Australia concludes major digital platform inquiry with 35 recommendations

Australia's competition regulator delivers final assessment calling for new digital competition regime after five-year investigation.

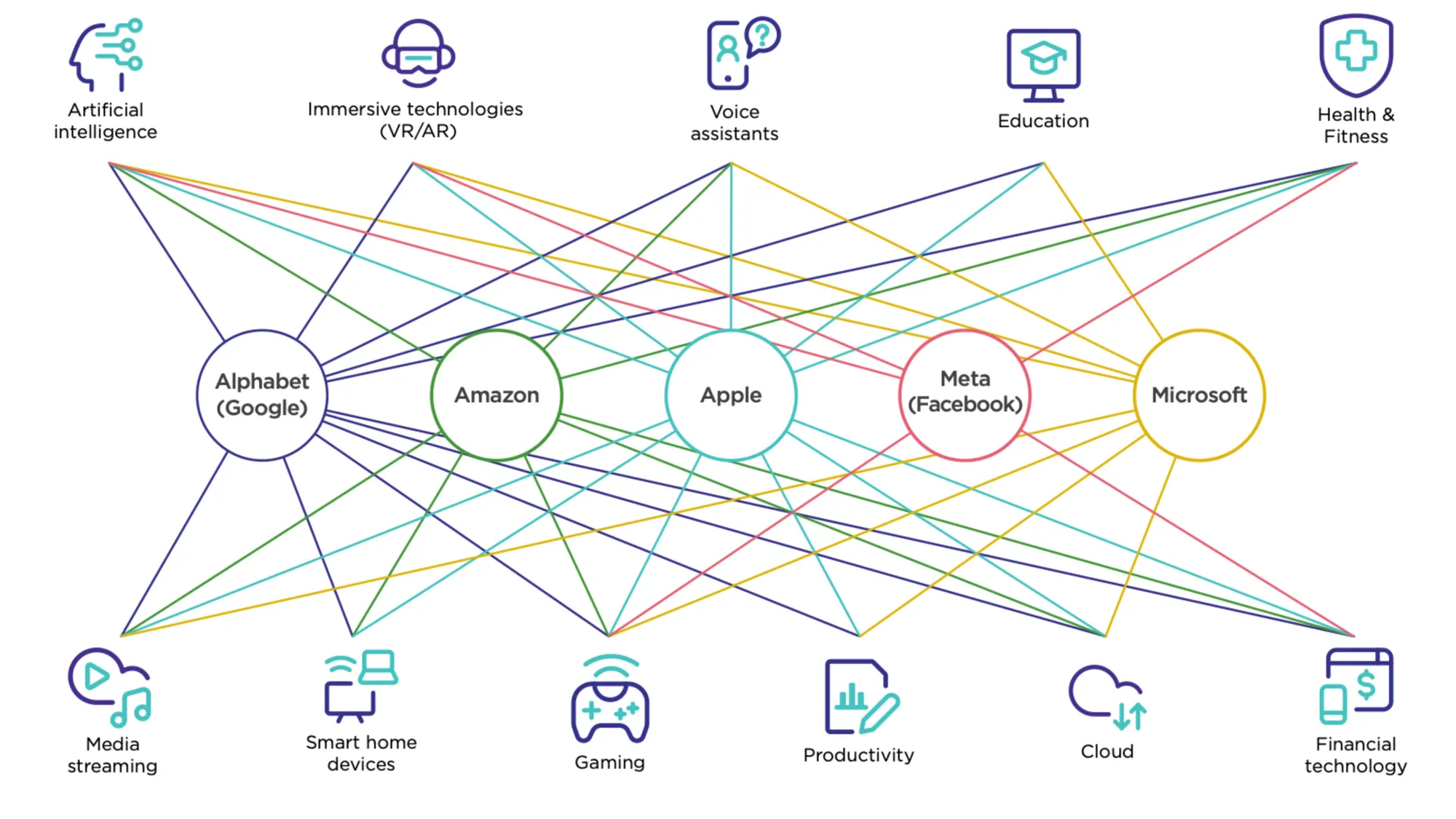

Australia's Competition and Consumer Commission concluded its comprehensive Digital Platform Services Inquiry on 31 March 2025, delivering 35 recommendations across five years of investigation into digital platform markets. According to the final report, the inquiry examined competition and consumer issues spanning search services, social media, app marketplaces, cloud computing and generative artificial intelligence.

The ACCC launched its Digital Platform Services Inquiry in 2020 following an earlier Digital Platforms Inquiry that began in 2017. According to the report, the commission published 14 reports across these inquiries, making recommendations spanning competition law, consumer protection, media regulation and privacy law. The inquiry was mandated to be completed by 31 March 2025 under subsection 95K(1) of the Competition and Consumer Act.

Get the PPC Land newsletter ✉️ for more like this.

Summary

Who: Australia's Competition and Consumer Commission conducted the inquiry, with the Australian Government responding through policy reforms and the proposed digital competition regime.

What: A comprehensive five-year investigation into digital platform services, producing 35 recommendations across competition law, consumer protection, media regulation and privacy law, concluding with a final report calling for new regulatory measures.

When: The Digital Platform Services Inquiry ran from 2020 to 31 March 2025, building on earlier investigations beginning in 2017, with the Government announcing its digital competition regime consultation on 2 December 2024.

Where: The inquiry examined Australian digital platform markets while analyzing international developments across European Union, United Kingdom, Germany and other jurisdictions implementing similar regulatory frameworks.

Why: The investigation addressed lack of effective competition in digital platform markets, consumer protection concerns including scams and manipulative practices, and the need for Australia to keep pace with international regulatory developments while protecting local consumers and businesses.

Government advances digital competition framework

The Australian Government announced consultation on a proposed digital competition regime on 2 December 2024, running until 14 February 2025. According to the final report, this proposed framework would introduce new competition measures for certain "designated" digital platforms through service-specific codes of conduct. The framework addresses anti-competitive conduct including self-preferencing, tying arrangements and barriers to switching between services.

The Government identified three economy-wide notification thresholds for acquisitions. According to the report, these include a monetary threshold requiring notification when combined Australian turnover reaches $200 million, a targeted threshold for large acquirers with $500 million turnover buying smaller businesses worth $10 million, and a three-year cumulative threshold for acquisitions totaling $50 million in the same sector.

Digital platforms with substantial market positions would face obligations addressing anti-competitive self-preferencing, exclusive arrangements and data-related barriers to entry. According to the ACCC, these measures aim to promote effective competition and unlock innovation while providing better services for Australian consumers and businesses.

Major platforms implement European compliance changes

European Union Digital Markets Act requirements drove significant platform modifications throughout 2024. According to the report, designated gatekeepers including Google, Apple, Meta and Amazon implemented changes affecting search results, app distribution and data sharing practices. These changes provide insights into potential compliance approaches for Australia's proposed regime.

Google introduced choice screens for Android search engines and enabled alternative billing systems for app purchases in the European Economic Area. According to the report, Google also implemented numerous changes to search results, including carousels for travel and shopping queries and aggregator units directing users to specialized content sites. In September 2024, Google announced users would no longer require Gmail accounts to set up Android devices.

Meta announced interoperability features for WhatsApp and Facebook Messenger in the EU, enabling end-to-end encrypted messaging between platforms. According to the report, Meta stated it would provide one-to-one text messaging and file sharing between individual users across different messaging services. The company also introduced consent prompts for data sharing between Amazon services and expanded data portability tools.

Apple faced scrutiny over app marketplace restrictions and interoperability requirements. According to the report, Apple expressed concerns that DMA requirements could compromise product security and privacy. The company noted regulatory uncertainties had already delayed artificial intelligence technology rollouts in European markets.

Cloud computing market concentration raises concerns

The inquiry identified significant concentration in cloud computing infrastructure markets. According to the report, Amazon Web Services held approximately 31% of global cloud infrastructure revenue in 2024, followed by Microsoft Azure at 25% and Google Cloud at 11%. Three major providers control approximately two-thirds of the global market, raising competition concerns about customer switching costs and data portability.

Hyperscale cloud providers increasingly partner with artificial intelligence developers through exclusive arrangements. According to the report, Microsoft invested up to $13 billion in OpenAI and became its primary cloud provider, while Amazon invested $8 billion in Anthropic for similar arrangements. These partnerships grant preferential access to foundation models and include revenue-sharing agreements.

The report notes that established platforms possess competitive advantages in generative AI development through access to proprietary user data. According to the ACCC, this creates potential barriers for new entrants lacking similar data resources. Large platforms can integrate AI capabilities across existing services, potentially strengthening their market positions.

Advertising technology services face ongoing scrutiny

The inquiry continued monitoring advertising technology markets where Google maintains dominant positions. According to the report, Google operates across the advertising supply chain through its search advertising, display advertising network and ad tech services. This vertical integration enables Google to compete with publishers and advertisers while operating the infrastructure they depend upon.

The ACCC identified concerns about self-preferencing in advertising auctions and lack of transparency in pricing mechanisms. According to the report, these issues affect competition between advertising technology providers and pricing for advertisers and publishers. The commission supports implementing service-specific codes addressing these competitive dynamics.

European Commission investigations target Google's advertising practices through multiple proceedings. According to the report, the Commission opened formal investigations into Google's advertising technology services and search advertising policies. These cases examine whether Google abused dominant positions to favor its own services over competitors.

Consumer protection measures advance across sectors

The Government implemented several consumer protection reforms responding to ACCC recommendations. According to the report, new legislation establishes the National Anti-Scam Centre within the ACCC and enacts the Scams Prevention Framework Act 2025. These measures address scam activity across digital platforms and telecommunications services.

Unfair contract terms provisions received enhanced penalties taking effect in November 2023. According to the report, the Government announced further consultation on unfair trading practices protections, including prohibitions on subscription traps and manipulative online practices. These reforms aim to address consumer harms identified across digital platform services.

The inquiry examined fake reviews and review manipulation affecting online marketplaces. According to the report, truthful reviews provide important information for consumers, but manipulated reviews can lead to purchasing unsuitable or harmful products. The ACCC supports mandatory processes for preventing and removing fake reviews across digital platforms.

Gaming platforms present emerging consumer concerns

Online gaming services increasingly employ monetization techniques that may harm consumers. According to the report, these include loot boxes containing randomized virtual items, battle passes requiring completion within limited timeframes, and timed events leveraging scarcity to encourage spending. Daily login rewards and limited-time offers create psychological pressure for continued engagement.

The ACCC identified concerns about consumer understanding of digital game licensing restrictions. According to the report, consumers typically access games through digital stores rather than physical purchases, but may lack awareness about licensing limitations affecting game access and ownership rights. These issues require consideration under proposed consumer protection measures.

Gaming platforms collect extensive personal data from users including gameplay patterns, purchase history and social interactions. According to the report, this data collection enables targeted advertising and may influence game design decisions affecting player behavior. The inquiry supports applying digital platform obligations to gaming services where appropriate.

Get the PPC Land newsletter ✉️ for more like this.

International coordination influences Australian approach

Australia's proposed digital competition regime reflects international developments across multiple jurisdictions. According to the report, the European Union's Digital Markets Act, United Kingdom's Digital Markets, Competition and Consumers Act, and German Competition Act Section 19a provide models for ex ante regulation of digital platforms.

Several stakeholders expressed preference for Australia adopting service-specific approaches rather than broad horizontal rules. According to the report, submissions from TikTok, Microsoft, Skyscanner and Match Group supported tailored obligations addressing specific competition issues relevant to each platform type. This approach allows flexibility while maintaining clear compliance standards.

The ACCC notes risks from regulatory fragmentation if jurisdictions adopt incompatible requirements. According to the report, coordination between international regulators helps ensure consistent approaches while allowing local customization addressing specific market conditions. Australia aims to keep pace with international developments while maintaining proportionate responses.

Merger notification regime introduces new thresholds

The Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024 received Royal Assent on 10 December 2024. According to the report, this creates mandatory notification obligations for acquisitions meeting specified thresholds, with the ACCC as primary decision maker rather than the Australian Competition Tribunal.

The new regime becomes effective 1 January 2026, with voluntary notifications available from 1 July 2025. According to the report, Treasury will review threshold levels twelve months after implementation to ensure appropriate coverage. While not specifically targeting digital platforms, acquisitions by major platforms likely meet notification requirements.

Three-year cumulative thresholds address strategic acquisition patterns by large firms. According to the report, these provisions capture acquisitions where individual transactions fall below standard thresholds but collectively represent significant market concentration. The approach addresses "killer acquisition" strategies aimed at eliminating potential competitors.

Media sector receives targeted funding support

The Government announced $180.5 million investment supporting local news and community broadcasting on 16 December 2024. According to the report, this includes launching the News Media Assistance Program and providing additional community broadcasting funding. These measures address concerns about news media sustainability in digital platform environments.

Additional funding of $116.7 million over four years supports news organizations delivering public interest journalism. According to the report, these investments aim to build sustainability and capacity for local news serving Australian communities. The measures complement existing programs supporting regional and multicultural publishers.

The ACCC's previous recommendations included grants for local journalism and improving digital media literacy. According to the report, successive governments implemented various support programs including the Public Interest News Gathering program with $50 million funding and regional publisher assistance during COVID-19. These initiatives provided funding to 107 regional publishers and broadcasters.

Get the PPC Land newsletter ✉️ for more like this.

Timeline

- 2017: ACCC begins original Digital Platforms Inquiry

- 2020: Digital Platform Services Inquiry commences under ministerial direction

- 28 April 2021: ACCC releases second interim report on app marketplaces

- 28 October 2021: Third interim report examines search defaults and choice screens

- 28 April 2022: Fourth interim report focuses on general online retail marketplaces

- 11 November 2022: Fifth interim report recommends regulatory reforms

- 28 April 2023: Sixth interim report analyzes social media services

- 27 November 2023: Seventh interim report examines expanding platform ecosystems

- 21 May 2024: Eighth interim report covers data products and services

- 2 December 2024: Government announces consultation on digital competition regime

- 4 December 2024: Ninth interim report revisits general search services

- 10 December 2024: Treasury Laws Amendment (Mergers and Acquisitions Reform) Act receives Royal Assent

- 16 December 2024: Government announces $180.5 million investment in local news

- 14 February 2025: Digital competition regime consultation concludes

- 31 March 2025: ACCC delivers final report completing Digital Platform Services Inquiry