AWS becomes central infrastructure for advertising beyond Amazon's own business

AWS RTB Fabric announcement on October 23 reveals Amazon's strategy to control advertising infrastructure, with cloud services generating 70% of company profits.

Amazon Web Services announced AWS RTB Fabric on October 23, 2025, revealing the extent to which cloud infrastructure has become central to the company's advertising ambitions. Rather than competing solely for advertising dollars, Amazon positions itself as the underlying technology provider for the entire digital advertising industry.

Industry analyst Karsten Weide states, "AWS is absolutely central to Amazon's advertising play. They are already making a lot of money, but they are also controlling more and more of the infrastructure that powers how digital ads are bought, sold, and measured. That translates into long-term strategic strength."

The numbers support this assessment. AWS generated $30.9 billion in revenue and $10.2 billion in operating income last quarter, accounting for roughly 70% of Amazon's total profit. While Amazon's advertising business attracts attention for its rapid growth, the infrastructure layer provides the majority of the company's profitability.

AWS RTB Fabric operates as a specialized computing environment built inside Amazon AWS to host and move real-time bidding traffic—the trillions of bid requests and responses that flow between advertising technology vendors, advertisers, and publishers. The service includes 'RTB Broker,' which Amazon claims can cut integration times between advertising technology partners from months to hours. AWS launched this infrastructure with immediate availability in six AWS Regions.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

The service delivers bid requests at single-digit millisecond latency and can reduce networking costs associated with real-time bidding by up to 80% compared to standard cloud rates, according to Amazon. Transaction-based pricing per billion transactions creates a model where Amazon benefits from the growth of programmatic advertising regardless of which platforms capture advertiser spending.

Understanding AWS RTB Fabric architecture

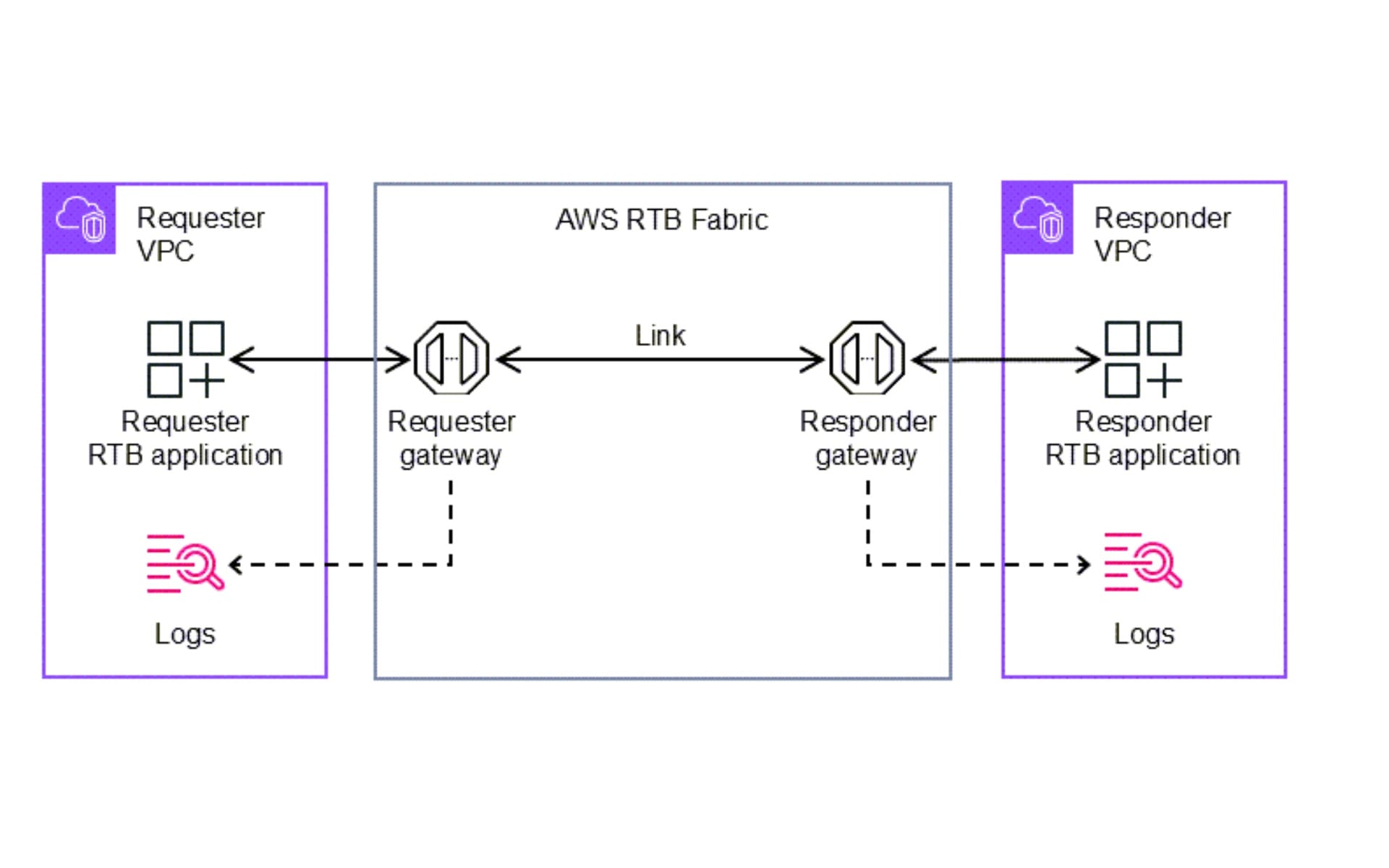

AWS RTB Fabric operates as connecting infrastructure between real-time bidding applications rather than hosting applications directly. The service provides secure, low-latency pathways that enable bidirectional communication through a request-response model. One application sends OpenRTB requests to another application and receives responses while RTB Fabric maintains the infrastructure layer.

The architecture consists of several AWS-managed components. Requester gateways serve as network endpoints that operate colocated with customer Virtual Private Clouds to facilitate secure communication from requester applications to RTB Fabric infrastructure. These gateways route outbound bid requests and receive responses without hosting, storing, or processing customer application logic or business data.

Links function as AWS-managed connection components within RTB Fabric infrastructure that enable secure, bidirectional communication between requester and responder gateways. Requester gateways create links that must be accepted by the AWS account owning the target responder gateway before becoming active. The link establishment process requires requester gateway owners to obtain the target responder gateway ID directly from their RTB Fabric partners—AWS does not provide gateway IDs.

Responder gateways operate as network endpoints colocated with customer VPCs to facilitate secure communication from RTB Fabric infrastructure to responder applications. These gateways route inbound bid requests and return responses while maintaining the same architectural principle: AWS manages the infrastructure without accessing customer application logic or business data.

The service supports three distinct connectivity patterns. Internal-to-internal connections involve both requester and responder applications as RTB Fabric customers, with single applications on each end of the link. A typical example involves a supply-side platform connecting to a demand-side platform where both use RTB Fabric infrastructure.

External-to-internal patterns accommodate requester applications outside RTB Fabric—applications not operating as RTB Fabric customers—that may represent multiple systems located on or outside AWS. These external requester applications send requests to RTB Fabric requester gateways, which forward them through links to RTB Fabric responder gateways. An SSP not using AWS can connect to a DSP that uses RTB Fabric through this pattern.

Internal-to-external configurations allow requester applications to send requests through RTB Fabric infrastructure to external responder gateways. These external gateways forward requests to single responder applications outside RTB Fabric that can be located on or outside AWS. The pattern enables SSPs using RTB Fabric to connect with DSPs not operating on AWS infrastructure.

RTB Fabric requires IPv6 support exclusively. Customers must ensure sufficient free IPv6 addresses in each VPC subnet where they plan to connect gateways. The number of required addresses depends on expected traffic scale. The service supports single Availability Zone deployment by default, with multi-AZ deployment available as an optional configuration that may require service quota increases.

Security group configuration varies by role. Requesters require HTTPS (TCP port 443) inbound from VPC CIDR range or compute instance IP addresses. Responders need HTTPS (TCP port 443) inbound to VPC CIDR range or fleet endpoint IP addresses. Network access controls, security groups, and routes must prevent unauthorized access within AWS accounts.

DNS configuration requirements differ between roles. Requesters must set DNS TTL values to 30 seconds for clients sending requests to the service. This configuration ensures proper routing and failover capabilities within RTB Fabric infrastructure.

Modules represent configurable components that process RTB traffic flowing through links to implement rate limiting, filtering, error handling, and traffic management capabilities. RTB Fabric provides built-in modules for rate limiting, OpenRTB filtering, and error masking available at no additional charge. Customers configure modules using the RTB Fabric API, with Rate Limiter controlling request volume, OpenRTB Filter validating message formats, and Error Masking managing response handling.

These modules execute inline within the AWS RTB Fabric environment, maintaining network-speed performance without adding application-level latency. All configurations are managed through the AWS RTB Fabric API, enabling programmatic definition and updates as workloads scale. Flows define how RTB requests are processed as part of link configuration, created using the UpdateLinkModuleFlow operation. Default flows are created with links, but customers can update flows with additional modules for specific behaviors.

Optional logging capabilities allow both requester and responder sides to independently configure log delivery through sampling rates for error logs and filter logs. Logs can be delivered to external AWS services including Amazon CloudWatch Logs or Amazon S3. Log delivery requires setup of log delivery sources, destinations, and appropriate IAM permissions. RTB Fabric does not store logs within its infrastructure—they flow directly to customer-specified destinations.

Most RTB auctions must complete within 200-300 milliseconds, requiring reliable, high-speed exchange of OpenRTB requests and responses among multiple partners. Advertising technology companies process millions of bid requests per second across publishers, supply-side platforms, and demand-side platforms. These workloads demonstrate high sensitivity to latency at every stage of the transaction process.

Historically, companies addressed latency requirements by deploying infrastructure in colocation data centers near key partners. This approach reduced latency but added operational complexity, long provisioning cycles, and high costs. Alternative approaches using cloud infrastructure provided elasticity and scale but often faced complex provisioning, partner-specific connectivity requirements, and long-term commitments to achieve cost efficiency.

AWS RTB Fabric eliminates these trade-offs by providing managed private network infrastructure built specifically for RTB workloads. The service delivers consistent performance, simplifies partner onboarding, and achieves predictable cost efficiency without requiring customers to maintain colocation facilities or custom networking setups. The infrastructure layer remains AWS-managed while customers maintain complete control over applications, data, and bidding decisions.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Cloud infrastructure defines competitive positioning

The AWS infrastructure advantage extends beyond technical specifications. Advertising technology vendors historically faced expensive choices: building and maintaining their own data centers or accepting higher costs and latency from generic cloud services. AWS RTB Fabric eliminates this dilemma by providing specialized infrastructure optimized specifically for advertising technology workloads.

This represents the second phase of Amazon's infrastructure strategy in advertising. The first phase involved building AWS as the dominant cloud computing platform, establishing relationships and technical dependencies with thousands of companies across industries. The second phase leverages that foundation to create advertising-specific infrastructure that reinforces AWS's central position.

According to Florian Clemens of Tesco Media and Insights, "Amazon defaults to building platforms." This pattern appears consistently: Amazon operates retail stores while providing e-commerce infrastructure through AWS to competitors like Shopify merchants. Amazon runs a massive advertising business while simultaneously selling the infrastructure that powers competing advertising platforms.

The approach creates strategic advantages that compound over time. Each advertising technology vendor that adopts AWS RTB Fabric increases Amazon's visibility into industry technical requirements, performance benchmarks, and competitive dynamics. This information asymmetry provides Amazon with market intelligence that purely advertising-focused competitors cannot access.

AWS's central role in advertising infrastructure means Amazon captures revenue from advertising transactions even when advertisers deliberately avoid Amazon's own advertising products. A brand spending money through Google Display & Video 360 or The Trade Desk likely processes those transactions through AWS infrastructure. The toll booth exists regardless of which highway drivers choose.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Infrastructure investment despite market uncertainties

The AWS infrastructure strategy proves resilient even amid questions about real-time bidding's long-term relevance. Bryan Gildenberg, Confluencer and Retail Insights Leader, questions whether "all this RTB talk is the ultimate in 'faster horse' technology from the Biddable Media Industrial Complex...given the daily diminishing in importance of keyword-based advertising?"

Gildenberg identifies a contradiction: Amazon invests in optimizing real-time bidding infrastructure while underlying technologies—keyword targeting and third-party cookies—face obsolescence. The advertising industry increasingly prioritizes first-party retailer data and full-funnel measurement over traditional programmatic mechanisms.

Yet this contradiction reveals AWS's strategic position. Ben Foulkes of Kevel argues that for advertising technology companies, buying into RTB Fabric means going "out of the furnace into the fire." Foulkes contends that "many are blinkered by an over reliance on 'RTB' as a fix for-all. For established retailers or publishers' independent technology is a priority in safeguarding their businesses."

The infrastructure layer, however, remains valuable regardless of which specific advertising technologies dominate. AWS provides the computing environment, networking, data storage, and processing power that advertising platforms require. Whether the future involves real-time bidding, retail media networks, or entirely different mechanisms, those systems require cloud infrastructure to operate at scale.

The retail media sector projects growth to exceed $300 billion by 2030, capturing 20% of global advertising revenue. This growth relies on first-party data and closed-loop measurement rather than traditional real-time bidding. Yet retail media platforms require infrastructure to process transactions, store data, and serve advertisements—functions that AWS provides through multiple services beyond RTB Fabric.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

AWS infrastructure creates defensible competitive advantages

AWS's central position in advertising infrastructure creates advantages that extend beyond individual product launches. As Gildenberg observes, "Amazon's superpower is their ability to build an express lane with a toll booth literally anywhere on the information and commerce superhighway where one doesn't exist. They're the WD-40 of commerce—a simple solution to remove friction wherever you find it."

AWS RTB Fabric exemplifies this approach. The service removes friction from programmatic advertising infrastructure while establishing Amazon as the essential intermediary. Advertisers spending money through Google, The Trade Desk, or any major advertising platform increasingly process those transactions through Amazon's cloud network. The infrastructure layer captures value from advertising growth regardless of which specific platforms advertisers prefer.

This infrastructure-first strategy insulates Amazon from market volatility in ways that purely advertising-focused businesses cannot replicate. Google and Meta depend on advertising revenue for the majority of their profits. Amazon's advertising business contributes to overall growth, but AWS provides the profit foundation. When advertising markets contract, Amazon maintains infrastructure revenue. When advertising markets expand, Amazon benefits both from increased advertising spending and from higher infrastructure utilization.

The AWS ecosystem extends far beyond RTB Fabric. Amazon introduced Amazon Retail Ad Service in January 2025, built on AWS infrastructure, enabling retailers to implement sponsored product advertisements using Amazon's technology. Major retailers including Macy's adopted this service, despite competitive concerns about empowering Amazon with access to their advertising ecosystems.

Each additional service built on AWS infrastructure reinforces the platform's central position. Retailers using Amazon Retail Ad Service depend on AWS. Advertising technology vendors using AWS RTB Fabric depend on AWS. Publishers using Amazon Publisher Cloud depend on AWS. These dependencies create switching costs and lock-in effects that compound over time.

The infrastructure centrality provides visibility advantages. AWS processes transactions, stores data, and powers applications across the advertising ecosystem. This positioning gives Amazon unparalleled insight into industry trends, technical requirements, performance benchmarks, and competitive dynamics. Competitors focusing solely on advertising products lack this comprehensive market visibility.

AWS foundation supports multiple advertising technology approaches

The AWS infrastructure enables Amazon to support multiple, sometimes competing, approaches to digital advertising simultaneously. RTB Fabric focuses on traditional programmatic mechanisms. Amazon Retail Ad Service addresses the shift toward retail media. Amazon Marketing Stream delivers performance data through AWS integration. Each service builds on the same underlying cloud infrastructure.

This diversified approach through a common infrastructure layer reduces risk while maximizing optionality. Multiple platforms began enabling real-time bidding for onsite retail media throughout 2025, addressing speed limitations that previously prevented programmatic solutions from working with sponsored products. These solutions require infrastructure to operate—infrastructure that AWS provides.

The Trade Desk established partnerships with retail media platforms like Koddi to provide unified access to sponsored product inventory. These integrations process transactions through cloud infrastructure. AWS's dominance in cloud computing means these workloads likely run on Amazon's infrastructure even when advertisers explicitly avoid Amazon's advertising products.

Privacy and security concerns drive additional infrastructure demand. Earlier in 2025, privacy organizations filed complaints about real-time bidding data practices, arguing that RTB systems expose sensitive data during automated advertising auctions. AWS RTB Fabric's private network architecture addresses these concerns by limiting data exposure during bid request transmission. The privacy infrastructure itself becomes a product that AWS sells.

Launch partners for AWS RTB Fabric include Amazon Ads, GumGum, Kargo, MobileFuse, Sovrn, TripleLift, Viant, and Yieldmo. These partnerships establish AWS as infrastructure standard for programmatic advertising, similar to how AWS became the infrastructure standard for e-commerce and software-as-a-service applications. Network effects strengthen as more partners integrate with the platform.

Infrastructure dependency reshapes competitive dynamics

AWS's central role in advertising infrastructure creates implications that extend beyond technical specifications or cost savings. Marketing professionals and advertising technology companies face decisions about infrastructure dependencies that carry strategic consequences for years.

Adopting AWS RTB Fabric provides immediate benefits: specialized infrastructure optimized for programmatic advertising, significant cost reductions compared to building proprietary systems, and millisecond-level latency performance. These advantages solve real problems that advertising technology vendors face daily. The infrastructure works better and costs less than alternatives.

However, infrastructure dependencies accumulate. Companies adopting AWS RTB Fabric become reliant on Amazon's technical capabilities, pricing structures, and strategic priorities. Switching costs increase over time as integrations deepen and workflows optimize around AWS-specific features. Amazon's unified advertiser accounts demonstrate how the company builds comprehensive ecosystems that integrate multiple services and touchpoints.

The competitive dynamics shift as AWS establishes itself as central infrastructure for advertising. Google and Microsoft compete in cloud computing, but AWS maintains dominant market share across most segments. In advertising infrastructure specifically, AWS's early positioning through services like RTB Fabric, Amazon Retail Ad Service, and Amazon Publisher Cloud creates advantages that competitors struggle to match.

Market concentration in infrastructure layers creates vulnerabilities. A single technical failure at Amazon Web Services knocked out 142 platforms for 15 hours on October 19-20, 2025, affecting millions of users and costing businesses billions in lost revenue. Advertising platforms depending on AWS infrastructure face similar concentration risks.

The information asymmetry deserves particular attention. As AWS processes more advertising transactions, stores more advertising data, and powers more advertising applications, Amazon gains comprehensive visibility into industry operations. This intelligence informs product development, pricing strategies, and competitive positioning across Amazon's entire advertising business. Competitors relying on AWS infrastructure inadvertently provide this market intelligence.

Industry initiatives like IAB Europe's commerce media standards aim to establish consistent frameworks across diverse retail environments. However, standardization efforts occur at the application layer while AWS controls the infrastructure layer. Standards may reduce fragmentation among advertising platforms while increasing dependence on underlying AWS services.

Measurement and attribution capabilities increasingly rely on cloud infrastructure. Clean room technologies enable privacy-preserving measurement while maintaining data separation between companies. These clean rooms typically operate on cloud infrastructure—often AWS—creating additional dependencies on Amazon's technical ecosystem.

The advertising technology industry faces a fundamental question: does centralizing infrastructure under AWS create efficiency gains that outweigh concentration risks? Cost savings prove immediate and quantifiable. Strategic vulnerabilities emerge gradually over years as dependencies deepen and alternatives become less viable.

AWS's central position in advertising infrastructure represents calculated positioning by Amazon. The service addresses immediate industry needs—specialized infrastructure, cost optimization, performance improvements—while establishing long-term strategic control. Whether real-time bidding, retail media, or entirely different mechanisms dominate future advertising, those systems require cloud infrastructure to operate at scale. AWS ensures Amazon benefits from advertising growth regardless of which specific platforms capture advertiser spending.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- June 2024: Amazon Publisher Cloud becomes generally available for streaming TV and web publishers in US and Canada

- January 9, 2025: Amazon launches Retail Ad Service at CES, enabling retailers to monetize their sites using Amazon's advertising technology

- July 24, 2025: Pentaleap and Teads announce first RTB solution for onsite sponsored products across retail networks

- September 2, 2025: Macy's partners with Amazon Retail Ad Service, expanding reach of Amazon's retail media technology

- September 4, 2025: Omdia research projects retail media will exceed $300 billion by 2030, capturing 20% of global advertising revenue

- October 9, 2025: The Trade Desk announces platform expansion enabling programmatic retail media buying through Koddi partnership

- October 23, 2025: Amazon Web Services announces AWS RTB Fabric with immediate availability in six AWS Regions

- October 23, 2025: LiveRamp expands measurement capabilities allowing retail media networks to analyze Meta advertising performance

- October 24, 2025: Amazon introduces unified advertiser accounts consolidating access to all advertising products

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Amazon Web Services announced AWS RTB Fabric, affecting advertising technology companies including supply-side platforms, demand-side platforms, publishers, and agencies processing real-time bidding transactions. Launch partners include Amazon Ads, GumGum, Kargo, MobileFuse, Sovrn, TripleLift, Viant, and Yieldmo. Industry analysts including Karsten Weide, Bryan Gildenberg from Confluencer, Florian Clemens from Tesco Media and Insights, and Ben Foulkes from Kevel provided perspectives on the announcement.

What: AWS RTB Fabric is a managed cloud network built specifically to handle high-speed, data-intensive transactions for programmatic advertising. The service hosts and moves real-time bidding traffic between advertising technology vendors, advertisers, and publishers. Key features include single-digit millisecond latency, up to 80% cost savings compared to standard cloud networking costs, transaction-based pricing per billion transactions, RTB Broker for simplified partner integration, and inline modules for traffic management and bid optimization. The infrastructure operates within Amazon Web Services and provides specialized computing environments for programmatic advertising transactions.

When: Amazon Web Services announced AWS RTB Fabric on October 23, 2025, with immediate availability in six AWS Regions. The announcement follows Amazon's January 2025 launch of Amazon Retail Ad Service and builds on the company's expanding advertising technology portfolio. The timing coincides with broader industry shifts toward retail media and programmatic infrastructure standardization.

Where: AWS RTB Fabric operates within Amazon Web Services infrastructure across six AWS Regions at launch. The service targets the global programmatic advertising market, with particular relevance for advertising technology vendors, retailers operating media networks, and brands managing programmatic campaigns. The infrastructure exists within Amazon's cloud computing environment rather than requiring colocated or on-premises infrastructure from partners.

Why: AWS RTB Fabric addresses costly infrastructure choices facing advertising technology vendors who previously split workloads between expensive owned infrastructure and cloud services that add latency. The service provides alternatives to building private infrastructure or accepting performance penalties from standard cloud services. For Amazon, AWS RTB Fabric positions the company at the infrastructure layer of digital advertising, ensuring media expenditures flow through Amazon's network even when advertisers don't purchase Amazon advertising inventory. With AWS generating 70% of Amazon's total profit, infrastructure services represent strategic priorities. The announcement extends Amazon's pattern of building platforms—operating within markets while simultaneously providing infrastructure to competitors, as demonstrated in e-commerce. Industry analysts note this approach establishes long-term strategic control over advertising technology infrastructure regardless of which specific mechanisms dominate future market evolution.