CTV shifts force media strategy pivot as 9 in 10 homes connect TVs

FAST platforms gain significant ground amid subscription fatigue and economic concerns, new data shows.

The television landscape continues to undergo significant transformation as consumer preferences shift dramatically from traditional TV to streaming platforms, according to a comprehensive research report released yesterday. LG Ad Solutions has published the fourth edition of its annual Big Shift insights series, which examines changing viewer behaviors in the connected TV (CTV) ecosystem.

The report, titled The Big Shift 2025 | US Edition, reveals several pivotal findings that marketers need to understand to effectively reach today's fragmented viewing audience.

Fundamental shift to streaming continues to accelerate

According to the study conducted in March 2025, nine out of ten US internet users now have an internet-connected TV, with 70% preferring to watch television via streaming apps rather than traditional cable or satellite services. This marks a dramatic shift in viewing habits that continues to gain momentum.

The research, which surveyed 1,133 US CTV viewers representative of US Census demographics by age and gender, found that 82% of respondents are watching the same amount or less linear TV compared to last year. This continuing migration toward streaming platforms is primarily driven by viewers' desire for greater control over their viewing experience.

"The TV Home Screen isn't just a place to find TV and movies," the report states. Viewers now embrace their televisions for a wider range of activities, with 56% using built-in content hubs for fitness training programs, 46% accessing cloud gaming without requiring a console, and 44% utilizing on-screen shopping features.

This expansion of the TV's role in the home presents both challenges and opportunities for marketers seeking to connect with consumers through this increasingly central home entertainment hub.

Economic pressures drive shift to free ad-supported streaming

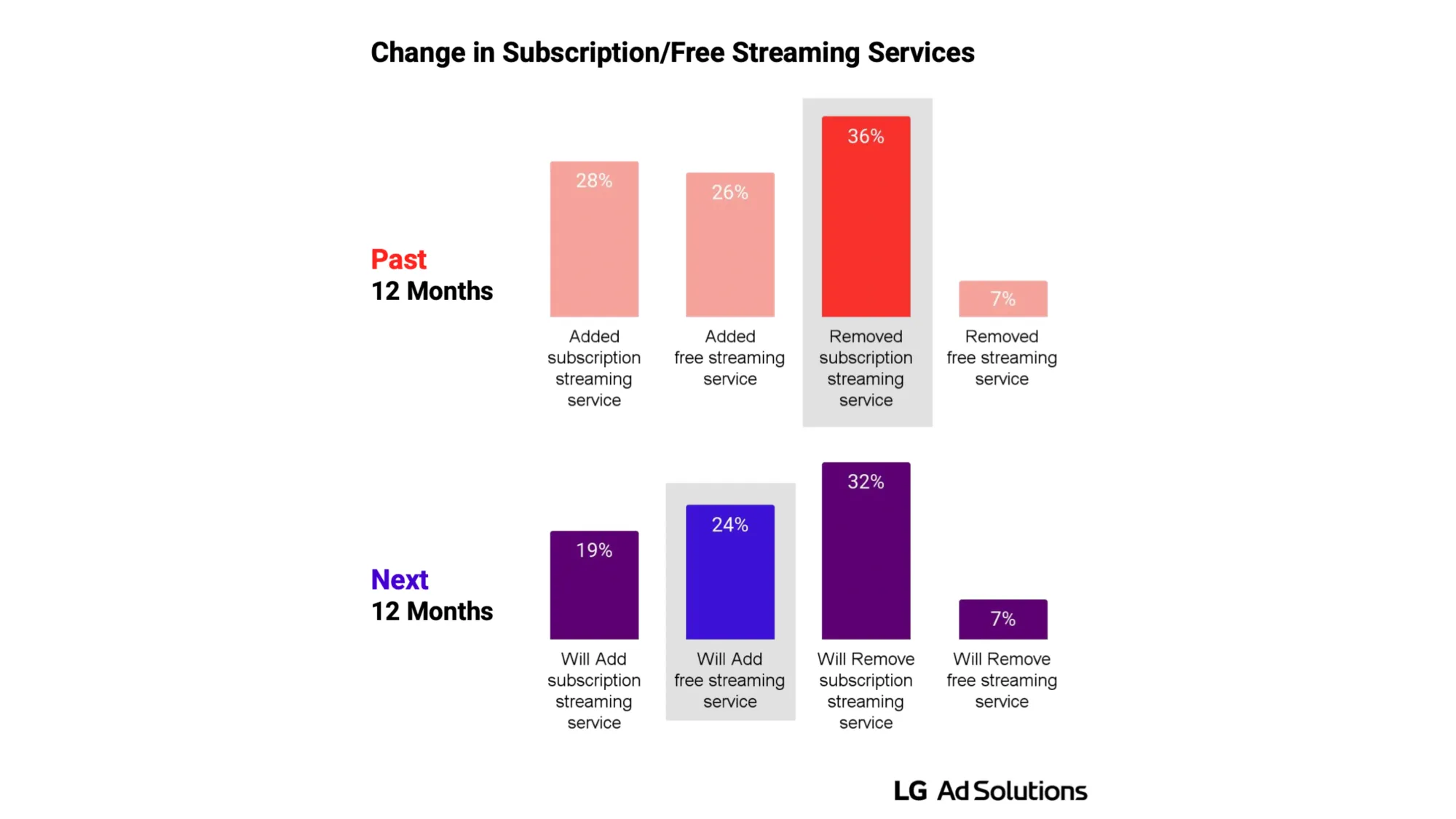

A particularly notable trend identified in the research is the rapid growth of free ad-supported streaming television (FAST) services. With 36% of viewers canceling at least one paid streaming subscription in the past year, 67% now indicate they prefer free ad-supported content, and nearly a quarter (24%) plan to add a FAST service in the next 12 months.

This shift comes as economic concerns intensify scrutiny of recurring subscription costs. A remarkable 89% of respondents stated that economic uncertainty has raised concerns about all recurring household subscription costs – a 4% increase year-over-year. Among these concerns, streaming subscriptions ranked highest at 62%, surpassing mobile phone bills (45%) and cable/satellite bills (44%).

The financial pressure has led to significant changes in subscription management behavior. The study found that 63% of viewers are likely to sign up for a streaming subscription service to watch specific content and then cancel or pause the service after watching – a practice known as subscription cycling.

Data from LG Ad Solutions' device tracking shows that FAST app user growth has outpaced subscription video on demand (SVOD) services by a factor of three. While SVOD services saw a 34% increase in active users from March 2023 to March 2025, FAST platforms experienced an impressive 109% growth during the same period.

This trend is further supported by behavior data showing that viewers spend approximately 100 minutes per session using FAST apps on LG TVs – 23% higher than time spent on subscription services.

Content discovery challenges create marketing opportunities

Despite the proliferation of streaming options, viewers face increasing frustration in finding content. The study reveals that viewers spend an average of 9 minutes and 46 seconds from powering on their TV to actually watching content, with 33% of this time spent on the Home Screen.

This content discovery phase represents a significant opportunity for marketers. According to the report, 40% of CTV viewers rely on the TV Home Screen for content guidance, making it the second most influential recommendation source after word of mouth (53%).

The research shows that 65% of viewers typically use their TV's built-in search function to find content. Additionally, 97% of LG TV users always enter the Home Screen, making it a critical touchpoint for reaching audiences during their content discovery journey.

Advertising effectiveness on connected TVs

Perhaps most important for marketers, the study demonstrates that CTV advertising drives meaningful consumer action. After viewing a relevant ad, 39% of CTV viewers searched for a product online, 38% visited a website, 21% made a purchase, and 19% visited a physical store.

These conversion rates were even higher among LG TV users specifically, with this segment 23% more likely to search for a product online, 16% more likely to visit a website, 29% more likely to make a purchase, and 46% more likely to visit a physical store after seeing streaming ads.

The research also identified a preference for relevant advertising, with 75% of viewers preferring ads that align with their personal interests. Additionally, 51% of respondents feel that streaming TV ads are more relevant to them than traditional TV advertisements – a slight increase from 49% in the previous year.

Multitasking behavior creates cross-screen opportunities

The report highlights that 95% of CTV viewers multitask while watching television, with 26% always engaging in other activities during viewing – an 8% increase year-over-year. These simultaneous activities include messaging (62%), browsing social media (54%), playing games (47%), shopping online (44%), and streaming other content (24%).

This multitasking behavior creates opportunities for cross-screen marketing strategies that can reach viewers across multiple touchpoints during their viewing sessions.

"As CTV viewer attention disseminates across more screens and constant multitasking, LG household device graph and ACR viewership data can help brands precisely and efficiently reach viewers with personalized, relevant messaging wherever their attention shifts," the report suggests.

Implications for marketers

Based on these findings, LG Ad Solutions recommends several strategies for implementing effective CTV campaigns:

- Adopt a CTV-first media strategy to reach consumers where attention is shifting, leveraging premium CTV video ads with enhanced design features.

- Create unique touchpoints with CTV native advertising across viewers' content discovery journey, particularly on the TV home screen where viewers spend significant time searching for content.

- Tap into FAST platforms as viewers increasingly spend more time with free ad-supported streaming content.

- Maintain ad relevance as viewer attention scatters across multiple screens and activities.

The continued growth of connected TV viewing, combined with the rise of FAST platforms and the expansion of TV functionality beyond traditional content consumption, presents both challenges and opportunities for marketers seeking to reach audiences in this evolving landscape.

Timeline

- March 2025: LG Ad Solutions conducts survey for The Big Shift 2025 | US Edition with 1,133 US CTV viewers

- 2023-2025: FAST app user growth (109%) outpaces SVOD (34%) by 3x

- 2025 (current): 9 in 10 US internet users have an internet-connected TV

- 2025 (current): 82% of linear TV viewers watching same or less compared to 2024

- 2025 (current): LG TV users have 8 installed apps on average but actively use only 4.1

- Past 12 months: 36% of viewers canceled at least one paid streaming subscription

- Next 12 months: 24% plan to add a FAST service