Australian online ad spending surges 12.1% in Q3 2024

IAB Australia reports significant growth in online advertising revenue for Q3 2024, with video spending leading the surge due to Olympics coverage.

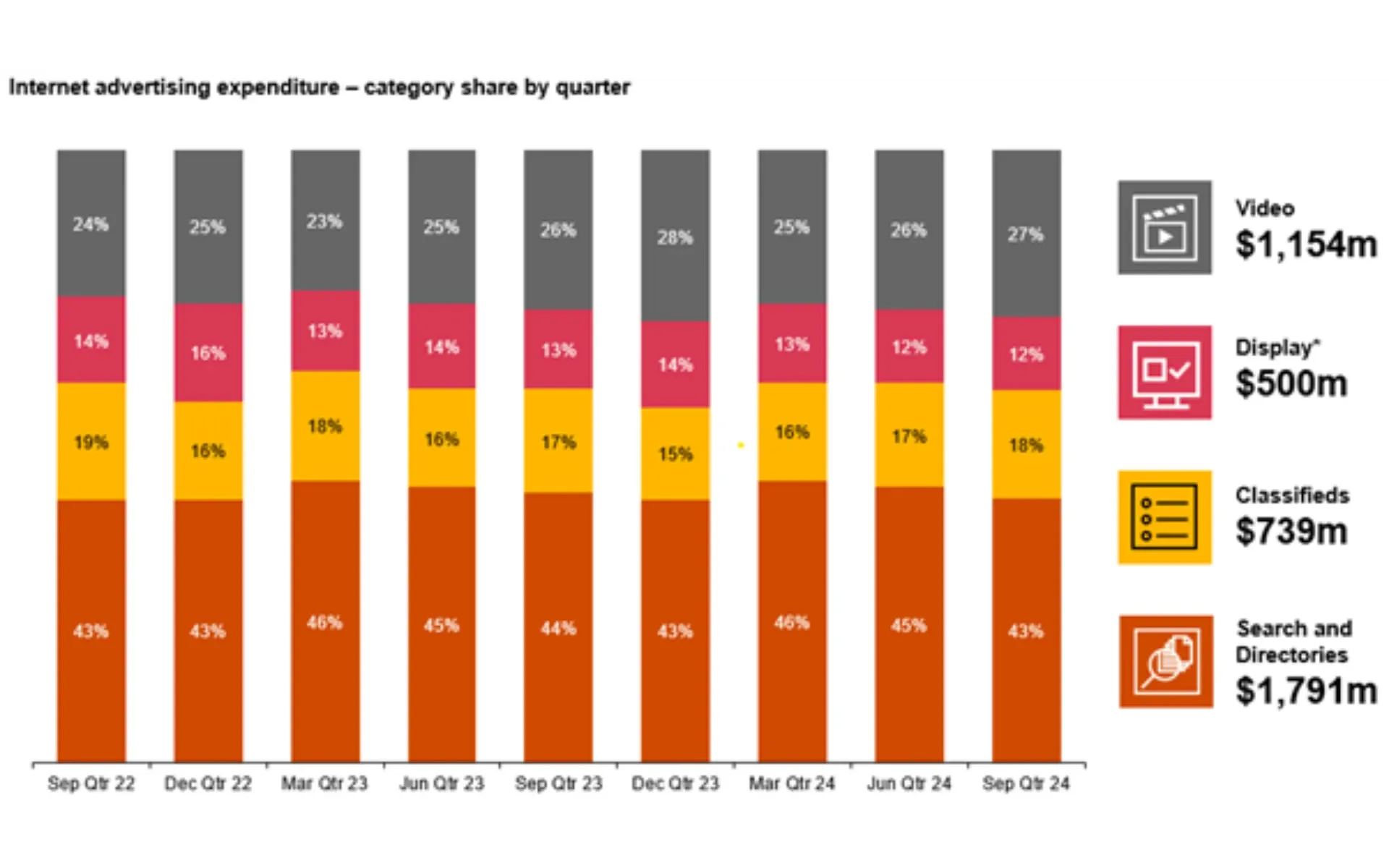

Online advertising expenditure in Australia demonstrated robust growth during the third quarter of 2024, reaching $4.2 billion, as revealed by the Interactive Advertising Bureau (IAB) Australia in its Internet Advertising Revenue Report released on November 25, 2024. The comprehensive analysis, prepared by PwC Australia, highlights who participated in the digital advertising landscape, what drove the growth, where the investments were made, when the changes occurred, why certain sectors outperformed others, and how different advertising formats performed during this period.

The digital advertising market experienced a significant year-on-year increase of 12.1%, primarily propelled by substantial investments in video advertising during the Olympics. According to the report, video advertising emerged as the standout performer, recording a remarkable 19.5% growth compared to the same quarter in 2023, with total spending reaching $1.15 billion.

The search and directories sector maintained its dominant position in the digital advertising landscape, accounting for 43 cents of every dollar spent on internet advertising. According to PwC Australia's analysis, search advertising revenue increased by 9.8% year-on-year, reaching $1.8 billion during the September quarter.

Classified advertising demonstrated strong performance, with expenditure rising by 13.8% to reach $700 million. The audio segment exhibited impressive growth, increasing by 16.2% to achieve $79 million in revenue. Display advertising showed more modest growth, increasing by 2.5% year-on-year to reach $500 million.

The Olympics significantly influenced the video advertising sector during the September quarter. According to the IAB Australia report, desktop devices captured 45% of video advertising expenditure, marking a substantial increase from previous quarters. Connected TV's share decreased to 44%, while mobile video advertising represented 11% of total video spending.

Social media platforms have established a significant presence in video advertising, now accounting for one-third of total video expenditure. This development reflects the growing importance of social media channels in video content distribution and advertising strategies.

The audio segment of internet advertising demonstrated notable development, particularly in podcast advertising. According to the IAB Australia data, podcast advertising experienced substantial growth, increasing its share of total internet audio advertising to 40%. This represents a 26.5% increase compared to the same period in 2023, indicating the growing significance of podcasts as an advertising medium.

The retail sector maintained its leadership position in general display advertising expenditure during the September quarter 2024. According to the IAB Australia report, retail commanded 18.1% of general display advertising, compared to 17.1% in the same quarter of 2023.

The automotive sector secured the second position with 13.5% of general display advertising expenditure, despite experiencing a slight decrease from 15.4% in the previous year. Financial services maintained steady performance, capturing 8.9% of general display advertising, showing a modest increase from 8.7% in the September quarter of 2023.

Entertainment and travel sectors rounded out the top five categories, securing 6.9% and 5.9% of general display advertising expenditure, respectively. The entertainment sector showed particular strength, increasing from 5.7% in the previous year.

Desktop devices demonstrated renewed strength in the video advertising sector, significantly increasing their share to 45% of video advertising expenditure. According to the IAB Australia data, this shift occurred while connected TV experienced a decrease in share to 44%, and mobile video advertising declined to 11% of total video spending.

According to Gai Le Roy, CEO of IAB Australia, the Olympics served as a crucial audience engagement driver during the quarter. The event's impact on advertising spend contributed significantly to the year-on-year growth in video inventory. The digital advertising market appears positioned for low double-digit growth for the calendar year, supported by consistent growth in search and social media advertising.

The telecommunications sector experienced the largest increase in share during the quarter, coinciding with new mobile device launches. According to the IAB Australia report, home products, services, and utilities categories demonstrated the strongest preference for video advertising formats.

Key Facts

- Total Q3 2024 online advertising expenditure: $4.2 billion

- Year-on-year growth: 12.1%

- Video advertising revenue: $1.15 billion (19.5% increase)

- Search advertising revenue: $1.8 billion (9.8% increase)

- Classified advertising revenue: $700 million (13.8% increase)

- Audio advertising revenue: $79 million (16.2% increase)

- Display advertising revenue: $500 million (2.5% increase)

- Desktop video advertising share: 45%

- Connected TV advertising share: 44%

- Mobile video advertising share: 11%

- Podcast advertising share of audio: 40%

- Retail sector share of display advertising: 18.1%

- Automotive sector share of display advertising: 13.5%

- Financial services sector share: 8.9%

- Entertainment sector share: 6.9%

- Travel sector share: 5.9%