Ai and digital channels emerge as top priorities in 2025 advertising outlook

Latest report reveals 68% of marketers increasing social media spend while generative AI surpasses CTV as leading consumer trend.

Mediaocean's 2025 Advertising Outlook Report, released on January 13, 2025, reveals significant shifts in advertising priorities and technology adoption. The comprehensive study, based on survey responses from nearly 700 marketing professionals, provides insights into emerging trends and investment patterns across the advertising industry.

According to the report, social media continues to dominate advertising investment plans, with 68% of marketers planning to increase their spending in this channel. Digital display and video follow closely behind at 67%, while Connected TV (CTV) maintains strong growth with 55% of marketers indicating plans for increased investment.

The research indicates a notable shift in consumer technology trends, with generative AI emerging as the leading focus area. According to a November 2024 study by Microsoft, cited in the report, generative AI adoption increased from 55% in 2023 to 75% in 2024. The technology has surpassed CTV, which now ranks second with 56% of marketers considering it a critical consumer trend.

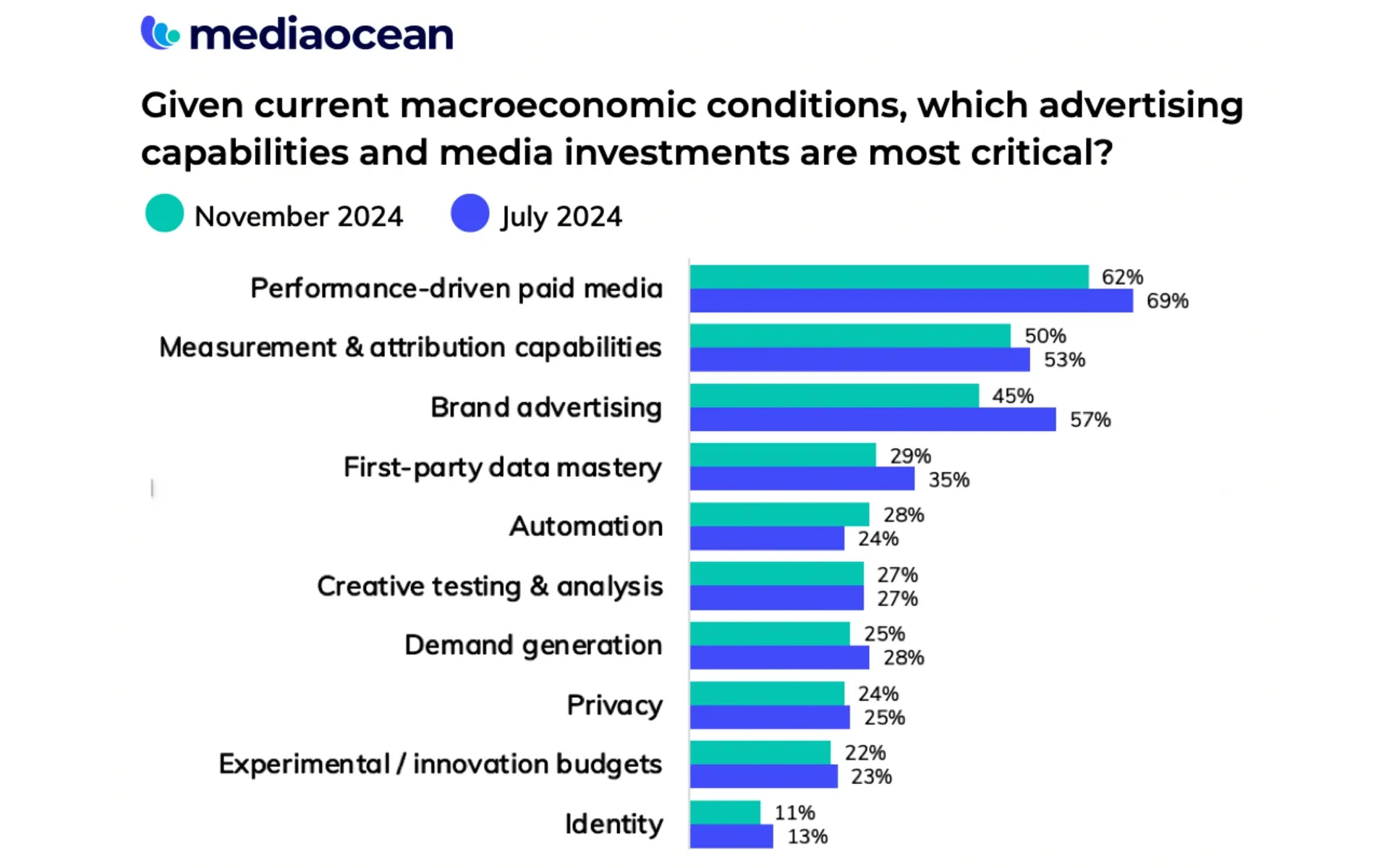

Brian Wieser, CEO and Principal of Madison and Wall, notes in his foreword to the report that individual practitioners increasingly focus on shorter-term sales metrics, particularly due to the measurability offered by newer media channels. This shift has contributed to the dominance of performance-driven media and digital channels.

The study reveals significant variations across industry verticals. In the automotive sector, 74% of marketers identify social platforms as their primary channel for increased spending. Similarly, the consumer packaged goods and fast-moving consumer goods (CPG/FMCG) sector shows a 74% preference for digital display and video advertising.

Automation has emerged as the fastest-growing investment area, showing a 17% increase in adoption since mid-2024. The report identifies this growth as marketers seek to improve workflow efficiency across media formats. Currently, 28% of marketers consider automation a critical capability, making it the only category to show an increase in the latest survey.

The research also highlights ongoing challenges in the industry. Despite slight improvements, 86% of advertisers report a lack of synchronization between creative and media processes, compared to 89% in the previous year. This gap represents a significant opportunity for improvement in the industry's operational efficiency.

In the area of measurement and attribution, almost half of advertisers cite multi-ID measurement as a top concern for 2025. This focus reflects the industry's need to adapt to changing privacy regulations and evolving technical capabilities in campaign measurement.

Aaron Goldman, CMO of Mediaocean, emphasizes the significance of these changes: "This year's outlook report underscores the profound shifts already underway and intensifying across the advertising industry." The statement indicates the rapid pace of transformation in advertising technologies and methodologies.

Deborah Wahl, Forbes CMO Hall of Fame member and former global CMO of General Motors, draws parallels between the current AI transformation and previous industry shifts: "Generative AI is no longer a futuristic concept—it's a cornerstone of today's advertising strategies." She compares the situation to the electric vehicle transformation in the automotive industry, suggesting similar levels of strategic reimagining are necessary.

The report marks Mediaocean's seventh bi-annual market analysis, synthesizing perspectives from various industry stakeholders including brands, agencies, media companies, measurement firms, and technology platforms. The company, which processes over $200 billion in annualized ad spend through its software products, provides these insights based on data from survey responses collected in November 2024.

The findings suggest a continuing trend toward digital transformation in advertising, with particular emphasis on artificial intelligence, automation, and integrated measurement solutions. These changes reflect broader shifts in consumer behavior and technological capabilities, indicating significant evolution in how advertisers approach market engagement and campaign execution.