Alphabet reaches $102.3 billion in quarterly revenue milestone

Alphabet posts 16% revenue growth to $102.3 billion in Q3 2025, marking first-ever $100 billion quarter. Google Search revenues up 15%, Cloud grows 34% to $15.2 billion.

Alphabet achieved its first quarterly revenue exceeding $100 billion during the third quarter of 2025, reaching $102.3 billion and marking a 16% increase from the prior year period. The company announced results on October 29, 2025, for the quarter ended September 30, 2025, demonstrating accelerated growth across search advertising, cloud computing, and subscription services despite facing a $3.5 billion European Commission fine.

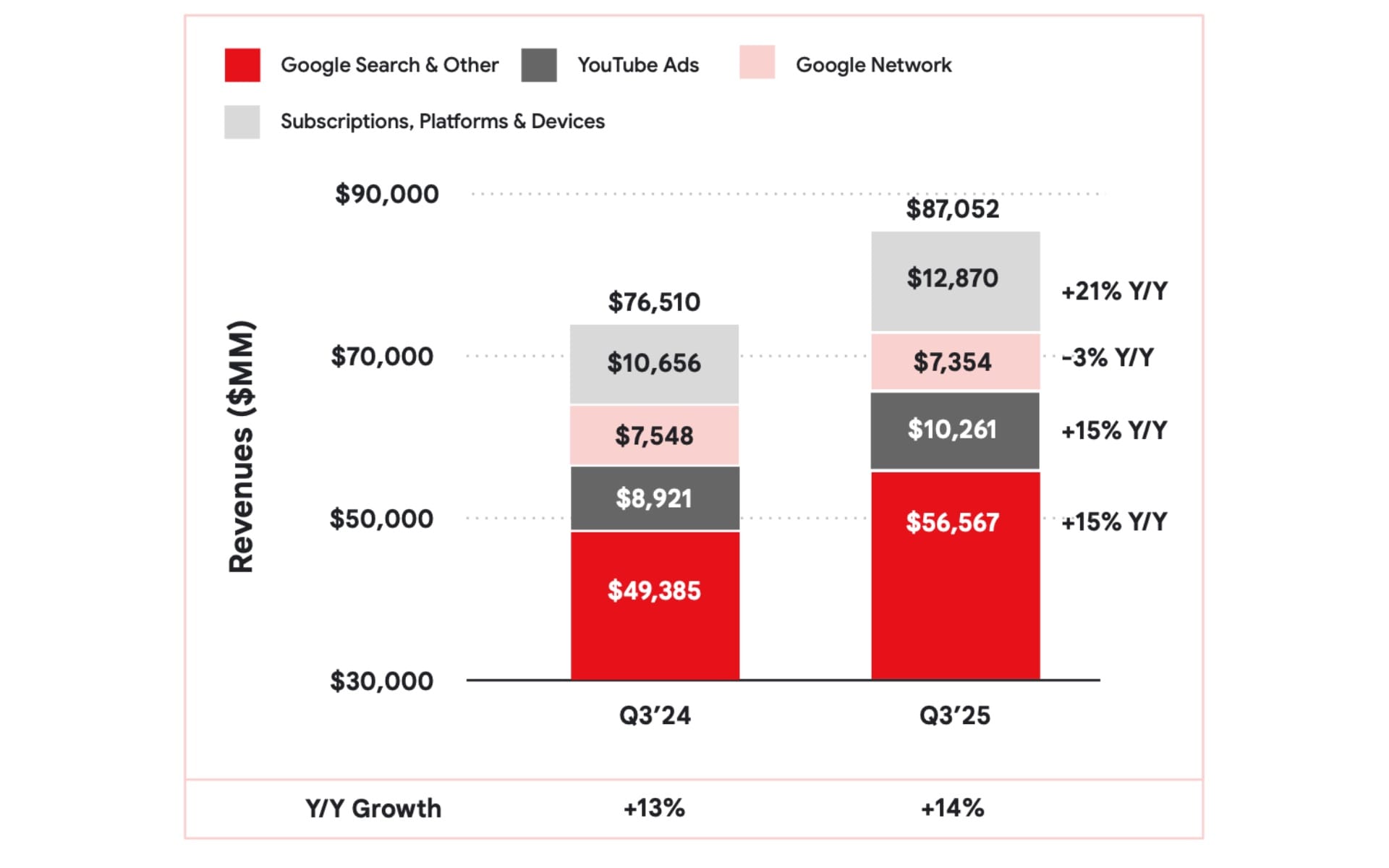

Revenue performance exceeded market expectations across multiple business segments. Google Search & other revenues reached $56.6 billion, representing 15% year-over-year growth, while YouTube advertising revenues climbed 15% to $10.3 billion. Google Cloud revenues surged 34% to $15.2 billion, driven primarily by Google Cloud Platform adoption and generative AI solutions.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

"Alphabet had a terrific quarter, with double-digit growth across every major part of our business," stated Sundar Pichai, CEO of Alphabet and Google, according to the earnings release. "We delivered our first-ever $100 billion quarter."

The Mountain View-based technology company reported net income of $35 billion, increasing 33% from the prior year, while diluted earnings per share grew 35% to $2.87. Operating income reached $31.2 billion with an operating margin of 30.5%, though this figure includes the European Commission fine recorded during the quarter.

Excluding the regulatory penalty, operating income would have reached $34.7 billion, representing 22% growth and an operating margin of 33.9%, according to the non-GAAP reconciliation provided in the earnings materials.

Google advertising dominates business model with $74.2 billion quarterly performance

Google advertising generated $74.2 billion in revenues during Q3 2025, representing 72.5% of Alphabet's total consolidated revenues and marking 13% growth from the prior year period. The advertising segment encompasses Search & other, YouTube ads, and Network properties, with Search maintaining its position as the company's largest single revenue source at $56.6 billion.

Total advertising revenues increased from $65.9 billion in Q3 2024 to $74.2 billion in Q3 2025, adding $8.3 billion in absolute revenue growth year-over-year. This performance occurred despite ongoing challenges in the Network advertising segment, which declined 3% to $7.4 billion, demonstrating the strength of owned property performance.

Search & other revenues reached $56.6 billion in the quarter, growing 15% year-over-year from $49.4 billion. The segment represents 55.3% of total Alphabet revenues and 76.3% of total advertising revenues, cementing Search's role as the company's primary business driver. The 15% growth rate in Q3 2025 represents an acceleration from previous quarters, attributed primarily to AI-powered features including AI Overviews and AI Mode.

YouTube advertising contributed $10.3 billion in revenues during Q3 2025, increasing 15% from $8.9 billion in the prior year period. YouTube ads represent 10% of total Alphabet revenues and 13.8% of advertising revenues, making YouTube the company's second-largest advertising property. The platform's performance benefited from sustained living room dominance and expanding Shorts monetization capabilities.

Google Network advertising totaled $7.4 billion in Q3 2025, declining 3% from $7.5 billion in Q3 2024. Network revenues now represent 7.2% of total Alphabet revenues and 9.9% of advertising revenues, continuing a downward trajectory established across 2025. The segment includes AdSense for website publishers, AdMob for mobile app monetization, and Google Ad Manager for programmatic advertising management.

Traffic acquisition costs reached $14.9 billion in Q3 2025, growing 8% year-over-year from $13.7 billion. TAC represents payments to distribution partners who direct search queries to Google properties, including browser manufacturers, mobile device makers, and telecommunications carriers. TAC as a percentage of advertising revenues decreased to 20.1% in Q3 2025 from 20.8% in Q3 2024, indicating improved advertising profitability.

The advertising business generated substantially higher margins than other revenue segments. Google Services, which primarily consists of advertising plus subscriptions and devices, achieved operating income of $33.5 billion on revenues of $87.1 billion, representing a 38.5% operating margin excluding the European Commission fine impact. Including the $3.5 billion EC penalty, the reported operating margin stood at 38.5%, though the fine artificially depressed this metric.

Advertising revenue concentration within owned properties intensified during Q3 2025. Search & other combined with YouTube ads totaled $66.8 billion, representing 90% of total advertising revenues compared to 88.5% in Q3 2024. This consolidation pattern reflects strategic platform changes that increasingly direct user attention toward company-controlled surfaces rather than third-party publisher websites.

Geographic advertising revenue distribution showed varying growth rates across major markets. United States advertising revenues, while not separately disclosed, can be estimated to represent approximately 47% of total advertising revenues based on overall geographic revenue splits. The EMEA region contributed approximately 29% of advertising revenues, while APAC represented roughly 17% and Other Americas approximately 6%.

AI integration drove advertising revenue acceleration during Q3 2025. Management commentary emphasized that AI Overviews and AI Mode contributed to increased query volumes, with "growth rate increased in Q3, largely driven by our AI investments in Search, most notably AI Overviews and AI Mode," according to CEO Sundar Pichai's prepared remarks.

Commercial query growth outpaced overall query growth during the quarter, indicating stronger performance in advertising-relevant searches. This pattern suggests that AI-powered features attract users seeking information with commercial intent, benefiting advertiser engagement metrics and revenue performance.

Advertising within AI-generated responses maintained monetization effectiveness. Earlier quarterly results disclosed that ads integrated within AI Overviews achieved monetization rates similar to traditional search results, addressing concerns about potential advertising revenue disruption from generative AI features.

The advertising business demonstrated resilience despite substantial platform changes throughout 2025. Policy modifications allowing multiple ads from the same advertiser on individual search results pages, AI Overview expansion across 40 languages, and AI Mode deployment occurred alongside sustained revenue growth, validating the company's ability to maintain monetization effectiveness during product transitions.

Vertical-specific performance varied during Q3 2025, though detailed segment breakdowns were not provided in the earnings materials. Financial services advertising historically represents a significant contributor to Search revenues, while retail advertising drives substantial YouTube performance, particularly during seasonal shopping periods in Q4.

Looking forward, advertising revenue faces comparisons against progressively stronger prior year periods. Q4 2024 represented a particularly robust quarter with accelerated growth rates, potentially creating challenging year-over-year comparisons for Q4 2025. However, ongoing AI feature improvements and expanding international AI Overview availability provide potential growth drivers offsetting comparison difficulties.

The advertising segment's dominance within Alphabet's business model remains unchanged despite diversification efforts. While Google Cloud achieved 34% growth and subscriptions grew 21%, these segments generated combined revenues of $28.1 billion compared to $74.2 billion from advertising. Advertising represented 72.5% of Q3 2025 revenues compared to 74.6% in Q3 2024, showing modest but gradual diversification progress.

Advertising operating leverage improved year-over-year as revenue growth outpaced cost increases. Sales and marketing expenses remained essentially flat at $7.2 billion, declining slightly from $7.2 billion in the prior year, while advertising revenues grew 13%. This dynamic contributed to operating margin expansion within the Google Services segment.

The advertising business benefits from proprietary data assets accumulated across Search, YouTube, Android, Chrome, and other Google properties. These first-party data sources provide targeting capabilities increasingly valuable as third-party cookie deprecation and privacy regulations limit traditional tracking methodologies. Industry-wide cost increases of 12.88% in average cost per click during 2025 reflect intensifying competition for access to Google's audience reach and measurement capabilities.

Advertising technology infrastructure investments support the revenue performance. Capital expenditures totaling $23.953 billion in Q3 2025 primarily target AI capabilities, but these systems also power advertising targeting, creative optimization, and measurement solutions that enhance advertiser return on investment and justify premium pricing.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Search advertising momentum accelerates through AI features

Search advertising demonstrated renewed strength following earlier concerns about AI-driven traffic changes. The company's flagship search property generated revenues substantially above analyst projections, benefiting from increased query volumes and commercial advertising engagement.

"Overall queries and commercial queries continued to grow year over year," Pichai stated during the earnings call, noting that "this growth rate increased in Q3, largely driven by our AI investments in Search, most notably AI Overviews and AI Mode."

AI Overviews now generates increased search activity among users. The feature currently serves over 2 billion monthly active users and has been rolled out across 40 languages. During the quarter, the company observed particularly strong engagement from younger demographics.

AI Mode, which launched during Q3 2025, achieved 75 million daily active users by quarter end. "We shipped over 100 improvements to the product in Q3—an incredibly fast pace," according to Pichai's prepared remarks. The feature demonstrated consistent week-over-week usage growth throughout the quarter and "is already driving incremental total query growth for Search."

The Gemini app, which provides direct access to the company's large language models, reached 650 million monthly active users during the quarter. Query volumes through the Gemini app increased threefold from Q2 2025 to Q3 2025, according to the CEO's remarks.

Technical infrastructure supporting these AI capabilities processed over 1.3 quadrillion monthly tokens across all surfaces by October 2025, representing more than 20-fold growth over a 12-month period. First-party models including Gemini now process 7 billion tokens per minute through direct API access by enterprise customers.

Google Cloud accelerates growth trajectory through enterprise AI adoption

Google Cloud revenues reached $15.2 billion in Q3 2025, accelerating from 32% growth in Q2 2025 to 34% growth in the current quarter. Operating income for the segment jumped to $3.6 billion from $1.9 billion in the prior year period, expanding operating margins from 17.1% to 23.7%.

The cloud division signed more deals exceeding $1 billion in value through the first three quarters of 2025 than during the previous two years combined, according to management commentary. New Google Cloud Platform customer additions increased 34% year-over-year, while existing customer engagement deepened with over 70% of current customers utilizing AI products.

Cloud backlog surged 46% quarter-over-quarter to $155 billion, indicating substantial contracted future revenue. The backlog figure represents the strongest sequential growth rate reported in recent quarters and suggests continued momentum extending into 2026.

AI infrastructure differentiation drove enterprise adoption. The company offers the broadest array of specialized chips including its seventh-generation TPU called Ironwood, scheduled for general availability in the coming months, alongside NVIDIA GB300-powered A4X Max instances now shipping to customers.

"As we announced yesterday at NVIDIA GTC, we are now shipping the new A4X Max instances powered by NVIDIA GB300 to our Cloud customers," Pichai stated in his earnings call remarks. The company maintains it is "the only company providing a wide range of both" proprietary TPUs and partner GPUs.

Revenue from products built on generative AI models grew more than 200% year-over-year during Q3 2025. Nearly 150 Google Cloud customers each processed approximately 1 trillion tokens with the company's models over the trailing 12-month period, according to the CEO's prepared statements.

Gemini Enterprise, launched earlier in October 2025, crossed 2 million subscribers across 700 companies. The product serves as "the new front door for AI in the workplace" and includes packaged enterprise agents optimized for various business domains.

Thirteen distinct product lines within Google Cloud now operate at annual run rates exceeding $1 billion, demonstrating revenue diversification beyond core infrastructure services.

YouTube maintains living room dominance while expanding monetization

YouTube sustained its position as the leading streaming platform by watch time in United States living rooms for more than two consecutive years, according to Nielsen data referenced in the earnings materials. The platform's first exclusive NFL broadcast in September 2025 drew over 19 million viewers globally, establishing a new record for most concurrent viewers of a live stream on YouTube.

Advertising revenues from YouTube reached $10.3 billion in Q3 2025, growing 15% year-over-year. YouTube Shorts, the platform's short-form video product competing with TikTok and Instagram Reels, achieved a significant monetization milestone by earning more revenue per watch hour than traditional in-stream advertising in the United States market.

The platform implemented AI-powered features designed to enhance creator productivity and business development. New tools streamline content creation workflows from initial video generation through editing, while AI-powered insights help creators optimize channel performance. The company also deployed AI systems to automatically identify products within videos, making content more shoppable and expanding monetization opportunities.

Network advertising continues decline amid platform consolidation

Google Network revenues, comprising AdSense, AdMob, and Google Ad Manager, declined 3% year-over-year to $7.4 billion in Q3 2025. The decline extends a pattern established in earlier 2025 quarters and represents ongoing structural shifts in the advertising ecosystem.

The Network revenue reduction contrasts sharply with growth across Google-owned properties including Search, YouTube, and Discover. Total advertising revenues reached $74.2 billion in the quarter, representing 13% growth, but distribution increasingly favors company-owned surfaces rather than third-party publisher partnerships.

Earlier analysis following Q2 2025 results indicated that approximately 90% of Google's advertising revenues now flow to owned properties rather than through publisher revenue-sharing arrangements, marking a historic shift in digital advertising economics.

Subscription services surpass 300 million paid accounts

Google subscriptions, platforms, and devices generated $12.9 billion in revenues during Q3 2025, growing 21% year-over-year. The company crossed 300 million total paid subscriptions, led by Google One cloud storage service and YouTube Premium.

The subscription milestone demonstrates consumer willingness to pay for enhanced experiences across the company's product portfolio. YouTube Premium removes advertisements and provides access to YouTube Music, while Google One offers expanded cloud storage and additional benefits across Google services.

Device revenues within this category include the Pixel 10 series smartphones, launched in August 2025 and featuring the Tensor G5 chip. The devices represent "our best-reviewed devices ever," according to Pichai, and incorporate deep integration with Gemini AI capabilities.

Chrome browser received substantial AI-powered enhancements during the quarter, including deep Gemini integration and AI Mode functionality. The company also announced Android XR, a new operating system for extended reality headsets and glasses, with Samsung launching the Galaxy XR device utilizing the platform.

Capital expenditures surge to support AI infrastructure expansion

Capital expenditures reached $23.953 billion in Q3 2025, representing 83% growth from the prior year period. The substantial investment primarily targets technical infrastructure supporting AI model training and inference workloads across both internal products and cloud customer deployments.

The company updated its full-year 2025 capital expenditure guidance to a range of $91 billion to $93 billion, according to the earnings announcement. Previous guidance suggested lower spending levels, but management increased projections to accommodate "the growth across our business and demand from Cloud customers."

Property and equipment on the balance sheet reached $223.8 billion as of September 30, 2025, compared to $171 billion at December 31, 2024. The expansion reflects data center construction, specialized chip procurement including TPUs and GPUs, and supporting infrastructure necessary for operating large-scale AI systems.

Free cash flow totaled $24.5 billion for Q3 2025, declining from $48.4 billion in net cash provided by operating activities after subtracting capital expenditures. Trailing twelve-month free cash flow reached $73.6 billion, growing 32% year-over-year despite the substantial infrastructure investment requirements.

Regulatory penalties and other business segments

The European Commission announced on September 5, 2025, that the company had infringed European competition laws, imposing a $3.5 billion fine accrued in general and administrative expenses during Q3 2025. The penalty impacted operating margin calculations but did not affect the company's cash position during the quarter as payment timing extends beyond the reporting period.

Changes to United States tax law enacted on July 4, 2025, allow immediate expensing of domestic research and experimentation costs alongside accelerated depreciation on eligible capital expenditures, according to the earnings materials. These modifications benefited operating cash flows during Q3 2025.

Other Bets, representing various experimental business initiatives including Waymo autonomous vehicles, Verily life sciences, and other ventures, generated $344 million in revenues while recording $1.4 billion in operating losses. Waymo announced expansion plans including London and Tokyo launches scheduled for 2026, alongside United States market expansion to Dallas, Nashville, Denver, and Seattle.

The autonomous vehicle service secured permission for fully autonomous operations at San Jose and San Francisco airports while continuing testing in New York City. Waymo for Business allows enterprises to offer autonomous transportation as a corporate travel option, while Waymo Teens accounts launched in Phoenix during summer 2025.

Alphabet's Board of Directors declared a quarterly cash dividend of $0.21 per share payable December 15, 2025, to stockholders of record as of December 8, 2025, covering Class A, Class B, and Class C shares.

Financial position and shareholder returns

Total assets reached $536.5 billion as of September 30, 2025, compared to $450.3 billion at December 31, 2024. Cash, cash equivalents, and marketable securities totaled $98.5 billion, while non-marketable securities including equity investments reached $63.8 billion.

Other income reflected a net gain of $12.8 billion during Q3 2025, primarily driven by net unrealized gains on non-marketable equity securities. Gain on equity securities totaled $10.7 billion, partially offset by $174 million in performance fees related to certain investments. The equity gains increased provision for income tax, net income, and diluted net income per share by $2.2 billion, $8.3 billion, and $0.68 respectively.

The company repurchased $11.5 billion of stock during Q3 2025, bringing year-to-date repurchases to $40.2 billion. Dividend payments totaled $2.5 billion for the quarter and $7.5 billion year-to-date through September 30, 2025.

Long-term debt reached $21.6 billion as of quarter end, compared to $10.9 billion at the beginning of 2025. The company issued $38 billion in debt net of costs through the first nine months of 2025 while repaying $26.1 billion, according to the consolidated statements of cash flows.

Employee headcount stood at 190,167 as of September 30, 2025, representing an increase of approximately 8,900 employees compared to December 31, 2024. Research and development expenses totaled $15.2 billion for the quarter, growing 22% year-over-year, while sales and marketing expenses remained essentially flat at $7.2 billion.

Significance for digital marketing ecosystem

The Q3 2025 results demonstrate continuing momentum in AI-powered advertising capabilities following patterns established in earlier 2025 quarters. Search advertising growth acceleration through AI Overviews and AI Mode validates the company's strategic emphasis on generative AI integration across core products.

However, the persistent Network advertising decline represents structural challenges for third-party publishers participating in the advertising ecosystem. As Google increasingly directs user attention toward owned properties and AI-generated answers, traditional publisher monetization models face ongoing pressure.

Marketers should note the significant enterprise AI adoption rates within Google Cloud, with over 70% of existing customers utilizing AI products. This adoption pattern suggests widespread acceptance of generative AI capabilities for business applications, potentially influencing advertising creative development, audience targeting methodologies, and campaign optimization approaches.

The 200% year-over-year growth in revenues from products built on generative AI models indicates substantial enterprise spending on AI infrastructure and services. Marketing technology vendors and agencies may find opportunities in helping clients implement similar AI capabilities for customer engagement and content creation workflows.

Capital expenditure commitments totaling $91-93 billion for 2025 underscore the company's confidence in AI-driven business model sustainability. The infrastructure investments position the company to maintain technological advantages in search quality, advertising effectiveness, and cloud services competitiveness extending through 2026 and beyond.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- September 5, 2025: European Commission announces decision imposing $3.5 billion fine for competition law violations

- July 4, 2025: United States enacts tax law changes allowing immediate expensing of research costs and accelerated capital expenditure depreciation

- August 2025: Google launches Pixel 10 series featuring Tensor G5 chip

- Q3 2025: AI Mode ships 100+ product improvements at "incredibly fast pace"

- Q3 2025: Google Cloud signs more $1+ billion deals than previous two years combined

- Q3 2025: YouTube Shorts surpasses traditional in-stream revenue per watch hour in United States

- September 2025: YouTube broadcasts first exclusive NFL game from Brazil, drawing 19 million viewers

- October 2025: Gemini Enterprise launches, reaching 2 million subscribers across 700 companies

- October 29, 2025: Alphabet announces Q3 2025 results with first-ever $100+ billion quarterly revenue

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Summary

Who: Alphabet Inc., parent company of Google, reported quarterly financial results with CEO Sundar Pichai and other executives discussing performance across search, cloud, and other business segments.

What: Alphabet achieved $102.3 billion in quarterly revenues, marking the company's first time exceeding $100 billion in a single quarter, with 16% year-over-year growth driven by search advertising, cloud computing, and subscriptions. The company reported net income of $35 billion and diluted earnings per share of $2.87, though results included a $3.5 billion European Commission fine.

When: The results cover the quarter ended September 30, 2025, with the announcement made on October 29, 2025. Key developments occurred throughout Q3 including the EC fine announcement on September 5, 2025, and various product launches during August and September 2025.

Where: Alphabet operates globally with revenues generated across United States ($48.8 billion), EMEA ($29.9 billion), APAC ($17.8 billion), and Other Americas ($6.1 billion) regions. The company maintains headquarters in Mountain View, California, with expanding data center infrastructure supporting AI capabilities worldwide.

Why: The results demonstrate successful AI integration across core products, with AI Overviews and AI Mode driving increased search query volumes while Google Cloud adoption accelerates through enterprise AI solutions. Strong performance validates substantial capital investments in AI infrastructure and positions the company for continued growth despite regulatory challenges and changing market dynamics in publisher relationships.