Australian travel sector surges as digital habits reveal strong growth trends

Digital audience data shows dramatic shifts in how Australians research and book travel options.

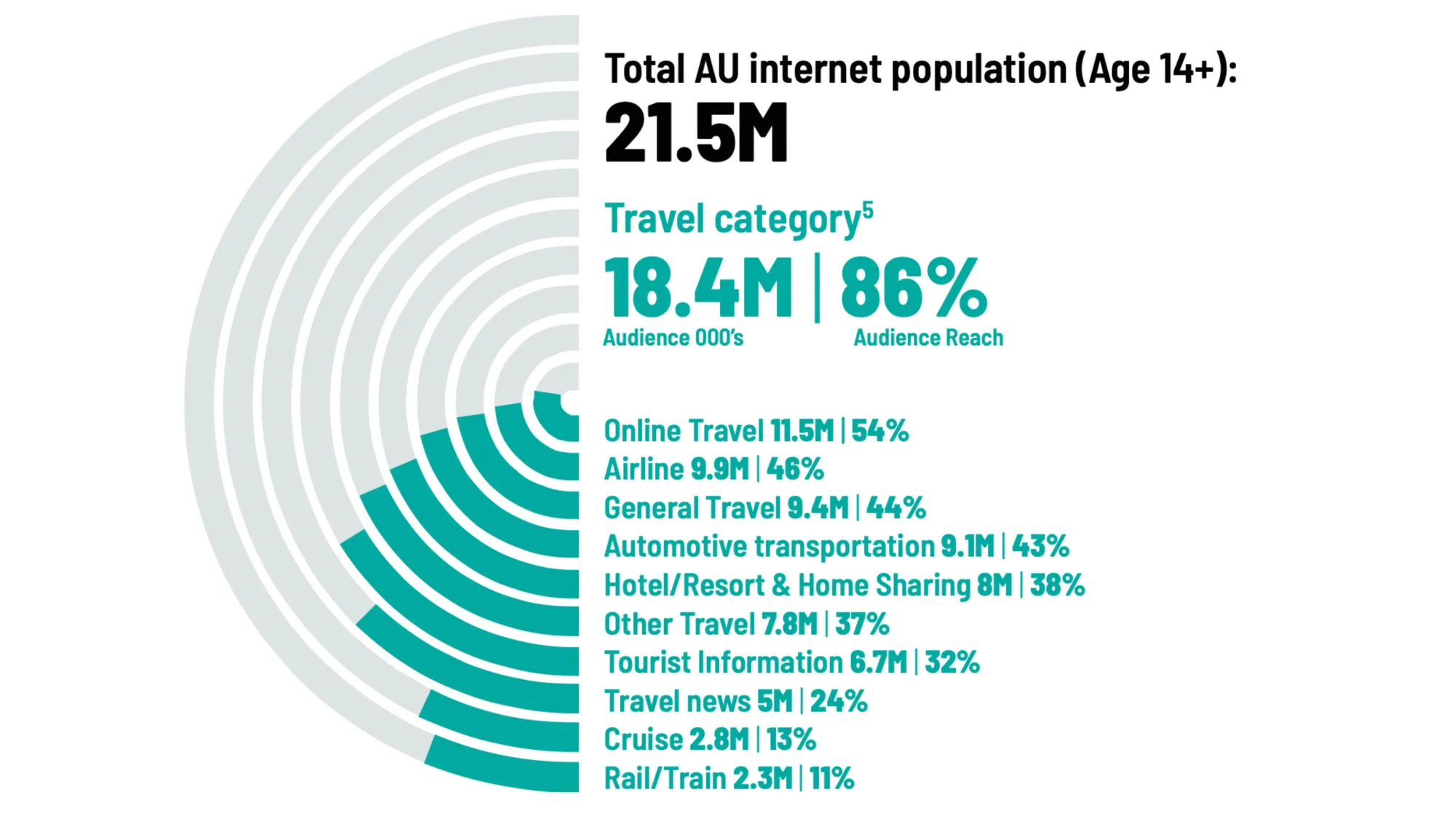

The latest Ipsos iris Travel Category Report, released in April, 2025, reveals significant growth in Australia's travel industry as demonstrated through digital behavior data. According to the report, airline website and app audiences increased by 12% year-over-year, while the total digital travel category audience grew by over 7% compared to December 2023.

The comprehensive analysis, which examines Australians' digital travel activity across websites and apps, provides detailed insights into changing consumer behaviors that directly impact marketing strategies across the travel industry.

The digital behavior patterns identified in the report align with real-world travel statistics. According to The Department of Home Affairs, "international departures by air and sea grew by 10% in the year to November 2024." This correlation between digital signals and actual travel outcomes provides marketers with valuable predictive insights for future planning.

Inbound tourism also shows robust growth, with "total overseas arrivals into Australia increasing by over 8% from 1.7M during December 2023 to 1.84M in December 2024," according to the report.

Demographic shifts driving growth

The data reveals fascinating demographic patterns behind the overall growth. Ipsos iris data shows that "year-over-year audience growth within the travel category is strongest among two distinct demographics: Australians under 24 years old and those aged 40 to 54, encompassing Generation Z and Generation X."

This bifurcated growth pattern suggests different motivations between these age groups. For younger Australians, the report notes this "may be their first opportunity to have an extended trip since Covid lockdowns," while for Generation X, "it could be a career break or long service leave."

Time spent on travel websites and apps has increased significantly, with Australians spending approximately 4 minutes more per month within the travel category than a year ago. Overall engagement metrics show a 7% increase in average minutes per person from 51.1 minutes in December 2023 to 54.7 minutes in December 2024.

Rail and automotive categories show strongest growth

Among the various travel subcategories, rail/train services demonstrated the most dramatic growth. "Rail/Train audience reach increased by 32% YoY," the report states, highlighting how "the introduction of new rail services and the gradual return to office-based working has increased the digital audiences of Rail and Train websites and apps."

Automotive travel websites and apps similarly grew (up 17% YoY), indicating a shift toward various transportation options. In fact, seven out of ten travel subcategories experienced increases in audience reach percentage.

The substantial growth in rail usage correlates with school holiday patterns and return-to-office trends. The report notes that "Rail/Train travel category correlates with school holiday off peaks and back to office. Audience drops during February, and again in July and tails off from Aug through the December 2024."

Mobile apps becoming essential to travel experience

One of the most significant findings concerns the growing dominance of travel apps. In December 2024, "travel apps accounted for over two thirds of total time spent in the Travel category." This data point underscores "the critical importance of engaging and well-designed feature-rich apps in the travel industry for customer retention and expansion."

Year-over-year, there has been a 15% increase in the number of Australians using travel-related apps, growing from 9.5 million in December 2023 to 10.9 million in December 2024.

The shift toward app usage varies by subcategory:

- Hotel, Resorts & Home sharing apps: 58% of total minutes in December 2024 vs. 56% in December 2023

- Online Travel apps: 46% of total minutes in December 2024 vs. 39% in December 2023

- Airline apps: 33% of total minutes in December 2024 vs. 32% in December 2023

Brand loyalty growing in ride-sharing sector

The report reveals interesting patterns in brand loyalty, particularly in the automotive ride-sharing space. "Consumers consolidated their preferred brands in the Ride Share and Taxi space," with clear increases in exclusive use of rideshare and taxi apps across the top three automotive app brands.

Exclusive user data shows significant shifts year-over-year:

- Uber: 75% exclusive users in December 2024 vs. 71% in December 2023

- DiDi: 41% exclusive users in December 2024 vs. 27% in December 2023

- 13cabs: 55% exclusive users in December 2024 vs. 45% in December 2023

This trend toward brand consolidation suggests consumers are finding their preferred services and sticking with them rather than comparison shopping across multiple platforms.

Online booking dominates while cruise sector struggles

The report highlights contrasting fortunes across different travel sectors. Online booking site Expedia demonstrated especially strong growth with a 45% increase in audience and 60% increase in total time spent year-over-year. Similarly, Agoda saw a 57% audience increase during the same period.

Meanwhile, the cruise sector shows signs of struggling amid economic pressures. "Australians are spending less digital time on the Cruise category. Audience size was stagnant, with total time and average min spent dropped by -33%." Individual cruise lines showed mixed results, with Princess seeing a 4% audience increase but a 40% decrease in time spent.

This disparity between growing digital booking platforms and struggling cruise operators likely reflects broader economic concerns, with the report noting that "Luxury Escapes saw a reduction in audience figures of -19%. This data illustrates the market conditions, with Australians willing to land on booking websites but perhaps reluctant on luxury travel."

Implications for marketers

These shifts in digital behavior carry significant implications for travel industry marketers. The data suggests several key strategies:

- Prioritize mobile app development and engagement, given the substantial shift toward app usage across most travel categories

- Target campaigns toward the two demographically distinct growth segments: Generation Z (under 24) and Generation X (40-54)

- Recognize the increased importance of transportation booking, particularly rail and automotive options

- Understand that economic pressures may be shifting consumers away from luxury travel options toward more DIY accommodation platforms

- Leverage the detailed demographic profiles identified in the report to better target specific audiences

As the report notes, "In these tough economic times, the travel sector can take many learnings from Ipsos iris. It can provide the sector with a holistic view of where Australians are going for travel support and information, what apps/sites they consume and how engaged they are."

Timeline

- January 2023: Ipsos iris launched in Australia as the IAB Australia endorsed digital measurement system

- November 2024: Department of Home Affairs data shows 10% growth in international departures

- December 2023 to December 2024: Total digital travel category audience increased by over 7%

- December 2023 to December 2024: International arrivals into Australia increased by 8%

- December 2023 to December 2024: Average time spent on travel websites/apps increased from 51.1 to 54.7 minutes per person

- December 2023 to December 2024: Rail/Train audience reach increased by 32%

- December 2023 to December 2024: Automotive travel websites/apps audience increased by 17%

- December 2023 to December 2024: Airline web/app digital audiences increased by 12%

- December 2024: Travel apps account for 64% of all time spent within the total Travel category

- April 21, 2025: Ipsos iris Travel Category Report published