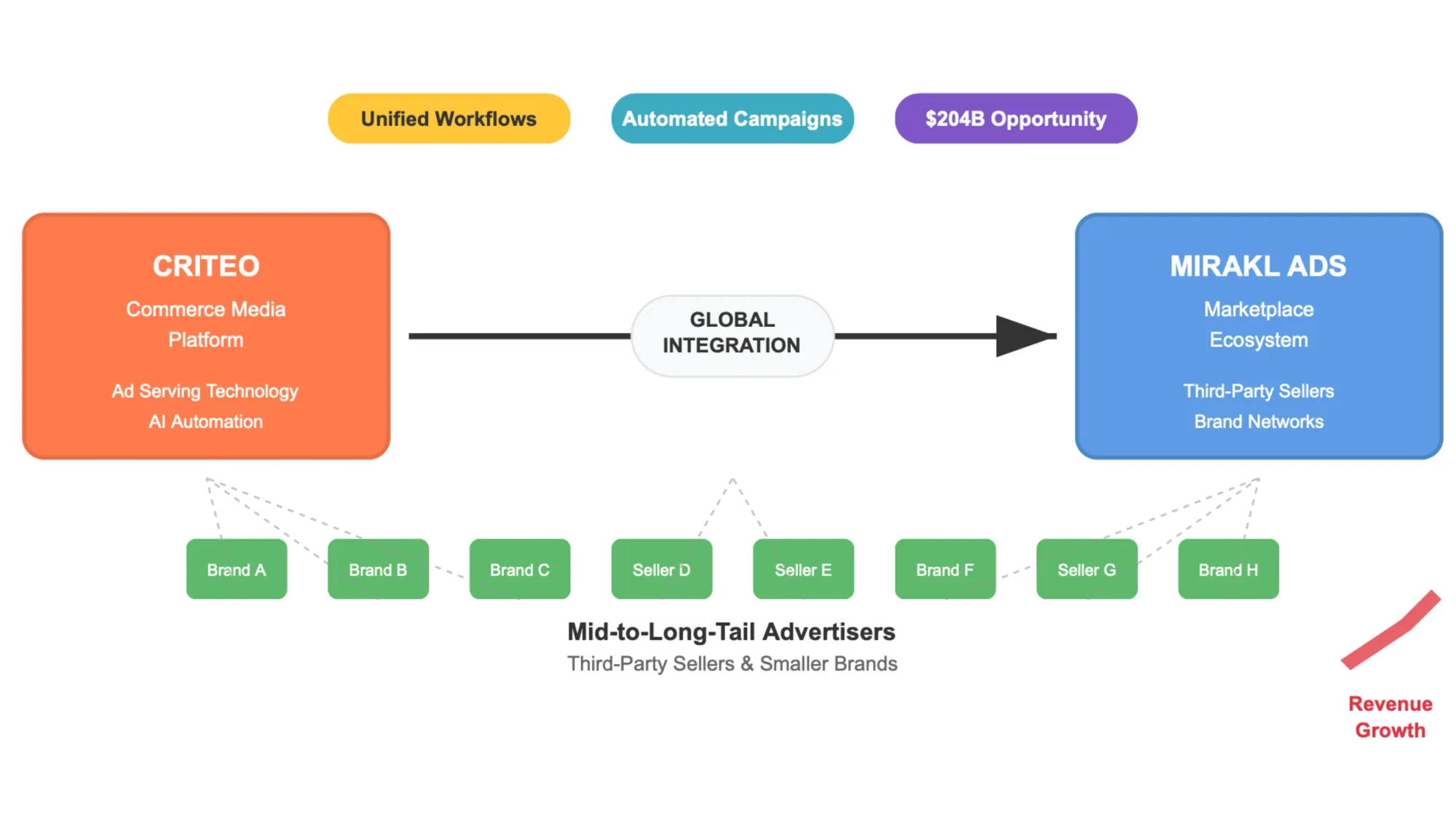

Criteo and Mirakl Ads launch global integration for marketplace revenue

Mid-to-long-tail advertisers gain access to $204B retail media opportunity through unified workflows and automated campaign management.

Criteo and Mirakl Ads announced a global integration on July 17, 2025, targeting mid-to-long-tail advertisers in the rapidly expanding retail media sector. The collaboration combines Mirakl's extensive ecosystem of brands and third-party sellers with Criteo's retail media supply and ad-serving technology to unlock new revenue streams through automated campaign execution.

According to the companies, the strategic alliance addresses an increasingly valuable but hard-to-reach segment: third-party sellers and mid-to-long-tail advertisers who remain outside traditional sales and media management channels. These smaller brands and marketplace vendors collectively represent significant advertising investment potential, with data from SmartScout indicating they spend 127% more than first-party brands on Amazon platforms.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Summary

Who: Criteo, the global commerce media platform company, and Mirakl Ads, the retail media solution from the eCommerce software leader, targeting mid-to-long-tail advertisers, third-party sellers, and marketplace retailers seeking revenue growth.

What: A global integration combining Mirakl's extensive ecosystem of brands and third-party sellers with Criteo's retail media supply and ad-serving technology, featuring unified workflows, integrated billing and reporting, and AI-automated campaign execution to unlock marketplace advertising opportunities.

When: Announced on July 17, 2025, targeting the $204 billion retail media industry projected for 2027.

Where: Global implementation across retail marketplaces and commerce platforms, serving thousands of smaller brands and marketplace vendors who spend 127% more than first-party brands on Amazon according to SmartScout data.

Why: To unlock untapped revenue potential from mid-to-long-tail advertisers who sit outside traditional sales and media management channels, enabling retailers to monetize marketplaces more efficiently while providing self-service tools and automated campaign management for previously hard-to-reach advertiser segments.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

The integration leverages ad serving technology, unified workflows, integrated billing and reporting systems to activate this underserved advertiser segment within retail media networks. Mid-to-long-tail advertisers consist of thousands of smaller brands and marketplace vendors who, while modest in individual scale, represent substantial collective advertising investment according to the announcement.

Melanie Zimmermann, General Manager of Global Retail Media at Criteo, stated: "As retail media evolves, retailers are seeking streamlined solutions to grow demand and connect with diverse brand partners. Together we enable third-party advertisers to easily launch campaigns, boosting product variety without adding operational complexity to retailers. This integration empowers retailers to monetize their marketplaces more efficiently while enhancing the shopping experience for consumers."

The collaboration targets the $204 billion retail media industry projected for 2027, according to sources including Activate, eMarketer, GroupM, Madison & Wall. The integration provides self-service tools and automated campaign management capabilities to help these advertisers scale their retail media efforts across multiple marketplace platforms efficiently.

Technical components of the integration include AI-automated campaign execution systems designed specifically for marketplace environments. The platform enables third-party advertisers to launch campaigns while reducing operational complexity for retailers managing diverse brand partnerships. The system supports both direct marketplace operations and extended retail media network participation.

Octavie Gosselin, Global Vice President of Mirakl Ads, noted: "We're thrilled to offer this integrated capability to retailers who want to unlock the untapped power of mid-long-tail advertisers through automation and self-service. We are helping advertisers and sellers to seamlessly participate in all retail programs, and this partnership shows the growing importance of marketplaces in all the commerce ecosystem."

The marketplace advertising landscape has evolved significantly as retailers seek to monetize their platforms beyond traditional first-party brand partnerships. Third-party sellers represent a substantial but previously difficult-to-access revenue opportunity for retail media networks, particularly those operating across multiple platforms and channels.

This announcement follows Criteo's recent expansion efforts in retail media, including the June 17, 2025 launch of auction-based display technology that introduced programmatic flexibility to retail environments. The company has been systematically building capabilities to serve diverse advertiser segments across its commerce media platform.

The integration addresses specific challenges facing marketplace operators who must balance advertiser demand with operational efficiency. Traditional retail media management often requires extensive manual oversight for smaller advertisers, creating barriers to scale. The Criteo-Mirakl collaboration automates these processes while maintaining campaign effectiveness across diverse product categories.

Marketplace dynamics have shifted considerably as consumer shopping behavior increasingly favors platform-based discovery and purchasing. Retailers operating marketplace models need sophisticated advertising solutions that can accommodate thousands of smaller sellers while generating meaningful revenue streams without proportional increases in management overhead.

The collaboration builds on both companies' existing marketplace expertise. Mirakl has been pioneering platform economy solutions since 2012, working with over 450 industry-leading businesses worldwide. The company's retail media solution specifically addresses the monetization challenges facing marketplace operators across various industry verticals.

Criteo operates retail media programs for approximately 225 retailers globally, including major partnerships with retailers like Target, JCPenney, and Walgreens according to recent reporting. The company's platform processes over $1 trillion in annual commerce sales, providing extensive data signals for campaign optimization and audience targeting.

The timing of this integration reflects broader industry trends toward marketplace consolidation and advertising automation. Retailers increasingly recognize that mid-to-long-tail advertisers represent untapped revenue potential, but accessing this segment requires technology solutions that can operate at scale without proportional increases in operational complexity.

Self-service capabilities become essential for reaching smaller advertisers who lack the resources for managed service relationships typical of larger brands. The integration provides these advertisers with campaign management tools previously available only to enterprises with substantial advertising budgets and dedicated account management resources.

Campaign automation specifically addresses the challenge of managing thousands of smaller advertising accounts across multiple product categories and seasonal demand patterns. The system must accommodate varying advertising sophistication levels while maintaining performance standards expected by retailers and their consumers.

Industry data suggests that marketplace advertising represents one of the fastest-growing segments within retail media. Platforms that can effectively monetize their long-tail inventory while providing meaningful value to smaller advertisers gain competitive advantages in both advertiser acquisition and retention.

The integration enables retailers to expand their advertiser base without corresponding increases in sales and support overhead. Automated campaign management handles routine optimization tasks while self-service interfaces allow advertisers to maintain control over budget allocation and creative decisions.

For marketplace operators, the collaboration addresses the fundamental challenge of scale versus service quality. Traditional advertising sales models often prove uneconomical for smaller advertisers due to account management costs. Automated solutions enable profitable relationships with previously inaccessible advertiser segments.

The retail media sector has experienced rapid growth as brands seek alternatives to traditional digital advertising channels. Marketplace advertising offers particular appeal due to high-intent shopping environments and first-party data availability for targeting and measurement purposes.

This development occurs amid significant financial performance from Criteo's retail media division, which reached $250 million in annual revenue for 2024 while growing 23% at constant currency in the fourth quarter. The company's transformation from retargeting specialist to comprehensive commerce media platform continues to show momentum across multiple advertiser segments.

Technical implementation of the integration involves seamless connection between Mirakl's seller management infrastructure and Criteo's advertising technology stack. The system must accommodate diverse retailer requirements while maintaining standardized campaign management interfaces for advertisers operating across multiple marketplace environments.

Data integration between platforms enables unified reporting and billing systems that simplify campaign management for advertisers participating in multiple retail media programs. This consolidation reduces administrative overhead while providing comprehensive performance visibility across different marketplace partnerships.

The collaboration represents strategic positioning for both companies as marketplace advertising matures. Early adopters of comprehensive automation solutions gain advantages in advertiser acquisition and retention as the sector becomes increasingly competitive.

For retailers evaluating marketplace monetization strategies, the integration offers immediate access to previously inaccessible advertiser segments without requiring internal technology development or expanded sales teams. The plug-and-play approach enables rapid deployment across existing marketplace infrastructure.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Key Terms

Retail Media Networks: Advertising platforms operated by retailers that enable brands to promote products directly within the retailer's digital ecosystem. These networks leverage first-party shopping data and high-intent consumer environments to deliver targeted advertising across retailer websites, mobile apps, and related digital properties. Unlike traditional advertising platforms, retail media networks operate within active shopping environments where consumers demonstrate immediate purchase intent.

Mid-to-Long-Tail Advertisers: Smaller brands and marketplace vendors who represent modest individual advertising budgets but collectively constitute significant market opportunity. These advertisers typically lack the scale or resources for premium managed service relationships, requiring self-service platforms and automated campaign management tools. The "long tail" concept describes the large number of niche advertisers that exist beyond the major brands dominating traditional advertising channels.

Third-Party Sellers: Independent merchants who sell products through marketplace platforms operated by other companies, such as Amazon, eBay, or retailer-operated marketplaces. These sellers maintain their own inventory and business operations while leveraging the marketplace's infrastructure, customer base, and advertising capabilities. Third-party sellers often face unique advertising challenges due to limited direct customer relationships and dependence on platform-specific promotional tools.

Contribution ex-TAC: A financial metric representing revenue minus traffic acquisition costs, effectively measuring the gross profit generated from advertising operations. TAC (Traffic Acquisition Costs) includes payments to publisher partners, affiliate commissions, and other direct costs associated with acquiring advertising inventory. This metric provides clearer insight into advertising platform profitability by excluding variable acquisition expenses that fluctuate with campaign volume.

Ad Serving Technology: The technical infrastructure responsible for selecting, delivering, and tracking digital advertisements in real-time. This technology processes bid requests, evaluates targeting criteria, selects winning advertisements, and serves creative content to users within milliseconds. Modern ad serving systems incorporate machine learning algorithms, fraud detection mechanisms, and performance optimization capabilities to maximize campaign effectiveness.

Commerce Media Platform: Integrated advertising technology that combines commerce data, inventory management, and advertising capabilities within unified systems. These platforms leverage transactional data, product catalogs, and shopping behavior patterns to enable more precise targeting and measurement than traditional advertising networks. Commerce media platforms typically serve both retailers seeking advertising revenue and brands pursuing sales-driven marketing objectives.

Marketplace Monetization: The process of generating revenue from marketplace operations beyond transaction fees, primarily through advertising and promotional services. This includes sponsored product listings, display advertising, brand store development, and data licensing opportunities. Effective marketplace monetization requires balancing advertiser demand with user experience while maintaining competitive pricing that attracts both sellers and buyers.

Self-Service Campaign Management: Automated advertising platforms that enable advertisers to create, optimize, and manage campaigns without dedicated account management support. These systems provide user interfaces for budget allocation, targeting configuration, creative upload, and performance monitoring. Self-service platforms typically incorporate algorithmic optimization and simplified workflows designed for users with varying levels of advertising expertise.

Programmatic Advertising: Automated buying and selling of digital advertising inventory through real-time bidding systems and algorithmic decision-making. This technology enables precise audience targeting, dynamic pricing, and campaign optimization across multiple advertising channels simultaneously. Programmatic systems process millions of bid requests daily, using data signals and machine learning to optimize campaign performance in real-time.

AI-Automated Campaign Execution: Advanced systems that use artificial intelligence to manage advertising campaigns with minimal human intervention. These systems analyze performance data, adjust bidding strategies, optimize targeting parameters, and allocate budgets across channels based on predicted outcomes. AI automation enables sophisticated campaign management at scale while reducing the manual oversight traditionally required for effective advertising operations.

Subscribe the PPC Land newsletter ✉️ for similar stories like this one. Receive the news every day in your inbox. Free of ads. 10 USD per year.

Timeline

- July 12, 2021: Criteo acquires Mabaya, marketplace monetization specialist, expanding Commerce Media Platform capabilities for sponsored products and retail media

- April 15, 2022: Criteo launches self-service retail media platform in the U.S. and Canada, enabling advertisers to buy ads across retailers at scale

- March 29, 2024: Criteo achieves MRC accreditation for retail media measurement, validating display rendered impressions and clicks across environments

- November 18, 2024: Criteo unveils strategic growth plans at retail media investor update, presenting long-term vision and AI-driven innovation strategy

- February 13, 2025: Criteo reports record profits with retail media revenue reaching $250 million milestone in 2024, growing 23% in Q4

- May 3, 2025: Criteo announces major client relationship changes impacting revenue outlook while maintaining strong financial position

- June 13, 2025: Criteo partners with dentsu for global commerce media expansion, integrating AI-powered platforms for enhanced campaign performance

- June 17, 2025: Criteo debuts auction-based display ads for retail media, introducing programmatic bidding to retail environments with clients including Costco and Shipt

- July 17, 2025: Criteo and Mirakl Ads announce global integration to accelerate marketplace revenue growth, targeting mid-to-long-tail advertisers in $204B retail media industry