FTX debtors sue marketing executive for millions in clawback lawsuit

The bankruptcy estate claims Neil Patel and his companies received over $30 million for duplicative and substandard marketing services during the cryptocurrency exchange's final months.

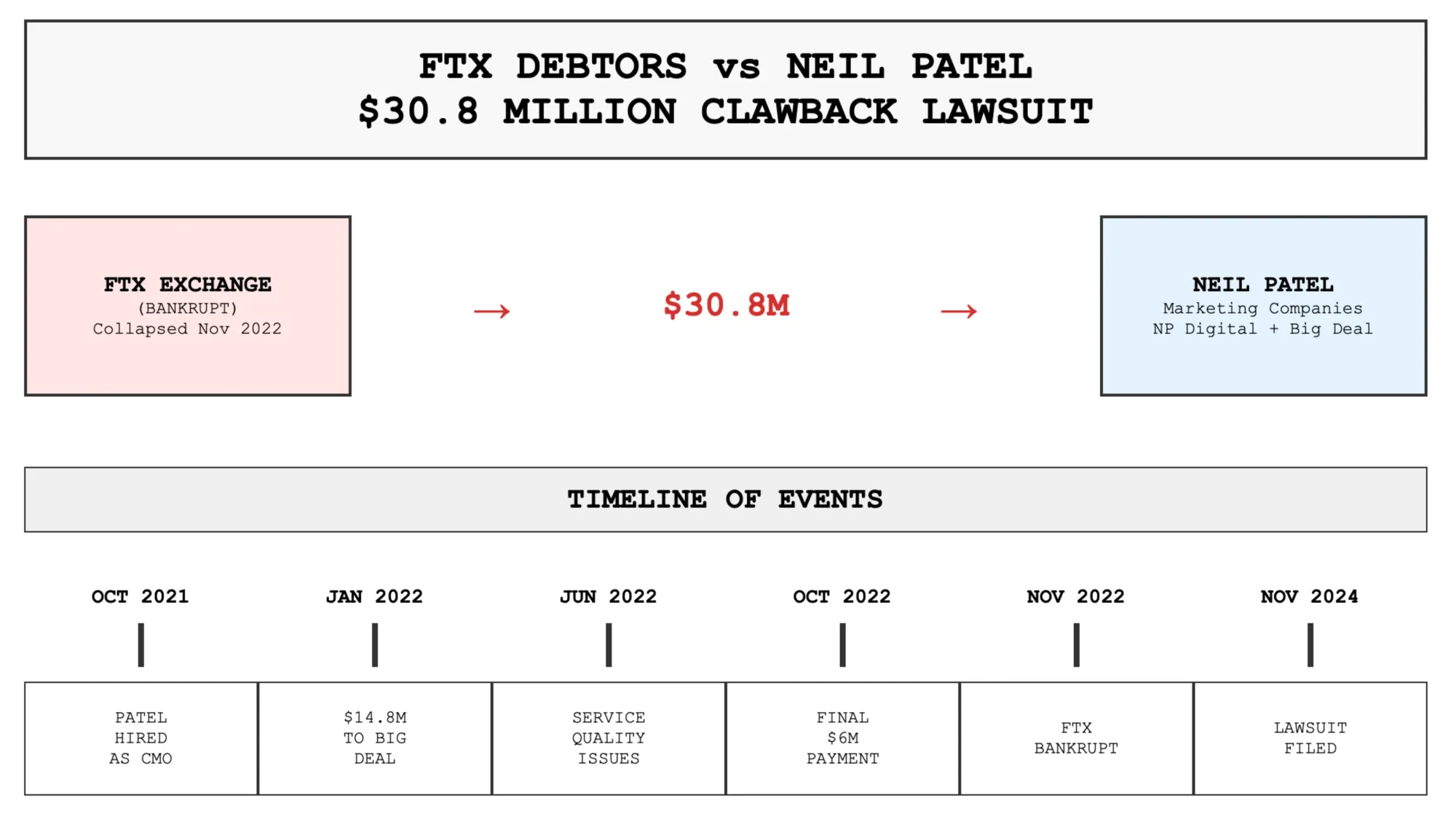

The bankrupt FTX cryptocurrency exchange has filed a federal lawsuit against prominent digital marketing figure Neil Patel and his associated companies, seeking to recover more than $30 million in payments made during the final year before the platform's November 2022 collapse.

Get the PPC Land newsletter ✉️ for more like this

According to court documents filed November 8, 2024 in the U.S. Bankruptcy Court for the District of Delaware, FTX debtors allege that Patel's companies provided "duplicative, sub-par, and often non-existent services" while charging fees dramatically above market rates. The lawsuit, which emerged nearly two years after FTX's bankruptcy filing, represents one of numerous clawback actions pursued by the estate to recover funds for creditors.

The complaint details how FTX insiders, including convicted founder Sam Bankman-Fried, orchestrated payments totaling $30.8 million to three entities controlled by Patel between October 2021 and October 2022. These included I'm Kind of a Big Deal LLC, which received $14.8 million, and Neil Patel Digital LLC, which collected over $16 million through various marketing agreements.

Allegations of excessive fees and poor performance

FTX's investigation revealed stark disparities between the fees charged to the cryptocurrency exchange and Patel's standard market rates. According to the filing, "NP Digital charged other businesses $200,000 to $500,000 annually for similar services—12 times less than it was charging FTX Trading." The complaint states that FTX Trading paid NP Digital a one-time setup fee of $1 million and an annual management fee of $6 million for search engine optimization services.

Internal FTX communications cited in the lawsuit paint a damaging picture of the marketing work's quality. FTX employees described the performance as "sooo sloppy" and noted "terrible performance," according to the court filing. One associate general counsel reportedly became "used to doing that with NPD because they were sooo sloppy" when reviewing basic writing elements like grammar and sentence structure in marketing materials.

The largest single payment, totaling $14.8 million, was allegedly made to Big Deal for "attempting to find another consultant," a task the lawsuit claims was never completed. The agreement described Big Deal's responsibility vaguely as finding "a 3rd party consultant and work with them to either become an affiliate or find ways to promote FTX."

Key allegations

- Services described as "sooo sloppy" by FTX employees

- Fees 12x higher than market rates ($6M vs $200K-500K annually)

- $14.8M paid just to "find a consultant" - never completed

- Final $6M payment made via private Slack during FTX collapse

- "Duplicative, sub-par, and often non-existent services"

Timeline reveals payments during FTX's deteriorating finances

The timing of several major payments raises particular concerns for the bankruptcy estate. FTX Trading made a $6 million payment to NP Digital on October 25, 2022, just weeks before declaring bankruptcy on November 11, 2022. This payment came through private Slack messages between Patel and FTX's then-chief financial officer, despite the marketing engagement having been effectively terminated due to performance issues.

The lawsuit details how FTX began limiting NP Digital's services by June 2022, removing the company's app store access and requiring written approval for website updates. Despite providing few contracted services after this point, according to the filing, "NP Digital appears to have performed few, if any, services under the Earned Media SOW after June 2022."

Court documents show that Patel held significant influence within FTX's marketing operations. The filing notes that internal documents described him as "our CMO [Chief Marketing Officer] globally" and "primary consultant." Patel signed at least 51 sponsorship contracts totaling over $2.6 million and participated in hiring decisions for the marketing team.

Legal claims span fraud and preference violations

The 43-page complaint brings multiple claims under federal bankruptcy law, alleging both fraudulent transfers and preferential payments to insider entities. FTX debtors argue that Patel operated as a non-statutory insider due to his close relationship with the exchange, which began through a years-long connection with an FTX in-house lawyer who had previously represented Patel.

The lawsuit seeks to avoid all transfers to Patel's companies and recover the full amounts paid, plus interest and legal costs. Additionally, FTX requests that any claims filed by NP Digital in the bankruptcy proceedings be subordinated below other creditors or disallowed entirely until the recovered funds are returned.

The filing describes multiple "badges of fraud" that bankruptcy courts recognize as evidence of intent to defraud creditors. These include the close insider relationships, concealment of payment arrangements through private communications, and the dramatic disparity between services provided and compensation received.

Get the PPC Land newsletter ✉️ for more like this

Industry response

The lawsuit has drawn attention within the digital marketing community, where Patel maintains a significant following through educational content and speaking engagements. SEO consultant Cyrus Shepard observed that Patel had been flooding social media platforms with content about an unrelated 2011 lawsuit, potentially as "a clever bit of reputation management" to push down search results related to the FTX matter.

Shepard noted in a June 3, 2025 blog post that "if you search for 'Neil Patel sued', there's a good chance you'll see a torrent of posts by Neil talking about a time he got sued in 2011" across platforms including LinkedIn, Instagram, YouTube, and TikTok.

Neil Patel responded to the allegations in comments posted on Search Engine Roundtable, stating "We aren't being sued for $55 million" and arguing that "People tend to forget that the lawyers who took over FTX are suing, not the people who used to run FTX." He characterized the lawsuit as part of broader clawback efforts, noting that "They also sued 70-plus other companies the same week they sued us to try and claw back money."

Broader context of FTX's collapse and recovery efforts

The lawsuit against Patel represents part of extensive litigation by FTX's bankruptcy estate to recover assets for creditors who lost billions when the exchange collapsed. Sam Bankman-Fried was convicted on seven counts of fraud and conspiracy in November 2023 and sentenced to 25 years in prison in March 2024.

The bankruptcy proceeding has revealed that FTX insiders systematically misappropriated customer deposits through what prosecutors described as a multi-billion-dollar fraud scheme. The exchange used customer funds to cover trading losses at Alameda Research, Bankman-Fried's hedge fund, and to finance lavish marketing campaigns, political donations, and personal expenses.

According to the complaint, FTX insiders treated customer deposits "as their own personal piggy bank and treasury," using the funds to "shore up their house of cards from collapse and fund their seemingly insatiable aggrandizement." The aggressive marketing campaigns, including the agreements with Patel's companies, were designed to attract new customer deposits to sustain the fraudulent scheme.

The bankruptcy estate has pursued numerous similar clawback actions against vendors, employees, and other recipients of FTX funds. These efforts aim to recover assets that can be distributed to creditors, including customers who lost cryptocurrency holdings when the exchange froze withdrawals in November 2022.

Get the PPC Land newsletter ✉️ for more like this

Timeline

The FTX versus Neil Patel lawsuit illustrates how the cryptocurrency exchange's collapse continues to generate legal battles nearly two years after its bankruptcy filing. The case highlights the challenges facing digital marketing vendors when client relationships involve potentially fraudulent enterprises, even when the vendors may not have known about underlying criminal conduct.

- October 2021: Neil Patel hired as FTX Marketing Manager with $75,000 monthly salary

- October 22, 2021: FTX Media Agreements executed with NP Digital

- January 2022: Big Deal receives $14.8 million payment for consultant search services

- January 12, 2022: Serum marketing agreements signed

- June 2022: FTX begins limiting NP Digital's services due to performance issues

- October 25, 2022: Final $6 million payment made to NP Digital via private Slack

- November 11, 2022: FTX files for bankruptcy

- November 8, 2024: Lawsuit filed against Patel and companies

- June 5, 2025: Public attention focuses on case through social media discussions