Criteo: Major Retail Media Client Change Impacts Growth Outlook

Criteo revises retail media outlook amid client changes, highlighting industry shifts while maintaining strong financial position despite headwinds.

Criteo, the commerce media company, announced strong profitability in its Q1 2025 results on May 2, but also revealed a significant client relationship change that will impact future revenue projections. The news comes as Criteo continues its transition toward a technology-first platform strategy amid evolving market conditions.

Criteo reported Q1 2025 revenue of $451 million, representing a modest year-over-year increase of just 0.3%, while Contribution ex-TAC (their net revenue excluding traffic acquisition costs) grew by 4% to $264 million . Despite the limited topline growth, the company's profitability metrics showed significant improvement, with net income surging 367% to $40 million compared to $9 million in Q1 2024. Adjusted EBITDA rose 30% to $92 million, resulting in an impressive 35% Adjusted EBITDA margin.

The company delivered a free cash flow of $45 million in Q1 2025, a dramatic improvement compared to just $1 million in Q1 2024. As of March 31, 2025, Criteo maintained a strong financial position with $329 million in cash and marketable securities.

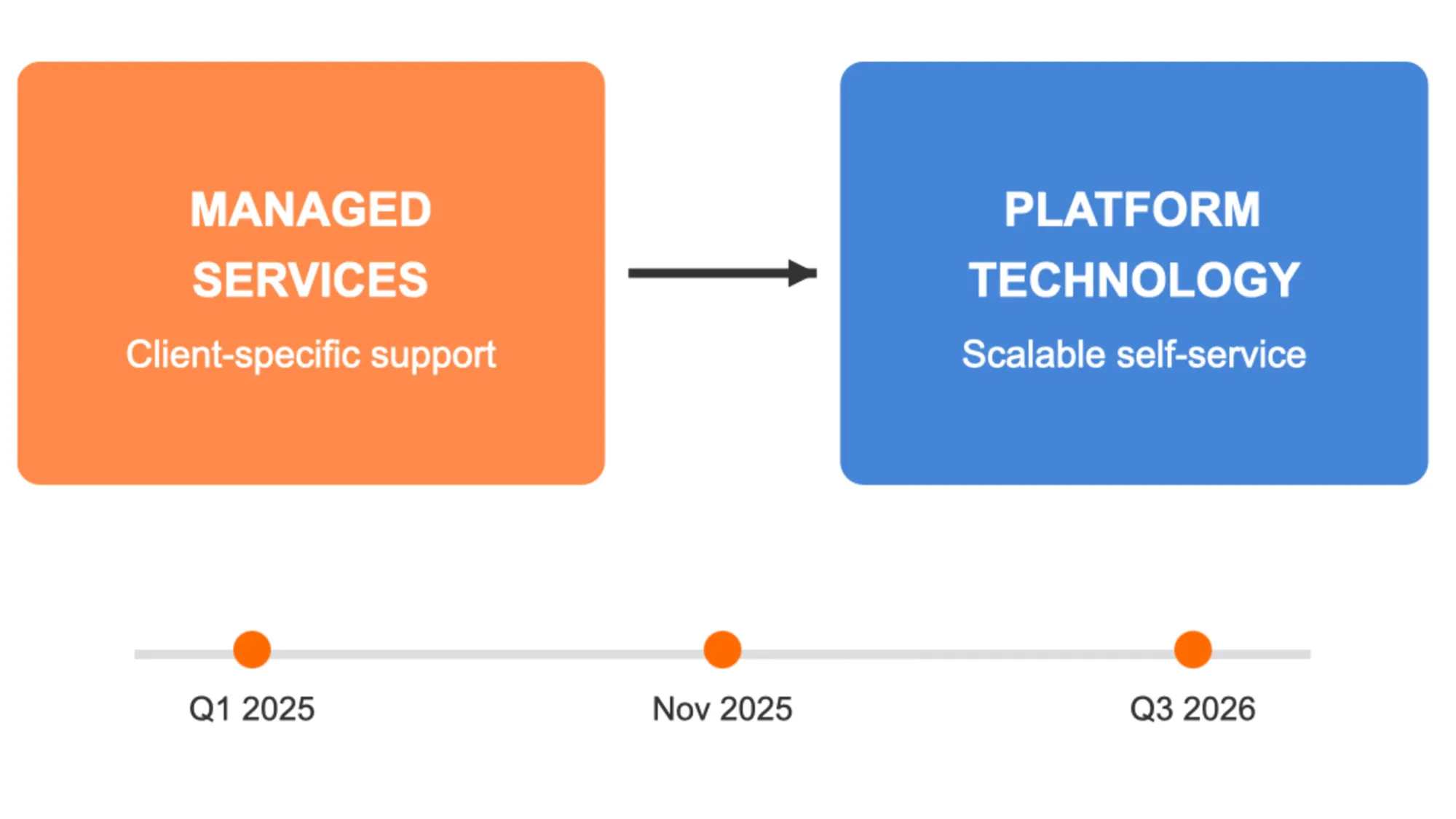

The most significant news in Criteo's earnings announcement was that its largest Retail Media client unexpectedly notified the company that, while they will continue to use Criteo's Retail Media technology platform under a multi-year committed contract, they will discontinue managed services and curtail the remaining brand demand sales services in November of this year.

Instead of a natural and gradual evolution of support services, this sudden change will result in a significant impact on the growth rates of Criteo's Retail Media business for a twelve-month period starting in Q4 2025. In specific financial terms, the reduced scope for these two specific clients is expected to result in a $25 million negative impact in 2025, largely related to Q4 2025, and approximately $75 million for the first ten months of 2026 until it annualizes.

The company emphasized that this near-term change does not affect their substantial opportunities to continue to grow faster than the market across the rest of their retailer base and for the long-term.

Criteo's business comprises two core segments:

- Retail Media: Revenue was $59 million and Contribution ex-TAC grew 18% at constant currency to $59 million. Growth was driven by continued strength in Retail Media onsite and continued traction for offsite campaigns. The company benefited from the contribution of newly signed retailers, and growth from existing clients remains strong with same-retailer Contribution ex-TAC retention at 120%.

- Performance Media: Revenue was $392 million and Contribution ex-TAC was $206 million, up 4% at constant currency. This was driven by Commerce Growth solution which leverages large-scale commerce data and AI-powered audience modeling technology to find in-market shoppers. The segment also benefited from the growth of Commerce Grid SSP, while AdTech services continued to be negatively impacted by lower spend by a large client.

Despite client-specific challenges, Criteo continues to expand its retailer base globally. The company now partners with 70% of the top 30 retailers in the U.S. — an increase from 65% previously. Recent new client wins include Dick's Sporting Goods in the U.S., Endeavour in Australia, d shopping in Japan, Cooperative U in France, and Elkjop, their first retailer in the Nordics.

Technology Innovation and Product Development

Criteo is continuing to invest in its technology platform and new formats. The company is building from its success with sponsored ads to expand with newer formats, including onsite video, which was recently launched into general availability, and an outcome-based, native onsite display offering coming later this year.

A recent campaign with HP and Costco showcased the power of Criteo's full-funnel Retail Media strategy. Shoppers exposed to both onsite and offsite ads saw an 855% uplift in conversion rates, an over 10x increase in revenue per user, and a 58% lift in click-through rates — demonstrating how their integrated approach drives measurable business impact.

Strategic Shift Toward Platform Business

The client relationship changes reflect a broader strategic shift for Criteo. CEO Michael Komasinski described the company as "shifting from transformation to scale with continuous innovation and disciplined execution. That means further expanding across multiple channels, including Retail Media, open web, and social to serve the full buyer journey. We're investing in new formats such as outcome-based, native display, onsite video, and CTV – all expanding our SAM. Importantly, we are evolving from a largely managed service model to a more scalable self-service platform".

This transition, while potentially disruptive in the short term, could lead to a more scalable and profitable business model in the longer term, as technology platforms typically generate higher margins than services businesses.

Looking ahead, Criteo expects Contribution ex-TAC to grow low-single-digits year-over-year at constant currency for the full year 2025, with growth in each of its segments. For Retail Media specifically, 2025 growth is now projected to be in the low- to mid-single digits range at constant currency.

The company continues to anticipate an Adjusted EBITDA margin of approximately 33% to 34% for 2025. Management intends to maintain margins and generate strong cash flow while continuing to invest in the growth of their Commerce Media Platform. They anticipate that the investments being made this year will position the company for continued top-line growth and strong cash flow generation for the coming years.

For Q2 2025 specifically, Criteo expects Contribution ex-TAC of $272 million to $278 million, down -2% to flat at constant currency.

Criteo's Q1 2025 results reveal a company in transition – moving from a services-heavy business model toward a more scalable, technology-focused platform approach. While the unexpected change in its largest client relationship presents near-term challenges, the strong profitability metrics, expanding global footprint, and continued technology innovation suggest the company is positioning itself for sustainable long-term growth in the evolving digital advertising landscape.

The coming quarters will be critical as Criteo navigates this transition and works to replace the anticipated revenue shortfall from its largest client while continuing to expand its platform capabilities and client base.

Timeline

- Q1 2025: Criteo activates $335 million in media spend, up 21% year-over-year, from over 3,800 brands globally

- May 2, 2025: Criteo announces Q1 2025 earnings with $451 million in revenue and $264 million in Contribution ex-TAC

- May 2, 2025: Company discloses that its largest Retail Media client will discontinue managed services and curtail brand demand sales services starting November 2025

- Q1 2025: Criteo deploys $56 million for share repurchases

- Q1 2025: Company launches onsite video into general availability and campaigns with Albertsons and Costco

- Q1 2025: New retailer wins announced including Dick's Sporting Goods (U.S.), Endeavour (Australia), d shopping (Japan), Cooperative U (France), and Elkjop (Nordics)

- November 2025: Scheduled reduction in services for largest Retail Media client begins

- Q4 2025: Expected $25 million negative impact on revenue due to client changes

- Q4 2025-Q3 2026: Anticipated $75 million total impact over ten months until the change annualizes