Amazon advertising hits $17.7B as AWS accelerates with Anthropic AI cluster

Amazon advertising revenue reached $17.7 billion in Q3 2025, growing 22% year-over-year. AWS hit $33 billion with Project Rainier running Anthropic Claude models.

Amazon reported third quarter results on October 30, 2025, showing advertising revenue reached $17.7 billion with 22% year-over-year growth. The company's total net sales climbed to $180.2 billion, representing 12% growth excluding foreign exchange impacts. AWS revenue accelerated to $33 billion, marking the cloud division's fastest growth rate in 11 quarters at 20.2% year-over-year.

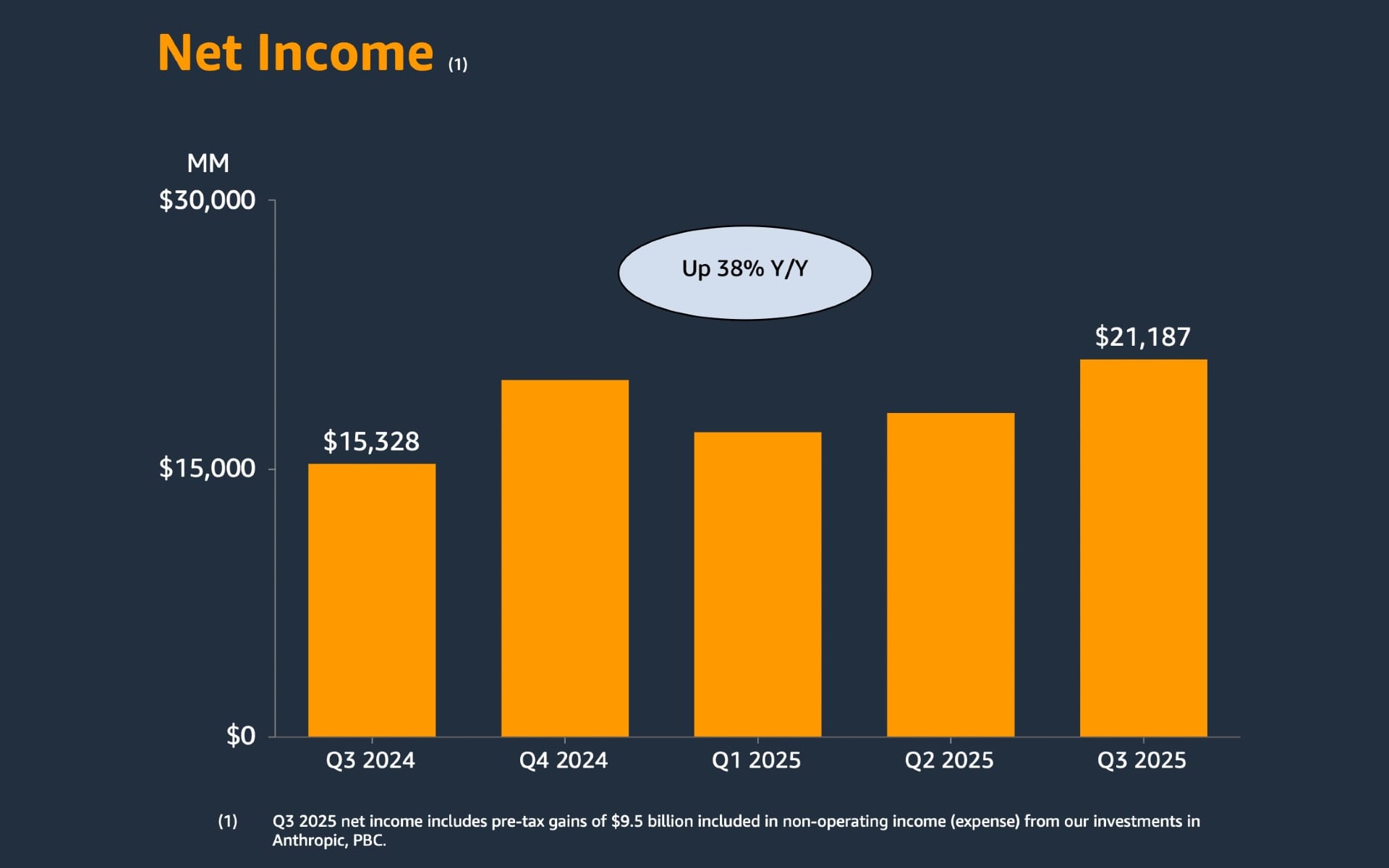

Operating income totaled $17.4 billion for the quarter. Two special charges reduced this figure: a $2.5 billion settlement with the Federal Trade Commission and $1.8 billion in estimated severance costs from planned role eliminations. Without these charges, operating income would have reached $21.7 billion. Net income climbed to $21.2 billion, or $1.95 per diluted share, compared with $15.3 billion in the same period last year.

The advertising performance marked the third consecutive quarter of accelerating growth. Amazon's Q2 2025 advertising revenue reached $15.7 billion, representing 22% year-over-year expansion. The consistent acceleration demonstrates strengthening advertiser demand across the company's full-funnel advertising portfolio spanning Amazon's retail marketplace, Prime Video, Twitch, Fire TV, and live sports programming.

CEO Andy Jassy emphasized AWS momentum during the earnings call. "AWS is growing at a pace we haven't seen since 2022, reaccelerating to 20.2% year-over-year, our largest growth rate in 11 quarters," Jassy stated. The AWS annualized revenue run rate reached $132 billion. AWS backlog grew to $200 billion by quarter end, excluding several unannounced October deals that together exceeded total Q3 deal volume.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Anthropic partnership drives AWS AI infrastructure

Amazon brought Project Rainier online during the quarter—a massive AI compute cluster spanning multiple U.S. data centers containing nearly 500,000 Trainium2 chips. Anthropic uses this infrastructure to build and deploy Claude AI models. Amazon completed a $4 billion investment commitment in Anthropic by March 2024, establishing AWS as Anthropic's primary cloud provider.

Trainium2 reached full subscription status and became a multibillion-dollar business growing 150% quarter-over-quarter. The custom AI chip delivers 30% to 40% better price-performance than competing options. "Trainium2 continues to see strong adoption, is fully subscribed is now a multibillion-dollar business that grew 150% quarter-over-quarter," Jassy said during the call. Anthropic plans to scale Claude training to more than 1 million Trainium2 chips by year-end.

Third quarter net income included a $9.5 billion pretax gain from Amazon's Anthropic investment, classified under nonoperating income. The partnership extends beyond financial investment to technical integration, with Anthropic offering Claude models through Amazon Bedrock while utilizing AWS as its primary infrastructure provider.

Jassy detailed Project Rainier's technical complexity: "it's not simple to be able to build a cluster that has 500,000 plus chips going to 1 million. That's an infrastructure feat that's hard to do at scale." AWS added more than 3.8 gigawatts of power capacity in the past 12 months, more than any other cloud provider. The company plans to double total capacity by 2027, with at least one additional gigawatt coming online in Q4 2025 alone.

Advertising grows across multiple channels

The $17.7 billion advertising figure marks substantial growth from the $14.3 billion reported in Q3 2024. Amazon's advertising success spans multiple formats and platforms. Sponsored products remain the largest contributor, while streaming advertising through Prime Video presents significant growth opportunities.

Thursday Night Football on Prime Video averaged 15.3 million viewers during the 2025 season, the best performance for TNF on any network in a decade according to Nielsen data. This represents a 16% increase over the previous season's seven-game average. NBA on Prime launched during the quarter, with the season-opening doubleheader averaging 1.25 million U.S. viewers—a double-digit increase over last season on cable.

Amazon announced partnerships expanding its demand-side platform reach. The company integrated with Netflix, providing Amazon DSP advertisers direct access to Netflix's premium ad inventory. Partnerships with Spotify and SiriusXM extend DSP reach to 400 million monthly Spotify ad-supported listeners and 160 million monthly SiriusXM digital listeners across services including Pandora and SoundCloud.

The Roku partnership announced in June 2025 created the largest authenticated Connected TV footprint in the United States, providing access to an estimated 80 million CTV households through Amazon DSP. This represents more than 80% of all CTV households according to ComScore data.

AI-powered commerce features drive engagement

Rufus, Amazon's AI-powered shopping assistant, reached 250 million active customers in 2025. Monthly users increased 140% year-over-year, while interactions grew 210% year-over-year. Customers using Rufus during shopping trips showed 60% higher purchase completion rates. The AI assistant tracks toward delivering over $10 billion in incremental annualized sales.

Amazon introduced several AI-enhanced shopping features. A generative AI-powered audio capability combines product summaries and reviews. The feature expanded from hundreds of products at launch to millions, with customers streaming almost 3 million minutes. Amazon Lens, an AI-powered visual search tool using phone cameras, screenshots, or bar codes, added Lens Live functionality showing real-time product matches in a swipeable carousel. Tens of millions of customers use Amazon Lens monthly.

The company launched Help Me Decide, an AI feature assisting customers in product selection using browsing activity, searches, shopping history, and preferences. Over 1.3 million independent sellers used Amazon's generative AI tools to create product listings. Third-party seller unit mix reached 62% in Q3, up 200 basis points from the prior year.

Amazon blocked AI crawlers from multiple companies in August 2025, including Anthropic's Claude bot, OpenAI's GPTBot, and others from Meta, Google, Huawei, and Mistral. The restrictions aim to protect Amazon's $56 billion advertising business from third-party AI tools that could bypass the marketplace and undermine both website traffic and advertising revenue.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

AWS technical capabilities expand

Amazon announced new Amazon EC2 P6e-GB200 UltraServers using NVIDIA Grace Blackwell Superchips, designed for training and deploying large AI models. The company added foundation models in Amazon Bedrock, including open weight models from OpenAI, DeepSeek-V3.1, and Qwen3, plus Anthropic's Claude Sonnet 4.5, Claude Opus 4.1, and Claude Haiku 4.5.

AWS launched AgentCore during the quarter—infrastructure building blocks enabling developers to deploy secure, scalable AI agents. The SDK has been downloaded over 1 million times. Ericsson used AgentCore to deliver AI agents across their workforce. Sony built an agentic AI platform with enterprise-level security, observability and scalability. Cohere Health deploys agents through AgentCore to reduce medical review times by 30% to 40%.

Amazon Connect reached $1 billion annualized revenue run rate. The AI contact center solution handled 12 billion customer interaction minutes in the last year. Major enterprises including Capital One, Toyota, American Airlines, and Ryanair use the service.

AWS announced RTB Fabric on October 23, 2025—a managed service for real-time bidding advertising workloads. The service delivers single-digit millisecond latency and up to 80% lower networking costs compared to standard infrastructure. RTB Fabric provides dedicated network environments for processing millions of bid requests per second with strict latency requirements.

Retail operations advance delivery capabilities

Amazon expanded same-day delivery of perishable groceries to more than 1,000 U.S. cities and towns. The company plans to reach 2,300 locations by year-end. Customers in these markets can order fresh groceries alongside millions of Amazon products with free same-day delivery. When customers start shopping groceries on Amazon, they visit the site more frequently and return twice as often as nonperishable shoppers.

The company increased the number of rural communities with access to same-day and next-day delivery by 60%, reaching roughly half the total communities planned by year-end. Amazon committed over $4 billion to expand its rural delivery network across the United States. These investments target small towns where other carriers have reduced service.

Worldwide paid units increased 11% year-over-year. North America segment sales grew 11% to $106.3 billion. International segment sales increased 10% excluding foreign exchange effects to $40.9 billion. The company deployed over 1 million robots in fulfillment operations. U.S. inbound lead time decreased by nearly 4 days compared to last year, improving working capital management.

Prime Day in July marked the largest event ever. Customers saved billions of dollars across more than 35 categories. Amazon continues tracking toward delivering at the fastest speeds ever for Prime members globally in 2025. The company added an "add to delivery" button allowing customers to add items to previously scheduled orders. The feature has been used more than 80 million times since launch.

Capital expenditure increases support AI growth

Cash capital expenditure reached $34.2 billion in the quarter. Year-to-date cash CapEx totaled $89.9 billion. CFO Brian Olsavsky stated, "we expect our full year cash CapEx to be approximately $125 billion in 2025, and we expect that amount will increase in 2026." The investments primarily support AWS infrastructure for AI and core services, custom silicon like Trainium, and technology infrastructure for retail segments.

Trailing twelve-month free cash flow reached $14.8 billion, down 69% year-over-year. The decline resulted from a $50.9 billion year-over-year increase in property and equipment purchases net of proceeds. Operating cash flow increased 16% to $130.7 billion for the trailing twelve months.

North America segment operating income reached $4.8 billion, representing a 4.5% margin. Excluding the $2.5 billion FTC settlement charge, North America operating income would have reached $7.3 billion with a 6.9% margin. International segment operating income totaled $1.2 billion with a 2.9% margin. AWS segment operating income reached $11.4 billion, up 9% year-over-year.

Workforce adjustments and fourth quarter guidance

The $1.8 billion severance charge relates to planned role eliminations across all three business segments. Jassy characterized the workforce reduction as culturally driven rather than financially motivated. "What I would tell you is the announcement that we made a few days ago was not really financially driven and it's not even really AI-driven, not right now, at least. It really -- its culture," Jassy stated during the earnings call.

The CEO explained that rapid growth led to increased organizational layers weakening ownership among frontline workers. "When that happens, sometimes without realizing that you can weaken the ownership of the people that you have who are doing the actual work and who own most of the 2-way door decisions, the ones that should be made quickly and right at the front line, and it can lead to slowing you down."

Amazon provided fourth quarter 2025 guidance projecting net sales between $206.0 billion and $213.0 billion, representing 10% to 13% growth compared with Q4 2024. The guidance anticipates a favorable impact of approximately 190 basis points from foreign exchange rates. Operating income is expected between $21.0 billion and $26.0 billion, compared with $21.2 billion in Q4 2024.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- February 6, 2025: Amazon reports Q4 2024 advertising revenue of $17.3 billion, marking 18% year-over-year growth

- March 2024: Amazon completes $4 billion investment commitment in Anthropic

- May 1, 2025: Amazon advertising reaches $13.9 billion in Q1 2025 with 19% year-over-year growth

- June 2025: Amazon and Roku announce exclusive Connected TV partnership

- July 31, 2025: Amazon reports Q2 2025 advertising revenue of $15.7 billion with 22% year-over-year growth

- August 2025: Amazon blocks AI crawlers from Anthropic, OpenAI, Meta, and others

- September 2, 2025: Anthropic completes $13 billion Series F funding at $183 billion valuation

- October 16, 2025: Amazon introduces reserve share of voice for branded search

- October 22, 2025: Amazon announces smart delivery glasses with AI-powered tracking

- October 23, 2025: AWS launches RTB Fabric for real-time advertising bidding workloads

- October 30, 2025: Amazon announces Q3 2025 results with $17.7 billion advertising revenue and $33 billion AWS revenue

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Amazon reported third quarter 2025 financial results. CEO Andy Jassy and CFO Brian Olsavsky presented earnings on October 30, 2025. Anthropic uses Amazon's Project Rainier infrastructure to train Claude AI models.

What: Amazon generated $17.7 billion in advertising revenue, growing 22% year-over-year for the third consecutive quarter of acceleration. AWS revenue reached $33 billion with 20.2% growth—the fastest rate in 11 quarters. Total net sales hit $180.2 billion. Operating income reached $17.4 billion, including $4.3 billion in special charges from an FTC settlement and workforce reductions. Project Rainier brought online nearly 500,000 Trainium2 chips for Anthropic's Claude AI training. Third quarter results included a $9.5 billion pretax gain from the Anthropic investment.

When: Amazon announced third quarter 2025 results on October 30, 2025, covering the period ended September 30, 2025. The advertising revenue marked the third consecutive quarter of accelerating growth. AWS achieved its highest growth rate in 11 quarters. Amazon brought Project Rainier online during Q3, with Anthropic scaling to more than 1 million Trainium2 chips by year-end.

Where: Results span Amazon's global operations across North America, International, and AWS segments. North America segment sales reached $106.3 billion. International segment sales totaled $40.9 billion. AWS serves customers globally with the $33 billion quarterly revenue. Project Rainier spans multiple U.S. data centers. Amazon expanded same-day grocery delivery to over 1,000 U.S. cities with plans to reach 2,300 by year-end.

Why: The Q3 2025 results matter for the marketing community because they demonstrate Amazon's strengthening position in digital advertising with three consecutive quarters of accelerating growth. The 22% advertising revenue increase significantly outpaces the company's overall 12% sales growth, indicating advertising's expanding importance to Amazon's business model. AWS infrastructure investments, particularly Project Rainier supporting Anthropic's Claude models, position Amazon as a critical enabler of AI-powered marketing tools. Trainium2's multibillion-dollar status and 150% quarter-over-quarter growth show rapid adoption of Amazon's custom AI chips, which deliver 30% to 40% better price-performance for AI workloads. The advertising technology developments including reserve share of voice for branded search, partnerships with Netflix, Spotify, and SiriusXM through Amazon DSP, and AWS RTB Fabric for real-time bidding provide marketers with enhanced targeting capabilities and expanded inventory access. Amazon's AI-powered commerce features like Rufus reaching 250 million users with 60% higher purchase completion rates demonstrate how generative AI drives measurable business results. The $125 billion full-year capital expenditure guidance for 2025, increasing further in 2026, signals Amazon's commitment to building infrastructure that will power next-generation advertising and marketing technologies.