $57.2 million, representing a 10.2% margin. Management attributed the quarter's performance to approximately $7.0 million of digital revenue shifting to the fourth quarter of 2025, alongside unplanned expenses tied to the company's $100 million cost reduction program implementation.

Cash provided by operating activities reached $15.2 million, while free cash flow totaled $4.9 million. The company recorded a net loss attributable to Gannett of $39.2 million for the quarter. "During the third quarter we continued to make solid progress across several key digital operating priorities while, simultaneously, completing the implementation of our $100 million cost reduction program," Reed stated.

Digital advertising revenues of $87.2 million represented 2.9% year-over-year growth, marking the second consecutive quarter of growth in this segment. The company attracted 187 million average monthly unique visitors in the third quarter, with approximately 128 million from the U.S. media network and 59 million from U.K. digital properties.

Digital-only subscription revenues totaled $43.7 million, showing sequential improvement from the second quarter's $42.7 million. Digital-only average revenue per user reached $8.80, establishing a new record and reflecting 8% year-over-year growth. "While it will take a few more quarters to return to volume growth, these wins show that our intentional actions are working," Reed noted during the earnings call.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

Balance sheet strengthening and debt reduction

The company achieved total debt falling below $1.0 billion during the third quarter, marking the first time since the November 2019 merger. Total principal debt outstanding at September 30, 2025, stood at $996.4 million, including $748.6 million in first lien debt. Cash and cash equivalents totaled $75.2 million, with expectations to reach approximately $100.0 million by year end.

Gannett repaid $18.5 million of debt during the quarter through quarterly amortization and asset sales. First lien net leverage improved to 2.69x. Chief Financial Officer Trisha Gosser noted the company expects to repay over $135 million in debt during 2025, bringing year-to-date debt paydown to $116.4 million as of September 30.

"With interest rates declining and lower debt balances, Trisha just mentioned, we expect that to lower our interest costs quite a bit in 2026, and that will be a big contributor to our free cash flow growth next year, which that free cash flow growth will allow us to continue to pay down debt above and beyond what our normal amortization is," Reed stated during the call.

Legal developments in Google litigation

The company received favorable legal developments in its lawsuit against Google. Federal Judge Paul Castell issued a partial summary judgment ruling on October 28, 2025, in the Southern District of New York. "The partial summary judgment ruling earlier this week in our lawsuit against Google is also a promising milestone. The decision represents an important step forward, as it establishes liability on several claims," Reed stated in the earnings release.

The ruling prevents Google from relitigating issues already determined in the Department of Justice's Virginia case, where Judge Leonie Brinkema found Google illegally monopolized digital advertising markets. The decision established that Google maintained over 90% market share in publisher ad servers from 2018 to 2022 through anticompetitive practices.

"Judge Castell said Google basically -- said Google can't relitigate the issues in our case. That was a big win for us," Reed explained during the earnings call. "It means the court has already established liability on key aspects of our claims. And the case really now focuses on damages and remedies for these claims." Reed indicated the ruling "has the potential to move the case forward more quickly now, allowing us really to concentrate on demonstrating the harm caused and the remedies we're seeking."

Digital Marketing Solutions segment performance

The Digital Marketing Solutions segment generated core platform revenues of $114.0 million during the quarter, with core platform average revenue per user reaching $2,828, reflecting 2% year-over-year growth. Average customer count stood at 13,400, showing improved year-over-year trends.

Segment Adjusted EBITDA totaled $9.8 million, representing an 8.5% margin. "We continue to see encouraging stabilization across our key metrics with year-over-year trend improvement on our core platform, which includes revenue and average customer count, while ARPU remained near all-time highs," Reed stated. Customer budget retention reached 96.0% in the third quarter.

The company implemented strategic adjustments to optimize platform economics. "For those who sit outside of that, so you heard us talk about really large customers that are multi-location. There are tools on the market today that allow us to do that more quickly, get those campaigns up and running with more speed and to manage many, many different locations at scale," Gosser explained during the analyst call. This approach allows the company to serve broader advertiser categories while concentrating development investment on the core platform's ideal customer profile.

Content protection and AI bot blocking

The company disclosed aggressive measures to protect content from unauthorized AI scraping. "Today, we are blocking over 99% of AI verified bots other than Google that try to scrape our content without licensing agreements in place," Reed stated. "In September alone, we blocked 75 million AI bots across our local and USA TODAY platforms, the vast majority of which were seeking to scrape our local content and about 70 million of those came from OpenAI."

The blocking strategy reveals significant demand for Gannett's local news content from AI systems. "This is a clear signal of just how valuable our content is to these AI engines, especially our local content, which we are uniquely positioned to deliver at scale," Reed noted. Specifically, 69.9 million of the OpenAI bot attempts targeted local content rather than national properties.

Current technical limitations prevent publishers from distinguishing between Google's traditional search indexing and AI-related content use. "We can't block because we still need that search traffic from the blue links, even though they don't distinguish and let us authorize content for the blue links only and not for AI, which is the problem I mentioned in the ecosystem," Reed explained. Publisher advocacy efforts have focused on establishing technical standards that would enable more granular control over content usage.

Audience growth and product initiatives

The company launched PLAY, a unified digital hub for casual entertainment and gaming, consolidating horoscopes, comics, and puzzles into one destination. Roberts highlighted the revenue potential: "Nearly 1/3 of our readers already play games online, but only a small share are currently doing so on PLAY. That means every incremental gain and engagement has an outsized impact. For instance, if we can get 1 more percent of our audience to play games at our current play ARPU rates, that equates to an additional $10 million annually in digital-only subscription and digital advertising revenue."

The company also launched DeeperDive, described as an "industry-first Gen AI answer engine" that brings conversational AI capabilities directly onto USA TODAY's platform. "Since launching in mid-September, readers have asked more than 3 million questions with average daily activity well over 50,000 interactions," Reed reported.

Sports coverage expansion included launching comprehensive hubs for the Big Ten, SEC, and NFL featuring vertical video and real-time statistics. "Early results show that time spent within these hubs is double compared to traditional browsing on our platforms, along with higher engagement levels," Roberts stated.

Segment performance across properties

The Domestic Gannett Media segment generated revenues of $417.1 million with Segment Adjusted EBITDA of $35.4 million, representing an 8.5% margin. This compared to $468.5 million in revenues and $46.3 million in Segment Adjusted EBITDA during the same quarter of 2024.

Newsquest, the company's U.K. operations, reported revenues of $61.0 million with Segment Adjusted EBITDA of $14.6 million, representing a 23.9% margin. Revenue trends posted a second consecutive quarter of growth, increasing 2.5% year-over-year, while Segment Adjusted EBITDA grew 4.6%.

The Digital Marketing Solutions segment recorded revenues of $114.4 million with Segment Adjusted EBITDA of $9.8 million. Operating costs for the segment totaled $84.3 million, while selling, general and administrative expenses reached $20.3 million.

Revenue composition and trends

Same store revenues decreased 6.8% year-over-year, factoring out the Austin American-Statesman sale, currency impacts, and exited operations. Total digital revenues declined 4.1% on a same store basis, though management projects growth returning in the fourth quarter.

Digital advertising revenues reached $87.2 million, digital marketing services contributed $114.8 million, digital-only subscription revenues totaled $43.7 million, and digital other revenues accounted for $17.1 million. Print advertising revenues decreased to $112.5 million from $123.9 million in the prior year quarter, while print circulation revenues declined to $138.5 million from $157.3 million.

Updated business outlook

The company updated its full year 2025 outlook on October 30. Total digital revenues are expected to decline in the low single digits on a same store basis for the full year, though fourth quarter total digital revenues are projected to grow in the low single digits on a same store basis. Total revenues are expected to decline in the low-mid single digits on a same store basis for 2025, leading to flat same store revenue trends in early 2026.

Net income attributable to Gannett is expected to improve compared to the prior year. Total Adjusted EBITDA is projected to grow versus the prior year, marking what would be the third consecutive year of full year adjusted EBITDA growth. Cash provided by operating activities is expected to grow in excess of 30% versus the prior year, while free cash flow is expected to grow in excess of 30% versus the prior year, though capital expenditures are projected to increase as a result of investments in technology and products.

Industry context and significance for marketers

The earnings report arrives as publishers navigate fundamental shifts in digital traffic patterns and monetization strategies. Multiple major publishers have filed antitrust lawsuits following the Virginia court's finding that Google monopolized digital advertising markets.

Gannett's experience illustrates broader industry challenges. The company's ability to maintain digital advertising growth despite traffic shifts demonstrates the value of scale and direct audience relationships. The 187 million average monthly unique visitors provides bargaining power in licensing negotiations and advertising sales that smaller publishers lack.

The Microsoft partnership represents an emerging business model where AI platforms compensate publishers for content access rather than driving traffic through traditional links. Industry standardization efforts by organizations like IAB Tech Lab aim to establish technical protocols for content monetization as AI reshapes information discovery.

For marketers, Gannett's performance indicates that quality content environments continue attracting audiences even as discovery mechanisms evolve. The company's sports hubs, games offerings, and specialty verticals create high-engagement environments that may offset traffic losses from AI-driven search. Digital advertising revenue growth suggests marketers still value direct publisher relationships and contextual ad placements alongside emerging AI-powered channels.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- October 28, 2025: Federal judge grants partial summary judgment in Gannett's lawsuit against Google, establishing liability on antitrust claims

- October 30, 2025: Gannett announces Q3 2025 financial results showing $560.8 million in total revenues and reveals Microsoft AI licensing deal

- September 30, 2025: Quarter ends with total debt falling below $1.0 billion for first time since 2019 merger

- September 12, 2025: Penske Media files antitrust lawsuit against Google over AI content practices and search monopoly

- September 8, 2025: PubMatic files comprehensive antitrust lawsuit against Google seeking damages

- August 29, 2025: Dotdash Meredith sues Google for antitrust violations in digital advertising

- August 20, 2025: IAB Tech Lab launches Content Monetization Protocols working group for AI

- August 5, 2025: Book exposing Google's advertising monopoly released documenting internal manipulation schemes

- August 4, 2025: OpenX files follow-on antitrust lawsuit against Google's ad tech monopoly

- April 17, 2025: Eastern District of Virginia rules Google illegally monopolized digital advertising markets

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Gannett Co., Inc., a diversified media company operating USA TODAY Network and local news organizations across the United States, along with Newsquest properties in the United Kingdom, serving 187 million average monthly unique visitors. The company announced a partnership with Microsoft while reporting financial results that included executives Michael Reed (Chairman and CEO), Trisha Gosser (CFO), and Kristin Roberts (President of Gannett Media).

What: The company reported third quarter 2025 revenues of $560.8 million (down 8.4% year-over-year), with total digital revenues reaching $262.7 million (46.9% of total). Major announcements included a new AI licensing agreement with Microsoft's Publisher Content Marketplace, achievement of total debt falling below $1.0 billion, and a favorable partial summary judgment ruling in the company's antitrust lawsuit against Google that establishes liability on several claims.

When: Financial results cover the quarter ended September 30, 2025, announced on October 30, 2025. The partial summary judgment in the Google lawsuit was issued on October 28, 2025. The Microsoft AI licensing deal timing coincides with Microsoft's upcoming Publisher Content Marketplace launch. The company completed implementation of its $100 million cost reduction program during the third quarter.

Where: Operations span the United States through the USA TODAY Network and local media properties, plus United Kingdom operations through wholly-owned subsidiary Newsquest. The Southern District of New York issued the favorable Google lawsuit ruling. Corporate headquarters are in New York, NY. Digital audience reach includes approximately 128 million average monthly unique visitors from the U.S. media network and 59 million from U.K. properties.

Why: This matters to the marketing community because Gannett's results illustrate how major publishers are navigating the transition from traffic-driven business models to licensing-based AI partnerships. The Microsoft deal represents an emerging revenue stream as AI-driven search reduces traditional website traffic by 20-60% according to industry data. The favorable Google antitrust ruling opens the path for publishers to recover damages from anticompetitive practices that harmed digital advertising markets. Digital advertising revenue growth despite traffic challenges demonstrates the continued value of quality publisher environments for marketers. The company's approach to content protection (blocking 75 million AI bots in September) and strategic AI partnerships provides a roadmap for how publishers are establishing content value in an AI-transformed information ecosystem.