The Federal Trade Commission sued JustAnswer LLC and CEO Andrew Kurtzig on January 13, 2026, alleging the online question-and-answer platform deceived consumers into costly recurring subscriptions by advertising a nominal $1 or $5 fee to access expert advice while simultaneously charging monthly subscription fees ranging from $28 to $125.

According to the complaint filed in the U.S. District Court for the Northern District of California, JustAnswer created a deceptive enrollment process that misled hundreds of thousands of consumers between January 2022 and the present. The platform, which operates JustAnswer.com and specialized sites including AskAVeterinarianOnline.com, AskALawyerOnCall.com, and AskWomensHealth.com, allegedly violated both the Restore Online Shoppers' Confidence Act and the Federal Trade Commission Act through its subscription enrollment practices.

Pearl's promise: $5 for answers, reality: $65 monthly subscriptions

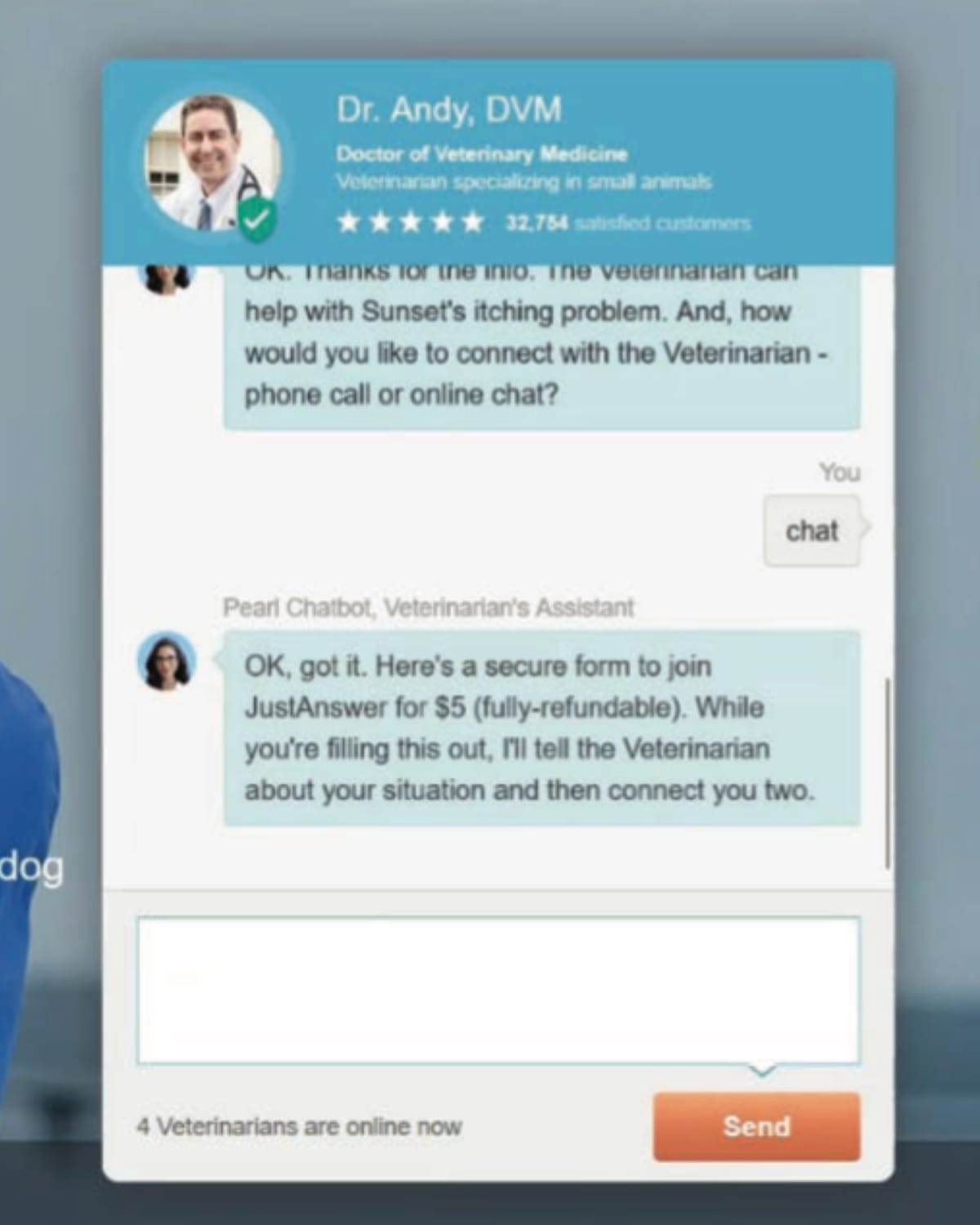

The FTC's investigation revealed that JustAnswer's chatbot assistant, typically referred to as "Pearl," told consumers during the signup process that they could "join JustAnswer for $5 (fully-refundable)" to get their questions answered. Court documents show that Pearl's message remained visible on screen while consumers entered payment information, creating what the FTC characterized as a false impression about the true cost of service.

"The launch of Vevo Evolve answers the industry-wide call for effective advertising and real-time optimization tools that truly drive impact for brands and media buyers," said Rob Christensen, EVP Global Sales at Vevo, in an announcement filed with the court as context for industry practices.

The reality proved substantially different. When consumers clicked "Confirm now" after entering credit card information, JustAnswer immediately charged both the advertised $1 or $5 joining fee and a separate monthly subscription fee. The subscription cost varied by expert category, with mechanics costing $47 monthly and legal advice reaching $79 in October 2024. As of November 2025, JustAnswer claims to charge new customers $65 monthly across all expert categories.

Hidden disclosures buried in fine print failed ROSCA requirements

While JustAnswer did include information about monthly subscription fees on its website, the FTC alleged the company failed to present these terms clearly and conspicuously as required under ROSCA. On desktop versions of the payment form, subscription fee information appeared in substantially smaller print than other text on the page, positioned between the credit card fields and the "Confirm now" button.

The disclosure language read: "By clicking 'Confirm now' I agree to the Terms of Service, Privacy Policy, to be charged the one-time join fee, and a $39 monthly membership fee today and each month until I cancel." The monthly subscription fee appeared in bold within this text block, but remained difficult to notice compared to the prominently displayed "$5 (fully-refundable)" claim in the Pearl chat visible simultaneously on screen.

Mobile versions of the payment form contained similar issues. The disclosure appeared in fine print below credit card entry fields, with automatic scrolling positioning the payment form directly below Pearl's final message about joining "for $5."

Christopher Mufarrige, Director of the FTC's Bureau of Consumer Protection, stated that "JustAnswer's misleading pricing tactics obscured the true price of its services, preventing consumers from making an informed choice on whether JustAnswer's services were worth it to them."

Evolving deception: JustAnswer made disclosures less visible over time

Court documents reveal that JustAnswer modified its purchase flow multiple times between 2022 and 2025, generally making subscription fee information less prominent rather than more transparent. Some earlier versions of landing pages included references to monthly fees positioned far down the page where consumers were unlikely to scroll. By mid-2024, JustAnswer had removed even these limited disclosures from most landing pages.

The payment form underwent similar changes. Iterations from October 2022 included a subheading above credit card fields stating "Unlimited conversations - one-time $1 join fee and $50/month. Cancel anytime." By March 2025, JustAnswer had moved the sole reference to monthly subscription fees into the fine print disclaimer above the "Confirm now" button.

The FTC noted that despite receiving significant consumer complaints and conducting internal website testing that revealed widespread confusion about pricing, JustAnswer and Kurtzig chose to make the purchase flow more deceptive rather than addressing the transparency issues.

Consumer harm: hundreds of thousands misled, massive refund requests

The complaint documents extensive consumer harm resulting from JustAnswer's practices. Many consumers contacted the company after discovering unexpected charges, explaining they believed they had paid only $1 or $5 for a single question to be answered.

Examples from consumer complaints included: "I thought I was paying $5 for a one-time question" and "I was charged $79 when I only agreed to pay $5." The volume of complaints reached such levels that JustAnswer reportedly received complaints related to pricing and subscription enrollment at consistently high rates throughout the relevant period.

Consumers also filed disputes with banks and credit card companies at substantial rates. Court documents indicate that a significant percentage of JustAnswer's transaction volume resulted in chargeback disputes, with many consumers disputing charges without first contacting JustAnswer - suggesting they viewed the charges as unauthorized rather than simply unwanted.

The FTC's complaint seeks permanent injunction preventing future violations, monetary relief for harmed consumers, and civil penalties against both JustAnswer and Kurtzig for violations of ROSCA.

Google amplified JustAnswer's visibility despite gated content raising questions

While JustAnswer faced regulatory scrutiny for deceptive subscription practices, the platform simultaneously experienced explosive growth in organic search visibility. SEO expert Lily Ray documented on January 30, 2025, that JustAnswer continued to "skyrocket in both SEO and AI Overviews, seemingly on the same visibility trajectory as Reddit and Quora."

Ray identified two major issues that raised questions about whether JustAnswer pages represented the best search results for users. First, answers remained "almost always hidden behind a gate and not viewable to logged out users" even though Googlebot could access the content and sometimes displayed gated information in search result snippets. Second, highly personal conversations with experts were used to build and scale content, with Ray questioning whether users truly understood their conversations would become visible in search results.

According to Ray's analysis, the gated content model created poor user experience for Google searchers landing on JustAnswer pages. Despite this, the platform's search rankings continued to improve throughout 2024 and into 2025. Dan Shure, an SEO consultant, noted that "50%+ of the traffic/growth is this one page, which I think inflates the numbers quite a lot."

The discrepancy between Google's stated commitment to user experience and JustAnswer's ranking success drew criticism from multiple SEO professionals. Ray expressed surprise that "these results would be given so much more visibility above and beyond sites providing expert contributions that are viewable for everyone."

James Arnold, cofounder of Answerbase, suggested the growth pattern "continues with business' individual Q&A content knowledge bases as well" and "fulfills Google's demand for original 'people first' content." Emilie Syverson observed that "a lot of the queries Just Answer has surged for are support queries" where actual company help pages failed to answer questions, creating an opening for JustAnswer's gated content to rank prominently.

The timing proved particularly notable given the FTC's findings about consumer harm. While hundreds of thousands of consumers complained about deceptive subscription enrollment between 2022 and 2025, Google's algorithms simultaneously rewarded JustAnswer with increased visibility for queries that would drive more consumers into the same deceptive purchase flow documented in the FTC complaint.

Industry context: subscription enforcement intensifies across platforms

The JustAnswer lawsuit extends the FTC's ongoing focus on subscription service transparency and cancellation practices. The Commission finalized its "Click to Cancel" rule on October 16, 2024, requiring sellers to make canceling subscriptions as simple as signing up and mandating clear disclosures before obtaining billing information.

That rule emerged after the FTC received more than 16,000 public comments during the rulemaking process, with the agency reporting nearly 70 consumer complaints per day in 2024 related to negative option and recurring subscription practices, up from 42 per day in 2021.

Other major enforcement actions addressing subscription practices include Instacart's $60 million settlement in December 2025 for hidden fees and unauthorized subscription charges, and ongoing litigation against Adobe regarding early termination fees and cancellation procedures.

The JustAnswer case also follows parallel enforcement by Australian regulators. The Australian Competition and Consumer Commission filed Federal Court proceedings against JustAnswer on September 23, 2025, alleging similar misleading pricing practices where the service cost AU$2 joining fee but actually charged monthly subscriptions ranging from AU$50 to AU$90.

Kurtzig's knowledge: internal testing revealed widespread consumer confusion

The complaint specifically names Andrew Kurtzig, JustAnswer's founder and CEO, as an individual defendant based on his direct involvement in the company's deceptive practices. Court documents indicate Kurtzig reviewed and approved website changes, requested and reviewed website testing results related to cost representations and fee disclosures, and reviewed employee feedback regarding consumer complaints.

According to the FTC, Kurtzig and JustAnswer conducted website testing and marketing research demonstrating that the company's purchase flow misled consumers. Despite this knowledge, they refused to make changes that would prevent consumer deception or injury. The complaint alleges that Kurtzig has known about rampant consumer deception for years but chose to maintain and even intensify deceptive practices.

The FTC characterized this behavior as particularly egregious given JustAnswer's 21 years of experience with negative option marketing under Kurtzig's control, extensive legal resources including in-house and outside counsel with ROSCA expertise, and awareness of government scrutiny including a Civil Investigative Demand issued in February 2023.

The Commission emphasized that JustAnswer and Kurtzig had significant experience with negative option marketing laws and were aware of requirements under both the FTC Act and ROSCA, making their continued violations particularly problematic.

Technical mechanisms: chatbot design obscured subscription commitment

The FTC's complaint provides detailed analysis of how JustAnswer's technical implementation created consumer confusion. The platform required users to interact with the Pearl chatbot before accessing the payment form, with Pearl described as an "assistant" to the Expert in each category.

Pearl's pre-scripted messages followed a consistent pattern. After gathering basic information about the consumer's question, Pearl stated: "OK, got it. Here's a secure form to join JustAnswer for $5 (fully-refundable). While you're filling this out, I'll tell the Veterinarian about your situation and then connect you two."

This message appeared to promise that consumers could join the service and have their question answered for just $5. The message remained visible in the chat window positioned to the right of the payment form on desktop versions or immediately above the payment form on mobile versions, creating persistent reinforcement of the false pricing claim even as consumers entered payment information.

The "Confirm now" button used large, brightly colored design to draw attention, while subscription fee disclosures used substantially smaller text in less prominent positions. This visual hierarchy directed consumer attention toward the transaction completion button and away from material cost information.

The FTC noted that JustAnswer did not require consumers to scroll down on landing pages to interact with Pearl or complete purchases, meaning consumers could miss even the limited fee information positioned lower on those pages.

ROSCA violations: missing consent, inadequate disclosure, poor cancellation

The complaint alleges three specific violations of the Restore Online Shoppers' Confidence Act, a 2010 law designed to protect online shoppers from deceptive negative option marketing practices.

First, JustAnswer failed to clearly and conspicuously disclose all material terms before obtaining billing information. The law requires sellers to disclose material terms including price, auto-renewal provisions, and timing of charges before consumers provide payment details. JustAnswer's practice of burying this information in fine print below credit card fields failed to meet ROSCA's clear and conspicuous disclosure standard.

Second, JustAnswer failed to obtain express informed consent before charging consumers. Under ROSCA, sellers must obtain consumers' express informed consent to be charged before processing payment. The FTC alleged that hundreds of thousands of consumers provided credit card information without affirmatively consenting to enroll in ongoing monthly subscriptions.

Third, while not detailed extensively in the complaint, ROSCA also requires simple mechanisms for stopping recurring charges. The law was passed after Congress found that consumer confidence in online commerce requires clear, accurate information and fair competition.

The statute treats ROSCA violations as violations of rules promulgated under Section 18 of the FTC Act, meaning they constitute unfair or deceptive acts or practices in or affecting commerce. This allows the FTC to seek both injunctive relief and civil monetary penalties.

Marketing strategy: targeted searches directed consumers to misleading flows

JustAnswer's business model relied heavily on search engine advertising targeting consumers seeking expert advice on specific topics. When users searched for terms like "ask a vet online" or "talk to a lawyer," they encountered JustAnswer sponsored ads linking to specialized landing pages.

These landing pages, accessible through domains like JustAnswer.com or hundreds of additional domains owned by the company, featured category-specific branding and imagery. A veterinary landing page showed images of pets and veterinary professionals, while legal advice pages featured courthouse imagery and lawyer photographs.

The search ad purchase flow represented the primary method through which consumers joined JustAnswer during the relevant period. The FTC distinguished this flow from other enrollment paths including direct access to the JustAnswer.com homepage or mobile app, which routed consumers through different purchase processes.

The specialized nature of landing pages and domains allowed JustAnswer to appear as though consumers were accessing category-specific services rather than a general subscription platform, potentially contributing to confusion about pricing structure and subscription terms.

Court documents show JustAnswer did not disclose fee structure or subscription requirements in search advertisements themselves, meaning consumers first encountered pricing claims after clicking through to landing pages and interacting with the Pearl chatbot.

Timeline

- January 2022: Period covered by FTC complaint begins, with deceptive practices allegedly in place

- October 2022: JustAnswer uses payment form design including subscription fee in subheading above credit card fields

- February 2023: FTC issues Civil Investigative Demand to JustAnswer seeking documents about subscription enrollment and pricing practices

- Mid-2024: JustAnswer removes subscription fee references from most landing pages and moves fee disclosure to fine print on payment forms

- October 2024: FTC finalizes "Click to Cancel" rule addressing negative option marketing practices

- September 23, 2025: Australian Competition and Consumer Commission files proceedings against JustAnswer over similar pricing deception claims

- November 2025: JustAnswer claims to charge $65 monthly subscription fee across all expert categories

- December 18, 2025: Instacart settles with FTC for $60 million over false advertising and unauthorized subscriptions

- January 13, 2026: FTC files complaint and seeks injunctive relief, monetary judgment, and civil penalties

Summary

Who: The Federal Trade Commission sued JustAnswer LLC (an Idaho limited liability company operating question-and-answer platforms) and its founder and CEO Andrew "Andy" Kurtzig for violations of the Restore Online Shoppers' Confidence Act and the Federal Trade Commission Act. The case affects hundreds of thousands of consumers who joined JustAnswer's service between January 2022 and the present believing they faced only a $1 or $5 fee.

What: JustAnswer deceived consumers through a three-step purchase flow that falsely represented the cost to access expert advice as $1 or $5 when the company actually charged both that nominal joining fee and a monthly subscription fee ranging from $28 to $125 depending on expert category. The platform's chatbot Pearl told consumers they could "join JustAnswer for $5 (fully-refundable)" while subscription fee disclosures appeared in substantially smaller print positioned in ways that prevented consumers from noticing before completing payment. JustAnswer failed to clearly and conspicuously disclose material terms before obtaining billing information, failed to obtain express informed consent before charging consumers, and continued these practices despite internal testing showing widespread consumer confusion.

When: The alleged violations occurred from at least January 1, 2022, through the filing date of January 13, 2026. The FTC's investigation included a Civil Investigative Demand issued in February 2023, and the complaint documents how JustAnswer made its disclosures less visible over time, with significant changes occurring in mid-2024 when the company removed subscription fee references from most landing pages.

Where: The case was filed in the U.S. District Court for the Northern District of California under Case No. 3:26-cv-00333. JustAnswer operated its headquarters and principal place of business in San Francisco, California until at least July 2023 before transitioning to virtual U.S. operations with a principal place of business listed in Covina, California. CEO Andrew Kurtzig resides in Marin County. The deceptive practices affected consumers throughout the United States who enrolled in JustAnswer's services through its websites and mobile applications.

Why: The FTC brought this enforcement action because JustAnswer's misleading pricing tactics prevented consumers from making informed choices about whether to purchase the service. The agency seeks to stop ongoing violations of ROSCA and the FTC Act, obtain monetary relief for harmed consumers, and impose civil penalties for ROSCA violations. The case represents part of the FTC's broader focus on subscription service transparency, with the agency receiving nearly 70 consumer complaints per day in 2024 related to negative option and recurring subscription practices. Christopher Mufarrige, Director of the FTC's Bureau of Consumer Protection, stated the agency is "focused on ensuring that online sellers transparently price their services."