European digital ads hit €118.9bn with 16% growth in 2024

Digital advertising surged 16% year-over-year across Europe, reaching €118.9 billion as video and retail media lead expansion.

The European digital advertising market crossed a historic threshold in 2024, reaching €118.9 billion with a robust 16% year-over-year growth rate, according to IAB Europe's comprehensive AdEx Benchmark Report released on May 21, 2025. This milestone represents the first time the European digital advertising market has exceeded €100 billion in constant currency terms, marking a decisive moment in the continent's media landscape transformation.

Get the PPC Land newsletter ✉️ for more like this

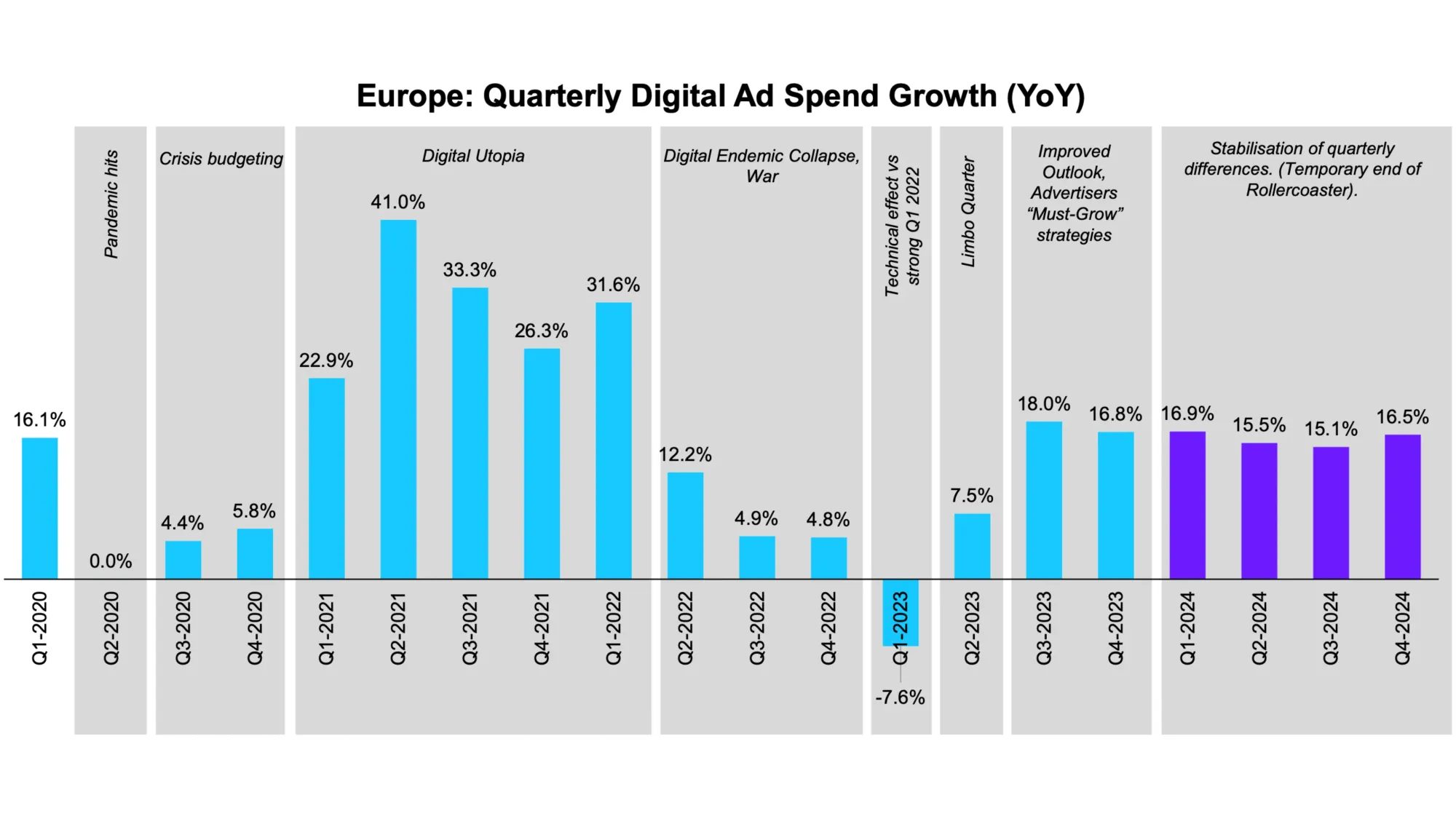

The nineteen-year study, now covering 30 European markets including newcomer Portugal, reveals a sector that has not only weathered economic uncertainty but thrived despite challenging macroeconomic conditions. The 16% growth rate represents the strongest expansion since 2011, excluding the exceptional pandemic-driven surge of 2021, when digital advertising grew by 30.5%.

Market dynamics reshape European advertising landscape

The growth trajectory reflects fundamental shifts in how European consumers engage with digital content and how advertisers allocate their budgets. According to Townsend Feehan, CEO of IAB Europe, "In 2024, the European digital advertising market once again defied economic gravity. Against a backdrop of ongoing geopolitical tensions, inflationary pressures, and evolving regulatory frameworks, the sector grew by an impressive 16%, reaching a total market value of €118.9 billion."

Digital advertising now commands 67.2% of total advertising expenditure across Europe, representing a continued migration from traditional media channels. This digital dominance reflects structural changes in media consumption patterns, with European consumers increasingly engaging with content through connected devices and digital platforms.

The market's resilience becomes particularly notable when examining quarterly performance throughout 2024. Unlike the volatile "rollercoaster" patterns experienced during the COVID-19 pandemic and subsequent global economic disruptions, 2024 demonstrated stabilized quarterly differences. Growth rates remained consistent across quarters at 16.9%, 15.5%, 15.1%, and 16.5%, suggesting a maturing market with predictable seasonal patterns rather than crisis-driven volatility.

Related stories

September 2024: IAB and IAB Europe release In-Store Retail Media measurement standards - Industry publishes first standardized measurement framework for in-store retail media advertising

October 2024: IAB Europe updates Retailer Digital Advertising Capability Map - Comprehensive mapping of 16 European retailers and retail media networks

January 2025: Search ad spending surged in Q4 2024, with retail media leading - Retail media emerges as biggest winner with 23% year-over-year growth in Q4

March 2025: Equativ and Titan OS partner to enhance CTV advertising with retail media data - Connected TV advertising integrates retail media precision targeting

Video advertising emerges as primary growth catalyst

Video content has become the undisputed driver of European digital advertising growth, with multiple video formats demonstrating exceptional performance across different channels and platforms. Display video advertising, excluding social media platforms, achieved remarkable 24.5% growth, while video within social media platforms surged by 32.8%.

The video advertising ecosystem in Europe now represents a €28.8 billion market when combining display and social video formats, up from €22.8 billion in 2023. This 28.8% growth rate significantly outpaces all other advertising formats, indicating that video has moved beyond being simply another channel to becoming the fundamental medium for digital brand communication.

Connected television formats particularly drove this expansion. Subscription Video on Demand (SVOD) platforms recorded extraordinary growth of 222.4%, as major streaming services including Netflix, Disney+, and Amazon Prime Video expanded their advertising capabilities across European markets. Broadcast Video on Demand (BVOD) services, representing traditional broadcasters' digital extensions, contributed with 29.5% growth.

The dominance of video advertising becomes evident when examining market share within display advertising. Video now exceeds 50% of display advertising spend in nine European markets, with Ukraine leading at 63%, followed by Greece at 62% and Bulgaria at 61%. This transformation reflects both technical capabilities of digital platforms and advertiser recognition of video's superior engagement and brand impact metrics.

Dr. Daniel Knapp, Chief Economist at IAB Europe, noted the strategic implications: "The end of 2023 signalled a clear upward shift in market momentum, and that trajectory carried into and throughout 2024. Key growth areas such as Social, Video, and Retail Media were driven by evolving consumer behaviour, innovation in media formats, and a renewed focus on measurable, performance-driven outcomes."

Retail media establishes €10+ billion category

For the first time in the AdEx Benchmark Report's history, retail media appears as a dedicated category, reflecting its emergence from niche advertising tactic to substantial market segment. The European retail media market achieved €11.1 billion in 2024, representing 22.2% growth from the previous year's €9.1 billion.

This growth stems from fundamental changes in consumer shopping behavior and retailers' recognition of their unique data advantages. Retail media networks can offer advertisers access to first-party purchase data, enabling targeting based on actual buying behavior rather than inferred interests or demographics.

The retail media expansion divides into two primary components: retail search and retail display advertising. Retail search, encompassing advertising within e-commerce platform search results, grew by 24.9% to reach €8.3 billion. This category now represents 16.2% of total search advertising across Europe, increasing from 14.5% in 2023.

Retail display advertising, including banner advertisements and sponsored product placements on retail websites, achieved 15.2% growth, reaching €2.9 billion. The slower growth rate for retail display compared to retail search reflects the maturity of traditional display formats and the immediate purchase intent associated with search advertising.

Major European retailers have invested significantly in building sophisticated advertising platforms. Companies like Zalando, ASOS, and local market leaders have developed comprehensive retail media networks offering targeting capabilities, measurement tools, and campaign management interfaces comparable to established digital advertising platforms.

The retail media phenomenon extends beyond pure-play e-commerce platforms to include traditional retailers' digital extensions. Supermarket chains, department stores, and specialty retailers have recognized the revenue potential of their customer data and website traffic, creating new advertising inventory previously unavailable to brands.

Get the PPC Land newsletter ✉️ for more like this

Geographic distribution reveals market maturity patterns

The European digital advertising market maintains pronounced geographic concentration, with the three largest markets—United Kingdom, Germany, and France—accounting for 60% of total expenditure. The UK leads substantially with €41.3 billion in digital advertising spend, followed by Germany at €17.9 billion and France at €11.2 billion.

However, growth patterns reveal a more complex dynamic. Twenty-one of the 30 markets achieved double-digit growth in 2024, with eight of the ten fastest-growing markets being outside the top ten largest markets. This pattern suggests digital advertising adoption is expanding beyond traditional media centers into smaller European economies.

Turkey topped growth rankings with 87.5% expansion, though this figure reflects significant currency devaluation effects. When examining growth in constant currency and inflation-adjusted terms, Ukraine led with 27.2% growth, followed by Serbia at 24.8% and Poland at 19.6%.

The strong performance in Eastern European markets reflects several factors. These economies demonstrate rapid digital infrastructure development, increasing internet penetration, and growing e-commerce adoption. Additionally, advertisers in these markets face less competition for digital advertising inventory, enabling more aggressive expansion strategies.

Austria's 17.8% growth rate proves particularly noteworthy, as it represents a mature Western European economy achieving exceptional digital advertising expansion. This performance suggests that even developed markets retain significant growth potential as digital advertising share continues expanding at traditional media's expense.

The geographic analysis reveals a clear correlation between market maturity and growth rates. Markets with lower digital advertising spend per capita demonstrate higher growth rates, while mature markets with established digital advertising ecosystems show more moderate but consistent expansion.

Social media advertising maintains momentum

Social media advertising achieved 23.9% growth across Europe, reaching €27.5 billion in total investment. This expansion reflects continued innovation in social platform advertising capabilities and growing advertiser sophistication in utilizing social media for brand building and performance marketing.

The social media category divides into standard social advertising and social video advertising, with video content driving the majority of growth. Social video advertising expanded by 32.8%, while standard social advertising grew by 14.1%. This disparity emphasizes the critical importance of video content in social media marketing strategies.

Platform diversification has contributed to social media's robust performance. While Facebook and Instagram maintain dominant positions, TikTok's European expansion has created new advertising opportunities, particularly for brands targeting younger demographics. LinkedIn's continued growth in B2B advertising and Twitter/X's evolving advertising proposition have also contributed to category expansion.

The measurement and attribution challenges that previously limited social media advertising investment have been partially addressed through improved tracking technologies and platform-provided analytics. Social media platforms have invested substantially in demonstrating return on investment, enabling more sophisticated budget allocation decisions by advertisers.

Programmatic advertising renaissance

After experiencing slower growth in 2023, programmatic advertising demonstrated renewed vitality in 2024 with 18.4% expansion, reaching €15.5 billion across Europe. This recovery reflects several technological and market developments that have enhanced programmatic advertising's value proposition.

Supply path optimization initiatives have improved programmatic advertising quality by reducing intermediary layers and enhancing transparency. Advertisers can now trace their programmatic spending through fewer intermediaries, reducing fees and improving campaign effectiveness.

The integration of first-party data into programmatic platforms has partially compensated for third-party cookie limitations. Advertisers have developed more sophisticated audience targeting strategies based on their own customer data, improving programmatic campaign relevance and performance.

However, programmatic growth patterns varied significantly across European markets. Turkey led with 93% growth, though currency effects inflate this figure. Poland, Hungary, and Slovenia also demonstrated strong programmatic expansion, suggesting that less mature markets offer greater programmatic adoption opportunities.

Conversely, some mature markets including Finland, Ukraine, and Estonia experienced programmatic spending declines. These patterns may reflect market consolidation, with programmatic budgets shifting toward more effective platforms and strategies rather than expanding overall category investment.

Audio advertising crosses billion-euro threshold

Digital audio advertising achieved €1.05 billion in European spending during 2024, crossing the billion-euro milestone for the first time. This 18.3% growth rate, while substantial, represents more modest expansion compared to video and retail media categories.

The audio advertising market divides between podcast advertising and other digital audio formats including music streaming and internet radio. Podcast advertising achieved 20.6% growth, reaching €451 million, while other audio formats grew 16.7% to €603 million.

Podcast advertising's strong performance reflects growing listenership and advertiser recognition of podcast audiences' engagement levels and purchasing power. European podcast consumption has expanded rapidly, with major platforms including Spotify, Apple Podcasts, and local players developing sophisticated advertising capabilities.

However, audio advertising faces significant measurement and scale challenges. Unlike video or display advertising, audio campaigns require different attribution methodologies and offer limited visual branding opportunities. These constraints limit audio advertising's appeal for many brand marketing campaigns.

The correlation between digital audio advertising investment and traditional radio market strength demonstrates interesting market dynamics. Countries with historically strong radio advertising markets, including Belgium, Spain, and Ireland, show proportionally higher digital audio advertising investment, suggesting complementary rather than substitutional relationships.

Get the PPC Land newsletter ✉️ for more like this

Search advertising stability amid retail media disruption

Search advertising achieved 12.4% growth, reaching €51.1 billion and maintaining its position as Europe's largest digital advertising category. However, this growth masks significant internal dynamics as retail search gains market share from traditional search advertising.

Standard search advertising, encompassing traditional Google Ads and Microsoft Advertising campaigns, grew by 10.3% to €42.8 billion. Meanwhile, retail search advertising expanded by 24.9% to €8.3 billion, demonstrating the continued migration of search budgets toward commerce-focused platforms.

This shift reflects fundamental changes in consumer search behavior. European consumers increasingly begin product searches on retail websites rather than general search engines, particularly for established product categories. This behavioral change has forced search advertisers to diversify their platform strategies beyond traditional search engines.

Sixteen European markets achieved double-digit search advertising growth, with Turkey leading at 81.7% (though currency effects significantly influence this figure). Serbia, Ukraine, and Austria also demonstrated exceptional search advertising expansion, suggesting robust e-commerce growth in these markets.

The search advertising landscape has become increasingly sophisticated, with advanced automation, machine learning optimization, and integrated shopping campaigns becoming standard features. These technological improvements have helped maintain search advertising's effectiveness despite increased competition and rising costs.

Classifieds and directories demonstrate resilience

Classifieds and directories advertising achieved modest 4.8% growth, reaching €7.1 billion across Europe. While representing the slowest growth among major categories, this expansion demonstrates the continued relevance of classified advertising platforms in European markets.

The UK and Germany dominate classifieds advertising, together accounting for approximately 35% of European category investment. This concentration reflects these markets' mature online classifieds ecosystems, including platforms like AutoTrader, Rightmove, and various job boards.

Turkey led classifieds growth with 73% expansion, followed by Estonia at 27.6%. These growth patterns suggest that emerging markets retain significant development potential for classifieds platforms, particularly in automotive, real estate, and employment advertising.

However, several mature markets including Denmark, Finland, and Slovenia experienced classifieds advertising declines. These patterns may reflect market saturation and migration toward social media platforms and specialized vertical websites for certain classified categories.

Market concentration and competitive dynamics

The European digital advertising market's top-heavy structure reflects both economic realities and historical media market development patterns. The three largest markets—UK, Germany, and France—possess substantial economic scale, mature digital infrastructure, and sophisticated advertising ecosystems that naturally attract larger investment levels.

Within individual countries, market concentration varies significantly. The UK's mature programmatic ecosystem and advanced measurement capabilities have attracted disproportionate investment, while Germany's strong e-commerce market has driven retail media expansion. France's media market demonstrates balanced growth across multiple categories.

The "top 15" European markets account for 95% of total digital advertising investment, suggesting that geographic diversification opportunities remain limited for most advertisers. However, the strong growth rates in smaller markets indicate potential for geographic expansion strategies as these economies develop.

Platform concentration within categories also influences market dynamics. Video advertising growth is heavily influenced by major platforms including YouTube, TikTok, Instagram, and emerging connected TV platforms. Similarly, search advertising remains dominated by Google, though Microsoft Advertising and retail search platforms are gaining market share.

Get the PPC Land newsletter ✉️ for more like this

Technological infrastructure and measurement evolution

The European digital advertising market's growth has been facilitated by substantial improvements in technological infrastructure and measurement capabilities. Advanced attribution modeling, cross-device tracking, and sophisticated audience segmentation have enhanced campaign effectiveness and advertiser confidence.

Privacy regulation compliance has driven innovation in measurement technologies. European advertisers have developed first-party data strategies, implemented server-side tracking, and adopted privacy-preserving measurement methodologies that maintain campaign effectiveness while respecting consumer privacy preferences.

The adoption of artificial intelligence and machine learning technologies has transformed campaign optimization. Automated bidding, dynamic creative optimization, and predictive audience modeling have become standard features across major advertising platforms, improving performance while reducing manual campaign management requirements.

Connected TV and streaming platform measurement capabilities have particularly advanced, addressing historical attribution challenges that limited video advertising investment. Cross-platform frequency capping, advanced audience verification, and viewability measurement have enhanced video advertising's accountability.

Economic outlook and market forecasting

Looking toward 2025, market leaders anticipate a more challenging environment characterized by economic uncertainty and geopolitical tensions. Dr. Knapp's analysis suggests that "the outlook for 2025 is marked by renewed volatility. Rising geopolitical tensions, economic headwinds, and regulatory shifts, including the introduction of new EU tariffs, are already influencing advertiser sentiment."

This cautious outlook reflects several factors beyond traditional economic concerns. European Union regulatory developments, including potential artificial intelligence legislation and continued privacy regulation evolution, may influence digital advertising strategies. Additionally, geopolitical tensions and their economic implications could affect advertiser spending confidence.

However, structural trends supporting digital advertising growth remain intact. European internet penetration continues expanding, e-commerce adoption shows no signs of deceleration, and connected device usage increases across demographic segments. These fundamental drivers suggest continued digital advertising growth, albeit potentially at more moderate rates.

The expected shift toward performance-driven advertising strategies may benefit categories with strong measurement capabilities, including search advertising, retail media, and programmatic display advertising. Conversely, brand awareness-focused categories might experience more cautious investment approaches.

Get the PPC Land newsletter ✉️ for more like this

Strategic implications for European marketers

The 2024 AdEx Benchmark Report findings present several strategic implications for European marketing professionals. The dominance of video advertising growth suggests that brands must prioritize video content creation and multi-platform video distribution strategies to remain competitive.

Retail media's emergence as a €10+ billion category indicates that brand relationships with retail partners require strategic reconsideration. Companies selling through retail channels should evaluate retail media opportunities as potential alternatives or complements to traditional digital advertising approaches.

The geographic growth patterns suggest opportunities for brands to explore expansion into high-growth smaller markets. While absolute investment levels remain modest, the strong growth rates in Eastern European markets may offer attractive customer acquisition opportunities for appropriate brands.

The continued expansion of programmatic advertising reinforces the importance of first-party data strategies and sophisticated audience development. Brands that have invested in customer data platforms and advanced analytics capabilities are better positioned to capitalize on programmatic opportunities.

For advertising agencies and marketing technology providers, the report's findings emphasize the critical importance of video production capabilities, retail media expertise, and cross-platform campaign management competencies. Service providers that can demonstrate expertise across multiple high-growth categories will be best positioned for client acquisition and retention.

The moderate growth expected for 2025 suggests that efficiency and measurement will become increasingly important differentiators. Advertisers will likely prioritize partners and platforms that can demonstrate clear return on investment and provide sophisticated attribution and optimization capabilities.

Get the PPC Land newsletter ✉️ for more like this

Industry transformation

The European digital advertising market's €118.9 billion milestone represents more than statistical achievement—it reflects fundamental transformation in how brands communicate with consumers and how media value is created and distributed. The continued migration from traditional media to digital channels appears irreversible, with digital's 67.2% share of total advertising expected to expand further.

The emergence of retail media as a major category illustrates how commercial innovation can create entirely new advertising ecosystems. The success of retail media suggests that other industry sectors with substantial customer data and direct consumer relationships may develop similar advertising capabilities.

Video advertising's dominance across multiple categories—display, social, and connected TV—indicates that video content creation and distribution capabilities have become essential marketing competencies rather than specialized tactics. This transformation requires organizational capabilities spanning creative development, technical production, and cross-platform optimization.

The geographic expansion of digital advertising into smaller European markets reflects broader economic development patterns and suggests continued growth opportunities as digital infrastructure and e-commerce adoption expand globally.

For the European digital advertising ecosystem, the 2024 results validate investments in technological infrastructure, measurement capabilities, and regulatory compliance systems that have enabled continued growth despite challenging external conditions. As the market approaches maturity in some segments and geographies, innovation and differentiation will become increasingly important competitive factors.

The 16% growth rate achieved in 2024, while exceptional by historical standards, may represent a peak performance level as the market matures and economic headwinds intensify. However, the fundamental drivers of digital advertising growth—increasing internet usage, expanding e-commerce adoption, and continued migration from traditional media—remain robust across European markets.

The IAB Europe AdEx Benchmark Report 2024 therefore documents not just a year of exceptional growth, but a pivotal moment in European media market evolution, establishing digital advertising as the dominant force in commercial communication and setting the foundation for continued expansion despite anticipated challenges ahead.