AI tools stabilize at 1.3% while traditional search hits yearly peak

New Q3 2025 data shows AI platforms and search engines both reached September highs, suggesting parallel growth rather than direct competition.

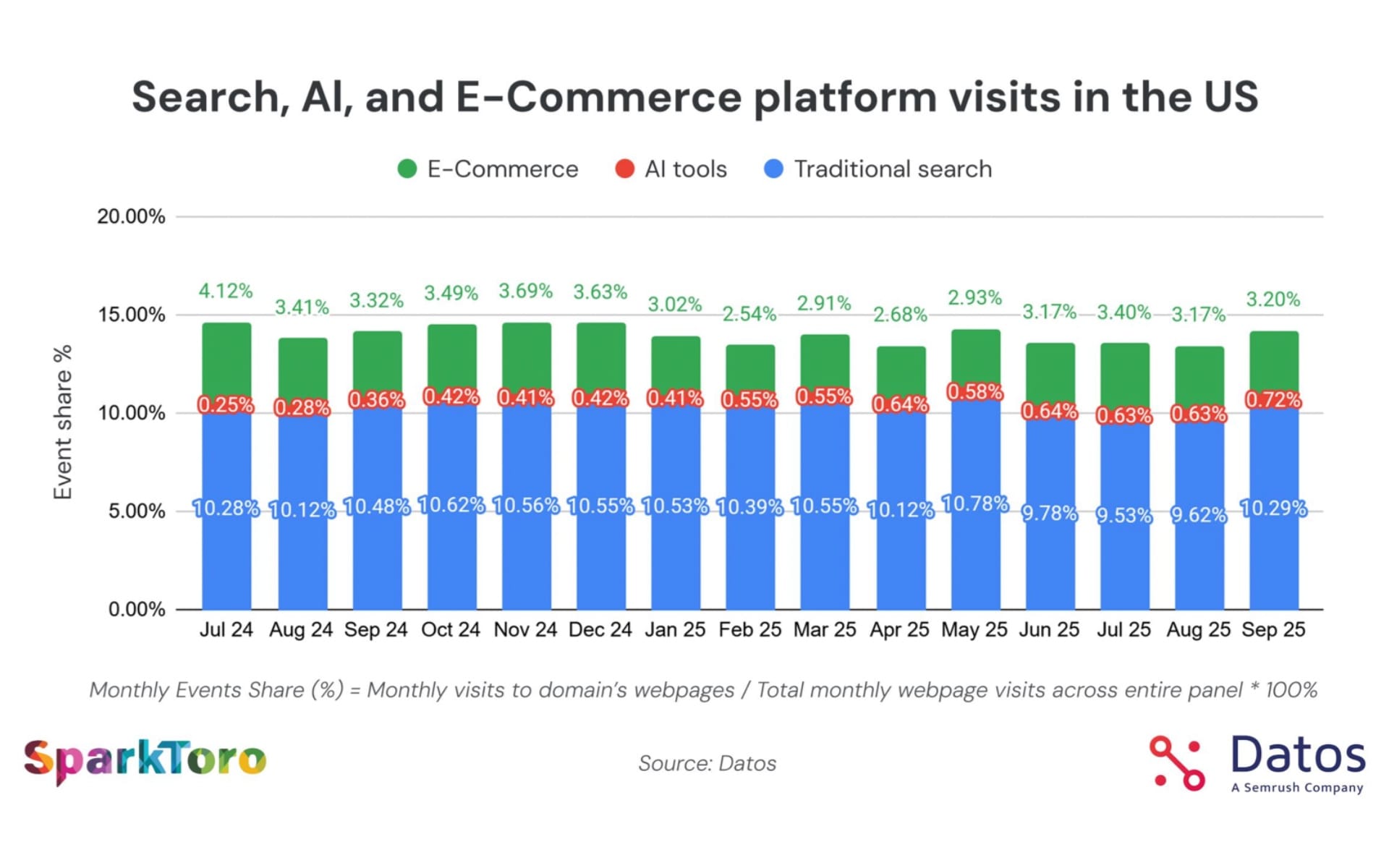

Traditional search engines and artificial intelligence tools simultaneously peaked in September 2025, reaching their highest activity levels of the year. Data from Datos spanning July 2024 through September 2025 reveals that AI tools have stabilized around 1.3% of desktop events while traditional search maintained approximately 10% of total desktop activity across both US and European markets.

The patterns contradict earlier predictions that AI assistants would cannibalize search traffic. Both categories climbed through Q3 2025, with traditional search rising from 9.88% in Q1 to 10.38% by September in the US market. AI tools grew from 0.24% in April 2024 to 0.72% by September 2025, but the growth curve flattened after reaching 1.31% in Q1 2025.

Rand Fishkin, co-founder and CEO of SparkToro, characterized the simultaneous peaks as confirmation that AI usage operates independently from traditional search. "The highpoint for BOTH traditional search engines and AI tools hitting in September 2025 is further confirmation that AI usage isn't cannibalizing Google/Bing/Yahoo/DuckDuckGo," Fishkin stated in analysis accompanying the report. "I strongly suspect that in years ahead, we'll come to think of AI tool usage like social media – an entirely new category of its own."

Subscribe PPC Land newsletter ✉️ for similar stories like this one

The Q3 period typically experiences reduced activity due to summer holidays, but 2025 bucked that historical pattern. Traditional search and e-commerce both strengthened through the quarter rather than declining. E-commerce activity climbed from 2.73% in Q1 to 3.49% in Q3, marking the strongest quarterly performance of the year in the US.

Fishkin attributed the unusual summer strength to changing cultural patterns. "Q3 is often a quieter time in search and e-commerce (due to the summer holidays), but 2025 seems to be bucking that trend," he noted. "Changes to school holiday schedules may be impacting that, but American cultural expectations around 'always-on' work are probably playing a role here, too."

Search dominance remains unchanged

Google maintained its overwhelming market position throughout the period, accounting for approximately 95% of desktop searches across both US and European markets. The stability proved remarkable given the introduction of AI-powered alternatives and Google's own AI Overviews feature that launched in May 2024.

Desktop search users averaged between 90 and 110 searches per month on Google throughout Q3 2025, showing seasonal variation but no structural decline. DuckDuckGo users demonstrated the second-highest engagement at 50-55 searches monthly, while Bing, Yahoo, and Baidu maintained lower but stable search intensity.

The consistency in per-user search volume suggests that traditional search behavior has normalized rather than diminished. Users continue relying on search engines as a primary discovery mechanism despite having access to conversational AI alternatives.

Zero-click searches continued their upward trajectory in the US market, reaching nearly 27% by September 2025. This represented a 3% increase since Q3 2024. Zero-click behavior occurs when users find complete answers within Google's search results page without clicking through to external websites.

Traffic to Google-owned properties like Maps, YouTube, and other services stayed consistent at 14-15% of search outcomes. Organic results remained the primary destination but their share edged slightly lower through the quarter, dropping from roughly 42% to 41% of clicks.

European markets showed different patterns. Organic click-throughs gained slightly through Q3, rising from 45% in June to 46% in September. Zero-click, repeat-search, and Google-owned property shares each declined slightly over the same period, suggesting a modest shift toward paid and organic search results.

The 48% organic click rate in Europe compared to 42% in the US represents billions of additional search-driven visits monthly, according to Fishkin. "The EU & UK may not look dramatically different from the US in the graphs, but 48% of searches leading to clicks vs. 42% is fairly substantial – it adds up to billions of additional search-driven visits each month," he observed.

Search intent analysis revealed that informational queries continue dominating desktop searches, holding steady at approximately 60% of total activity across all major search engines and regions. Commercial and product-related intent rose modestly year-over-year in both the US and Europe, reaching 19.75% in the US and 20.55% in Europe by Q3 2025.

Navigational intent declined in the US market from 18.71% to 17.01% year-over-year. Fishkin suggested two possible explanations: "Google's redirecting more of these desktop, nav-intent searches via the browser window before they ever hit the search results (via auto-suggest) or 2) Google's AI Overviews, answers, and AI mode are attracting more informational and product research queries."

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

AI adoption matures across regions

ChatGPT established clear leadership in the AI tools category, surpassing 30% of desktop users in the US and exceeding 40% in Europe by September 2025. The platform's dominance remained unchallenged despite competition from Google Gemini, Anthropic's Claude, Microsoft's Copilot, and Perplexity.

Gemini showed the most consistent growth trajectory among secondary platforms, particularly in Europe where it climbed from 2.95% to 9.25% of desktop users between July 2024 and September 2025. The growth reflected Google's ecosystem advantages and brand familiarity across European markets.

Perplexity, Claude, and Copilot each maintained modest but stable user bases around 2-3% of desktop users. Deepseek, which saw a strong surge in early 2025, declined sharply after Q2, falling from a February peak of 6.23% to 3.16% by September in the US market.

Europe demonstrated slightly higher overall AI engagement throughout the measurement period. ChatGPT reached 43.68% of European desktop users by September compared to 37.08% in the US. The faster European adoption curve and broader experimentation across multiple AI tools created a more distributed competitive landscape.

Usage behavior converged across regions over time. Both markets reflected the same hierarchy of dominant tools and gradual normalization of AI as part of daily routines. Monthly growth rates decelerated from the rapid expansion seen in late 2024 and early 2025, suggesting the market has shifted from experimentation to integration.

Destination patterns reveal usage contexts

Analysis of where users navigate after using AI tools revealed distinct usage patterns. Google, YouTube, and GitHub remained the top three destinations from AI platforms across both US and European markets, demonstrating AI's role in coding, productivity, and information lookup.

ChatGPT's presence as a top-ten downstream destination from Google searches marked a significant finding. The platform ranked ninth in the US and seventh in Europe among sites visited after Google searches, indicating that users treat AI tools as complementary resources rather than replacements.

Wikipedia and NIH.gov both maintained or strengthened their positions among top AI destinations, confirming steady demand for fact-checked, research-based information. This trend suggested that AI-assisted search behavior increasingly points toward trusted, authoritative knowledge sources.

Professional and creative tools showed mixed performance. LinkedIn and Canva both slipped in rankings over the year but continued attracting meaningful AI-driven traffic. Reddit and Facebook remained strong destinations, reinforcing the role of community-driven knowledge in the AI era.

The stability of these destination patterns underscored how AI has been integrated into existing workflows rather than replacing traditional digital behaviors. Users employ AI tools as starting points for task-specific exploration while maintaining connections to established information sources.

Walmart entered the top 15 e-commerce destinations from search for the first time in Q3 2025, joining Amazon and eBay. The addition reflected greater diversification in online shopping behavior. Temu's growth plateaued during the quarter while traditional retailers like Target and Etsy declined in parallel, indicating a broad sector-wide cooling rather than platform-specific losses.

Content platforms demonstrate hierarchy

YouTube continued dominating content platform usage with 70-75% of desktop users in the US and similar levels in Europe. The platform averaged 9-10 searches per user throughout Q3, demonstrating both broad reach and depth of engagement.

Reddit and Facebook occupied a solid second tier, each engaging around 35-40% of desktop users in the US. Reddit showed consistent growth throughout the year, rising from the lower tier previously alongside TikTok and LinkedIn to approach Facebook's reach levels.

Fishkin expressed surprise at Reddit's trajectory. "Those Reddit numbers are shocking," he stated. "I doubt anyone would have predicted 2 years ago that Reddit would overtake Facebook in desktop visits in the US and nearly match them in the EU and UK. As a marketer, I've personally found myself investing more in Reddit–the reach is undeniable."

Pinterest stood out with steady rises in both user share and searches per user, nearly doubling since 2024. The platform averaged 4-5 searches per user by Q3, maintaining upward momentum throughout the year.

TikTok maintained its eighth position in the US rankings, highlighting continued dominance of short-form and social discovery content. LinkedIn and X both slipped in rankings, while traditional reference sites like Quora and IMDb exited the top 15 entirely.

European patterns showed more diversity. Instagram and WhatsApp both remained within the top destinations, unlike in the US market. Meta's broader cross-platform reach and deeper embedding in European daily communication habits created a more balanced ecosystem compared to the YouTube-dominated US landscape.

Zero-click behavior reshapes traffic

The growing prevalence of zero-click searches has created measurement challenges for marketing organizations. March through May 2025 recorded the lowest-ever percentage of Google searches sending external traffic, according to Fishkin's analysis.

"While it's risen since then, we're still within a couple percentage points of that historic low, and the new 'normal,' promises to stay in the low 40s for percent of desktop searches that send traffic to anyone but Google themselves," Fishkin noted. The pattern suggested fundamental changes in how users consume information online.

The shift toward on-platform interactions rather than external clicks created strategic implications for content marketers. Fishkin recommended that marketing professionals reconsider resource allocation. "If 50%+ of your search marketing efforts are still going to traffic-generation > Zero Click marketing, you should probably have a tough conversation with your boss, team, or client," he advised.

Zero-click behavior intensified as Google's AI Overviews expanded to over 1.5 billion users monthly. Independent research from Ahrefs documented that AI Overviews reduce organic clicks by 34.5% when present in search results, while Pew Research Center found users click traditional search results 47% less frequently when AI summaries appear.

The traffic quality versus volume debate emerged as a central theme in industry discussions. Google executives maintained that clicks from AI-powered features deliver superior engagement despite lower volumes, while publishers reported significant revenue impacts from reduced organic sessions.

HubSpot's October 2025 acquisition of XFunnel, an answer engine optimization platform, signaled growing industry recognition that marketing strategies must adapt to AI-mediated discovery patterns. Answer engine optimization represents a distinct discipline from traditional SEO, requiring different technical approaches for content visibility in AI-generated responses.

Market implications emerge

The convergence of traditional search and AI tool growth patterns suggested that digital behavior has entered a normalization phase. Smaller swings in market share, diversified user attention, and an emerging equilibrium between search, AI exploration, and platform-based discovery indicated a maturing landscape.

E-commerce activity remained broadly stable at approximately 3% of desktop events, though Amazon's dominance proved more pronounced in the US than Europe. Amazon accounted for nearly half of all US desktop e-commerce visits by September but only 27% of European traffic, where AliExpress maintained a strong second position.

The data revealed gradual diversification in desktop browsing beyond traditional search. AI and e-commerce together now account for nearly 5% of tracked platform visits in the US market, indicating shifts in how users navigate online environments.

Regional differences persisted despite overall convergence. European markets showed slightly higher traditional search share, faster AI adoption rates, more balanced e-commerce competition, and greater diversity across content platforms. These variations reflected cultural differences, regulatory environments, and varying levels of platform integration into daily routines.

The marketing community faces strategic decisions about resource allocation as user behavior fragments across multiple discovery channels. Traditional search engine optimization must now coexist with answer engine optimization, social platform presence, and direct audience development.

Measurement frameworks designed for search engines and social media platforms struggle to accommodate AI-generated traffic patterns. Google's Gemini iOS app traffic initially appeared without proper documentation, highlighting attribution gaps in AI-driven referral tracking.

The simultaneous growth of both traditional search and AI tools through September 2025 suggested that digital discovery has expanded rather than shifted. Users maintain search engine habits while adding AI assistants as complementary tools for research, comparison, and decision support.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Timeline

- July 2024 – September 2024: Baseline period shows traditional search at 9.96% and AI tools at 0.85% of US desktop events in Q3 2024

- April 2024: AI tools account for just 0.24% of desktop events, marking early adoption phase

- Q1 2025: AI tools reach 1.31% peak in US market before stabilizing; e-commerce drops to 2.73%, marking yearly low

- Q2 2025: Google Gemini begins learning from user chats by default on August 13, 2025

- May 2024: Google launches AI Overviews driving zero-click searches from 56% to 69%

- July 2025: Marketing professionals question AI reliability as deployment challenges mount

- September 2025: Both traditional search (10.38%) and AI tools (0.72%) hit yearly highs in US market

- September 18, 2025: Chrome integrates Gemini AI with agentic browsing features

- Q3 2025: E-commerce rebounds to 3.49%, marking strongest quarterly performance; traditional search reaches 10.38%

- October 23, 2025: Measure Protocol reveals 21.6% of ChatGPT conversations show commercial intent

- October 28, 2025: xAI launches Grokipedia with 885,279 articles

Subscribe PPC Land newsletter ✉️ for similar stories like this one

5 Ws summary

Who: Datos, a Semrush company, analyzed desktop user behavior from tens of millions of active users across the US, Europe, EU, and UK. The research included SparkToro co-founder and CEO Rand Fishkin providing analysis of the findings.

What: Traditional search engines and AI tools both reached their highest activity levels in September 2025, with search maintaining 10% of desktop events and AI tools stabilizing at 1.3%. The data reveals parallel growth rather than competition between the categories, contradicting predictions that AI would cannibalize search traffic.

When: The study spans July 2024 through September 2025, with Q3 2025 data showing both traditional search and AI tools peaking in September. The research was published in late October 2025.

Where: The analysis covers desktop users in the United States and Europe (including EU and UK markets). Regional differences emerged, with Europe showing slightly higher AI adoption rates and more balanced e-commerce competition compared to the US.

Why: The findings matter because they reveal fundamental shifts in digital discovery behavior. Users integrate AI tools as complementary resources alongside traditional search rather than replacing established patterns. This creates strategic implications for marketers, publishers, and platform operators as zero-click searches grow and traffic patterns diversify across multiple channels.